Global Targeting Pods Market Size to Exceed USD 5.86 Billion by 2033

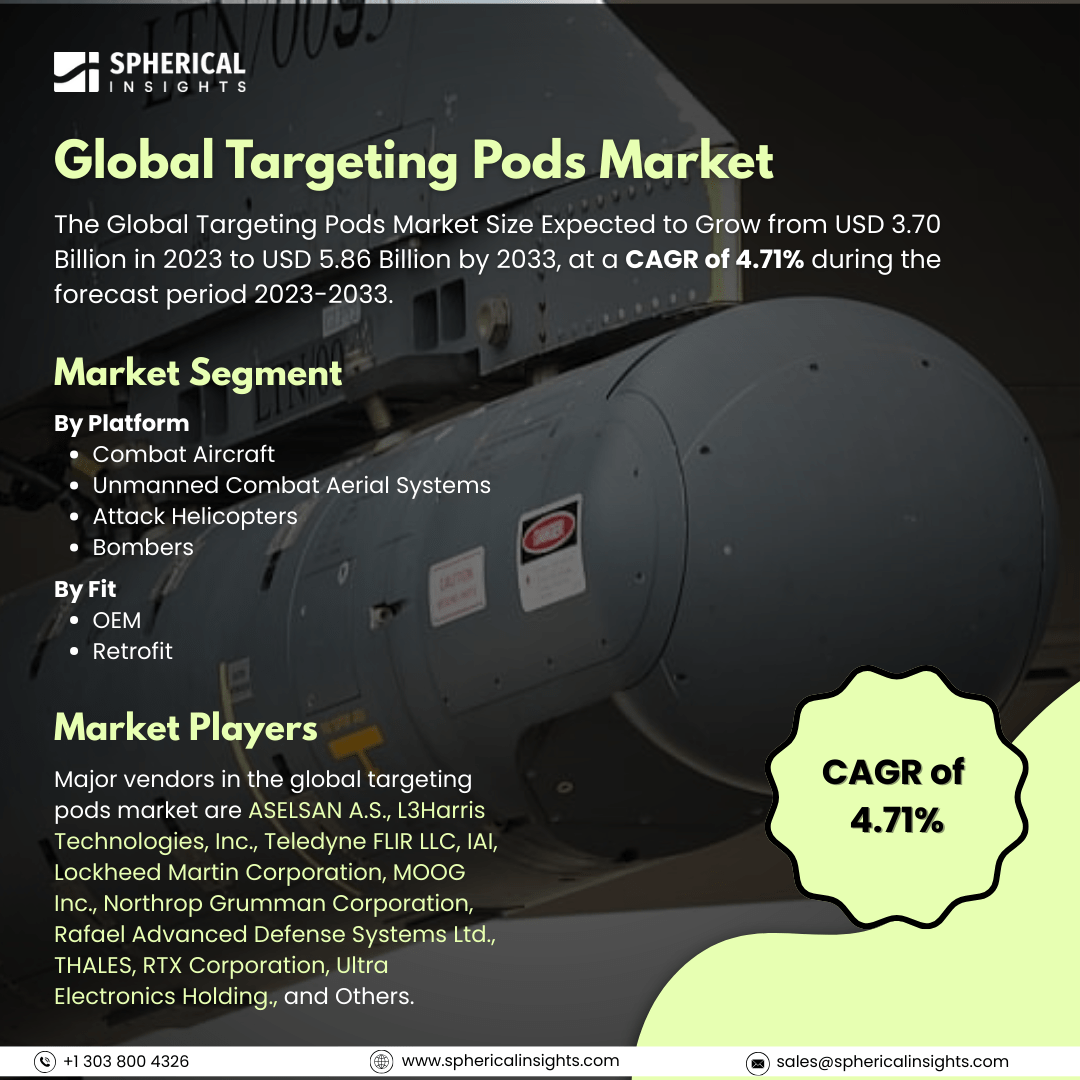

According to a research report published by Spherical Insights & Consulting, The Global Targeting Pods Market Size Expected to Grow from USD 3.70 Billion in 2023 to USD 5.86 Billion by 2033, at a CAGR of 4.71% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Targeting Pods Market Size, Share, and COVID-19 Impact Analysis, By Platform (Combat Aircraft, Unmanned Combat Aerial Systems, Attack Helicopters, and Bombers), By Fit (OEM and Retrofit), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The targeting pods market is the international business of developing, manufacturing, and deploying electro-optical targeting systems installed on combat aircraft. These pods increase the accuracy of targeting, surveillance, and reconnaissance with the integration of sophisticated sensors, infrared cameras, and laser designation technology. Targeting pods play a critical role in contemporary combat operations by increasing situational awareness, minimizing collateral damage, and facilitating precision-guided munition deployment in air-to-ground and air-to-air operations. Moreover, the targeting pods market is being propelled by escalating demand for guided weapons, increased military modernization initiatives, and expanding defense expenditure globally. Advances in infrared sensors and electro-optical technology provide improved accuracy of targeting and awareness of surroundings. Escalation in asymmetric conflicts, counter-terror missions, and UAVs also significantly fuels demand. Also, inclusion of artificial intelligence and data analytics into targeting solutions stimulates market expansion with enhanced operating effectiveness and efficiency. However, market constraints consist of high development and integration expense, strict military controls, and complexity in fitting targeting pods to existing aircraft. Export controls and cybersecurity threats further constrain market growth in some regions.

The combat aircraft segment accounted for the largest share of the global targeting pods market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the platform, the global targeting pods market is divided into combat aircraft, unmanned combat aerial systems, attack helicopters, and bombers. Among these, the combat aircraft segment accounted for the largest share of the global targeting pods market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Fighter aircraft depend significantly on targeting pods for precision attacks, reconnaissance, and situational awareness. Rising defense budgets, modernization initiatives, and the increasing need for multi-role aircraft fuel the use of advanced targeting pods in air forces across the globe.

The OEM segment accounted for a substantial share of the global targeting pods market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the fit, the global targeting pods market is divided into OEM and retrofit. Among these, the OEM segment accounted for a substantial share of the global targeting pods market in 2023 and is anticipated to grow at a rapid pace during the projected period. Most of the new-generation fighter jets, UAVs, and helicopters are equipped with advanced targeting pods at the time of production. Increasing defense purchases, military modernization initiatives, and growing demand for technologically sophisticated aircraft drive the dominance of the OEM segment.

North America is projected to hold the largest share of the global targeting pods market over the projected period.

North America is projected to hold the largest share of the global targeting pods market over the projected period. Driven by defence expenditure, cutting-edge military aircraft programmes, and the extensive presence of critical defence manufacturers such as Lockheed Martin and Northrop Grumman. The U.S. takes the lead in the development and integration of targeting pods, enabling continuous modernization for fighter aircraft, UAVs, and attack helicopters to maintain regional superiority.

Europe is expected to grow at the fastest CAGR of the global targeting pods market during the projected period. This is sustained by rising defense expenditures, military modernization projects, and robust aerospace industries within nations such as the UK, France, and Germany. The region is served by sophisticated fighter aircraft development, including the Eurofighter Typhoon and Rafale, that incorporate state-of-the-art targeting pods to provide improved combat capabilities.

Company Profiling

Major vendors in the global targeting pods market are ASELSAN A.S., L3Harris Technologies, Inc., Teledyne FLIR LLC, IAI, Lockheed Martin Corporation, MOOG Inc., Northrop Grumman Corporation, Rafael Advanced Defense Systems Ltd., THALES, RTX Corporation, Ultra Electronics Holding., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Collins Aerospace, a business unit of RTX Corporation, was contracted by the US Air Force Research Laboratory (AFRL) for a USD 36 million deal to create and demonstrate a platform-independent, Beyond-Line-Of-Sight satellite communications pod.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global targeting pods market based on the below-mentioned segments:

Global Targeting Pods Market, By Platform

- Combat Aircraft

- Unmanned Combat Aerial Systems

- Attack Helicopters

- Bombers

Global Targeting Pods Market, By Fit

Global Targeting Pods Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa