Global Recurring Payments Market Size to worth USD 273.75 Billion by 2033

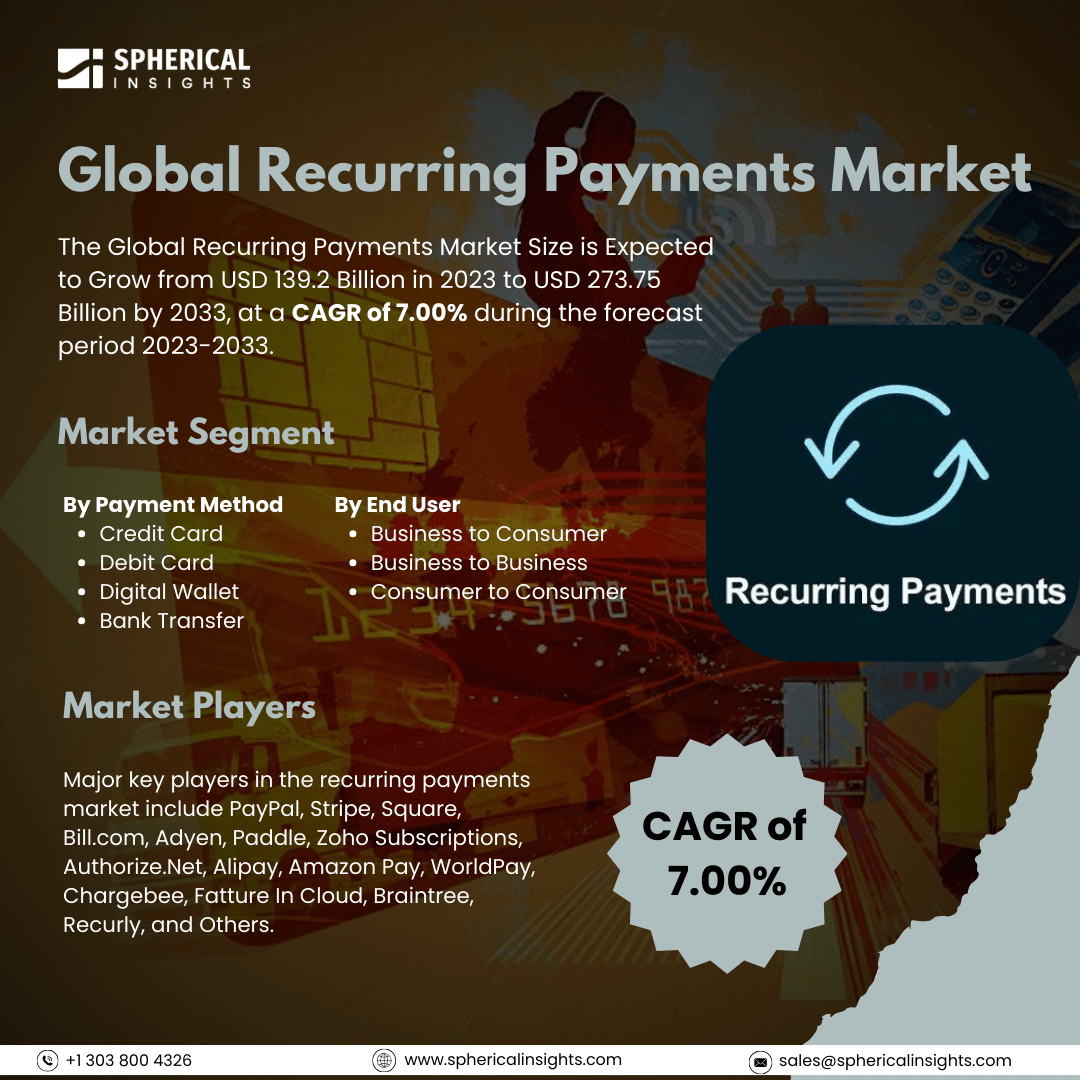

According to a research report published by Spherical Insights & Consulting, The Global Recurring Payments Market Size is Expected to Grow from USD 139.2 Billion in 2023 to USD 273.75 Billion by 2033, at a CAGR of 7.00% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Recurring Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Method (Credit Card, Debit Card, Digital Wallet, and Bank Transfer), By End User (Business to Consumer, Business to Business, and Consumer to Consumer), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The recurring payment market consists of transactions that are automatically deducted from a customer's account regularly. These payments are often referred to as subscription payments, automatic payments, or recurring billing. The market for recurring payments is expanding due to increasing consumer demand, advancements in technology, and the rise of subscription-based businesses. Consumers are looking for greater convenience and flexibility in managing their recurring expenses, such as utility bills, subscriptions, and memberships. Digital technologies, including cloud computing and mobile applications, have simplified the process for businesses to offer these subscription services. Automated invoicing and other technological innovations help businesses optimize their billing processes. However, the recurring payments market also faces several challenges. Businesses must comply with various regulations related to data privacy, financial transactions, and consumer protection. Failure to adhere to these regulations can lead to fines and damage to a company's reputation. Moreover, as the volume of digital transactions increases, payment systems become more appealing targets for cybercriminals. Therefore, businesses must ensure the protection of sensitive customer data, including credit card information and bank account details.

The credit card segment is predicted to hold the largest market share through the forecast period.

Based on the payment method, the recurring payments market is classified into credit cards, debit cards, digital wallets, and bank transfers. Among these, the credit card segment is predicted to hold the largest market share through the forecast period. Credit cards are widely accepted and convenient for consumers, particularly due to the rise in digital transactions and e-commerce. They provide a secure and efficient payment method that encourages consumer adoption. Ongoing innovations in credit card technology, including contactless payments and enhanced security features, further improve the user experience and drive demand, solidifying credit cards' position as a preferred payment option.

The business-to-consumer segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end user, the recurring payments market is divided into business-to-consumer, business-to-business, and consumer-to-consumer. Among these, the business-to-consumer segment is anticipated to hold the highest market share during the projected timeframe. The growth of business-to-consumer (B2C) transactions is primarily driven by the increase in online shopping and direct-to-consumer sales models. As consumers favor the convenience of purchasing goods and services directly from brands through digital platforms, businesses are adjusting their strategies to meet this demand. The rise of personalized marketing and enhanced customer experiences further fuels B2C transactions, making it a critical area for market growth.

North America is estimated to hold the largest share of the recurring payments market over the forecast period.

North America is estimated to hold the largest share of the recurring payments market over the forecast period. The demand for recurring payment solutions is growing, largely due to the region's advanced technological infrastructure and high consumer acceptance of subscription-based services. Many businesses are adopting recurring billing models, especially in sectors like software, entertainment, and e-commerce. The presence of major financial institutions and payment processors in North America also supports the growth of innovative payment technologies, reinforcing the region's market leadership.

Europe is expected to grow the fastest during the forecast period. The surge in digital payment adoption and the increasing popularity of subscription services across various industries are driving market growth. The region's regulatory environment encourages innovation and consumer protection, creating a favorable atmosphere for new payment solutions. As European consumers become more accustomed to automated billing and subscription models, businesses are increasingly integrating recurring payment systems, positioning Europe as a dynamic market with significant growth potential.

Company Profiling

Major key players in the recurring payments market include PayPal, Stripe, Square, Bill.com, Adyen, Paddle, Zoho Subscriptions, Authorize.Net, Alipay, Amazon Pay, WorldPay, Chargebee, Fatture In Cloud, Braintree, Recurly, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Finix, a full-stack payment processor that allows businesses to accept and send payments, has launched Recurring Billing. This new solution is available on the Finix dashboard, enabling customers to easily set up and manage recurring payments using no-code tools.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the recurring payments market based on the below-mentioned segments:

Global Recurring Payments Market, By Payment Method

- Credit Card

- Debit Card

- Digital Wallet

- Bank Transfer

Global Recurring Payments Market, By End User

- Business to Consumer

- Business to Business

- Consumer to Consumer

Global Recurring Payments Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa