Data Center Substation Market Size & Trends

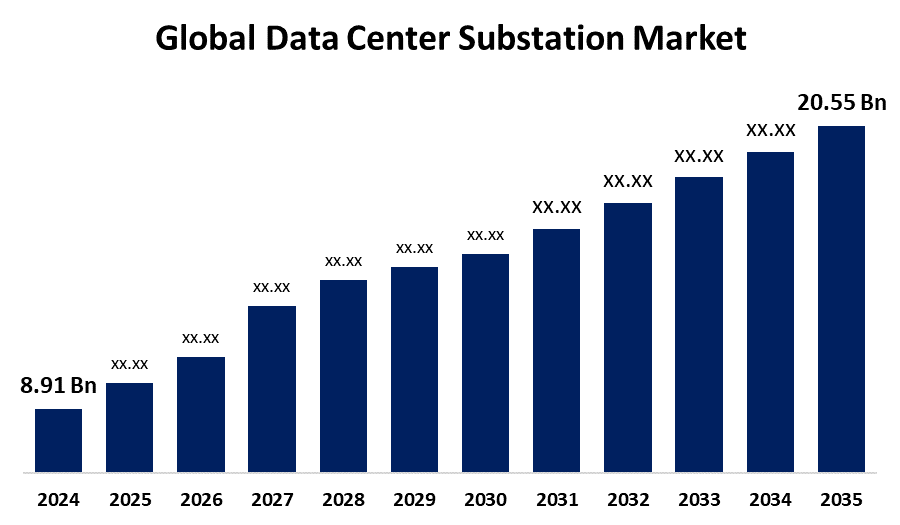

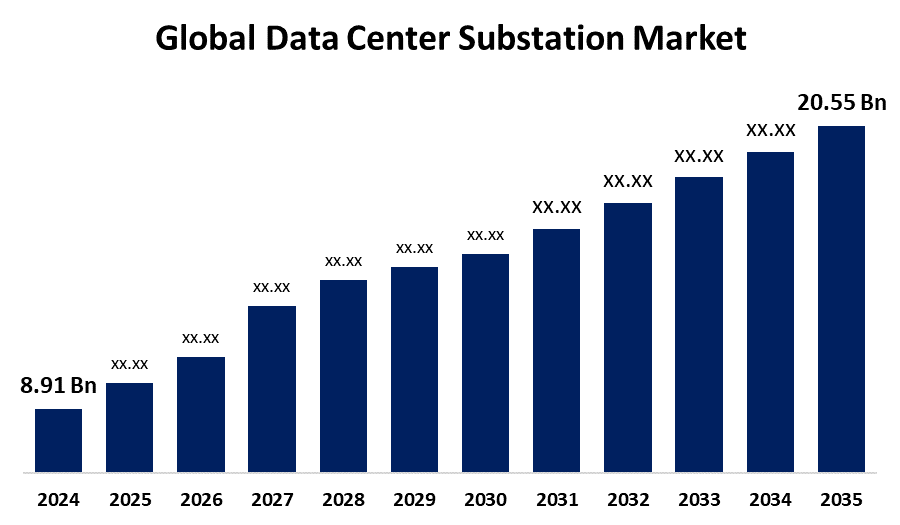

The Global Data Center Substation Market Size Was Estimated at USD 8.91 Billion in 2024 and is Projected to Reach USD 20.55 Billion by 2035, Growing at a CAGR of 7.89% from 2025 to 2035. Due to the growing need for data processing and storage brought on by cloud computing, 5G, and industry digitization, the data center substation market is expanding rapidly.

Key Regional and Segment-Wise Insights

- In 2024, the North American pet diabetes care market accounted for largest revenue share 36.5% of the market's revenue.

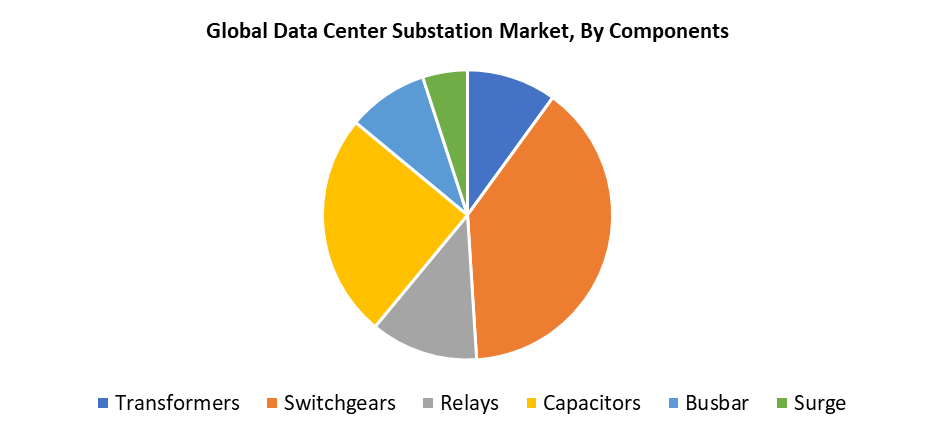

- In 2024, the switchgears segment held the largest revenue share by component, accounting for 39.5% market share.

- In 2024, the above 500 kV category accounted for the greatest market share by voltage.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.91 Billion

- 2035 Projected Market Size: USD 20.55 Billion

- CAGR (2025-2035): 7.89%

- North America: Largest market in 2024

The industry which supplies electrical infrastructure components, especially substations to control data center energy supply, operates under the Data Center Substation Market. Data generation, together with digital activity, has rapidly increased, which drives the strong worldwide expansion of the data center substation market. Digital platforms have become the primary method for personal and organisational interaction, thus causing rapid expansion of both structured and unstructured data. New facilities for data centers must be constructed because of this growth, which requires dependable electrical infrastructure that can expand. The uninterrupted power supply depends on substations, which maintain high-performance applications and prevent system downtime. The growing use of cloud-based services and edge computing requires localised power systems that maximise energy efficiency. Strategic substation placement enables fast data processing along with reduced latency and optimised energy control, which drives the market segment expansion.

The market growth is propelled by the ongoing enhancement of electrical systems to meet emerging operational requirements and environmental standards. Modern digital modular systems, which deliver enhanced efficiency and real-time monitoring and automation capabilities, now replace traditional substations during their upgrade process. Contemporary substations enable predictive maintenance while improving system reliability through intelligent power distribution capabilities. Data center managers prioritise sustainability because they need to lower their carbon emissions while fulfilling environmental requirements. The rising expenditure on energy-efficient substations with intelligent energy management systems stems from the need to optimise power consumption and balance loads. Data center ecosystems require modern, environmentally friendly substation solutions because government incentives, together with laws, promote green technologies.

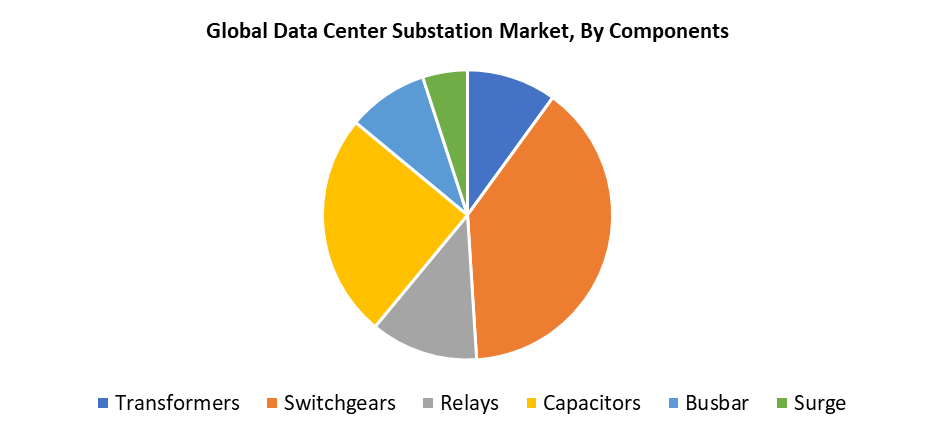

Components Insights

The switchgears segment dominated the data center substation market in 2024 by achieving a 39.5% revenue share because of its essential function in providing secure and reliable power distribution. The switchgear equipment functions as an essential component to perform fault isolation and voltage management, and equipment protection during power interruptions. Their usage is crucial in high-density data center scenarios where stability and uptime are paramount. Switchgear installations utilise gas-insulated and air-insulated designs to optimise available space while enhancing operational safety. The Xiria medium-voltage switchgear represents a new generation of data center switchgear solutions that Eaton developed to be compact and environmentally friendly. The market share of this segment grows because data centers need advanced switchgear systems that are compact yet high-performing as their operations become more complicated.

The capacitors market segment will experience substantial growth throughout the forecast period because they play an essential role in optimising power quality and efficiency within data centers. Power factor correction applications widely deploy capacitors to stabilise voltage levels and reduce reactive power, and enhance the system reliability of electrical networks. The effective implementation of capacitor systems helps data centers reduce energy losses and cut power costs while enhancing operational performance since these facilities consume substantial amounts of electricity. Substations today require capacitors as fundamental components since they enable stable power delivery and protect sensitive equipment. The pace of adoption for advanced capacitor technologies will accelerate among data center infrastructures because of rising power needs, together with cost-effective, sustainable operational requirements.

Voltage Insights

The above 500 kV segment led the market for data center substations in 2024 because these high-capacity electrical systems support large-scale mission-critical data center operations. These high-voltage substations function as essential equipment to maintain a steady, continuous, high-quality power supply, which protects both data center performance and uptime. Data centers find high attraction in this market because they need to move power efficiently across extended distances when they establish themselves in rural and remote areas. The expanding size and power needs of global hyperscale and colocation data centers create a positive market growth trend. The 500 kV+ market will continue to receive funding because digital infrastructure development across the world demands dependable high-voltage power distribution systems.

The 220 kV to 500 kV segment will experience significant growth during the projected period because it serves as a vital connection between high-voltage transmission systems and medium-voltage distribution networks in data center operations. Massive data centers receive a reliable and stable power supply through proper electrical transmission line voltage reduction which converts high-voltage power into operational levels. Large data centers expand rapidly because cloud computing, together with artificial intelligence and digital services, demand equipment that efficiently manages substantial power loads with minimal loss. The 220 kV to 500 kV substations deliver the best combination of capacity and efficiency, together with dependability to support mission-critical applications and maintain operational continuity for expanding digital infrastructures.

Regional Insights

The North American data center substation market held the largest revenue share worldwide at 36.5% in 2024 because of established technological frameworks combined with rising requirements for dependable power infrastructure. The region's advanced IT ecosystem supports a dense network of hyperscale data centers operated by AWS, Microsoft Azure, and Google Cloud. Advanced substations with high uptime and dependable operation are essential for these facilities to handle their large power demands. The United States leads the market because of its dense cloud infrastructure network and major investments in renewable energy integration and sustainable power solutions. The leading position of North America in the market remains strong because power system upgrades continue and digital services become more popular.

Europe Data Center Substation Market Trends

The European data center substation market experiences rapid growth because modern electrical systems need replacement and energy efficiency improvement. European nations advancing toward sustainability and carbon neutrality goals choose fibre optic-based digital substations for enhanced monitoring and reduced installation expenses, along with faster communication. The European Commission and other strict regulatory bodies drive data center infrastructure changes toward greener solutions by enforcing requirements for energy-efficient operations. Machine rooms with carbon-neutral status and renewable energy integration have become the primary focus of businesses because data center energy requirements will surge by 40% throughout the next decade. Modern, environmentally friendly substation technology experiences substantial demand across the region because of the ongoing green transformation initiatives.

Asia Pacific Data Center Substation Market Trends

The Asia Pacific data center substation market experiences rapid growth due to key nations such as China India and Singapore. The region's growing digital economy creates rising requirements for data storage and cloud computing services because of increasing internet adoption and widespread smartphone usage. The adoption of smart grid technology in China enables substations to meet modern data center power requirements through enhanced power distribution efficiency. The market growth continues to accelerate because the region experiences rising e-commerce activities, together with ongoing digital changes. Data centers in the Asia Pacific use almost 10% of the electricity in the region, according to the International Energy Agency (IEA), highlighting the significance of sophisticated, dependable substations. The strong growth of the Asia Pacific market happens because energy needs intersect with technological progress.

Key Data Center Substation Companies:

The following are the leading companies in the data center substation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Sterling & Wilson Pvt Ltd

- Bharat Heavy Electricals Limited (BHEL)

- General Electric

- Hitachi Energy

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Vertiv Holdings Co.

- CG Power and Industrial Solutions Limited

- Others

Recent Development

- In May 2023, Mapletree Investments acquired a new facility in Osaka through a transaction worth over USD 372 million. International investors' increasing interest in Japan's data center industry is reflected in this transaction, as they look to take advantage of the country's expanding need for reliable digital infrastructure and colocation services.

- In July 2022, Eaton has successfully acquired a 50% share in Jiangsu Huineng Electric Co., Ltd., a Chinese circuit breaker manufacturer that specialises in low voltage. Through the combination of customized products and its extensive global distribution network, this strategic collaboration seeks to increase Eaton's growth strategy by enabling the company to access industries like grid modernization and renewable energy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the data center substation market based on the below-mentioned segments:

Global Data Center Substation Market, By Components

- Transformers

- Switchgears

- Relays

- Capacitors

- Busbar

- Surge

Global Data Center Substation Market, By Voltage

- 33 kV - 110 kV

- 110 kV - 220 kV

- 220 kV - 500 kV

- Above 500 kV

Global Data Center Substation Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa