Grain Alcohol Market Summary

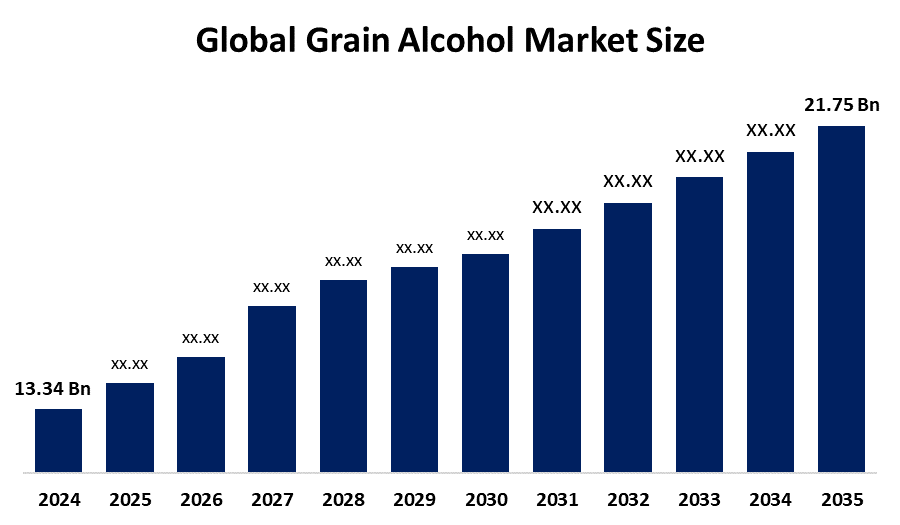

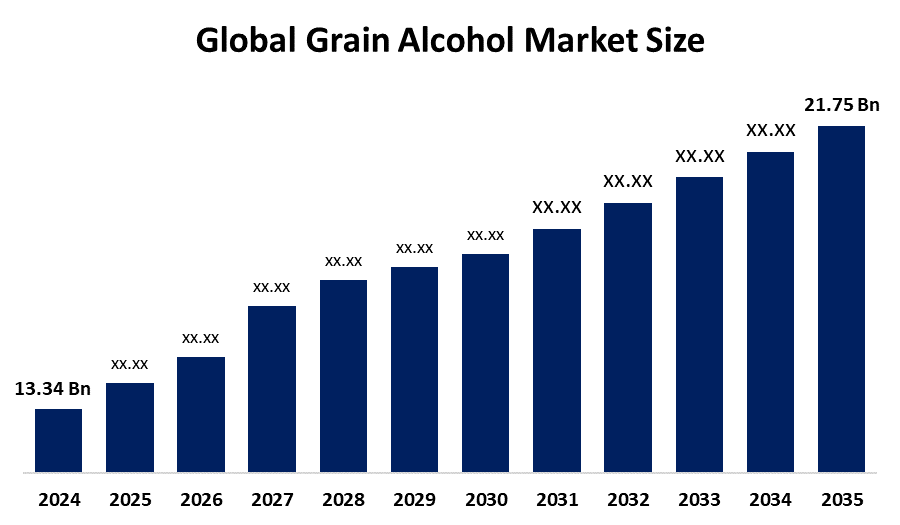

The Global Grain Alcohol Market Size Was Estimated at USD 13.34 Billion in 2024 and is Projected to Reach USD 21.75 Billion by 2035, Growing at a CAGR of 4.54% from 2025 to 2035. A number of factors are driving the expansion of the grain alcohol market globally, such as the growing demand for alcoholic beverages, the craft beverage industry, the growing usage of biofuels, and the growing desire for sustainable and natural ingredients.

Key Regional and Segment-Wise Insights

- In 2024, Europe held the largest revenue share of over 39.5% and dominated the market globally.

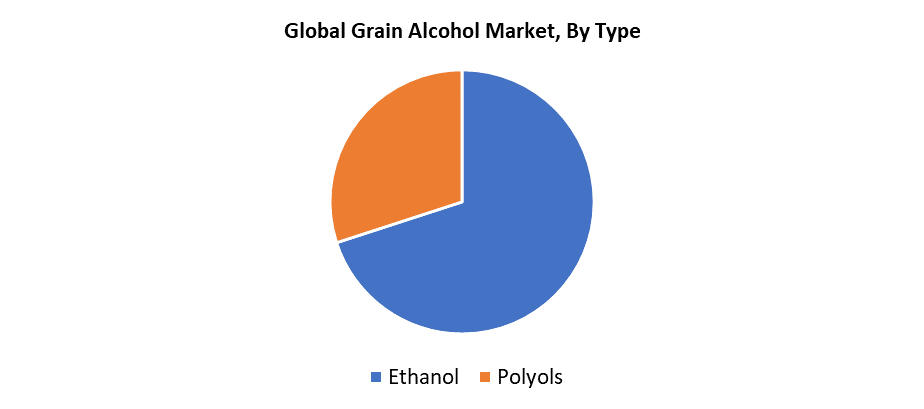

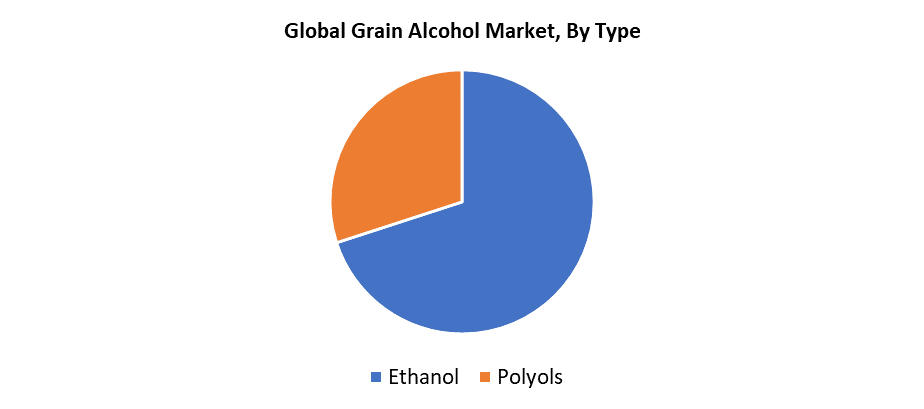

- In 2024, the ethanol segment had the highest market share by type.

- In 2024, the beverage segment had the biggest market share by application and led the market globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 13.34 Billion

- 2035 Projected Market Size: USD 21.75 Billion

- CAGR (2025-2035): 4.54%

- Europe: Largest market in 2024

The Grain Alcohol Market Size operates as a worldwide industry that manufactures and distributes ethanol derived from corn, wheat, rye, and barley. Multiple industries rely heavily on grain alcohol, including food and beverage production, medical and cosmetic applications, and industrial operations. The expanding market growth stems from the rising bioethanol consumption as a renewable fuel, which emerges from environmental issues and fossil fuel dependency reduction goals. The market continues its expansion because grain alcohol serves as a preservative and solvent in consumer goods while being essential for hand sanitizer production and other hygiene items across both developed and emerging market territories.

The future development of the grain alcohol market is substantially influenced by current technological advancements. The combination of innovative fermentation processes with improved distillation methods produces enhanced operational efficiency while reducing production expenses and promoting sustainable ethanol industry operations. Real-time monitoring systems and automated production processes allow facilities to achieve higher yields and better quality results. Government initiatives that promote biofuel adoption and ethanol blending rules drive rising demand for grain-based ethanol. Multiple countries throughout Asia, Europe, and North America are dedicating infrastructure funding toward expanding bioethanol production while decreasing carbon emissions. Market expansion is expected to continue growing due to these developments, along with supportive regulatory frameworks and sustainability objectives in the coming years.

Type Insights

The ethanol segment accounted for the largest revenue share in the grain alcohol market in 2024 because companies across multiple industries widely use ethanol. The production of biofuels, along with medications, cosmetics, and beverages, depends on ethanol, which is manufactured from corn, wheat, and barley grains. The combination of government fuel regulations, together with rising environmental worries, has led to a significant increase in demand. The market position of ethanol improved because of its rising usage in disinfectants and sanitizers throughout and following the COVID-19 pandemic. Grain alcohol markets favor ethanol because it provides both economic benefits and versatile applications, with sustainable production methods.

The global grain alcohol market's polyols segment is anticipated to grow at the fastest CAGR during the forecast period. The rising usage of polyols, including glycerin and sorbitol, in personal care and cosmetics and pharmaceutical applications drives their increasing popularity. The applications take advantage of polyols' properties as excipients, stabilizers, and moisturizers in pharmaceutical products. The flexibility of polyols in various formulations drives their growing consumer acceptance because people seek clean-label and multiple-purpose additives. The grain alcohol industry identifies polyols as a key growth segment through this development, which particularly affects regions with rigorous regulatory standards and plant-based component preferences.

Application Insights

The beverage sector led the grain alcohol market with the largest revenue share during 2024 because grain alcohol serves as the base ingredient for vodka, gin, whiskey, and various other spirits. The market experienced growth because changing consumer preferences, along with rising disposable income levels, created increased demand for premium and craft alcoholic drinks throughout the world. The distillation of many alcoholic drinks requires ethanol as a fundamental component because this ingredient remains affordable and has no distinct taste while maintaining purity. The segment achieved its dominant position due to the rising popularity of ready-to-drink (RTD) beverages and the expanding nightlife culture, together with changing social drinking patterns.

The food segment of the grain alcohol market will experience the fastest CAGR during the forecast period. The rising use of grain alcohol as a natural preservative, flavor enhancer, and solvent in food preparation drives the market growth. The growing popularity of clean-label products, together with the demand for natural ingredients, pushes manufacturers to replace synthetic additives with grain-derived alcohol. The high demand for grain alcohol stems from its wide application in baking, along with confections and extracts, and food coloring. The food category will achieve substantial and long-lasting growth throughout the forecasted period because of the expanding food and beverage sector in developing countries, as well as changing dietary patterns and government backing for natural ingredients.

Regional Insights

The North American grain alcohol market had a substantial market share in 2024 because of its strong industrial foundation and its high demand from the personal care, food and beverage, and pharmaceutical industries. The United States held the leading position in the regional market because of its large ethanol production facilities and supportive government policies promoting renewable and bio-based chemical applications. The use of grain alcohol in hand sanitizers and medical applications, and health-focused food items has expanded because people prefer natural and sustainable ingredients. The post-pandemic emphasis on sanitation and hygiene practices has created additional demand growth. The worldwide grain alcohol market features North America as a leading player because of its powerful distribution networks combined with progressive fermentation and distillation technological advancements.

Europe Grain Alcohol Market Trends

The European grain alcohol sector held the largest revenue share of the total market, accounting for 39.5% in 2024, because various industries, including biofuels and food and beverage, alongside cosmetics and medicines, increased their consumption. The region's strong regulatory framework for sustainable and bio-based products led to a major increase in grain alcohol usage as a chemical substitute, particularly in Germany, France, and the UK. Stable consumption was also aided by the growing pharmaceutical industry and the growing demand for organic personal care items. Revenue growth increased because Europe implemented ethanol fuel blending to reduce carbon emissions. The combination of advanced manufacturing methods and precise quality standards established Europe as the leading revenue-producing region of the global grain alcohol market in 2024.

Asia Pacific Grain Alcohol Market Trends

The Asia Pacific grain alcohol market will grow at a significant CAGR throughout the forecast period because of the region's fast industrialization and population growth, together with increasing demand in food and beverage and pharmaceutical and personal care sectors. Countries such as China, India, and Japan serve as key drivers because of their expanding middle-class populations, urban development, and their citizens' preference for natural and health-based ingredients. The rising popularity of grain alcohol in sanitizers and disinfectants stems from increased hygiene awareness, especially after the epidemic outbreak. The expansion of the market receives backing from government initiatives that push for renewable chemical and biofuel utilization. The Asia Pacific region will experience one of the fastest growth rates in the global grain alcohol market because of rising exports and growing investment in regional production capacities.

Key Grain Alcohol Companies:

The following are the leading companies in the grain alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- Archer-Daniels-Midland Company (ADM)

- Wuliangye Yibin Co.

- Manildra USA

- Cargill Inc.

- Diageo plc

- Roquette Frères SA

- MGP Ingredients Inc.

- ChemCeed LLC

- Cristalco SAS

- Glacial Grain Spirits LLC

- Pernod Ricard SA

- Kweichow Moutai Co. Ltd.

- Greenfield Global Inc.

- Wilmar International Limited

- Others

Recent Developments

- In July 2025, in Punjab, Jagatjit Industries Limited's recently inaugurated 200 KLPD grain-based ethanol distillery plant began producing ethanol on a commercial basis. With this breakthrough, India's green fuel programs are supported, and the ethanol market is significantly expanded.

- In January 2021, the acquisition of Luxco, a well-known branded-alcohol company, was finalized by MGP Ingredients as part of its plans to diversify into higher-value product categories and bolster its portfolio of branded spirits.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the grain alcohol market based on the below-mentioned segments:

Global Grain Alcohol Market, By Type

Global Grain Alcohol Market, By Application

- Beverage

- Food

- Pharmaceuticals

- Others

Global Grain Alcohol Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa