Aluminum Hydroxide Market Summary

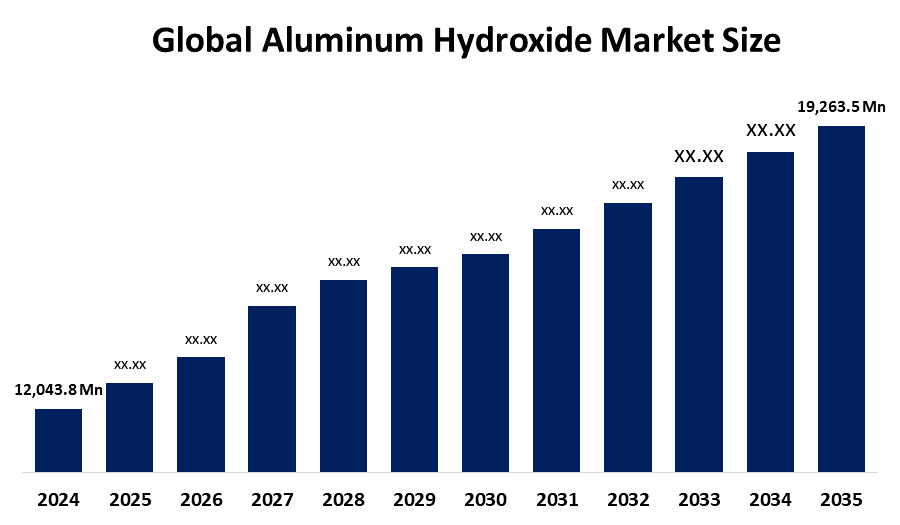

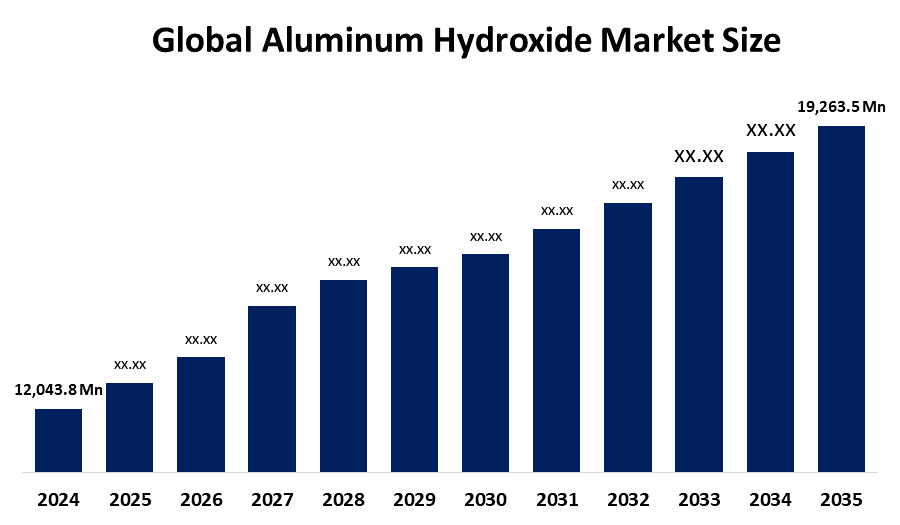

The Global Aluminum Hydroxide Market Size was Estimated at USD 12,043.8 Million in 2024 and is Projected to reach USD 19,263.5 Million by 2035, Growing at a CAGR of 4.36% from 2025 to 2035. The Global Market for Aluminum Hydroxide is Growing mainly because of its rising application as a fire retardant across several sectors, notably in Construction, Automotive, and Electronics. Furthermore, the pharmaceutical Industry's need for antacids and Vaccine adjuvants, as well as its use in water Purification, adds to the Growth of the Market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific aluminum hydroxide market held the largest revenue share and led the global market.

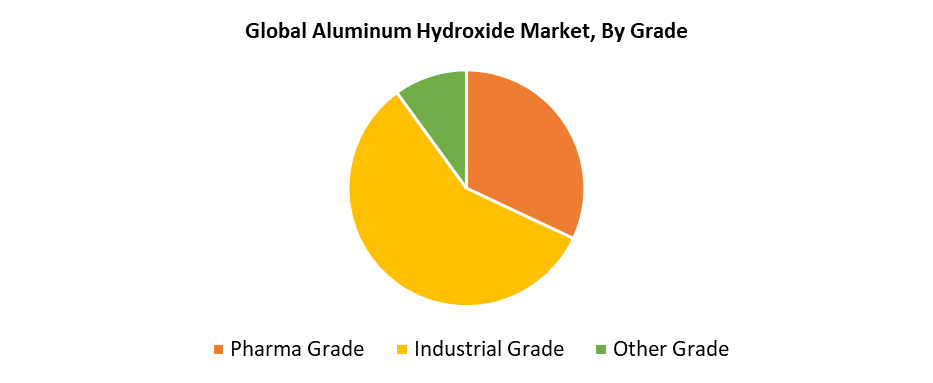

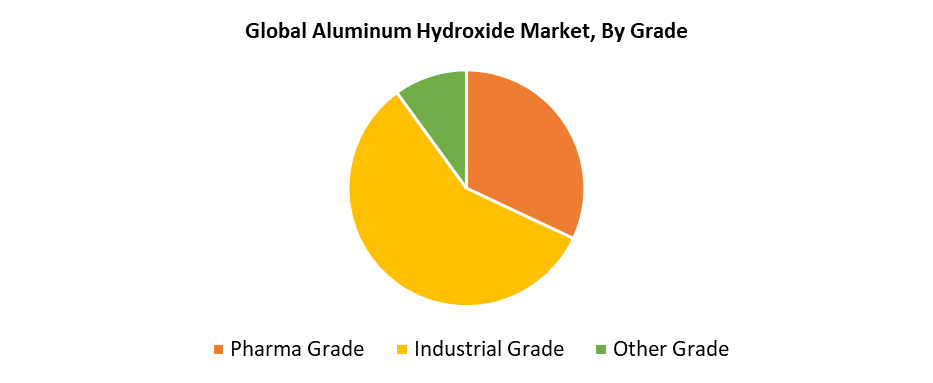

- In 2024, industrial grade held the largest revenue share of 58.4% and led the market based on grade.

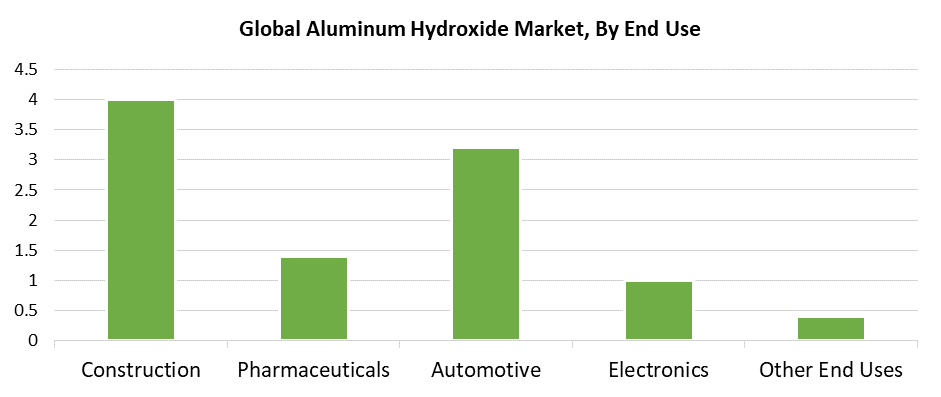

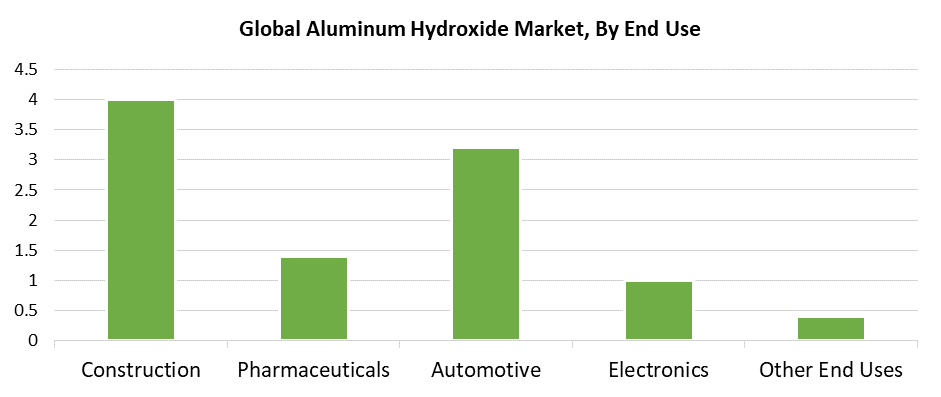

- Construction dominated the market and generated the highest revenue share of 40.4% in 2024 based on end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12,043.8 Million

- 2035 Projected Market Size: USD 19,263.5 Million

- CAGR (2025-2035): 4.36%

- Asia Pacific: Largest market in 2024

The global aluminum hydroxide market involves the production, distribution, and use of the inorganic compound aluminum hydroxide (Al(OH)3). It is used for a myriad of industrial and pharmaceutical applications, typically as a flame retardant, antacid, and precursor. The global industry is booming with increasing demand for medical applications, in part due to the growing elderly population that requires certain pharmaceuticals. Additionally, the growing need for it to be used as a flame retardant and increasing safety expectations in building construction also drive demand. Aluminum hydroxide is mainly used in polymer applications where it is easily sourced. The increasing production of polymers and manufacturing in Europe and the Asia-Pacific region will further increase growth. Finally, the increasing need for fireproof automotive products and lightweight automotive products that provide more flexibility in design will only enhance growth.

Additionally, market growth is being driven by the rise in patients experiencing gastrointestinal disease and heartburn-related ailments. Furthermore, aluminum hydroxide is also at work in water treatment to remove impurities from water and improve water quality. Market growth is also due to growing fears about water pollution and the need for satisfactory drinking water. There is a substantial market growth due to rising demand in the painting and coating industries for cost-effective applications of products. With the increased use of battery and chemical products, this is expected to create a positive growth environment. Additionally, aluminum hydroxide is used in cosmetics and skin care products to thicken and provide a smooth feel in the formulation. Increased focus on product quality and performance in the beauty industry is influencing the growth of aluminum hydroxide. Nevertheless, issues like the volatility of raw material costs and increased health risks linked to aluminum hydroxide exposure present major worries for the industry.

Grade Insights

In 2024, the industrial-grade segment accounted for a major share of the total revenue at 58.4%. Industrial-grade aluminum hydroxide is used as a filler in a wide range of different polymers and composites, improving the mechanical properties of materials, such as their stiffness and durability. It is particularly valuable in sectors such as aerospace, automotive, and construction, where the low weight and structural stability of materials are highly significant. Industrial-grade aluminum hydroxide is also used in various water treatment processes. It is commonly used as a flocculant and coagulant to physically remove contaminants, suspended solids, and other impurities present in the wastewater, including residential and industrial wastewater. Its position as a leader in the industrial-grade segments is due to its affordability and abundance for all industrial processes except those where purity levels need to be extremely high, as it is somewhat impure and often contains other metals.

Pharma grade is the fastest-growing segment of the aluminum hydroxide market. To ensure high purity and adherence to pharmaceutical specifications, aluminum hydroxide of pharmaceutical grade is manufactured under a stringent quality control process. In the pharmaceutical industry, it is used as an active ingredient for antacid products and as an adjuvant in vaccines. The growth of pharmaceutical-grade aluminum hydroxide is driven by the growing demand for antacid drugs and the prevalence of gastrointestinal diseases. In addition, aluminum hydroxide is growing rapidly in the pharmaceutical grade due to its application as a pharmaceutical adjuvant to enhance the immune responses of vaccines.

End-use Insights

In 2024, the construction segment accounted for a revenue share of 40.4% with respect to the market. In the construction industry, aluminum hydroxide serves mainly as a flame retardant and smoke suppressant in building materials such as plastics, coatings, and insulation. Construction composites benefit from aluminum hydroxide, as it increases their service life and improves their weatherability and durability. Key drivers for market growth have been increased use of mandatory fire safety requirements in both residential and commercial buildings, encouraging the use of non-toxic and green flame retardants like aluminum hydroxide. This is because aluminum hydroxide will release water molecules when exposed to high temperatures, which can slow the spread of fires. Overall, aluminum hydroxide is a critical additive to enable homes and businesses to be constructed as fire-resistant structures.

In the automotive industry, aluminum hydroxide is utilized as a flame retardant in parts such as interior panels, wiring, and plastic, in order to improve fire safety. In comparison to other fire retardants, aluminum hydroxide is favored as a system for lightweight, heat-resistant materials found in electric and traditional vehicles because it is non-toxic, halogen-free, and flame-retardant. One of the main drivers of the market is the rise in vehicle safety standards and the use of electric vehicles (EVs), which require advanced flame-retardant material in order to meet stricter regulatory requirements. In addition, it provides improved insulation and durability in automotive coatings and composites.

Regional Insights

The market for aluminum hydroxide in North America is growing significantly. The demand for aluminum hydroxide is projected to increase as construction activity rises in North America. It is also anticipated that the demand for the product market will increase substantially due to increased automotive production in North America. The aesthetic and safety value of aluminum hydroxide is reinforced with a flurry of countertop renovation and flooring renovation activity. The demand for coagulants is also set to benefit from upgrades to water-treatment facilities, as set out in the U.S. Infrastructure Investment and Jobs Act, achieving a favorable mid-term outlook. The region has also engaged in advanced research on high-thermal-conductivity ATH for EV batteries; this helps maintain its strategic importance for the specialized grades of aluminum hydroxide produced.

Asia Pacific Aluminum Hydroxide Market Trends

The Asia Pacific region dominated the global aluminum hydroxide market. The region's leading aluminum hydroxide producers and its emerging manufacturing sector are responsible for the region's dominance. The increase in demand across various industries, such as flame retardants, ceramics, and pharmaceuticals, has contributed to the region's dominant position in the aluminum hydroxide market. In addition, the region has relatively lower production costs and a favorable policy environment to further support the regional market dominance. Furthermore, government support to develop the manufacturing sector in countries such as China, India, and South Korea is expected to drive further market demand for mercury remediation technologies and automotive applications.

Europe Aluminum Hydroxide Market Trends

The aluminum hydroxide sector of Europe is growing rapidly, primarily driven by the role of aluminum hydroxide as a flame retardant in building materials in accordance with tough fire safety standards. Currently, the aluminum sector is making substantial gains in terms of sustainability, with a report from European Aluminum stating that carbon emissions relative to each kilogram of aluminum produced have decreased by 5% since 2015, while 78% of the electricity used in the production process is derived from renewable sources. Such indications of advancement in terms of sustainability speak to the industry's commitment to sustainability and help facilitate growth in the market. The aluminum hydroxide market is further supported by the bloc's commitment to circularity and low-carbon materials that drive further recycling initiatives and the use of green-energy feedstock in production.

Key Aluminum Hydroxide Companies:

The following are the leading companies in the aluminum hydroxide market. These companies collectively hold the largest market share and dictate industry trends.

- Almatis

- Sumitomo Chemical Co. Ltd.

- Alteo

- LKAB Minerals AB

- Aluminum Corporation of China Ltd (Chalco)

- MAL - Magyar Aluminum

- Huber Materials.

- ALUMINA - CHEMICALS & CASTABLES

- TOR Minerals International, Inc.

- LKAB Minerals AB

- Donau Carbon GmbH

- Sibelco

- Hindalco (Aditya Birla Management Corporation Pvt. Ltd)

- Others

Recent Developments

- In April 2024, Finolex Cables has launched a line of eco-friendly wires under the FinoGreen brand. This will account for approximately 5% of the company's wires business. The range of FinoGreen industrial cables is halogen-free and flame-retardant, and is designed specifically to reduce the degree of hazards presented by electrical installations and prevent incidents of fire/ accidents generally. FinoGreen cables are designed for use with alternating current voltage less than or equal to 1100 V and a frequency of 50 Hz. The wires greatly lower smoke production emissions and allow hydrochloric acid gas to be released only in trace amounts during a fire.

- In July 2023, Hindustan Unilever Limited (HUL) has launched a New Pureit Revito Series of water purifiers, which includes DURAViva™, a unique filtration technology that features a WQA gold seal component that guarantees heavy metal removal while offering purified water up to 8000L. The water purifier saves up to 70% water and replenishes additional minerals such as calcium and magnesium to the purified water.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aluminum hydroxide market based on the below-mentioned segments:

Global Aluminum Hydroxide Market, By Grade

- Pharma Grade

- Industrial Grade

- Other Grade

Global Aluminum Hydroxide Market, By End Use

- Construction

- Pharmaceuticals

- Automotive

- Electronics

- Other End Uses

Global Aluminum Hydroxide Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa