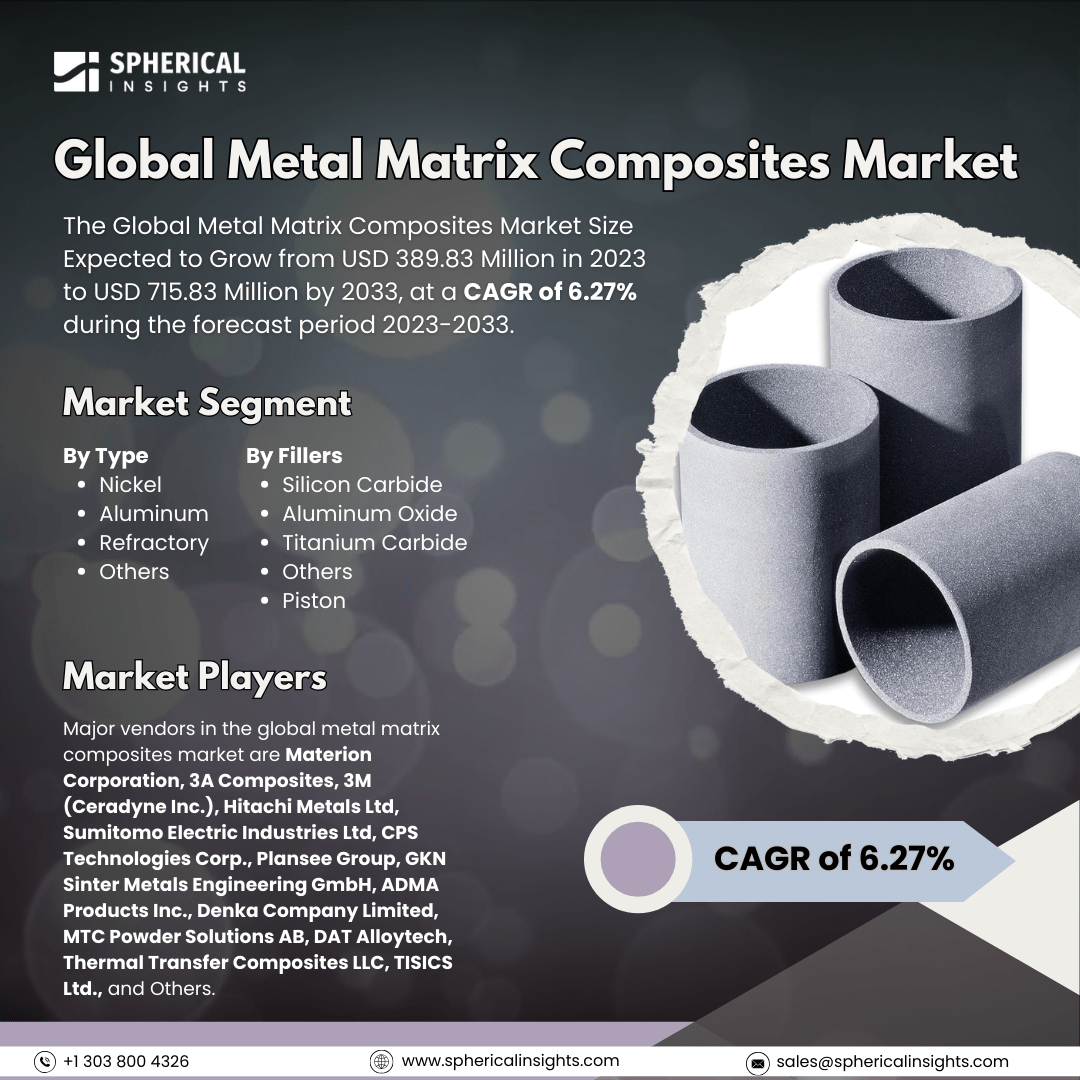

Global Metal Matrix Composites Market Size to Exceed USD 715.83 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Metal Matrix Composites Market Size Expected to Grow from USD 389.83 Million in 2023 to USD 715.83 Million by 2033, at a CAGR of 6.27% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Metal Matrix Composites Market Size, Share, and COVID-19 Impact Analysis, By Type (Nickel, Aluminum, Refractory, and Others), By Fillers (Silicon Carbide, Aluminum Oxide, Titanium Carbide, and Other Fillers), By End-user Industry (Automotive and Locomotive, Electrical and Electronics, Aerospace and Defense, Industrial and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The metal matrix composites (MMC) market is the worldwide industry that is involved in producing, distributing, and applying composites that are manufactured from a metal matrix with ceramic, carbon, or other reinforcement materials. These composites possess greater strength, wear resistance, and thermal conductivity than conventional metals, making them well-suited for aerospace, automotive, defense, and industrial uses. Moreover, the metal matrix composites market is propelled by increasing demand for lightweight, high-strength materials in the aerospace, automotive, and defense sectors. Improved properties such as high thermal conductivity, wear resistance, and corrosion resistance boost their usage. Advances in manufacturing methods, rising applications in electric vehicles, and increasing applications in industrial and biomedical fields also propel market growth. Trends in sustainability also fuel innovation in green composite materials. However, high cost of production, sophisticated manufacturing techniques, and poor machinability hinder market growth. Moreover, difficulties in widespread adoption, the presence of substitute composite materials, and unstable raw material costs further hamper the growth of the MMC market.

The aluminum segment accounted for the largest share of the global metal matrix composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the global metal matrix composites market is divided into nickel, aluminum, refractory, and others. Among these, the aluminum segment accounted for the largest share of the global metal matrix composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Aluminum MMCs are utilized extensively in the aerospace, automotive, and industrial sectors because aluminum is light, strong, and possess superior thermal conductivity. Demand for fuel-efficient vehicles and high-end aerospace parts fuels the superiority of this market.

The silicon carbide segment accounted for a substantial share of the global metal matrix composites market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of fillers, the global metal matrix composites market is divided into silicon carbide, aluminum oxide, titanium carbide, and others. Among these, the silicon carbide segment accounted for a substantial share of the global metal matrix composites market in 2023 and is anticipated to grow at a rapid pace during the projected period. Silicon carbide-reinforced MMCs possess greater strength, wear resistance, and thermal stability and find applications in aerospace, automotive, and industrial fields. High performance in harsh conditions and growing utilization of sophisticated engineering solutions fuel the market growth.

The aerospace and defense segment accounted for the largest share of the global metal matrix composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of end-user industry, the global metal matrix composites market is divided into automotive and locomotive, electrical and electronics, aerospace and defense, industrial and others. Among these, the aerospace and defense segment accounted for the largest share of the global metal matrix composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. MMCs are also extensively applied in aircraft structures, engine parts, and military equipment because of their high strength, light weight, and heat resistance. The rise in demand for efficient aircraft and sophisticated defense applications fuels this segment's leadership.

North America is projected to hold the largest share of the global metal matrix composites market over the projected period.

North America is projected to hold the largest share of the global metal matrix composites market over the projected period. This is led by robust demand from aerospace, defense, and automotive markets. Presence of key players in the aircraft manufacturing space, state-of-the-art R&D centers, and growing use of lightweight materials in defense drive market leadership. Investment by governments in advanced materials also drives regional growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the global metal matrix composites market during the projected period. This is led by strong industrialization, soaring aerospace and defense spending, and growing automobile production. Regional heavyweights China, India, and Japan are some of the driving forces behind demand growth fueled by rising consumption of lightweight, high-performance materials by manufacturing, electronic, and transport industries. Policymaking assistance also lends aid to regional market expansion.

Company Profiling

Major vendors in the global metal matrix composites market are Materion Corporation, 3A Composites, 3M (Ceradyne Inc.), Hitachi Metals Ltd, Sumitomo Electric Industries Ltd, CPS Technologies Corp., Plansee Group, GKN Sinter Metals Engineering GmbH, ADMA Products Inc., Denka Company Limited, MTC Powder Solutions AB, DAT Alloytech, Thermal Transfer Composites LLC, TISICS Ltd., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2022, Plansee Group entered into a binding agreement to buy Mi-Tech Tungsten Metals. The takeover will assist Plansee Group in enhancing its market share for tungsten products in North America.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global metal matrix composites market based on the below-mentioned segments:

Global Metal Matrix Composites Market, By Type

- Nickel

- Aluminum

- Refractory

- Others

Global Metal Matrix Composites Market, By Fillers

- Silicon Carbide

- Aluminum Oxide

- Titanium Carbide

- Others

- Piston

Global Metal Matrix Composites Market, By End-user Industry

- Automotive and Locomotive

- Electrical and Electronic

- Aerospace and Defense

- Industrial

- Others

Global Metal Matrix Composites Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa