Heated Tobacco Products Market Summary

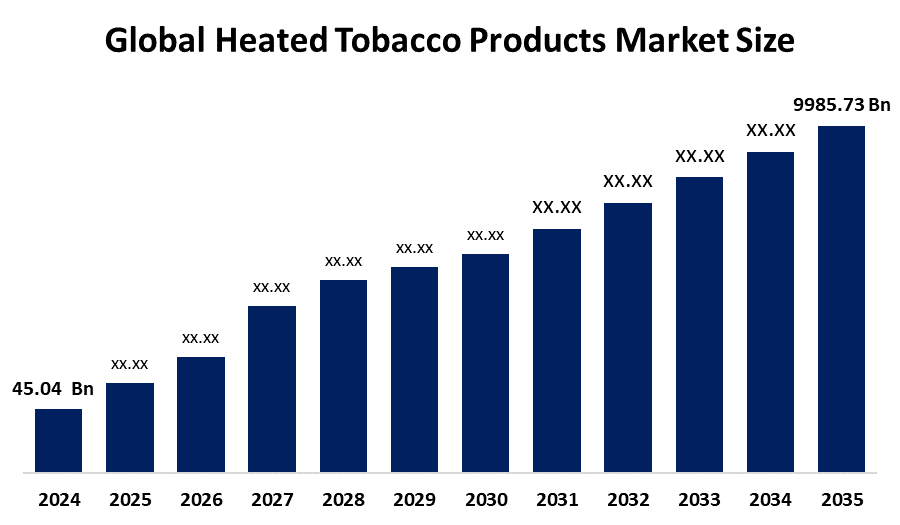

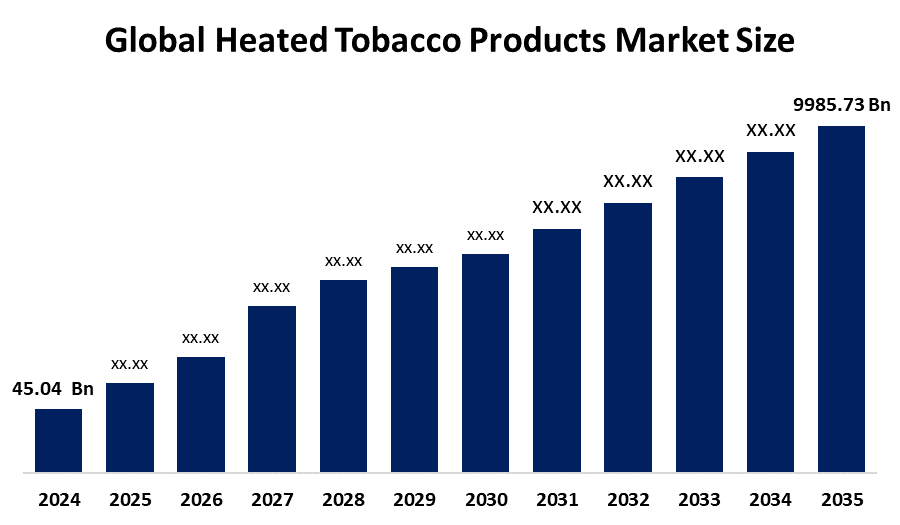

The Global Heated Tobacco Products Market Size Was Valued at USD 45.04 Billion in 2024 and is Projected to Reach USD 9985.73 Billion by 2035, Growing at a CAGR of 63.4% from 2025 to 2035. The market for heated Tobacco Products is expanding due to factors such as growing health concerns, the demand for smoking cessation alternatives, perceptions of lower risk, technological advancements, and growing acceptability among smokers looking for harm-reduction solutions.

Key Regional and Segment-Wise Insights

- In the Global market for heated tobacco products, Asia Pacific held the largest revenue share of 67.5% in 2024.

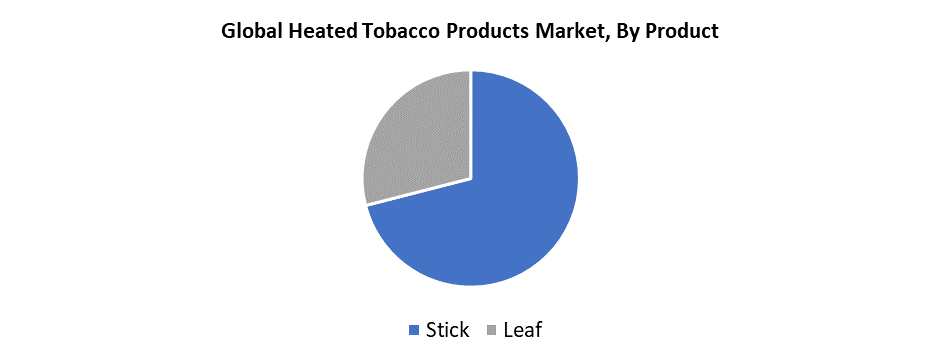

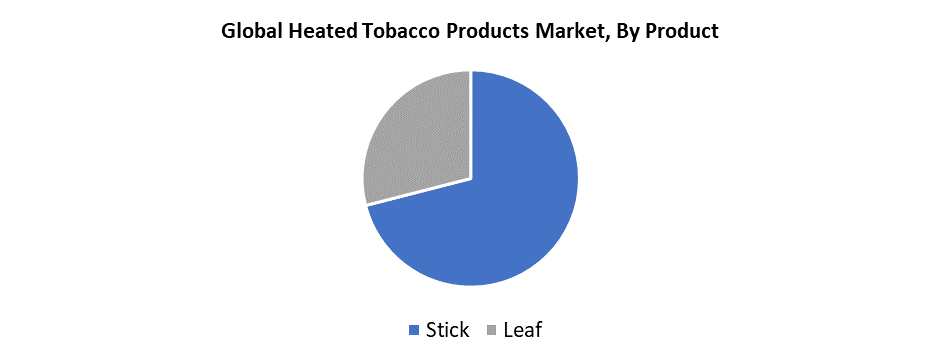

- In 2024, the stick segment had the biggest revenue share in the heated tobacco products market, accounting for 71.3% based on product.

- In 2024, the offline segment led the worldwide heated tobacco products market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 45.04 Billion

- 2035 Projected Market Size: USD 9985.73 Billion

- CAGR (2025-2035): 63.4%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The tobacco industry operates the Global Heated Tobacco Products (HTPs) Market as its dedicated segment for devices that produce inhalable aerosols through tobacco heating without combustion. The elimination of combustion in HTPs compared to traditional cigarettes results in reduced toxic effects. The market expands because people seek healthier products while needing safer tobacco alternatives and developing awareness about their health. Increasing adoption of heated tobacco products has been driven by shifting social attitudes as well as strategic promotional efforts from leading tobacco companies. The market expansion receives support from urban development and rising personal wealth, together with the increasing appeal of smoke-free environments. The demand for less dangerous nicotine delivery systems among North American, European, and Asia-Pacific consumers drives sales of HTPs in these regions.

The advancement of the HTP market depends heavily on technological advancements. The market focuses on enhancing user experience through smart temperature controls, together with advanced heating mechanisms and improved energy efficiency. Leading brands dedicate resources to developing diverse taste options and minimalist devices, which attract new customers. Governments, including Japan and various European regions, have adopted supportive measures through tax differentiation and regulatory systems that treat HTPs as reduced-risk products. These initiatives have started the process of expanding market reach and opening new entry points. Potential barriers may develop since various regions continue to debate product classification regulations.

Product Insights

The stick segment held a 71.3% revenue share while leading the global heated tobacco product market during 2024. The stick products, which are also known as heat sticks or tobacco units, appeal to adult smokers who want alternatives because they duplicate traditional cigarette sensations and operate with heating devices. Their growth has been supported by their simple design, easy portability, and their widespread distribution through physical stores and online platforms. The substantial marketing investments from major tobacco corporations toward stick-based products resulted in increased market share acquisition. Consumers seek delicious and consistent single-use products, which drives their demand. The stick segment maintains its leadership position in the evolving tobacco substitute market because it combines user-friendly design with established branding and familiar usage patterns.

The leaf segment of the global heated tobacco products market will experience the fastest growth during the forecast timeframe. Compared to pre-made tobacco sticks, the leaf category delivers loose-leaf tobacco or capsules, which give consumers personalized consumption options along with increased flexibility. The format attracts experienced tobacco consumers as well as those who want natural options because it lets users manage their tobacco amounts and select their preferred blends. The rising consumer interest in inexpensive, eco-friendly options drives market expansion through increased usage of refillable and reusable heated tobacco devices. Innovations in flavor diversity and gadget interoperability will drive adoption, particularly in markets where shifting consumer preferences coincide with relaxed regulatory frameworks.

Distribution Channel Insights

The offline segment dominated the worldwide heated tobacco product market with the largest revenue share in 2024. This product category consists of physical retail establishments, including supermarkets, convenience stores, tobacco specialty shops, and branded kiosks. Customers continue to prefer offline channels since they provide immediate access to products and direct customer assistance alongside the ability to physically check equipment before purchasing. Large tobacco corporations have made significant investments in retail infrastructure, such as flagship locations and advertising stands, to enhance consumer trust and brand awareness. The most efficient method for selling heated tobacco products remains offline distribution in regions including Asia-Pacific and Europe, where these products are widely used. The offline segment maintains its market leadership position because several regions have implemented restrictions that support controlled in-store transactions.

The online segment of heated tobacco products (HTPs) will experience the fastest CAGR during the forecast period. The rapid growth of this market segment results from consumers choosing online shopping because it offers both convenience and expanded product selection as well as attractive discounts. Manufacturers can reach more customers via e-commerce platforms that collect valuable consumer information to develop customized promotional activities. Digital advertising has increased consumer awareness of heated tobacco products, while smartphone adoption and improved internet access have also driven this trend forward. Contactless shopping became a preference among consumers during COVID-19, which led to online distribution channels becoming the dominant choice in the market.

Regional Insights

The Asia Pacific region dominated the global heated tobacco product (HTP) market with 67.5% revenue share in 2024. The large population of the region, together with increasing disposable income levels and rising recognition of alternative tobacco products as potentially safer alternatives to traditional cigarettes, explains its market leadership. The acceptance of heated tobacco technology has been prominent in countries that have efficient distribution networks and supportive regulatory environments, including South Korea and Japan. The market growth rate in the region remains strong due to expanding retail and online channels, together with rising health awareness and rapid urbanization. The Asia Pacific market will sustain its leading position throughout the forecast period because of ongoing product development and increasing consumer interest in smokeless tobacco alternatives.

North America Heated Tobacco Products Market Trends

North America held a significant revenue share within the heated tobacco products (HTPs) market during 2024. The rising use of next-generation tobacco products, together with increased consumer awareness about alternative harm reduction products, serves as the primary cause for this trend. The area benefits from strong distribution channels through physical storefronts and expanding internet platforms, together with established regulatory frameworks. The market for less dangerous cigarette substitutes benefits from the rising health awareness of smokers. Major market players maintain stable market growth because of their successful marketing strategies, together with continuous product development. The forecast period should see continued revenue share stability because of North America's favorable economic environment and ongoing research and development activities.

Europe Heated Tobacco Products Market Trends

During the forecast timeframe, Europe is anticipated to experience the fastest CAGR in the worldwide heated tobacco product (HTP) market. The fast expansion results from increased public knowledge concerning traditional smoking risks coupled with rising consumer interest in safer alternatives. Industry leaders drive market expansion through their effective marketing strategies and new product launches, while several European nations maintain regulatory support. Strong retail and online distribution channels help customers find heated tobacco products with ease. The rising research and development spending, combined with increasing smoke-free environment initiatives throughout the region, drives the growing adoption of heated tobacco products.

Key Heated Tobacco Products Companies:

The following are the leading companies in the heated tobacco products market. These companies collectively hold the largest market share and dictate industry trends.

- BAT

- Imperial Brands plc

- China National Tobacco Corporation

- JT International S.A.

- PAX Labs, Inc.

- Philip Morris Products S.A.

- Vapor Tobacco Manufacturing LLC

- Altria Group, Inc.

- Shenzhen Yukan Technology Co., Ltd.

- KT&G Corp.

- Others

Recent Developments

- In March 2024, British American Tobacco announced the opening of its advanced 'Innovation Centre' facility at its R&D headquarters in Southampton. The facility would consist of nine technological rooms that would accelerate the development of the company's New Category, Reduced Risk Products. Products that will be developed include liquids and flavors for vapor products, heated tobacco products, and contemporary oral nicotine pouches. The stimulation and health of users would also be studied, in addition to nicotine, packaging, engineering, and system integration. The innovation is in line with BAT's "Build a Smokeless World" plan, which calls for non-combustible solutions to account for 50% of total income by 2035.

- In March 2024, in Japan, Philip Morris International celebrated the tenth anniversary of the debut of their IQOS portfolio with the launch of the 'IQOS ILUMA i line of heated tobacco products. On average, the new products emit 95% fewer dangerous chemicals than traditional cigarettes, which is comparable to other devices in this range. The IQOS ILUMA i PRIME, IQOS ILUMA i, and IQOS ILUMA i ONE are devices in this range that make use of PMI's bladeless SMARTCORE INDUCTION SYSTEM. Additionally, they have a touchscreen on the device holder, FlexBattery to enhance battery life and lower the production of e-waste, and Pause Mode to maximize stick usage.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the heated tobacco products market based on the below-mentioned segments:

Global Heated Tobacco Products Market, By Product

Global Heated Tobacco Products Market, By Distribution Channel

Global Heated Tobacco Products Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa