Global Financial Cards and Payments Market Size To Exceed USD 350.89 Billion By 2033

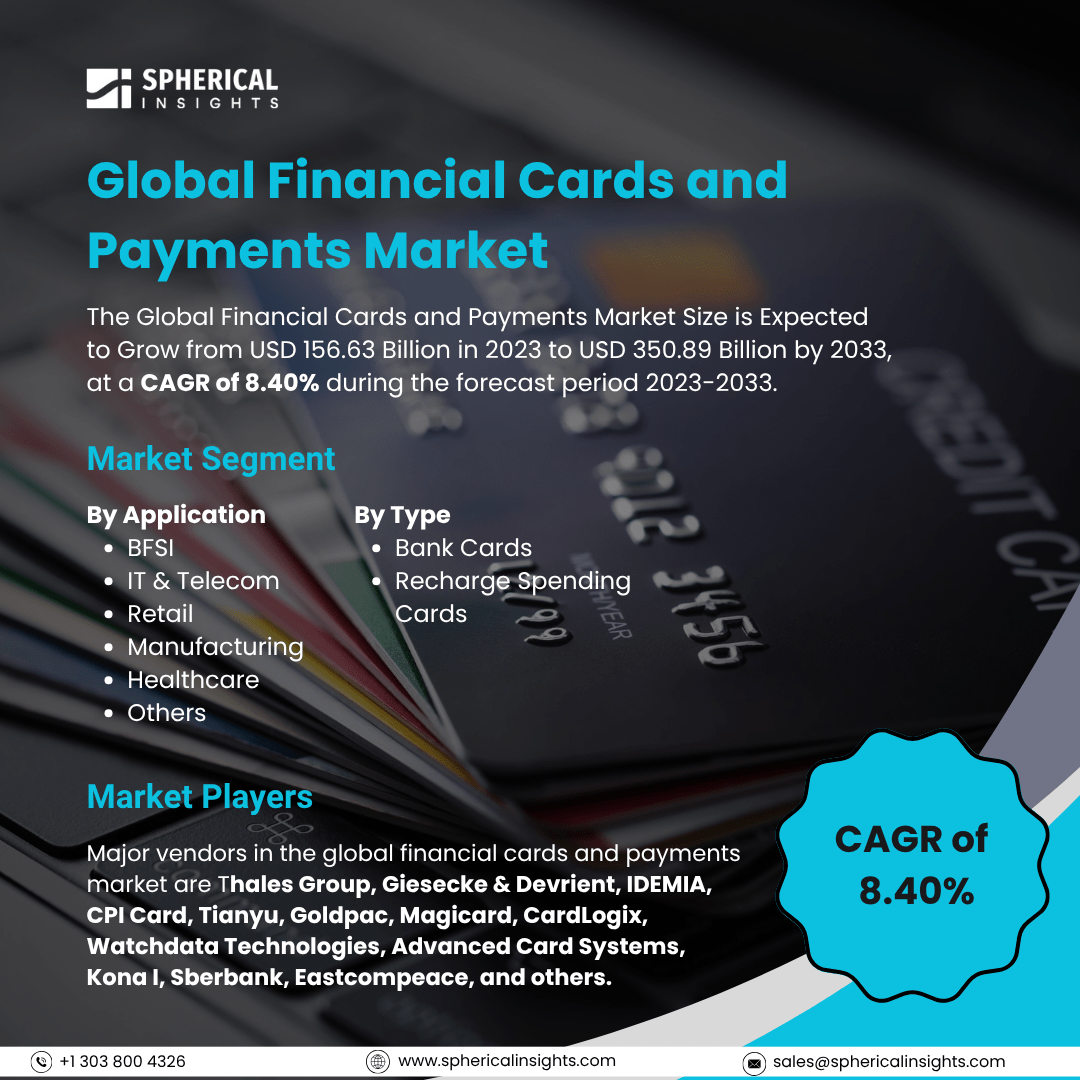

According to a research report published by Spherical Insights & Consulting, The Global Financial Cards and Payments Market Size is Expected to Grow from USD 156.63 Billion in 2023 to USD 350.89 Billion by 2033, at a CAGR of 8.40% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Financial Cards and Payments Market Size, Share, and COVID-19 Impact Analysis, By Type (Bank Cards and Recharge Spending Cards), By Application (BFSI, IT & Telecom, Retail, Manufacturing, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global financial cards and payments market refers to the worldwide industry that covers the issuance, use, and processing of financial cards (such as credit cards, debit cards, prepaid cards, and charge cards) and the various methods of electronic payments (like mobile payments, online transfers, digital wallets, and point-of-sale transactions). This market includes the systems, technologies, regulations, and services facilitating secure financial transactions between consumers, businesses, and financial institutions across different countries. Furthermore, the global financial cards and payments market is driven by rising e-commerce adoption, increasing smartphone penetration, demand for secure and contactless transactions, and expanding digital banking services. Growth is further fueled by technological innovations like AI and blockchain, supportive government policies, and the shift toward cashless economies, especially in emerging markets seeking financial inclusion. However, the high regulatory scrutiny, cybersecurity risks, fraud concerns, economic instability, high competition, technological barriers, and consumer trust issues are key restraining factors impacting the growth of the global financial cards and payments market.

The bank cards segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the type, the global financial cards and payments market is divided into bank cards and recharge spending cards. Among these, the bank cards segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to widespread adoption of credit and debit cards, rising consumer preference for cashless transactions, and strong banking infrastructure. Growth is driven by increasing online shopping, enhanced card security features, and financial inclusion initiatives, encouraging greater card usage across emerging and developed markets, leading to a significant CAGR during the forecast period.

The IT & telecom segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global financial cards and payments market is divided into BFSI, IT & telecom, retail, manufacturing, healthcare, and others. Among these, the IT & telecom segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to rapid digitalization, growing demand for online services, and widespread smartphone adoption. Increasing mobile payments, cloud-based platforms, and 5G expansion are driving higher transaction volumes, supporting the segment’s remarkable CAGR during the forecast period.

North America is projected to hold the largest share of the global financial cards and payments market over the forecast period.

North America is projected to hold the largest share of the global financial cards and payments market over the forecast period. The regional growth is attributed to its advanced financial infrastructure, high consumer adoption of digital payments, strong presence of major card issuers, and continuous technological innovations. Supportive regulatory frameworks and widespread use of credit, debit, and prepaid cards further strengthen the region’s market dominance.

Asia Pacific is expected to grow at the fastest CAGR in the global financial cards and payments market during the forecast period. The regional growth is attributed to rapid urbanization, increasing smartphone and internet penetration, and rising adoption of digital wallets and contactless payments. Government initiatives promoting cashless economies, expanding e-commerce markets, and a large unbanked population transitioning to formal banking systems are key drivers fueling the region’s strong market growth.

Company Profiling

Major vendors in the global financial cards and payments market are Thales Group, Giesecke & Devrient, IDEMIA, CPI Card, Tianyu, Goldpac, Magicard, CardLogix, Watchdata Technologies, Advanced Card Systems, Kona I, Sberbank, Eastcompeace, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global financial cards and payments market based on the below-mentioned segments:

Global Financial Cards and Payments Market, By Type

- Bank Cards

- Recharge Spending Cards

Global Financial Cards and Payments Market, By Application

- BFSI

- IT & Telecom

- Retail

- Manufacturing

- Healthcare

- Others

Global Financial Cards and Payments Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa