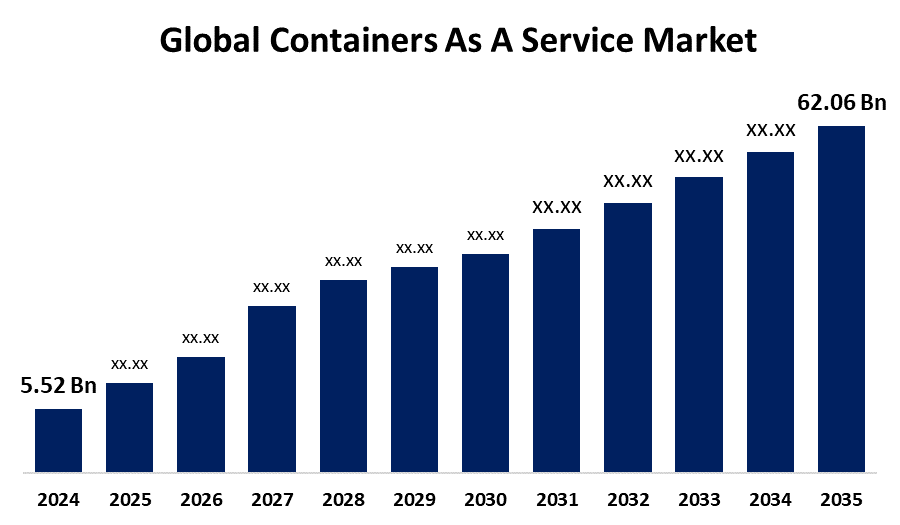

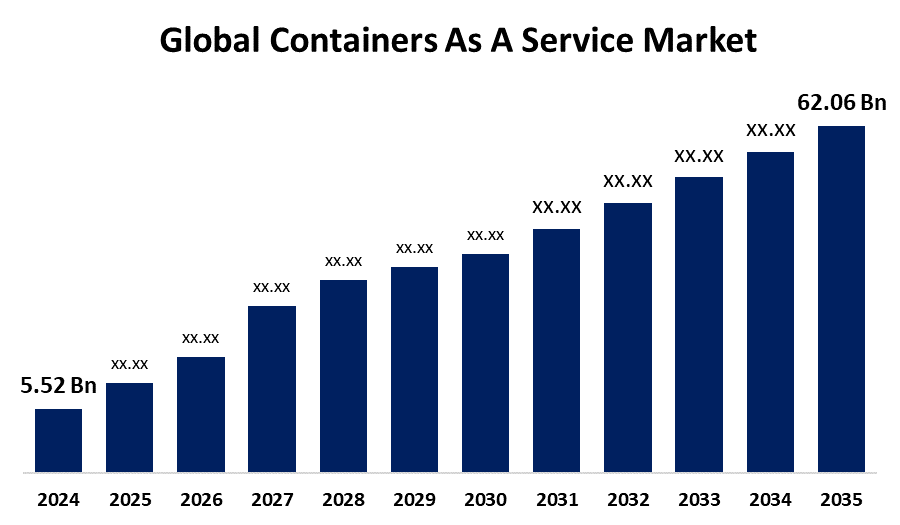

Global Containers As A Service Market Insights Forecasts to 2035

- The Global Containers As A Service Market Size Was Estimated at USD 5.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 24.6% from 2025 to 2035

- The Worldwide Containers As A Service Market Size is Expected to Reach USD 62.06 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Containers As A Service Market

The global containers as a service market involves cloud-based platforms that enable users to deploy, manage, and scale containerized applications efficiently. Containers package applications and their dependencies into isolated units, ensuring consistent performance across different computing environments. CaaS provides essential tools such as container orchestration, management, and security, allowing organizations to streamline application development and operations. These services support technologies like Kubernetes and Docker, facilitating automated container deployment and management. By leveraging CaaS, businesses can simplify infrastructure management, enhance application portability, and improve resource utilization. The market includes offerings from cloud providers and specialized vendors that enable seamless integration with various cloud and on-premises systems. Overall, CaaS is a crucial component of modern cloud-native application development, enabling faster, more flexible software delivery while reducing the complexity of managing container ecosystems.

Attractive Opportunities in the Containers As A Service Market

- AI and ML applications often involve complex, resource-intensive processes that require scalable infrastructure. Containers provide a flexible environment to package and deploy these workloads efficiently. By integrating AI/ML workloads with CaaS platforms, businesses can automate deployment, scale processing dynamically, and improve performance. This enables faster development cycles and smoother model updates, making CaaS an attractive solution for AI-driven industries.

- Edge computing brings data processing closer to where it’s generated, reducing latency and improving responsiveness, which is critical for applications like IoT, autonomous vehicles, and smart cities. Containers are lightweight and portable, making them ideal for deployment on edge devices. Offering container services optimized for edge environments allows providers to support real-time data processing and lower bandwidth usage, unlocking new markets and use cases.

Global Containers As A Service Market Dynamics

DRIVER: Increasing shift towards microservices and container-based architectures

The surge in cloud adoption and ongoing digital transformation efforts compel organizations to find more efficient ways to deploy and manage applications, positioning CaaS as a preferred choice. The increasing shift towards microservices and container-based architectures accelerates development speed and supports agile workflows, driving demand for container services. Growing use of hybrid and multi-cloud strategies further amplifies the need for versatile container management platforms that can operate seamlessly across different environments. Advanced orchestration tools like Kubernetes simplify container lifecycle management, boosting operational productivity. Additionally, the emphasis on improving application portability and optimizing infrastructure resources motivates businesses to embrace CaaS. Together, these elements foster a dynamic environment where CaaS solutions gain traction, enabling companies to innovate quickly while maintaining scalability and control.

RESTRAINT: Security concerns present a critical barrier

A significant obstacle is the steep learning curve associated with container orchestration and management, which demands skilled professionals, a resource many organizations find scarce. Security concerns also present a critical barrier, as containers introduce unique vulnerabilities that require advanced, specialized protection strategies to safeguard sensitive data. Moreover, integrating container solutions with legacy IT systems remains a complex task, often leading to increased deployment times and operational difficulties. Performance limitations, including potential resource overhead and network configuration issues, can impact application efficiency within containerized environments. Additionally, strict regulatory standards and data privacy laws in various sectors impose constraints on container usage, particularly in cloud settings. Collectively, these issues pose considerable challenges that organizations must overcome to fully capitalize on the benefits offered by CaaS platforms.

OPPORTUNITY: Developing industry-specific container offerings presents another opportunity

One key area is the increasing focus on edge computing, where containers deployed closer to data sources can enhance processing speed and reduce latency, benefiting applications like IoT devices, autonomous systems, and smart infrastructure. There is also potential in integrating AI and machine learning workloads with container platforms, creating tailored CaaS solutions that support complex data processing needs. Developing industry-specific container offerings presents another opportunity, allowing sectors such as healthcare, finance, and manufacturing to adopt solutions designed around their unique security and compliance requirements. Additionally, the combination of serverless architectures with container services introduces innovative hybrid models that can boost efficiency and lower costs. Expanding adoption in emerging economies further opens new markets as organizations transition toward cloud-native environments. These opportunities highlight promising directions for growth and innovation within the CaaS landscape.

CHALLENGES: Ensuring stable performance and high availability is difficult

Efficiently handling container lifecycle tasks such as updates, scaling, and monitoring demands requires advanced automation tools to prevent operational bottlenecks. Ensuring stable performance and high availability is difficult in multi-cloud or hybrid setups where applications constantly shift across infrastructures. Additionally, the rapid evolution of container technologies and standards creates uncertainty, making it challenging for organizations to plan long-term strategies. Debugging and troubleshooting containerized applications also prove complex due to their distributed and transient nature. Moreover, cultivating a culture that embraces DevOps and cloud-native methodologies remains a hurdle as successful CaaS implementation requires not only technology but also skilled teams and effective processes. Addressing these challenges is essential for widespread CaaS adoption and efficiency.

Global Containers As A Service Market Ecosystem Analysis

The global containers as a service ecosystem includes cloud providers like AWS, Azure, and Google Cloud, offering scalable infrastructure and native CaaS platforms. Core technologies such as Kubernetes and Docker enable container orchestration and management, while runtimes like Docker Engine handle execution. Independent vendors provide security, monitoring, and DevOps tools to support container lifecycle management. End-users across industries utilize CaaS for flexibility and scalability. Open-source communities also play a vital role by driving innovation and standardizing technologies within the evolving CaaS market.

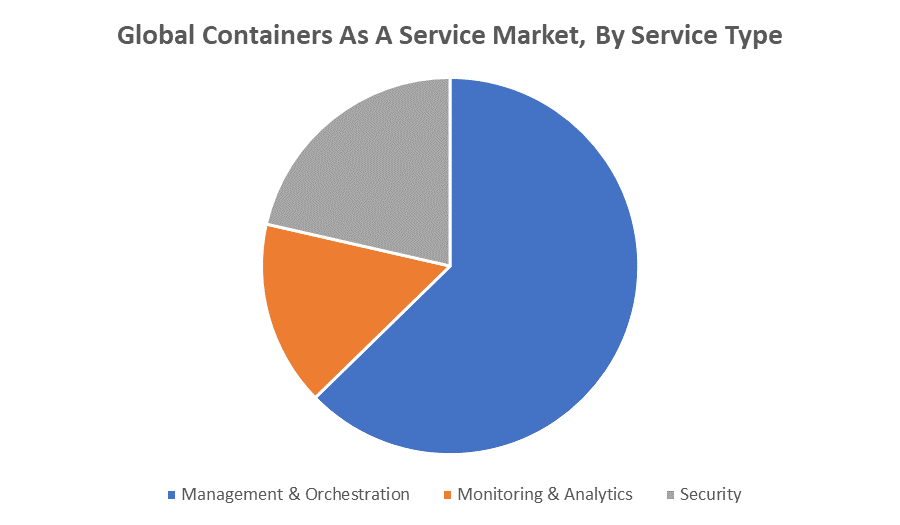

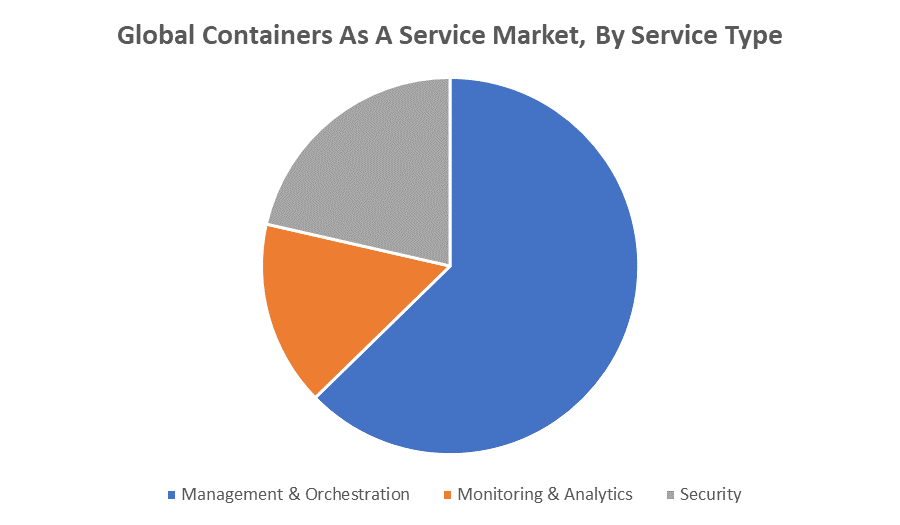

Based on the service type, the management & orchestration segment held the largest revenue share over the forecast period

The management & orchestration segment dominance is due to the critical role orchestration tools play in automating the deployment, scaling, and monitoring of containerized applications. Efficient management simplifies complex container environments, enabling businesses to optimize resources and ensure application reliability. As organizations increasingly adopt multi-cloud and hybrid infrastructures, the demand for robust orchestration solutions continues to grow, driving significant revenue generation within this segment of the containers as a service market.

Based on the deployment, the public cloud segment dominated the containers as a service (CaaS) industry with a revenue share during the forecast period

Public cloud segment dominance is attributed to the scalability, flexibility, and cost-effectiveness offered by public cloud platforms. Public cloud providers enable businesses to quickly deploy and manage containerized applications without heavy upfront infrastructure investments. Additionally, seamless integration with existing cloud services and global accessibility further boost the adoption of public cloud-based CaaS solutions, driving substantial revenue growth in this segment.

North America is anticipated to hold the largest market share of the containers as a service market during the forecast period

North America is anticipated to hold the largest market share in the containers as a service market during the forecast period due to several key factors. The region is home to major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM, all of which offer advanced CaaS platforms. These companies are at the forefront of innovation and have played a critical role in driving adoption across various industries. Additionally, North American enterprises have been early adopters of DevOps practices, microservices architecture, and cloud-native technologies, all of which rely heavily on containers. The region also benefits from a well-established IT infrastructure and high levels of investment in digital transformation, enabling organizations to deploy and manage containerized applications at scale. Moreover, the strong startup ecosystem and widespread cloud adoption across sectors such as finance, healthcare, retail, and government further contribute to the region’s leadership in the CaaS market. These factors collectively position North America as the dominant force in the global CaaS landscape throughout the forecast period.

Asia Pacific is expected to grow at the fastest CAGR in the containers as a service market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the containers as a service (CaaS) market during the forecast period, driven by rapid digital transformation, increasing cloud adoption, and a growing focus on application modernization across the region. Countries such as China, India, Japan, South Korea, and Australia are witnessing significant growth in cloud-native technologies, with both large enterprises and small-to-medium-sized businesses investing in container-based infrastructure to improve scalability, agility, and deployment speed. The expanding presence of global cloud service providers in the region, along with government initiatives supporting cloud adoption and digital infrastructure, further accelerates this growth. Additionally, the rise of tech startups and the increasing use of DevOps and CI/CD practices in software development are contributing to the rising demand for CaaS platforms. As a result, Asia Pacific is poised to become a major growth engine for the global CaaS market in the coming years.

Recent Development

- In December 2024, Amazon Web Services (AWS) launched EKS Auto Mode, a new feature for Amazon Elastic Kubernetes Service (EKS) that automates the provisioning of compute, storage, and networking resources for Kubernetes clusters. Built on Karpenter, AWS’s open-source cluster autoscaler, EKS Auto Mode simplifies and streamlines cluster lifecycle management by eliminating the need for manual infrastructure configuration. This enhancement significantly reduces DevOps overhead and accelerates the deployment of containerized workloads, making Kubernetes more accessible for teams with limited infrastructure expertise.

Key Market Players

KEY PLAYERS IN THE CONTAINERS AS A SERVICE MARKET INCLUDE

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Corporation

- Red Hat

- VMware, Inc.

- Docker, Inc.

- Oracle Corporation

- Cisco Systems, Inc.

- SUSE Group

- Alibaba Cloud

- Tencent Cloud

- Google Anthos

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the containers as a service market based on the below-mentioned segments:

Global Containers As A Service Market, By Service Type

- Management & Orchestration

- Monitoring & Analytics

- Security

Global Containers As A Service Market, By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

Global Containers As A Service Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa