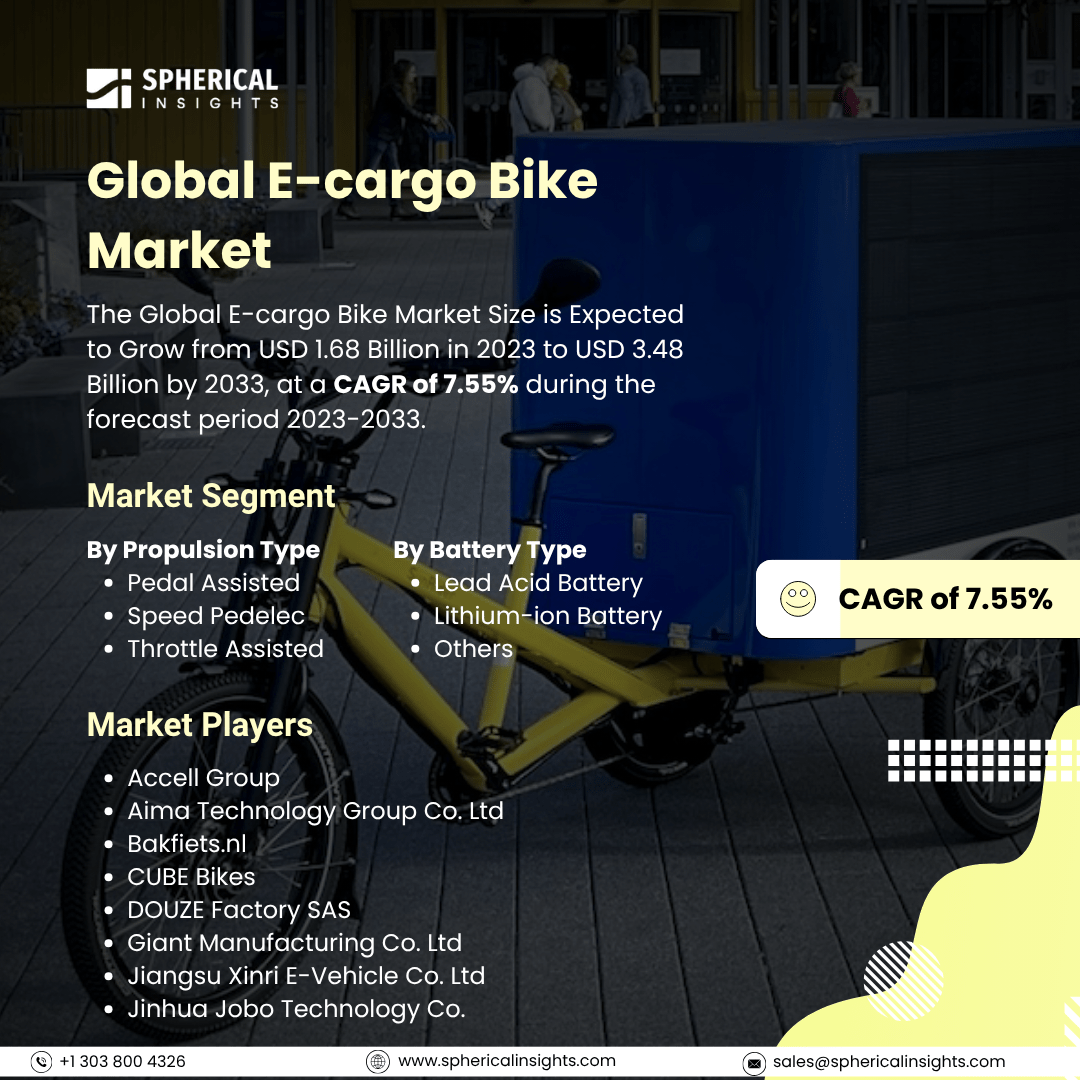

Global E-cargo Bike Market Size To Exceed USD 3.48 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global E-cargo Bike Market Size is Expected to Grow from USD 1.68 Billion in 2023 to USD 3.48 Billion by 2033, at a CAGR of 7.55% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global E-cargo Bike Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Pedal Assisted, Speed Pedelec, and Throttle Assisted), By Battery Type (Lead Acid Battery, Lithium-ion Battery, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The E-cargo bike market denotes the global industry dedicated to the manufacturing, sale, and distribution of electric cargo bikes, which are bicycles with electric motors built for carrying heavy loads, commodities, or people. E-cargo bikes present a green, economical, and effective option compared to conventional delivery vehicles, particularly for short- to medium-distance urban delivery, family transport, and business applications. Moreover, the E-cargo bike market is driven by rising urbanization, increasing demand for sustainable transportation, growth in e-commerce and last-mile delivery services, government incentives for green mobility, and advancements in battery technology. Businesses and consumers alike are adopting e-cargo bikes for their cost-efficiency, environmental benefits, and ability to navigate congested cities. However, high initial costs, limited range, long charging times, and lack of dedicated infrastructure restrain the e-cargo bike market, especially in regions with underdeveloped cycling networks or harsh weather conditions.

The pedal assisted segment accounted for the largest share of the global E-cargo bike market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on propulsion type, the global E-cargo bike market is divided into pedal assisted, speed pedelec, and throttle assisted. Among these, the pedal assisted bike segment accounted for the largest share of the global E-cargo Bike market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Pedal-assisted e-cargo bikes hold the largest market share globally. They offer an ideal balance between manual effort and electric support, making them energy-efficient, affordable, and popular for urban deliveries and family transport. Their extended range, lower maintenance costs, and eligibility for various subsidies further boost their widespread adoption.

The lithium-ion battery segment accounted for a substantial share of the global E-cargo bike market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the battery type, the global E-cargo bike market is divided into lead acid battery, lithium-ion battery, and others. Among these, the lithium-ion battery segment accounted for a substantial share of the global E-cargo bike market in 2023 and is anticipated to grow rapidly during the projected period. Their high energy density, lightweight design, and long lifespan make them ideal for urban logistics and personal transport. These batteries offer longer ranges, faster charging, and lower maintenance compared to alternatives, driving their widespread adoption in the industry.

Europe is projected to hold the largest share of the global E-cargo bike market over the projected period.

Europe is projected to hold the largest share of the global E-cargo bike market over the projected period. Strong environmental policies, government incentives, advanced cycling infrastructure, and growing adoption of sustainable last-mile delivery solutions drive demand. Countries like Germany, the Netherlands, and Denmark lead the market, promoting e-cargo bikes for both commercial and personal transportation.

Asia Pacific is expected to grow at the fastest CAGR of the global E-cargo bike market during the projected period. Rapid urbanization, expanding e-commerce, and increasing environmental awareness fuel growth, particularly in China and Japan. Government initiatives supporting electric mobility and the need for efficient urban delivery solutions also contribute to the regions strong and rising market presence.

Company Profiling

Major vendors in the global E-cargo bike market are Accell Group, Aima Technology Group Co. Ltd, Bakfiets.nl, CUBE Bikes, DOUZE Factory SAS, Giant Manufacturing Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd, Jinhua Jobo Technology Co., Pedego Electric Bikes, Pon Holding B.V., Rad Power Bikes, Riese & Müller, RYTLE GmbH, Smart Urban Mobility B.V., Tern Bicycles, The Cargo Bike Company, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Douze Cycles, a French company, released a line of cargo bikes in four models, three of which have electric assistance. The series of bikes has an impressive carrying capacity of up to 205 kg.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global E-cargo bike market based on the below-mentioned segments:

Global E-cargo Bike Market, By Propulsion Type

- Pedal Assisted

- Speed Pedelec

- Throttle Assisted

Global E-cargo Bike Market, By Battery Type

- Lead Acid Battery

- Lithium-ion Battery

- Others

Global E-cargo Bike Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa