Global Industrial Diamond Market Size to Exceed USD 2.58 Billion by 2033

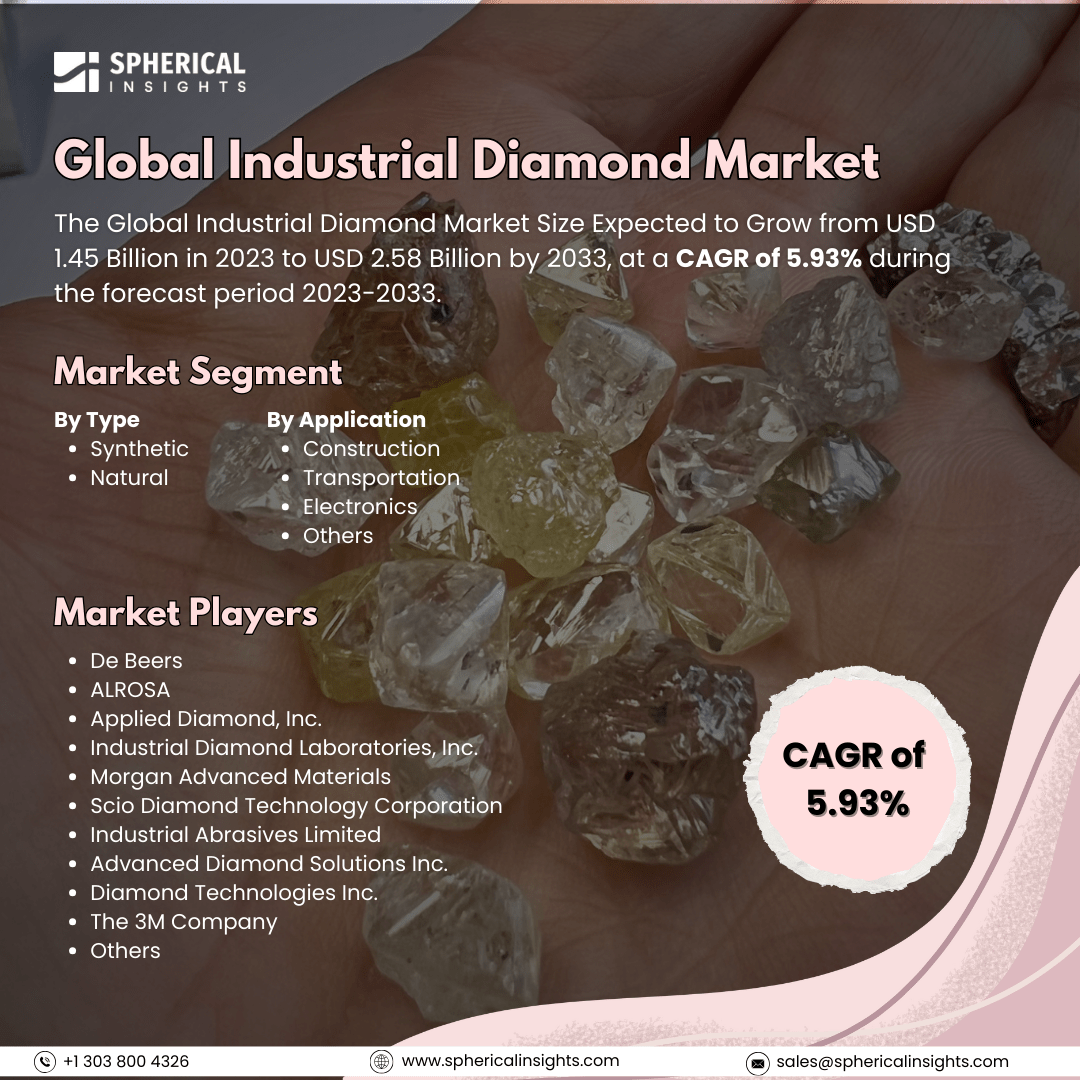

According to a research report published by Spherical Insights & Consulting, The Global Industrial Diamond Market Size Expected to Grow from USD 1.45 Billion in 2023 to USD 2.58 Billion by 2033, at a CAGR of 5.93% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Industrial Diamond Market Size, Share, and COVID-19 Impact Analysis, By Type (Synthetic, Natural), By Application (Construction, Transportation, Electronics, Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The industrial diamond market is the international industry engaged in the manufacturing, distribution, and use of natural and synthetic industrial diamonds. These are prized for their high hardness, thermal conductivity, and resistance to wear, which makes them indispensable in cutting, grinding, drilling, polishing, and high-precision machining in industries like construction, automotive, electronics, and mining. Moreover, the industrial diamond market is driven by growing demand within construction, mining, electronics, and automotive sectors owing to superior hardness and durability. Expansion in infrastructure developments, sophisticated machining, and semiconductor production drives market growth. Furthermore, improved synthetic diamond manufacturing technology and growing adoption in aerospace and medical usage also drive market demand worldwide. However, the Industrial Diamond Market is constrained by high costs of production, low availability of natural diamonds, environmental issues, and substitutes in the form of alternative superhard materials that affect affordability and usage in different industrial applications.

The synthetic segment accounted for the largest share of the global industrial diamond market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the global industrial diamond market is divided into synthetic and natural. Among these, the synthetic segment accounted for the largest share of the global industrial diamond market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of the extent of use for ceramics, refractories, and foundries. This is because of its cost savings, uniform quality, and extensive application in cutting, grinding, drilling, and polishing operations. Developments in HPHT and CVD technologies have improved production efficiency, making synthetic diamonds the preferred material in many industrial and high-precision uses.

The construction segment accounted for a substantial share of the global industrial diamond market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the application, the global industrial diamond market is divided into construction, transportation, electronics, and others. Among these, the construction segment accounted for a substantial share of the global industrial diamond market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to its wide application in cutting, drilling, grinding, and polishing operations. Industrial diamonds improve the strength and effectiveness of saw blades, drill bits, and grinding tools and are, therefore, indispensable in road construction, infrastructure development, and construction work.

Asia Pacific is projected to hold the largest share of the global industrial diamond market over the projected period.

Asia Pacific is projected to hold the largest share of the global industrial diamond market over the projected period. This is spurred by high growth in construction, electronics, and manufacturing sectors. China, India, and Japan are the leaders in infrastructure development, semiconductor manufacturing, and industrial machinery, boosting demand for industrial diamonds in cutting, grinding, and precision machining applications in a range of industries.

North America is expected to grow at the fastest CAGR of the global industrial diamond market during the projected period. This is driven by rising demand in construction, electronics, and automotive sectors. The U.S. and Canada are at the forefront with technological advances in semiconductor production, aerospace, and high-precision machining, as well as increasing infrastructure projects that need industrial diamonds for cutting, grinding, and drilling purposes.

Company Profiling

Major vendors in the global Industrial Diamond market are De Beers, ALROSA, Applied Diamond, Inc., Industrial Diamond Laboratories, Inc., Morgan Advanced Materials, Scio Diamond Technology Corporation, Industrial Abrasives Limited, Advanced Diamond Solutions Inc., Diamond Technologies Inc., The 3M Company, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, De Beers launched a diamond verification device for retail counters, taking cutting-edge synthetic diamond detection technology to distinguish natural diamonds from lab-grown ones, increasing consumer confidence by guaranteeing authenticity at the point of sale for loose and set diamonds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global industrial diamond market based on the below-mentioned segments:

Global Industrial Diamond Market, By Type

Global Industrial Diamond Market, By Application

- Construction

- Transportation

- Electronics

- Others

Global Industrial Diamond Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa