Helium Market Summary

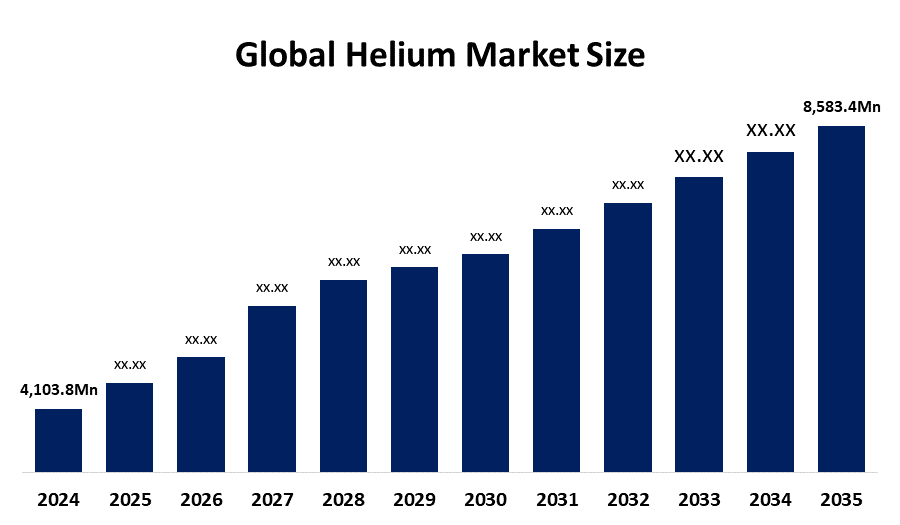

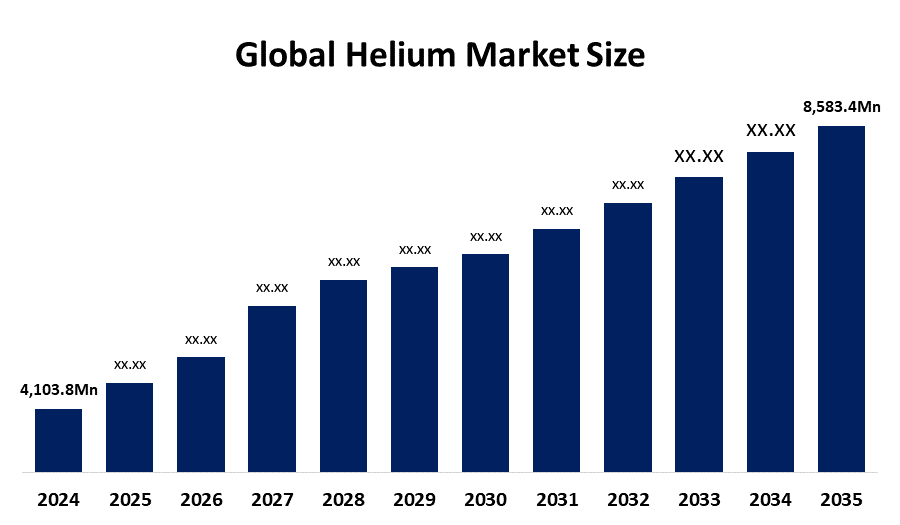

The Global Helium Market Size was Estimated at USD 4,103.8 Million in 2024 and is Projected to Reach USD 8,583.4 Million by 2035, Growing at a CAGR of 6.94% from 2025 to 2035. Increasing Helium demand across a Number of end-use sectors, Including Research, Electronics, Healthcare, Aircraft, and defense. The Helium Industry is Expanding Rapidly due to the Growing demand for Helium and the ongoing advancements in Scientific Research.

Key Regional and Segment-Wise Insights

- With a revenue share of 35.5 % in 2024, North America dominated the worldwide helium market by region.

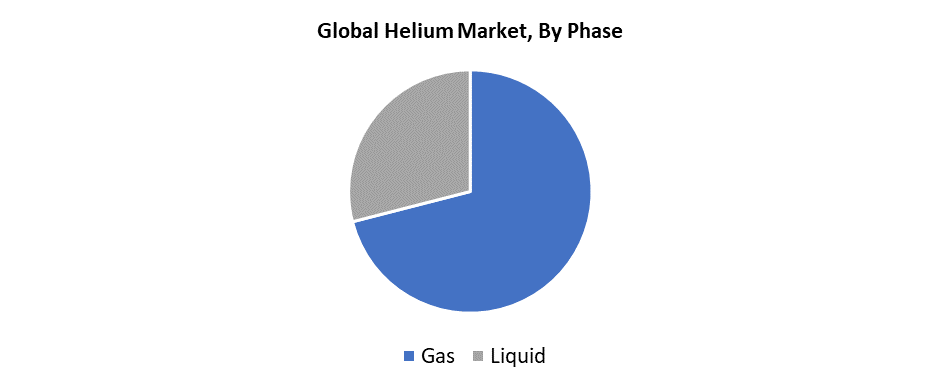

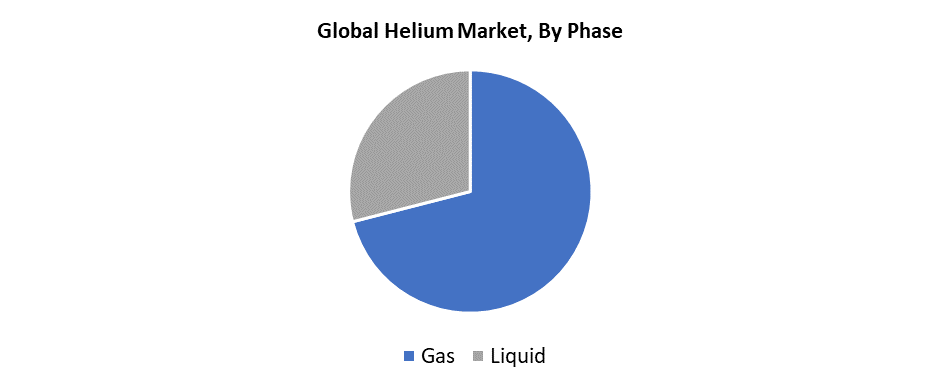

- The gas phase led the global market by phase, with a revenue share of 71.7% in 2024.

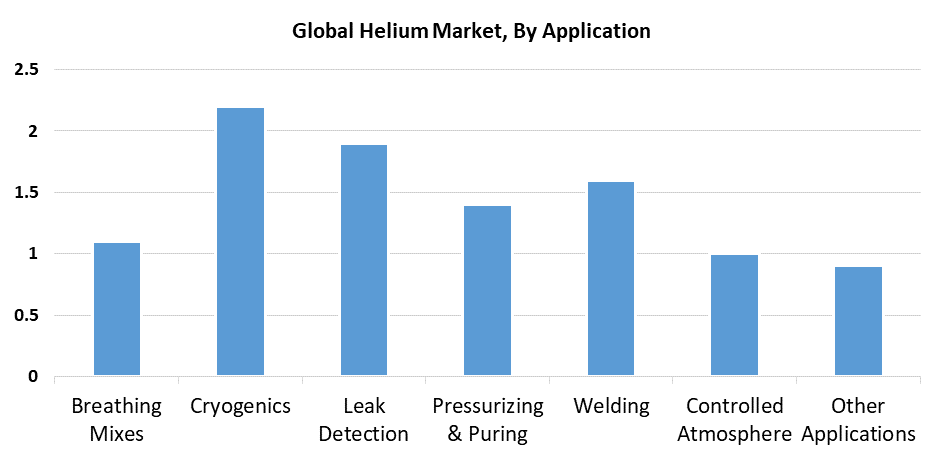

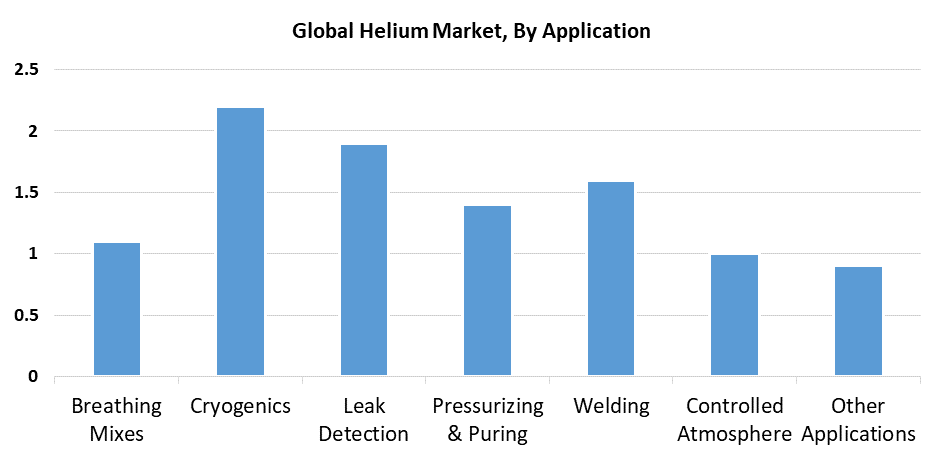

- The cryogenics application had the highest revenue share by application in 2024, accounting for 22.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4,103.8 Million

- 2035 Projected Market Size: USD 8,583.4 Million

- CAGR (2025-2035): 6.94%

- North America: Largest market in 2024

The global helium market encompasses the production, marketing, and distribution of helium a colorless, odorless, and inert gas, for a variety of industrial and scientific applications. The market encompasses both gaseous and liquid helium; each type of helium has a variety of applications and end-use industries. Helium plays an important role in many scientific studies and experiments in many areas of science, such as physics, chemistry, and materials science. As long as scientific research continues to advance, the demand for materials will remain high. While many manufacturing companies, domestic and international, are competing for market share, the global market will experience increased competitive activity. For example, helium is used in the medical field for critical diagnostic equipment such as MRI machines. The helium market is driven by its essential use in fiber optics, semiconductor fabrication, and MRI equipment. It is perfect for cooling and precision applications because of its extraordinarily low boiling point and inert, non-reactive nature. The need for helium keeps growing as the high-tech and healthcare sectors around the world, particularly in Asia-Pacific and North America, grow.

Critical uses of helium in the defense sector range from air-to-air missile guidance systems to scientific balloons, surveillance aircraft, rocket engine tests, and other applications. In defense, helium has been increasing in price, following a general trend of almost continuous price increases due to the characteristics of the global supply, demand, and storage. The impending global helium scarcity is a real concern due to the decreasing reliable sources of supply. Helium is a precious commodity and a limited resource in electronics, aerospace, healthcare, and other domains. Rising demand has also contributed to the helium crisis created by the use of helium for many outstanding advantages, such as its lowest boiling point, which creates an ideal gas. Its non-reactive characteristics also make it a coolant in the nuclear reactor plants. Helium is less dense than any other gas, which is a benefit for buoyant products and their desire to rise in the atmosphere.

Phase Insights

The gas phase held more than a 71.7% revenue share in 2024, indicating that the gas phase held the largest share of the global market. This is due to the increase in applications for the product, such as gas chromatography, as well as wide applications in welding and cutting, cooling and refrigeration, leak detection, and nuclear power. Contributing is the electronics industry where gaseous helium plays a key role in creating a controlled production environment. Moreover, helium gas has significant roles in scientific research and testing in the fields of physics, chemistry, and materials science. It is used as a carrier gas in various analytical instruments and is integral to cryogenic designs as well as low- and low-temperature research.

The liquid category is projected to grow at the highest rate in the forecasted period. Advanced technologies and innovations, such as quantum communication and quantum computing that often use superconducting components, as they need precise cooling with liquid helium. Liquid helium will have ever-increasing demand based on this new technology, with its ability to keep things at a temperature as close to absolute zero. Liquid helium is extremely in demand in numerous scientific applications. The use of liquid helium is critical for innovative scientific applications that require the lowest temperature, such as particle accelerators and space travel.

Application Insights

In 2024, the cryogenics application segment had the largest revenue share, reaching 22.4%. The factors that make helium unique from all other substances are its ability to reach and remain at extremely low temperatures. The impact of this segment is further enhanced due to the fact that helium is utilized as a coolant in the production of electronic components to limit processing discrepancies and maximize efficiency. Cryogenic technologies are also utilized in space exploration for various purposes, which include cooling the scientific instruments aboard spacecraft, as well as cooling infrared detectors utilized in observatories. It helps maintain the low operating temperatures that are required for this equipment to function.

Over the forecast period, the leak detection segment is expected to grow the fastest. Helium, being the second smallest molecule, has unique characteristics that include non-toxicity and inertness, and can pass through even the smallest leaks. And because helium is used in applications that are broad-reaching, such as lithium battery package testing, semiconductor component manufacturing, and automotive parts testing, this segment is growing even faster. This is one application of the helium leak detection method of high-precision manufacturing.

Regional Insights

The helium market in North America achieved a significant 35.5% of total revenues in 2024, resulting in a dominant region in the market. This market has grown due to many notable factors, including volume of production, number of end-user applications, and supporting infrastructure to various industries such as aerospace, defense, and semiconductors. The top three contributors to national market expansion in North America are the USA, Canada, and Mexico. The Federal Helium Reserve, one of the largest helium storage facilities in the world, was established in 1925 and is located in the USA. Supply of this product to many industries is integral to the market globally. The dominance of North America is further supported by the number of high-tech companies and research facilities.

Asia Pacific Helium Market Trends

The growth of the Asia Pacific helium market is resulting from strong demand from the electronics, semiconductor, and healthcare sectors, particularly in countries like China, Japan, South Korea, and India. Helium is used for wafer cooling and to maintain inert conditions in semiconductor manufacturing. Investments are booming in the region. The helium demand is also boosted by the increasing number of MRI scanners and advanced diagnostic equipment in the growing healthcare sector. Helium demand in the region is expected to increase due to growing investments across the industrial, healthcare, and aerospace end-user sectors, as well as in the military and aerospace sectors. The region currently still relies heavily on imports, and this has led to an interest in negotiating long-term supply agreements and exploring relationships with regional players for reliable supply.

Europe Helium Market Trends

Europe's helium industry accounts for a substantial share of the global market due to its established demand in industries such as industrial, research, healthcare, and aerospace. Helium's usage comes largely from the region's advanced medical imaging, largely in MRI usage, and is at the highest level in Germany, the UK, and France because of strong R&D and space program initiatives. As a market, the helium market in Europe is dominated by Germany. Germany is one of the major players in the European semiconductor segment, as it houses many local and foreign semiconductor manufacturing companies. The semiconductor sector will continue to witness an increase in helium demand because of the rise in demand for helium to control heat in semiconductor manufacturing, which will continue to grow the regional market. Helium consumption patterns throughout the continent also appear to be shaping up around regulations requiring a greater emphasis on energy efficiency and speculation on the sustainability of supply chains.

Key Helium Companies:

The following are the leading companies in the helium market. These companies collectively hold the largest market share and dictate industry trends.

- Air Products and Chemicals, Inc.

- Iwatani Corporation

- Linde Plc

- Gulf Cryo S.A.L.

- Messer Group

- MESA Specialty Gases & Equipment

- Matheson Tri-Gas Inc.

- Air Liquide

- Gazprom PJSC

- Taiyo Nippon Sanso India

- Gulf Cryo S.A.L.

- IACX Energy

- Others

Recent Developments

- In March 2024, Messer Group successfully acquired the United States Federal Helium System. The Helium System includes the Cliffside Field, wells and gathering system; a 423-mile crude helium pipeline; helium in the caverns in Amarillo, Texas; and other operating assets. Messer and its affiliates have independently operated the Cliffside Gas Plant, the Helium System, safely and reliably since May 2022 and continue to prove with their actions that their commitment to being good stewards of the Helium System has not waned.

- In October 2023, North American Helium has initiated operations at its seventh helium purification plant in Cadillac, near Ponteix, Saskatchewan. Because of steady drilling activities, the site will be capable of producing helium at a rate of 22 million cubic feet per year (MMcf/yr), with expansion planned for 2024. The start-up is occurring approximately one month ahead of management's expectations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the helium market based on the below-mentioned segments:

Global Helium Market, By Phase

Global Helium Market, By Application

- Breathing Mixes

- Cryogenics

- Leak Detection

- Pressurizing & Puring

- Welding

- Controlled Atmosphere

- Other Applications

Global Helium Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa