Global Detergent Alcohols Market Insights Forecasts to 2035

- The Global Detergent Alcohols Market Size Was Estimated at USD 5.80 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.21% from 2025 to 2035

- The Worldwide Detergent Alcohols Market Size is Expected to Reach USD 10.14 billion by 2035

- Middle East & Africa is expected to grow the fastest during the forecast period.

Detergent Alcohols Market

The global detergent alcohols market involves the production and use of fatty alcohols primarily utilized in the formulation of surfactants found in detergents and cleaning products. These alcohols, composed of long-chain aliphatic molecules, are derived from natural fats and oils or produced synthetically. They serve as essential ingredients in various applications, including household cleaners, laundry detergents, and personal care items such as shampoos and body washes. Detergent alcohols are often further processed into alcohol ethoxylates and sulfates, which enhance foaming and cleansing performance. The market includes a wide range of manufacturers who supply these alcohols to industries focused on hygiene, cleaning, and cosmetic products. It is defined by the consistent demand for high-quality surfactant ingredients, innovation in formulation, and advancements in production technologies. As a fundamental component in cleaning chemistry, detergent alcohols hold a central place in product development across the home care and personal care sectors.

Attractive Opportunities in the Detergent Alcohols Market

- Creating high-purity, bio-based, and specialty detergent alcohol formulations tailored for niche applications in premium personal care and cosmetic products. This taps into the growing consumer preference for natural, skin-friendly ingredients.

- Utilizing waste oils, non-edible feedstocks, and sustainable raw materials to improve environmental impact and appeal to eco-conscious brands, aligning with global sustainability trends.

- Partnering to develop advanced processing techniques and value-added detergent alcohol derivatives, fostering innovation and opening new market segments.

- Enhancing operational efficiency and supply chain responsiveness through digital tools, automation, and smart manufacturing technologies, enabling companies to adapt quickly to market changes and reduce costs.

Global Detergent Alcohols Market Dynamics

DRIVER: Rising consumer awareness of hygiene and cleanliness

Rising consumer awareness of hygiene and cleanliness is significantly increasing the demand for detergents and cleaning products, which directly boosts the need for detergent alcohols as essential raw materials. The expanding personal care and home care industries are also major contributors, with growing usage of products like shampoos, body washes, and surface cleaners. In addition, increasing urbanization and population growth are leading to higher consumption of daily-use cleaning items. The trend toward eco-friendly and biodegradable products is encouraging the use of naturally derived fatty alcohols, supporting market expansion. Technological advancements in production processes and improved supply chain efficiencies are also contributing to growth by enabling higher output and cost-effective manufacturing. Moreover, the rising disposable incomes in emerging markets are allowing consumers to spend more on premium and specialized cleaning products, further stimulating demand for detergent alcohols.

RESTRAINT: Volatility in raw material prices

Volatility in raw material prices, especially for natural oils and petrochemical derivatives, which can lead to fluctuating production costs and reduced profit margins for manufacturers. Environmental concerns and regulatory restrictions related to the use of synthetic and non-biodegradable ingredients also pose hurdles, particularly in regions with stringent environmental standards. Additionally, the production of detergent alcohols from natural sources may compete with food resources, raising sustainability concerns. Technological limitations in certain production methods can impact efficiency and scalability, especially for small and medium-sized manufacturers. Market fragmentation and intense competition among key players can also suppress pricing power and profitability. Furthermore, the availability of alternative surfactant ingredients and bio-based solutions may shift demand away from conventional detergent alcohols, potentially slowing market expansion.

OPPORTUNITY: Development of innovative bio-based and specialty alcohol

One key opportunity lies in the development of innovative bio-based and specialty alcohol formulations tailored for niche applications in premium personal care and cosmetic products. As consumer preferences shift toward natural and skin-friendly ingredients, manufacturers can tap into this trend by offering differentiated, high-purity alcohols. Another opportunity exists in the adoption of green chemistry and circular economy practices, including the use of waste oils or non-edible feedstocks, which can improve sustainability and appeal to environmentally conscious brands. Strategic collaborations with research institutions and technology providers can further open avenues for advanced processing techniques and value-added derivatives. Additionally, digitalization of the supply chain and integration of smart manufacturing can enhance operational efficiency and responsiveness to market changes. These innovations and strategic shifts provide a chance for companies to build competitive advantage and capture emerging segments in the global detergent alcohols market.

CHALLENGES: Maintaining consistent product quality and performance across diverse feedstocks

One notable challenge is maintaining consistent product quality and performance across diverse feedstocks and production methods, especially as manufacturers explore alternative raw materials. Ensuring compatibility of detergent alcohols with evolving formulations in personal care and cleaning products requires continuous R&D and adaptation. Another challenge is meeting the growing demand for transparency and traceability in sourcing and manufacturing practices, driven by consumer and regulatory expectations. This necessitates complex supply chain monitoring and certification processes. Additionally, navigating intellectual property issues and patent restrictions, particularly in the development of novel or specialty alcohol derivatives, can limit innovation and market entry for smaller players. Global geopolitical instability and trade policy changes also pose risks to the supply and pricing of key inputs. Addressing these challenges requires strategic investments in technology, compliance, and collaboration across the value chain to ensure long-term competitiveness and resilience.

Global Detergent Alcohols Market Ecosystem Analysis

The global detergent alcohols market ecosystem includes raw material suppliers, manufacturers, formulators, distributors, regulatory bodies, and end-use industries. Natural oils and petrochemical inputs are processed into fatty alcohols, which are then converted into surfactants used in detergents and personal care products. These products are distributed to home care, personal care, and industrial sectors. Regulatory bodies ensure safety and environmental compliance, while consumer demand for sustainable and biodegradable products shapes innovation. The ecosystem is highly interconnected, with collaboration across supply chains and increasing focus on green chemistry and ethical sourcing.

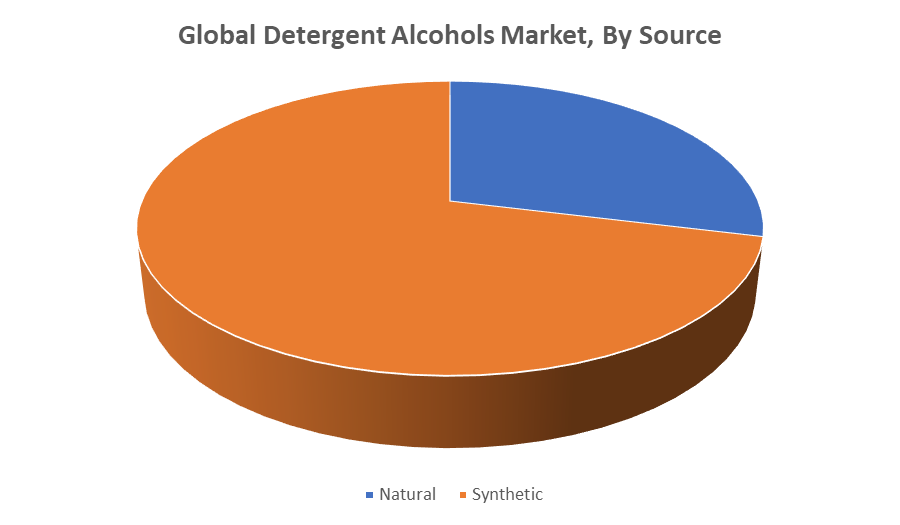

Based on the source, the synthetic segment accounted for the largest revenue share and is expected to grow at a substantial CAGR over the forecast period

The synthetic segment accounted for the largest revenue share in the global detergent alcohols market and is expected to grow at a substantial CAGR over the forecast period. This dominance is attributed to the wide availability, cost-effectiveness, and consistent quality of synthetic detergent alcohols, which are primarily derived from petrochemical sources. Their compatibility with various formulations in detergents and industrial cleaning products makes them highly preferred across multiple end-use sectors. Additionally, ongoing advancements in petrochemical processing and large-scale production capabilities further support the segment’s growth trajectory.

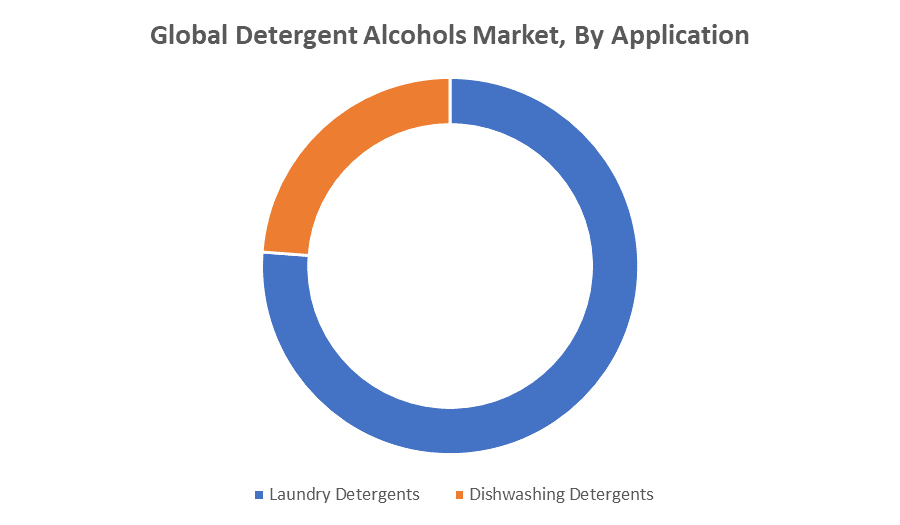

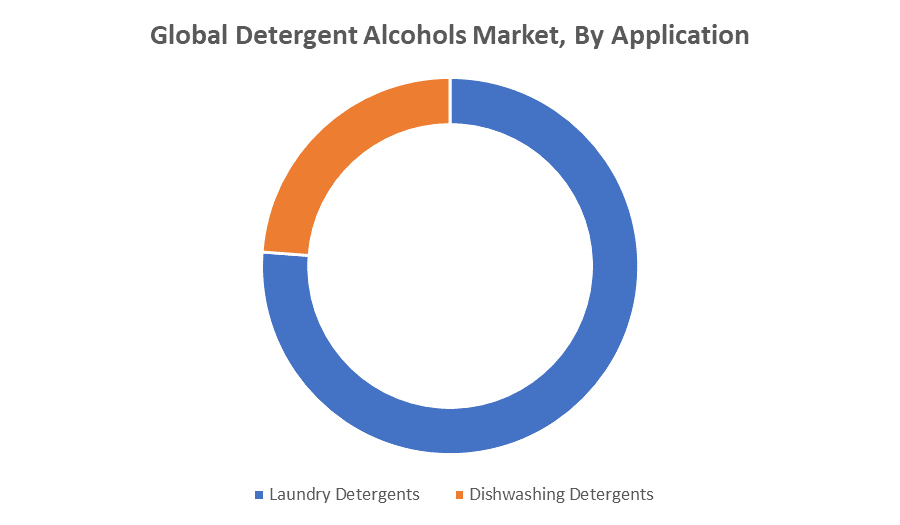

Based on the application, the laundry detergents segment held the largest revenue share and is expected to grow at a remarkable CAGR over the forecast period

The laundry detergents segment held the largest revenue share in the global detergent alcohols market and is expected to grow at a remarkable CAGR over the forecast period. This growth is driven by the consistent global demand for effective cleaning solutions in both household and commercial laundry care. Detergent alcohols play a critical role in enhancing the cleaning performance and foaming properties of laundry detergents. Increasing consumer focus on hygiene and cleanliness, coupled with the rising use of liquid and powder detergents, supports the expanding market for detergent alcohols in this segment.

Asia Pacific is anticipated to hold the largest market share of the detergent alcohols market during the forecast period

Asia Pacific is anticipated to hold the largest market share in the detergent alcohols market during the forecast period. This is due to the region’s expanding population, rapid urbanization, and growing middle-class consumer base, which are driving increased demand for detergents and personal care products. Additionally, the presence of abundant raw materials, such as palm oil and coconut oil, supports local production of detergent alcohols. Rising industrialization and improved manufacturing capabilities further contribute to the region’s strong market position. Together, these factors make Asia Pacific a key hub for both consumption and production in the global detergent alcohols market.

Middle East & Africa is expected to grow at the fastest CAGR in the detergent alcohols market during the forecast period

The Middle East & Africa region is expected to grow at the fastest CAGR in the detergent alcohols market during the forecast period. This rapid growth is driven by increasing industrialization, rising consumer awareness about hygiene, and expanding urban populations. Additionally, growing investments in manufacturing infrastructure and improvements in the retail sector are boosting demand for detergents and personal care products. The region's strategic focus on diversifying economies and increasing disposable incomes further supports the accelerating market growth for detergent alcohols.

Recent Development

- In April 2024, Unilever launched Wonder Wash, a liquid laundry detergent designed for short cycles as quick as 15 minutes, under its Dirt Is Good brand (including Persil, OMO, and Skip). The product utilizes Pro-S Technolog, combining enzymes and other ingredients to effectively tackle stains and odors in reduced wash times. The launch was supported by a multi-million-pound campaign featuring Usain Bolt, aiming to tap into the growing demand for quick and efficient laundry solutions.

Key Market Players

KEY PLAYERS IN THE DETERGENT ALCOHOLS MARKET INCLUDE

- Sasol Limited

- Shell Chemicals

- BASF SE

- Ecogreen Oleochemicals

- Musim Mas Holdings Pte. Ltd.

- Wilmar International Ltd.

- KLK Oleo

- Emery Oleochemicals

- Kao Corporation

- Godrej Industries Limited

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the detergent alcohols market based on the below-mentioned segments:

Global Detergent Alcohols Market, By Source

Global Detergent Alcohols Market, By Application

- Laundry Detergents

- Dishwashing Detergents

Global Detergent Alcohols Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa