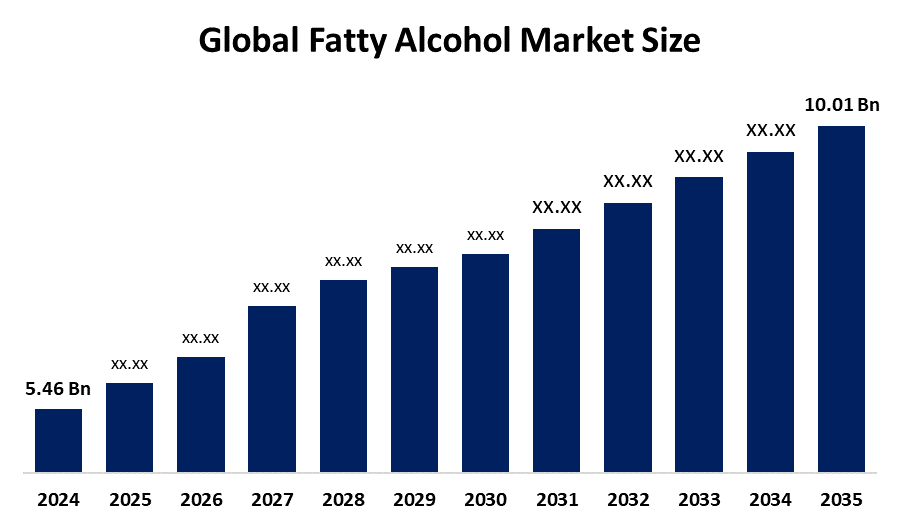

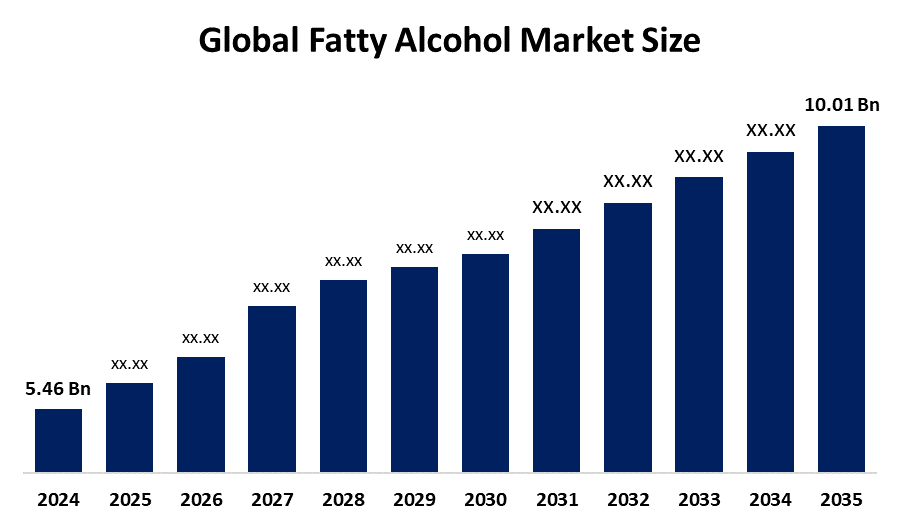

Global Fatty Alcohol Market Insights Forecasts to 2035

- The Global Fatty Alcohol Market Size Was Estimated at USD 5.46 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The Worldwide Fatty Alcohol Market Size is Expected to Reach USD 10.01 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Fatty Alcohol Market

The global fatty alcohol market encompasses the production and utilization of long-chain alcohols derived from natural fats and oils such as palm, coconut, and tallow. These alcohols, typically consisting of 8 to 18 carbon atoms, are widely used in the manufacture of surfactants, detergents, personal care products, and industrial chemicals. Fatty alcohols serve as key ingredients in products like shampoos, soaps, and household cleaners, acting as emulsifiers, foaming agents, and thickeners. They are also used in the production of lubricants, plasticizers, and solvents, making them essential in numerous industrial applications. The market is influenced by both consumer demand for natural and renewable ingredients and the growth of industries such as personal care, cleaning, and manufacturing. Fatty alcohols are increasingly seen as more sustainable alternatives to petroleum-based chemicals due to their biodegradable nature and renewable sources. As a result, their demand continues to rise across various sectors globally.

Attractive Opportunities in the Fatty Alcohol Market

- There’s a growing trend towards creating bio-based surfactants, specialty chemicals, and eco-friendly coatings, which opens up avenues for high-value products with minimal environmental impact. As industries are increasingly seeking greener alternatives, fatty alcohols can be positioned as key ingredients in these innovations. Additionally, advancements in biotechnology (like microbial fermentation) offer more sustainable methods of production, lowering costs and improving efficiency.

- Rising disposable incomes and increasing awareness of personal care and industrial chemicals in regions like Asia-Pacific, Latin America, and Africa create new growth potential. In these markets, fatty alcohols, as sustainable, biodegradable ingredients, are becoming increasingly popular. The combination of growing middle-class populations, urbanization, and rising consumer awareness of eco-friendly products is driving this shift.

Global Fatty Alcohol Market Dynamics

DRIVER: Expanding personal care and homecare industries contribute significantly to market growth

The global fatty alcohol market is driven by several key factors. First, the increasing consumer demand for sustainable, eco-friendly, and biodegradable products is fueling growth. Fatty alcohols, derived from renewable plant sources, are considered environmentally safer than petroleum-based alternatives, making them popular in green chemistry applications. Second, the expanding personal care and homecare industries contribute significantly to market growth, as fatty alcohols are used in products like shampoos, soaps, detergents, and lotions due to their emulsifying and foaming properties. Third, the rise in industrial applications such as lubricants, plasticizers, and surfactants further drive the market, as fatty alcohols are critical in the formulation of these products. Additionally, the growing focus on reducing harmful chemicals in everyday products boosts the demand for natural ingredients like fatty alcohols. Lastly, advancements in manufacturing technologies and an increased focus on renewable raw materials are enhancing the market's efficiency and cost-effectiveness, further promoting its expansion.

RESTRAINT: Volatility in the prices of raw materials

Despite its growth, the global fatty alcohol market faces several restraining factors. One of the primary challenges is the volatility in the prices of raw materials, particularly natural oils like palm, coconut, and tallow, which can be affected by supply chain disruptions, climate conditions, and geopolitical factors. This volatility often leads to fluctuating production costs, impacting market stability. Additionally, there are concerns regarding the environmental impact of large-scale palm oil cultivation, which can lead to deforestation and biodiversity loss, prompting regulatory scrutiny and affecting the market’s sustainability. Another restraint is the competition from synthetic alternatives, which, although less eco-friendly, may offer lower production costs. Furthermore, the complexity and high capital investment required for the production of fatty alcohols, including the need for specialized infrastructure and processes, can limit market accessibility for smaller manufacturers. Lastly, the slow pace of adopting sustainable practices in certain industries may hinder the widespread use of fatty alcohols.

OPPORTUNITY: Growing trend of innovation in product formulations

One major opportunity lies in the growing trend of innovation in product formulations. As industries explore new applications for fatty alcohols in areas like bio-based surfactants, specialty chemicals, and eco-friendly coatings, there is potential for creating high-value products with minimal environmental impact. Additionally, advancements in biotechnology offer promising avenues for producing fatty alcohols through more sustainable, microbial fermentation methods, which could lower costs and enhance production efficiency. There is also an expanding opportunity within emerging markets, where rising disposable incomes and increasing demand for personal care products and industrial chemicals present new growth potential. The shift toward more sustainable agriculture and production practices also opens doors for partnerships between manufacturers and suppliers focused on ethical sourcing. Furthermore, the growing focus on circular economy models presents opportunities for the reuse and recycling of fatty alcohols, reducing waste and improving resource efficiency.

CHALLENGES: Environmental and ethical concerns surrounding the sourcing of raw materials

Need for continuous innovation to meet evolving consumer preferences, especially in the personal care and cosmetics sectors. As consumers increasingly demand multifunctional and high-performance products, manufacturers must invest in research and development to create new formulations that meet these needs while maintaining product quality. Another challenge is the environmental and ethical concerns surrounding the sourcing of raw materials, particularly palm oil. While some companies are adopting sustainable practices, widespread certification and verification remain a challenge. Additionally, the market's reliance on natural oils exposes it to fluctuations in supply due to climate change and other environmental risks, making production schedules difficult to predict. Lastly, the increasing complexity of regulatory frameworks worldwide, especially regarding sustainability and chemical safety, presents a challenge for manufacturers striving to comply with varied regulations in different regions.

Global Fatty Alcohol Market Ecosystem Analysis

The global fatty alcohol market ecosystem involves raw material suppliers (palm, coconut, tallow), manufacturers converting oils into fatty alcohols, and distributors connecting these to end-users in industries like personal care, detergents, lubricants, and pharmaceuticals. Key players also include regulatory bodies enforcing sustainability standards and safety protocols. Technology providers drive innovation in production methods, especially for eco-friendly processes. End consumers, increasingly demanding sustainable and natural products, influence market trends, pushing for greener, biodegradable fatty alcohol alternatives in various applications.

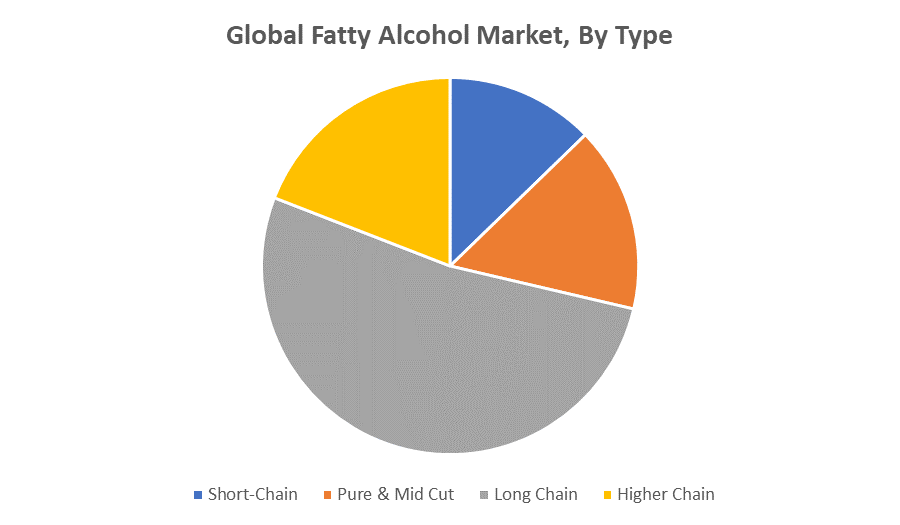

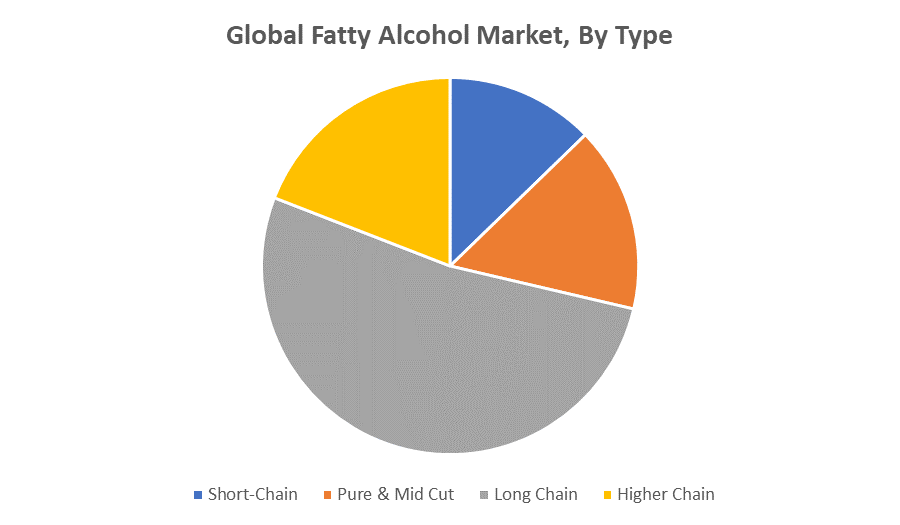

Based on the type, the long chain accounted for the largest market revenue share over the forecast period

Long-chain fatty alcohols are expected to account for the largest market revenue share over the forecast period. These alcohols, typically ranging from C12 to C18 in carbon chain length, are widely used in industries such as personal care, detergents, lubricants, and industrial chemicals. Their versatility and effectiveness as surfactants, emulsifiers, and thickeners make them essential in the formulation of shampoos, soaps, lotions, and cleaning products. Long-chain fatty alcohols are also preferred due to their superior biodegradability and renewable nature, aligning with the growing consumer demand for sustainable and eco-friendly products. Their dominant market share reflects their widespread applications and increasing demand in both consumer goods and industrial sectors.

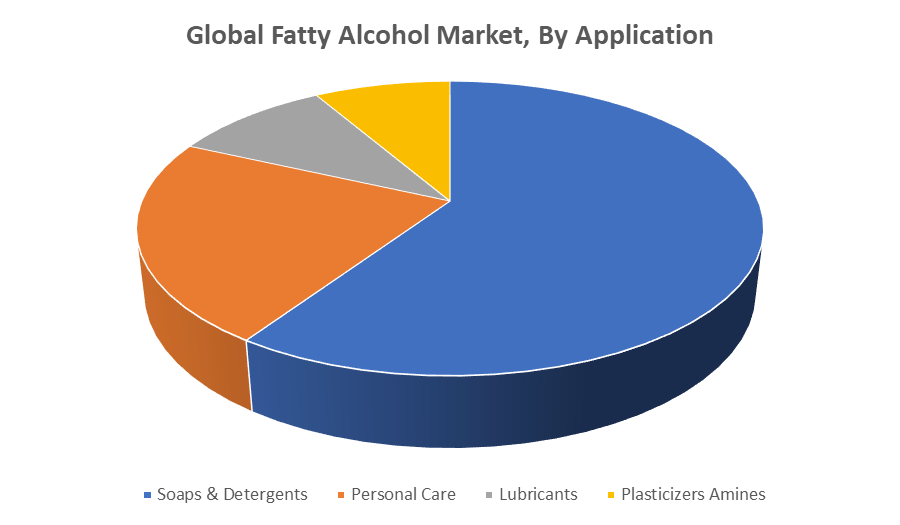

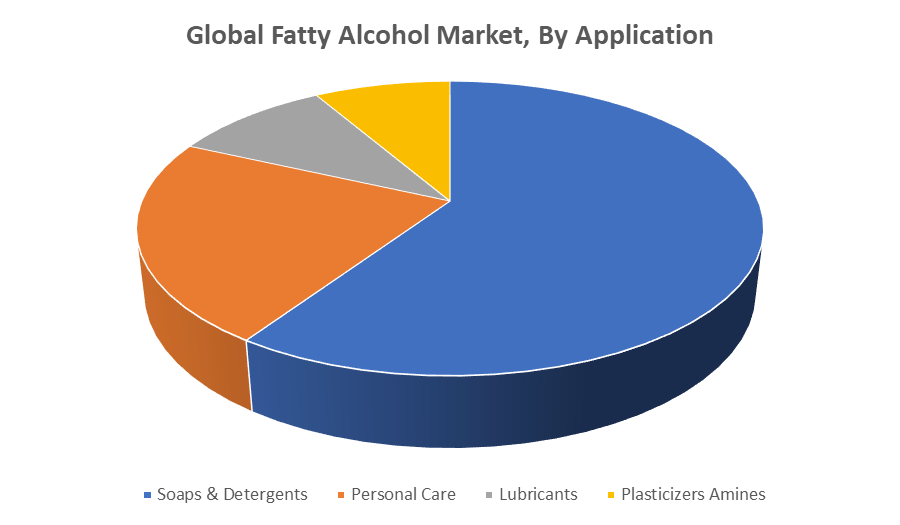

Based on the application, the soaps & detergents accounted for the largest market revenue share during the forecast period

Fatty alcohols play a crucial role in the production of soaps, shampoos, and laundry detergents due to their excellent surfactant and emulsifying properties. They help in the formation of stable foams, improve cleaning efficiency, and act as thickeners and conditioning agents. The growing demand for personal care and household cleaning products, driven by hygiene awareness and increased consumer spending, will continue to boost the use of fatty alcohols in this sector. Additionally, the shift toward biodegradable and eco-friendly ingredients in these products further supports the dominance of fatty alcohols in soaps and detergents.

Asia Pacific is anticipated to hold the largest market share of the fatty alcohol market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the fatty alcohol market during the forecast period. The region's dominance is driven by its strong manufacturing base, especially in countries like China, India, and Indonesia, where the production and consumption of fatty alcohols are substantial. The growing demand for personal care, home care, and industrial products in these developing economies, along with the availability of raw materials such as palm oil and coconut oil, supports market growth. Additionally, the rising consumer awareness of sustainable and eco-friendly products in Asia Pacific further boosts the demand for biodegradable and natural fatty alcohols. The region's expanding middle class and the rapid industrialization in emerging markets also contribute to the increased consumption of fatty alcohols across various applications like detergents, cosmetics, and lubricants.

North America is expected to grow at the fastest CAGR in the fatty alcohol market during the forecast period

North America is expected to grow at the fastest CAGR in the fatty alcohol market during the forecast period. This growth is driven by increasing demand for personal care products, household cleaning agents, and industrial chemicals, all of which rely on fatty alcohols for their emulsifying, foaming, and thickening properties. Furthermore, the rising shift towards sustainable and eco-friendly products in the U.S. and Canada is boosting the adoption of renewable ingredients like fatty alcohols. The region’s growing focus on green chemistry and innovation in the production of bio-based fatty alcohols also contributes to this rapid growth. Additionally, increasing awareness about environmental impact and consumer preference for natural, biodegradable products are pushing manufacturers to explore fatty alcohols as a sustainable alternative to synthetic chemicals. These factors, combined with strong regulatory support for eco-friendly and sustainable solutions, are driving North America’s rapid market expansion.

Recent Development

- In February 2023, KLK OLEO launched a new range of bio-based fatty alcohols sourced from sustainable palm oil. These products cater to the growing demand in personal care and homecare applications, focusing on performance and eco-friendliness. The launch supports the company’s commitment to providing renewable alternatives to traditional petroleum-based chemicals.

- In August 2022, Stepan Company introduced a new line of eco-friendly fatty alcohol derivatives, specifically targeting the surfactant market for personal care and cleaning products. These derivatives offer enhanced biodegradability and minimal environmental impact, aligning with the growing demand for natural and green products in the market.

Key Market Players

KEY PLAYERS IN THE FATTY ALCOHOL MARKET INCLUDE

- KLK OLEO

- Stepan Company

- Evonik Industries

- BASF SE

- Wilmar International Limited

- Sasol Limited

- Lonza Group

- Procter & Gamble (P&G)

- Cargill, Inc.

- Kraton Polymers

- Cognis (now part of BASF)

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fatty alcohol market based on the below-mentioned segments:

Global Fatty Alcohol Market, By Type

- Short-Chain

- Pure & Mid cut

- Long Chain

- Higher Chain

Global Fatty Alcohol Market, By Application

- Soaps & Detergents

- Personal Care

- Lubricants

- Plasticizers Amines

Global Fatty Alcohol Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa