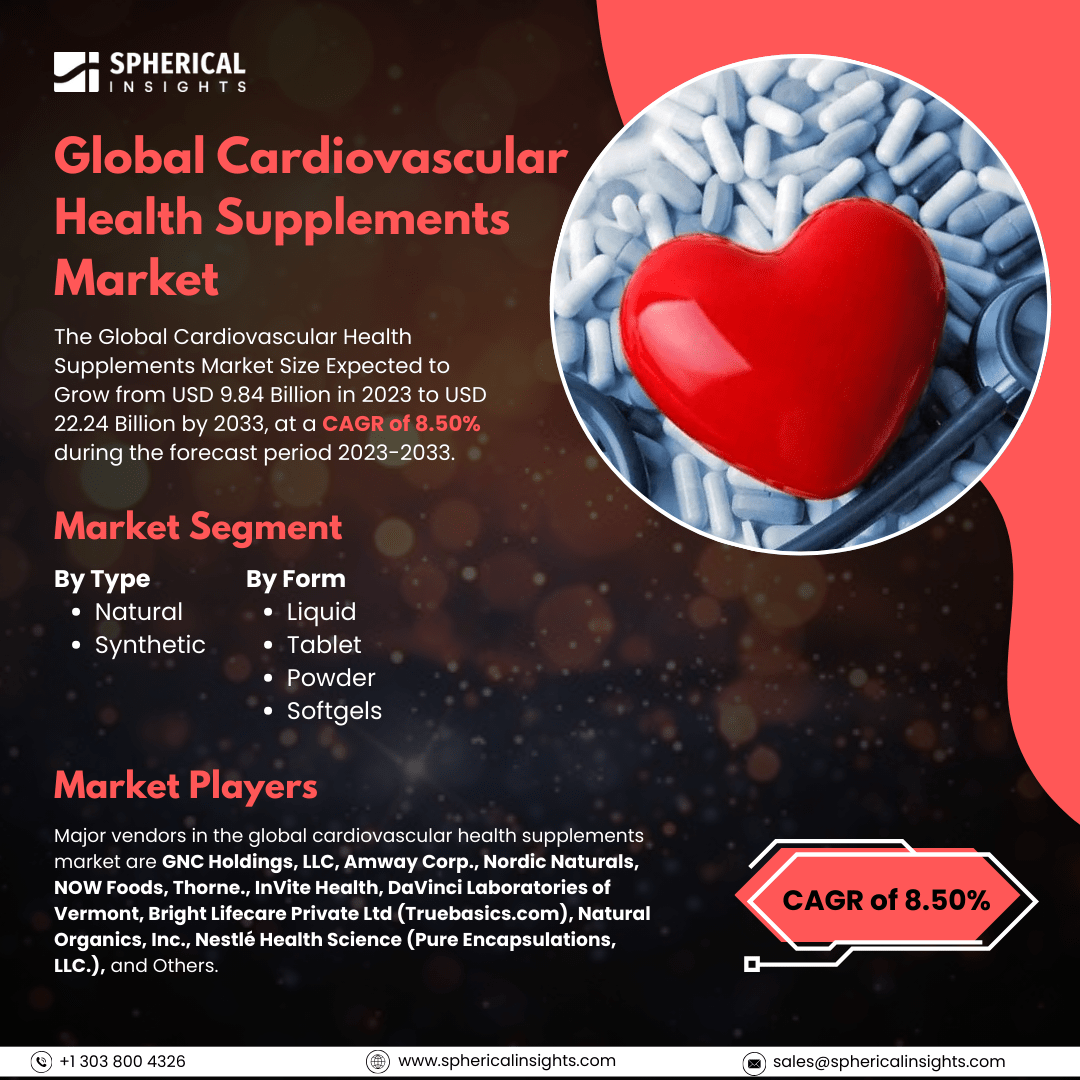

Global Cardiovascular Health Supplements Market Size to Exceed USD 22.24 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Cardiovascular Health Supplements Market Size Expected to Grow from USD 9.84 Billion in 2023 to USD 22.24 Billion by 2033, at a CAGR of 8.50% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Cardiovascular Health Supplements Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural, Synthetic), By Form (Liquid, Tablet, Powder, Softgels), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The cardiovascular health supplements market is the business dedicated to the manufacture, distribution, and sale of dietary supplements for maintaining heart health, blood flow, and overall cardiovascular well-being. Supplements encompass omega-3 fatty acids, CoQ10, fiber, plant sterols, antioxidants, and vitamins designed to manage cholesterol, blood pressure, and risk factors for heart disease. Moreover, the market for cardiovascular health supplements is driven by growing incidence of cardiovascular diseases, hypertension, and cholesterol, growing health awareness for preventive care, and an expanding ageing population. New developments in the formulation of nutraceuticals, growth in e-commerce platforms, and preference for natural elements also drive demand. Favourable government policies and studies on cardiovascular health supplements are also responsible for driving the market forward. However, premium supplements' high prices, regulatory requirements, and insufficient clinical evidence for certain products inhibit market growth. Consumer mistrust, counterfeiting, and possible side effects also inhibit widespread use.

The natural segment accounted for the largest share of the global cardiovascular health supplements market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the global cardiovascular health supplements market is divided into natural, and synthetic. Among these, the natural segment accounted for the largest share of the global cardiovascular health supplements market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of shifting consumer demand toward plant-based, organic, and non-GMO ingredients. Emerging consciousness of the benefits of omega-3 fatty acids, CoQ10, plant sterols, and antioxidants, coupled with demand for clean-label products, propels natural supplements' domination in the marketplace.

The tablet segment accounted for a substantial share of the global cardiovascular health supplements market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the application, the global cardiovascular health supplements market is divided into liquid, tablet, powder, and softgels. Among these, the tablet segment accounted for a substantial share of the global cardiovascular health supplements market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of their ease of use, extended shelf life, accurate dosing, and affordability. Consumers like tablets for ease of storage and convenience of carriage, and producers like them for ease of mass production. High availability in drugstores and internet retailers further underlines their market leadership.

North America is projected to hold the largest share of the global cardiovascular health supplements market over the projected period.

North America is projected to hold the largest share of the global cardiovascular health supplements market over the projected period. This is driven by the high incidence of heart diseases, rising health consciousness, and strong demand for preventive healthcare products. The U.S. dominates the market, backed by a well-developed nutraceutical industry, sophisticated R&D, widespread availability of supplements, and increasing consumer inclination towards natural and functional ingredients.

Asia Pacific is expected to grow at the fastest CAGR of the global cardiovascular health supplements market during the projected period. This is driven by growing cardiovascular disease incidence, rising health consciousness, and an expanding ageing population. China, India, and Japan are experiencing strong demand for natural supplements, boosted by growing e-commerce, developing healthcare infrastructure, and government policies encouraging heart wellness and preventive medicine.

Company Profiling

Major vendors in the global cardiovascular health supplements market are GNC Holdings, LLC, Amway Corp., Nordic Naturals, NOW Foods, Thorne., InVite Health, DaVinci Laboratories of Vermont, Bright Lifecare Private Ltd (Truebasics.com), Natural Organics, Inc., Nestlé Health Science (Pure Encapsulations, LLC.), and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, Nordic Naturals broadened its distribution with a major agreement with Sam's Club. Under this agreement, two of Nordic Naturals' top-selling omega-3 supplements became available in bulk packaging, which expanded access and affordability for a broader group of consumers. According to Brian Terry, director of U.S. retail sales at Nordic Naturals, the agreement was about more than expanding distribution and supply.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global cardiovascular health supplements market based on the below-mentioned segments:

Global Cardiovascular Health Supplements Market, By Type

Global Cardiovascular Health Supplements Market, By Form

- Liquid

- Tablet

- Powder

- Softgels

Global Cardiovascular Health Supplements Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa