Global Cling Films Market Size to Exceed USD 15.46 Billion by 2033

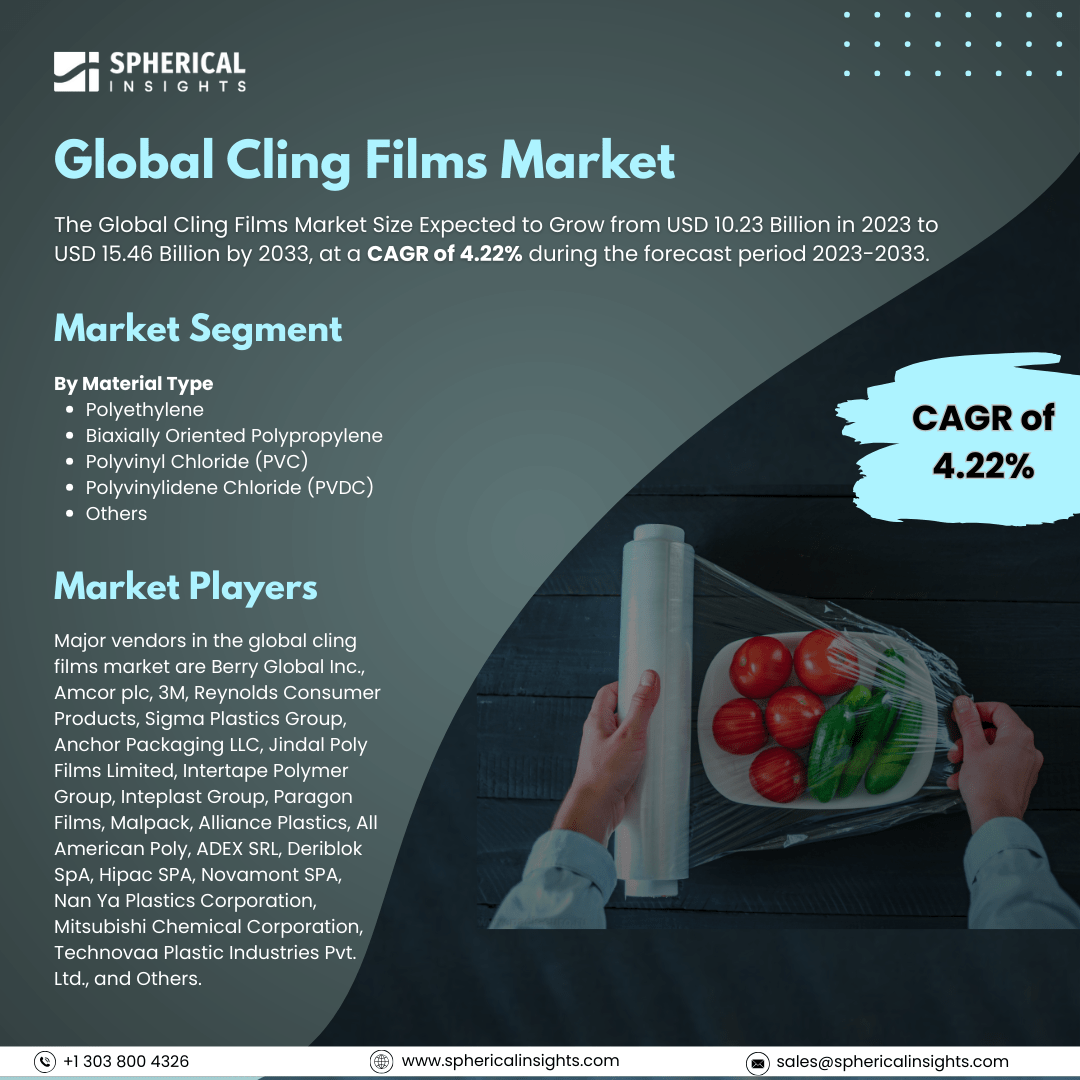

According to a research report published by Spherical Insights & Consulting, The Global Cling Films Market Size Expected to Grow from USD 10.23 Billion in 2023 to USD 15.46 Billion by 2033, at a CAGR of 4.22% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Cling Films Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polyethylene, Biaxially Oriented Polypropylene, Polyvinyl Chloride (PVC), Polyvinylidene Chloride (PVDC), and Others), By Form (Cast Cling Film and Blow Cling Film), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The cling films market means the global economy engaged in producing, supplying, and marketing flexible, flexible plastic films meant for sticking on surfaces without an adhesive. Produced largely from commodities such as polyethylene (PE), polyvinyl chloride (PVC), and bioplastics, cling films find application in packing foods, industrials, and household products in order to extend shelf life, seal against moisture and contamination, and improve on-show appeal. Moreover, the cling films market is driven by rising demand for food packaging solutions to preserve freshness and increase shelf life. Rising consumer hygiene awareness, urbanization, and growth in the retail and foodservice industries further drive market growth. Advances in biodegradable and environmentally friendly cling films, as well as strict food safety regulations, also fuel higher adoption across industries such as healthcare, consumer goods, and industrial packaging. However, the cling films market is constrained by issues such as environmental awareness of plastic pollution, production costs, scarcity of green alternatives, and regulatory hurdles in the usage of some materials in packaging.

The polyvinyl chloride (PVC) segment accounted for the largest share of the global cling films market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of material type, the global cling films market is divided into polyethylene, biaxially oriented polypropylene, polyvinyl chloride (PVC), polyvinylidene chloride (PVDC), and others. Among these, the polyvinyl chloride (PVC) segment accounted for the largest share of the global cling films market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is owing to its high flexibility, clarity, and good cling characteristics. Commonly applied in food packaging, the PVC cling films have superior barrier protection against oxygen and moisture, hence earning their place as a hot choice for maintaining food freshness in retail and domestic use.

The cast cling film segment accounted for a substantial share of the global cling films market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the form, the global cling films market is divided into cast cling film and blow cling film. Among these, the cast cling film segment accounted for a substantial share of the global cling films market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of its better clarity, even thickness, and superior stretchability. Its affordability and high production efficiency in manufacturing make it a popular choice for food packaging, industrial, and consumer applications, leading to its extensive use in different end-use industries.

North America is projected to hold the largest share of the global cling films market over the projected period.

North America is projected to hold the largest share of the global cling films market over the projected period. This is led by the high demand in the food packaging, healthcare, and consumer products sectors. Major retail chains, strong food safety requirements, and increased consumer demand for hygienic and convenient packaging solutions also drive market growth, with the U.S. being at the forefront due to its highly developed packaging sector.

Asia Pacific is expected to grow at the fastest CAGR of the global cling films market during the projected period. This is led by fast urbanization, growing food retail markets, and rising demand for packaged and convenience foods. These include China, India, and Japan, which are leading growth because of growth in disposable incomes, the increasing middle-class population, and advancement in packaging technologies, such as biodegradable and sustainable cling film substitutes.

Company Profiling

Major vendors in the global cling films market are Berry Global Inc., Amcor plc, 3M, Reynolds Consumer Products, Sigma Plastics Group, Anchor Packaging LLC, Jindal Poly Films Limited, Intertape Polymer Group, Inteplast Group, Paragon Films, Malpack, Alliance Plastics, All American Poly, ADEX SRL, Deriblok SpA, Hipac SPA, Novamont SPA, Nan Ya Plastics Corporation, Mitsubishi Chemical Corporation, Technovaa Plastic Industries Pvt. Ltd., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Berry Global Group Inc. introduced the next-generation incarnation of its established stretch hood film with a minimum of 30% recycled content. This will enable the firm to assist firms in the fulfillment of sustainability targets alongside compliance with existing and pending United Kingdom and European plastics packaging regulations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global cling films market based on the below-mentioned segments:

Global Cling Films Market, By Material Type

- Polyethylene

- Biaxially Oriented Polypropylene

- Polyvinyl Chloride (PVC)

- Polyvinylidene Chloride (PVDC)

- Others

Global Cling Films Market, By Form

- Cast Cling Film

- Blow Cling Film

Global Cling Films Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa