Global Direct Attach Cable Market Size to Exceed USD 234.79 Billion by 2033

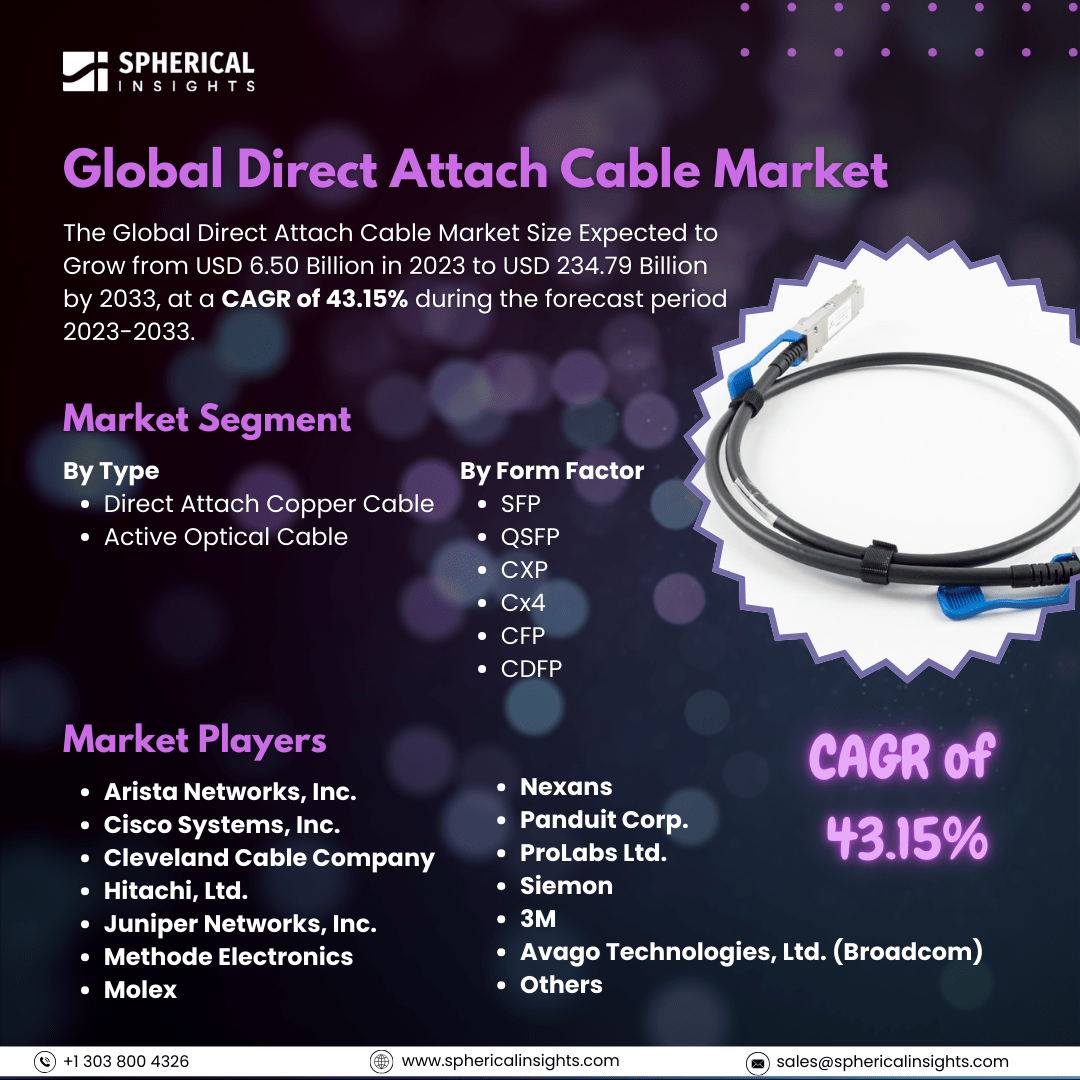

According to a research report published by Spherical Insights & Consulting, The Global Direct Attach Cable Market Size Expected to Grow from USD 6.50 Billion in 2023 to USD 234.79 Billion by 2033, at a CAGR of 43.15% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Direct Attach Cable Market Size, Share, and COVID-19 Impact Analysis, By Type (Direct Attach Copper Cable and Active Optical Cable), By Form Factor (SFP, QSFP, CXP, Cx4, CFP, and CDFP), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The direct attach cable market concentrates on high-speed, low-latency data centers, enterprise networking, and HPC Cables. With DACs' pre-terminated Twinax or fiber cables equipped with built-in transceivers, the high-bandwidth connection can be afforded by cloud computing, AI, and storage networking while keeping down the power consumed. Moreover, the demand for the Direct Attach Cable market is driven by the increasing application of high-speed data transfers in data centers, cloud computing, and AI applications. The requirement for low latency, cost-effective, and energy-efficient connectivity will stimulate the growth of DAC adoption. Growing 5G networks, IoT, and HPC are further bolstering market growth. Hyperscale data center investments and increasing server virtualization will further contribute to the growth. DACs are relatively a favorite choice in today's networking infrastructure because of their plug-and-play functionality, very high reliability, and lower power consumption compared with optical transceivers. However, the direct attach cable market faces restraints such as limited transmission distance, high compatibility issues with different network devices, growing preference for active optical cables (AOCs), and increasing adoption of wireless communication technologies.

The direct attach copper cable segment accounted for the largest share of the global direct attach cable market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on type, the global direct attach cable market is divided into direct attach copper cable and active optical cable. Among these, the direct attach copper cable segment accounted for the largest share of the global direct attach cable market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to cost-effectiveness, low power consumption, and high reliability for short-distance data transmission. DACs are widely used in data centers and enterprise networking because they are plug-and-play devices, hence reducing the expensive optical transceivers, thus making them preferred.

The QSFP segment accounted for a substantial share of the global Direct Attach Cable market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of form factor, the global direct attach cable market is divided into SFP, QSFP, CXP, Cx4, CFP, and CDFP. Among these, the QSFP segment accounted for a substantial share of the global Direct Attach Cable market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to its high data transfer rate, scalability, and wide deployment in data centers and HPC applications. QSFP DACs support 40G, 100G, and beyond and are ideal for high-bandwidth, low-latency networking environments.

North America is projected to hold the largest share of the global direct attach cable market over the projected period.

North America is projected to hold the largest share of the global direct attach cable market over the projected period. The presence of hyperscale data centers with high concentration, rapid adoption of cloud computing, and advancements in AI and HPC are key drivers for this market. This region is characterized by the presence of leading tech companies, with strong 5G infrastructure in place, coupled with increasing demand for low-latency networking solutions.

Asia Pacific is expected to grow at the fastest CAGR growth of the global direct attach cable market during the projected period. This is because of the rapid growth of data centers, increased adoption of the cloud, and rising investments in AI and 5G infrastructure. Countries like China, India, and Japan are driving demand with growing hyperscale data centers, IoT adoption, and advancements in high-speed networking solutions.

Company Profiling

Major vendors in the global direct attach cable market are Arista Networks, Inc., Cisco Systems, Inc., Cleveland Cable Company, Hitachi, Ltd, Juniper Networks, Inc., Methode Electronics, Molex, Nexans, Panduit Corp., ProLabs Ltd, Siemon, 3M, Avago Technologies, Ltd (Broadcom), and Others.

Key Target Audience

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, in collaboration with NVIDIA, Arista Networks, Inc., announced a technology showcase of AI Data Centers that unifies the domains of compute and network into an entity of AI. Utilizing this, customers can standardize the configuration, management, and monitoring of AI clusters, networks, NICs, and servers in order to generate efficient generative AI networks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global direct attach cable market based on the below-mentioned segments:

Global Direct Attach Cable Market, By Type

- Direct Attach Copper Cable

- Active Optical Cable

Global Direct Attach Cable Market, By Form Factor

- SFP

- QSFP

- CXP

- Cx4

- CFP

- CDFP

Global Direct Attach Cable Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa