CBD Pouches Market Summary

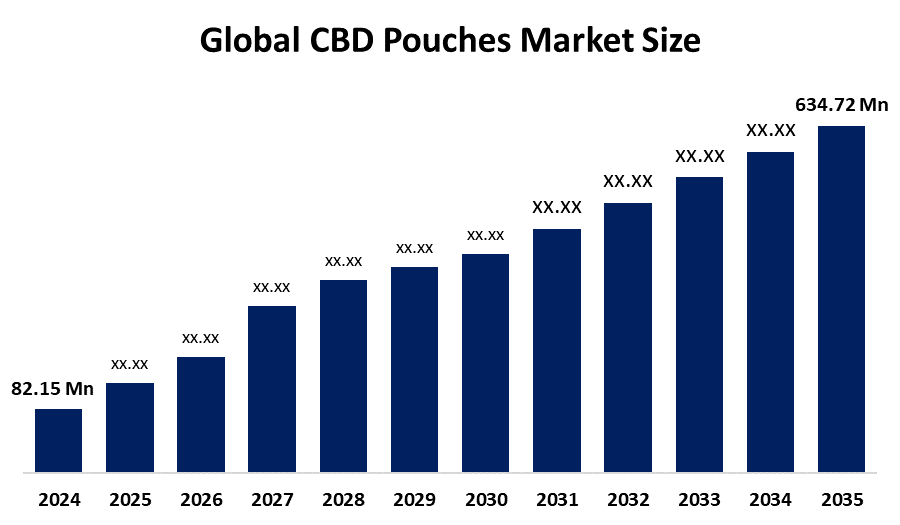

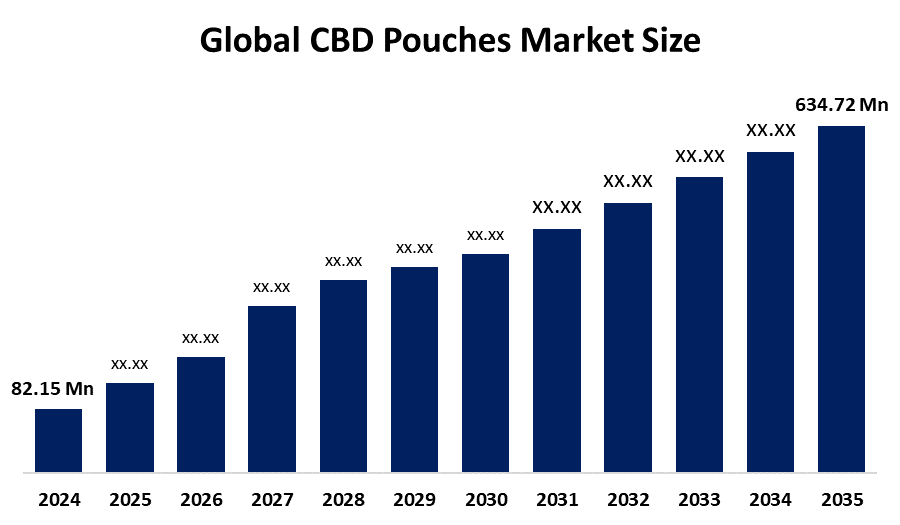

The Global CBD Pouches Market Size Was Estimated at USD 82.15 Million in 2024 and is Expected to Reach USD 634.72 Million by 2035, Growing at a CAGR of 20.43% from 2025 to 2035. The market for CBD pouches is expanding as a result of increased consumer acceptance of natural wellness products, legalization of CBD, growing health consciousness, the need for smokeless options, product innovation, convenience, and discreet use.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest market share by region, accounting for 57.83%.

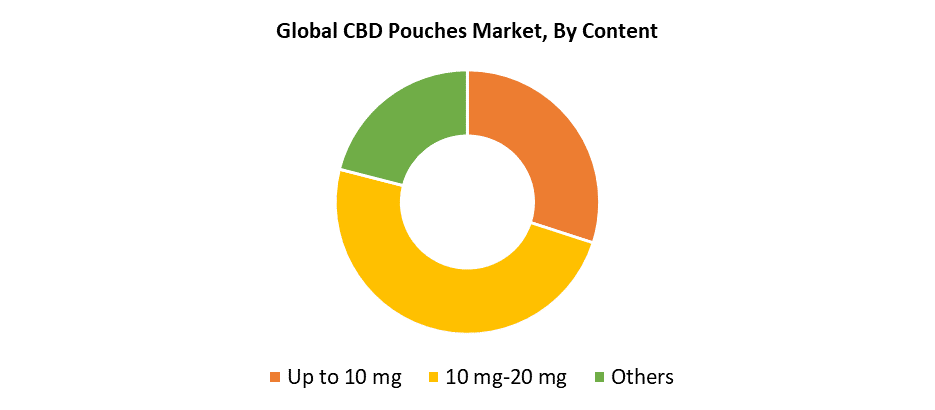

- In terms of content, the 10 mg–20 mg segment dominated the market in 2024, holding a 49.6% share.

- With an 85.4% market share in 2024, the flavored sector led the global market by type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 82.15 Million

- 2035 Projected Market Size: USD 634.72 Million

- CAGR (2025-2035): 20.43%

- North America: Largest market in 2024

The market for CBD pouches functions as the cannabinoid (CBD) sector, which focuses on non-inhalable and smokeless oral products for discreet use. These pouches resemble nicotine pouches, but their popularity continues to rise because consumers seek natural wellness options for managing pain and stress and reducing anxiety. The rising popularity of cannabis-derived products alongside expanding public knowledge about CBD health benefits has significantly boosted consumer demand. The decreasing smoking rates worldwide push customers toward choosing delivery methods that do not require inhalation. The market expands due to increased investment by key companies into product development and branding, alongside rising numbers of elderly individuals and athletes seeking natural recovery options.

The CBD pouch sector experiences growth because of governmental programs alongside technological advancements. Nanoencapsulation and bioavailability enhancement methods have advanced the quickness and efficiency of CBD absorption, which makes pouches more effective and attractive. Companies are exploring environmentally friendly packaging along with organic compositions to meet the needs of consumers who care about sustainability. The relaxation of rules regarding hemp-based CBD across multiple countries has established clear legal frameworks that encourage business investments and product development. The current market growth potential stems from legal frameworks that permit CBD products manufacturing and marketing under strict safety rules across the U.S., Canada, and European territories.

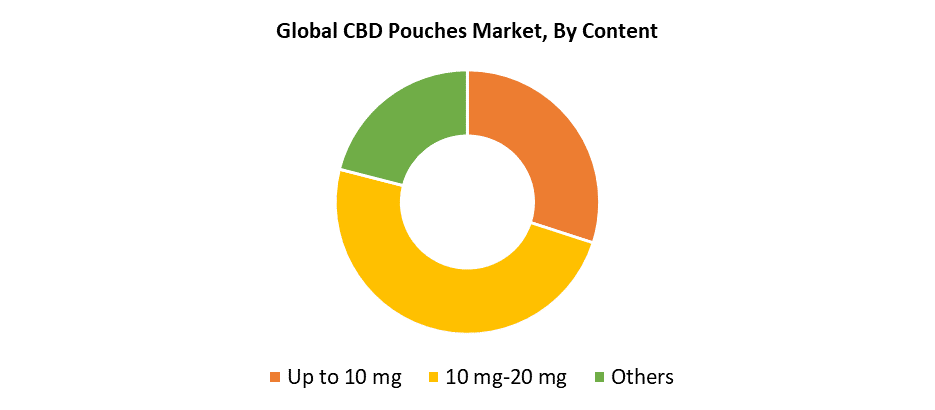

Content Insights

The 10 mg–20 mg CBD content segment demonstrated the largest revenue share of 49.6% during 2024 because it delivers balanced performance and satisfies most users. This dosage level works best for users who need everyday stress relief and mild discomfort management since it generates subdued yet observable effects. This dosage level appeals to a wide range of users because it meets the needs of beginners and experienced individuals. This assortment of products can be purchased from both retail stores and online platforms. Manufacturers prefer this category because it meets most regulatory standards, which allows for extensive distribution opportunities. The steady demand for safe and effective CBD dosages with controllable effects drives the market leadership of this segment.

The up to 10 mg category is anticipated to grow at a significant CAGR throughout the projected period. First-time users and health-conscious shoppers seeking low-dose, non-threatening wellness alternatives are the primary factors behind this increase. People who seek therapeutic CBD advantages without the possibility of high doses or intense euphoric effects will be drawn to the lower dosage options. The market receives increased support because of microdosing trends, along with growing acceptance by younger demographics. Manufacturers respond to the market by producing new flavor profiles and minimalist packaging designs while enhancing retail distribution to drive growth. The growing consumer trust in low-dose CBD products stems from clear regulations that define these products.

Type Insights

The flavored segment led the CBD pouches market in 2024 with a revenue share of 85.4%. The main reasons behind the rising trend are consumer preferences toward better flavors and enhanced product enjoyment. The flavored CBD pouches appeal to a wider audience of users, including beginners who may find natural hemp tastes unpleasant, because they come in mint, citrus, berry, and tropical flavors. The products create happier user experiences along with better taste profiles, which leads to stronger brand loyalty and customer retention. The introduction of new flavors allows producers to distinguish their products from other competitors in the market. The flavored segment maintains its lead in total market revenue because it attracts both traditional CBD users and nicotine pouch consumers moving into CBD products.

The unflavored segment is expected to experience significant CAGR during the forecast period because of growing consumer interest toward wellness products that have clean labeling and no additives. Health-conscious consumers have become more selective towards products and now choose unflavored CBD pouches that deliver an authentic experience without artificial flavors or sweeteners, or masking agents. The market growth is driven by seasoned CBD consumers who value products that maintain their original authenticity and purity. A small but expanding group of users shows interest in unflavored pouches because these products are commonly believed to perform better in therapeutic or medicinal applications. The segment experiences positive growth patterns because manufacturers focus on creating organic formulas with minimal components.

Regional Insights

The North America region led the CBD pouch industry with the largest revenue share of 57.83% during 2024 because consumers increasingly recognize CBD wellness benefits, together with their desire for convenient intake solutions. The established regulatory system in this region and expanding cannabis product legalization have become key factors behind market growth. The growing distribution platforms and innovative product development enable various consumer groups to buy CBD pouches through retail stores and online platforms. Market leaders allocate substantial funding to research and development activities, which focus on product enhancement and product variety expansion. The global CBD pouch industry finds its dominant market position in North America because health-conscious and wellness-oriented customers drive continuous demand in this region.

Europe CBD Pouches Market Trends

The European CBD pouch market held a significant market share in 2024 because of enhanced consumer knowledge about CBD benefits and increasing demand for smokeless, easy-to-use products. The market benefited from progressive regulatory approaches of various countries, which enhanced product accessibility and innovation. The availability of CBD pouches across Europe increased substantially because of expanding retail distribution networks and online sales platforms. The market continued its steady growth because wellness-focused customers showed increasing interest in the products. Major industry leaders established Europe's substantial standing in the worldwide CBD pouch market through their substantial product development investments and consumer-centric marketing strategies.

Asia Pacific CBD Pouches Market Trends

The Asia Pacific CBD pouch market is anticipated to experience significant CAGR throughout the forecasted period because consumers understand CBD benefits and want smokeless options. The industry advances through rising consumer acceptance of hemp products and the gradual relaxation of regulatory restrictions across important regions. The large population of the region, together with its rising middle-class population, drives the increasing adoption of products. The expanding retail distribution networks and online sales channels provide better accessibility, which speeds up market growth. The Asia Pacific CBD pouches market will experience faster growth because leading companies dedicate funds to developing new products alongside region-specific promotional efforts during the forthcoming years.

Key CBD Pouches Companies:

The following are the leading companies in the CBD pouches market. These companies collectively hold the largest market share and dictate industry trends.

- Cannadips

- V&YOU

- Vibe CBD+CBG

- Chillbar

- FlowBlend

- Comp9

- Metolius Hemp Company

- Jake's Mint Chew

- Chill.com

- Canndid

- Nicopods ehf.

- Others

Recent Developments

- In November 2024, to expand their product line outside California, Cannadips partnered up with Dark Horse Cannabis to introduce their smokeless cannabis pouches to Arkansas. The move featured a range of tastes and formulations intended for fast-acting, discreet consumption through dispensaries in Arkansas.

- In February 2023, together with Haypp Group, Cannadips Europe, a SpectrumLeaf company well-known for its high-end CBD snus products, introduced the ground-breaking Cannadips Terpene Pouch Collection. These simple, user-friendly pouches, which are available on Haypp's e-commerce platform snusbolaget.se, utilize the natural qualities of terpenes obtained from plants. The line, which is entirely free of tobacco, nicotine, CBD, and THC, is intended to provide snus users who prefer a cleaner, plant-based experience with a healthier option.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the CBD pouches market based on the below-mentioned segments:

Global CBD Pouches Market, By Content

- Up to 10 mg

- 10 mg-20 mg

- Others

Global CBD Pouches Market, By Type

Global CBD Pouches Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa