Automotive eCall Market Summary

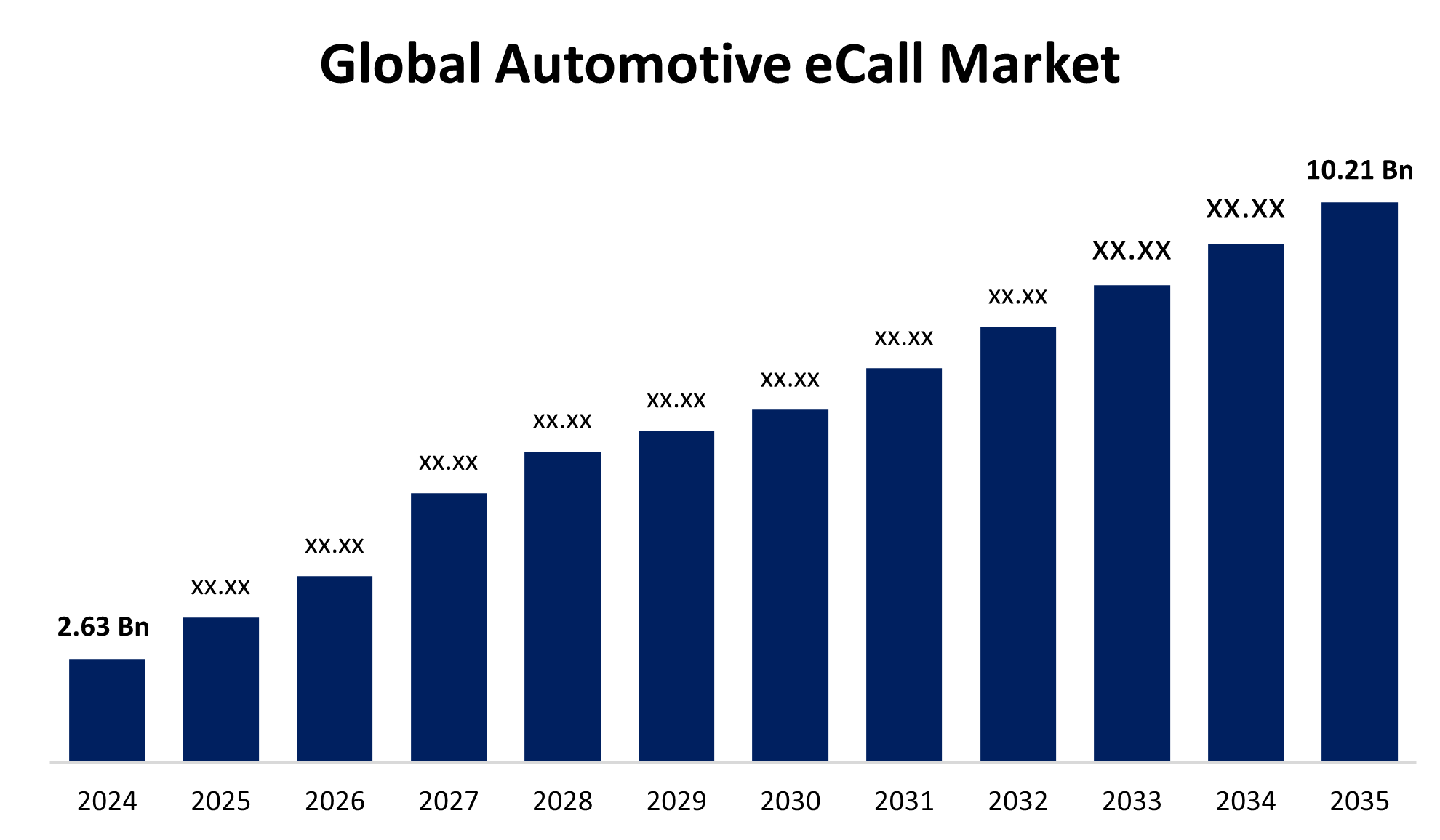

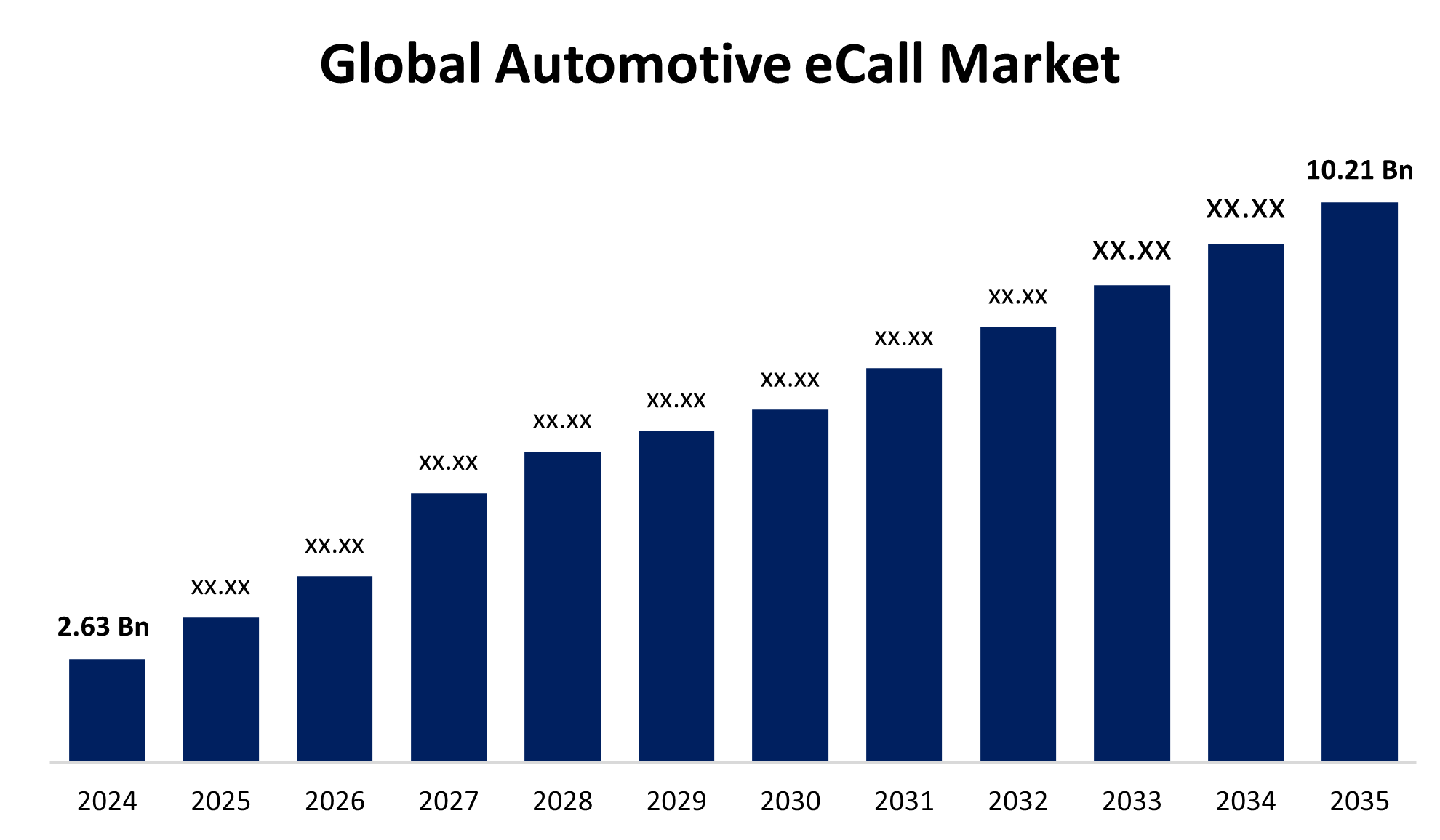

The Global automotive eCall Market Size Was Estimated at USD 2.63 Billion in 2024 and is projected to reach USD 10.21 Billion by 2035, Growing at a CAGR of 13.12% from 2025 to 2035. Government laws, growing road safety concerns, and technology developments in communication infrastructure are all contributing to the rise of the automotive eCall market.

Key Regional and Segment-Wise Insights

- In 2024, the European automobile eCall market accounted for 38.2% of global revenue, resulting in dominance in the market.

- The robust automobile safety culture in Germany is driving growth in the country's automotive eCall sector.

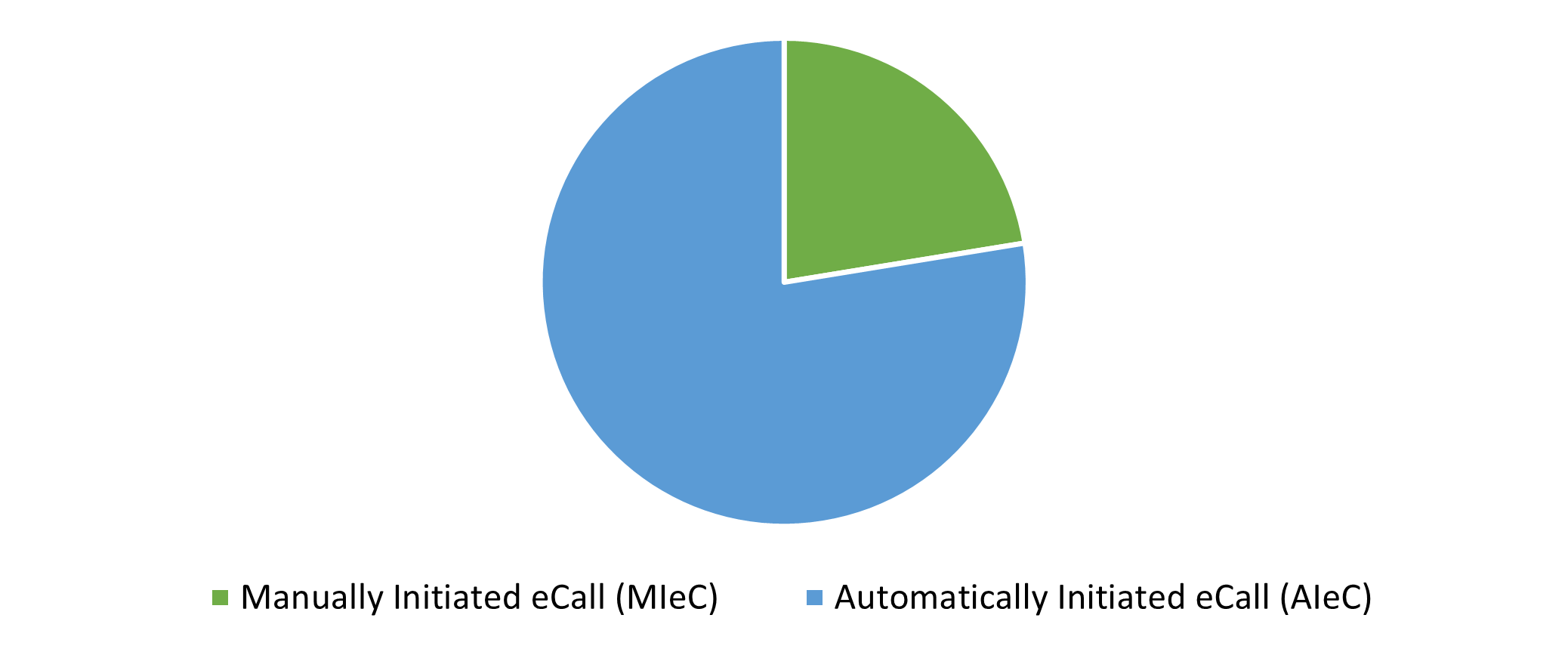

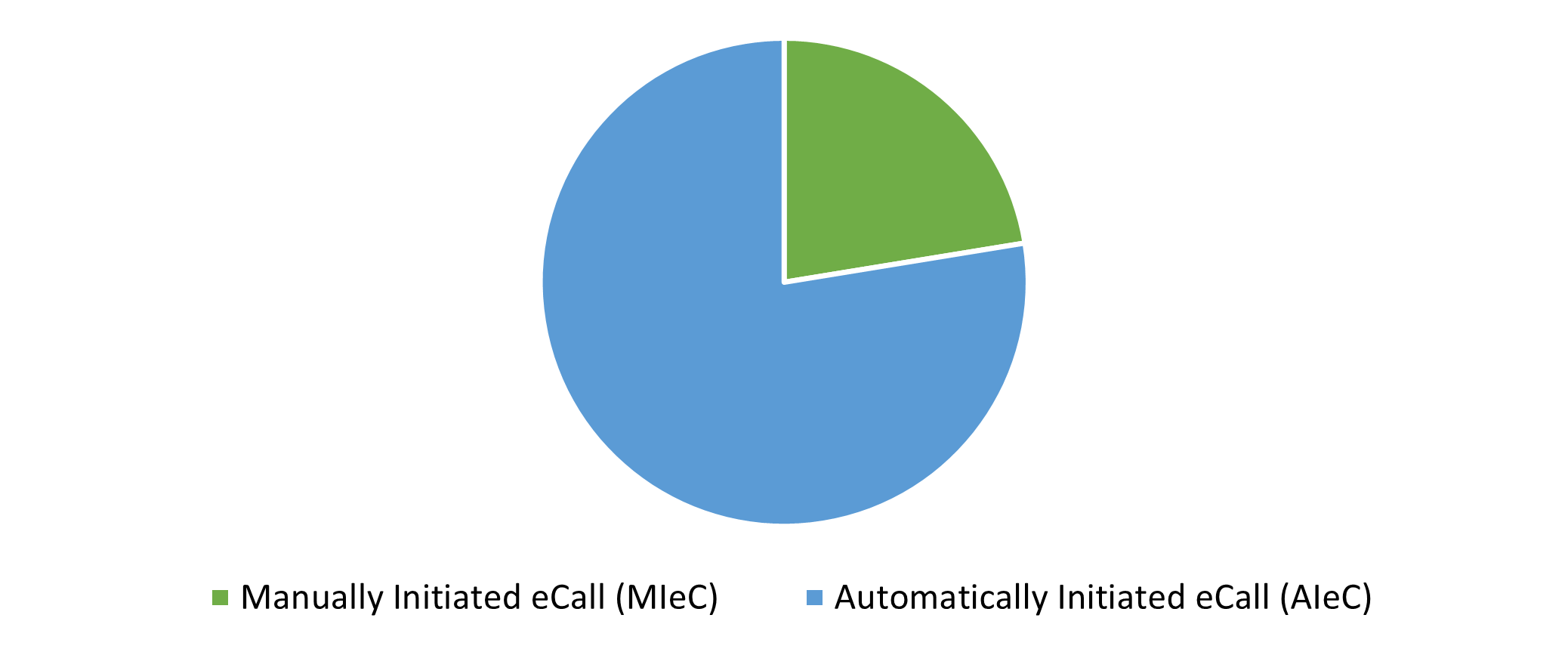

- The automatically initiated eCall category led the vehicle eCall market by trigger type, with a market share of 65.7%

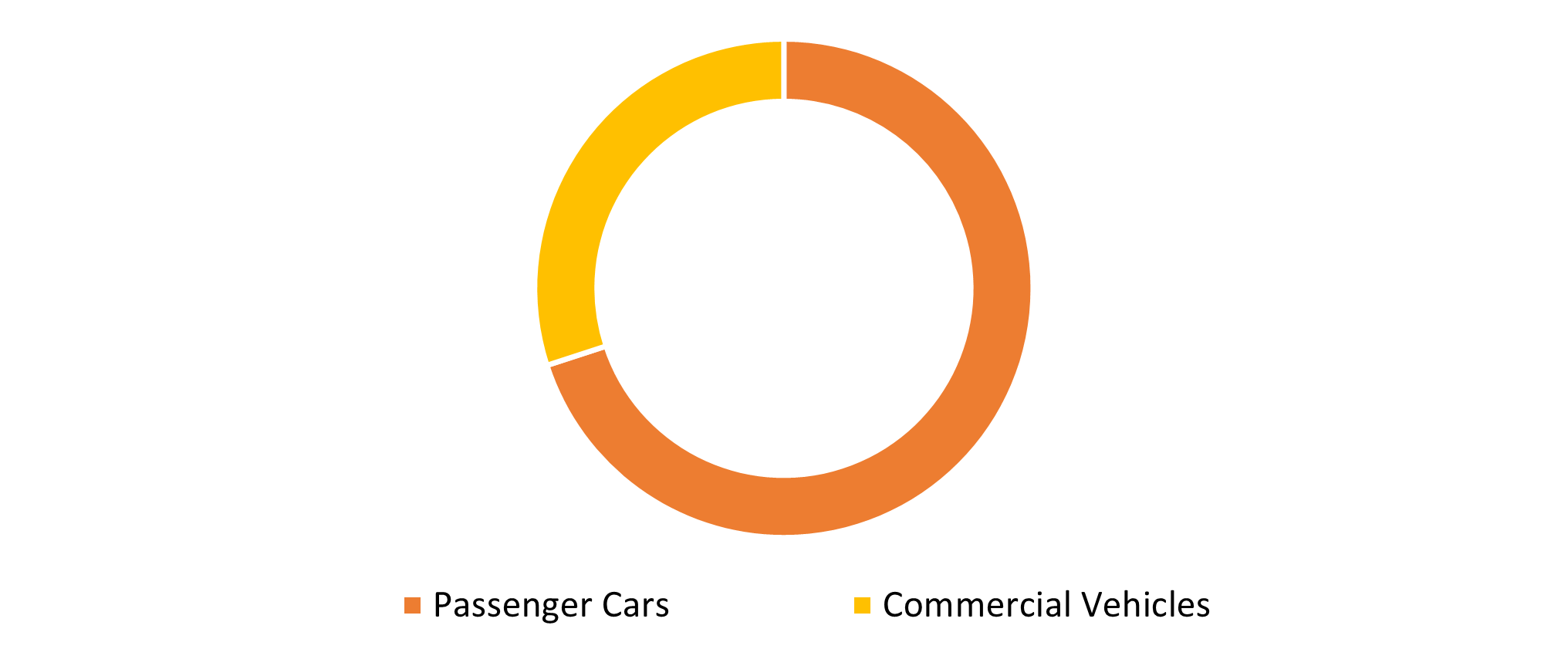

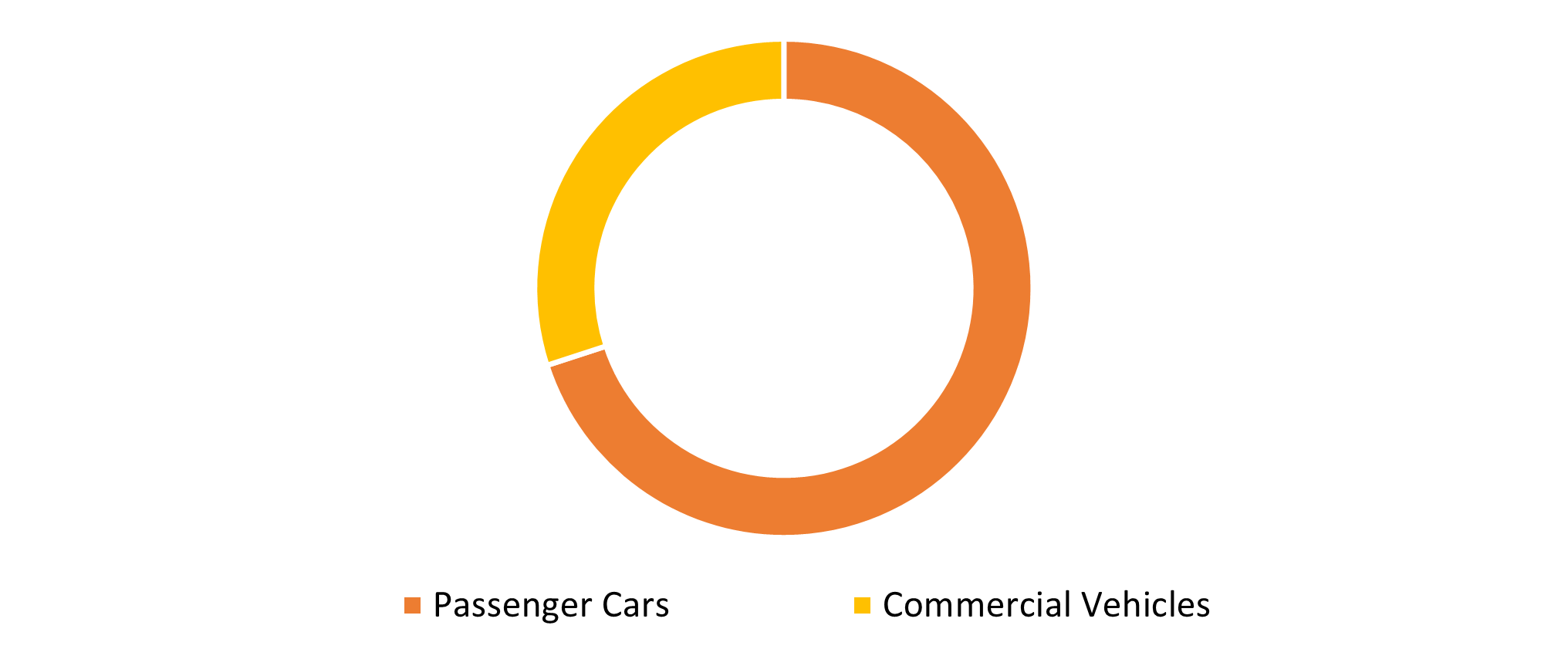

- The passenger car sector dominated the market by vehicle type and contributed 71.4% of global revenue in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.63 Billion

- 2035 Projected Market Size: USD 10.21 Billion

- CAGR (2025-2035): 13.12%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The automotive eCall market refers to the segment of the industry that develops, manufactures, and implements automobile emergency call systems, or eCalls, which automatically call emergency services in the event of a crash. This includes the systems, technology, components, and services related to automobile eCall systems, including software, hardware, and communications with emergency response networks. The automotive eCall market is supported by the increasing concern for vehicle and passenger safety. Governments and regulatory bodies across the globe are promoting the installation of automatic emergency call systems in automobiles to enhance road safety.

Another key motivator is the international focus on improving road safety. eCall systems have become an essential safety measure in response to the increase in the number of traffic accidents and fatalities. eCall systems reduce response times for emergency services by automatically transmitting GPS coordinates and other critical information to emergency services, which will dramatically assist them during serious accidents. The potential to save lives, especially in remote areas or out of hours, has seen these systems receive considerable support from both public safety agencies and customers. Technological advancements are also aiding the growth of the eCall market. As telematics, global navigation satellite systems (GNSS) and mobile communication technologies (particularly 4G and 5G) have increasingly improved the performance and reliability of eCall systems, the insurance sector is also contributing to the demand as it recognizes the importance of eCall systems in reducing losses from accidents and claims verification.

Trigger Type Insights

The automatically activated eCall (AIeC) segment, with a market share of 65.7%, fully led the automobile eCall market, as these systems send messages to emergency services when sensors detect a serious collision. These systems alert emergency services automatically. These systems ensure emergency services respond swiftly even if the driver is incapacitated. Because they operate hands-free, response times are reduced and road safety is improved. Their implementation with the backing of regulation has seen support from governmental and regulatory agencies, particularly in regions of Europe, leading to growing concern for car technology that will improve safety. As automatic eCall systems have become a contingency in new cars of various manufacturers generally explains the substantial share in the eCall market.

The manually initiated eCall (MIeC) segment is expected to grow significantly over the forecast period, due in part to increased interest in MIeC in some parts of the world where regulations governing connected vehicle and emergency call services are not as stringent as those for automatic emergency call (AIeC) systems. MIeC will become a lower-cost service as consumers demand stronger connected mobility services and more affordable safety features, especially in the more economical vehicle segment. MIeC allows car occupants to manually initiate an emergency call whenever they feel uncomfortable or require immediate assistance, more than likely preceding an expected "emergency", whereas AIeC only triggers when a serious collision occurs. MIeC can be utilized in medical emergencies, at collision scenes, or to manually request help with a vehicle breakdown in a hazardous situation. Because MIeC offers users the option of choosing when to engage, it is particularly attractive in vehicles whose target audience is the driver experience as well as user autonomy.

Vehicle Type Insights

The passenger car category was the market leader, generating 71.4% of global revenue in 2024. The rising segment can be attributed to the rising sales of passenger cars, high production volumes, and increasing demand for advanced safety features from customers. Many car manufacturers have been building eCall technology into passenger cars to meet regulatory demands and satisfy safety-conscious consumers looking for 'safety' features. Specifically, passenger cars are preferred eCall platforms since they are generally more receptive to connected technology. A unique combination of regulatory pressures, increasing consumer expectations for connected features with connected technology, and increasing consumer awareness of vehicle safety has prompted many automakers to implement eCall systems into their passenger car model line-ups.

During the forecast period, the commercial vehicle segment is expected to grow more rapidly than the passenger vehicle segment. The need for eCall technology is growing rapidly in the commercial vehicle market, as trucks, buses, and delivery vans are increasingly installed with advanced safety and telematics systems. eCall technology can provide significant implementation and safety benefits to fleet management, including improved fleet tracking, real-time site monitoring, and faster emergency service response times. Companies that utilize vehicles for essential business activities, such as delivering freight over long distances and passenger transport, need these capabilities to be competitive. Fleet management and operational efficiencies have become an important focus for logistics, transportation, and public industry services.

Regional Insights

Europe Automotive eCall Market Trends

In 2024, the European automobile eCall market had the largest revenue of 38.2% worldwide. The breadth of connected automobile technology applications and increasingly rigorous regulations for safety are all driving the growth. Demand from the market is increased by the presence of well-established automotive safety regulations that require new vehicles to be equipped with eCall devices. Demand is also driven by the consumer demand for smart safety solutions and real-time emergency support. Automakers are leveraging advanced telematics technology to enhance the reliability and delivery of eCall services in connected vehicles. In important countries, notably Germany, France, and the UK, automakers and IT companies are constantly advancing eCall applications, including Next Generation eCall (or NG eCall), which will enable richer data transmission.

- Germany, where manufacturers and consumers greatly value safety features, has a strong automotive safety culture driving the growth of the automotive eCall market in the country. The relevance of eCall in today's vehicles is strongly supported by its ties to accident sensors as well as ADAS (Advanced Driver Assistance Systems). Additionally, Germany's public safety answering points (PSAPs) can receive eCall alerts, ensuring timely and accurate event response. eCall systems, with their reliance on mobile phones, are built on the mobility infrastructure of the country's increasingly reliable mobile network, which includes 4G/LTE and future 5G networks.

Asia Pacific Automotive eCall Market Trends

In the Asia Pacific automobile eCall market, there is rapid growth with a CAGR of 13.6%. The growth is being driven by rising awareness of road safety and increased automobile production. Automakers are focusing on safety enhancements and the application of eCall systems for connected auto, and these systems continue to be adopted more rapidly. Advancements in telematics and the Internet of Things (IoT) are improving emergency response times and the accuracy of eCall. The development of smart transport infrastructure and consumer interest in electric and driverless cars are driving the application of integrated eCall technology. As automobile sales and vehicle production grow in countries such as China, India, and Japan, there is an increasing demand for advanced safety systems, such as eCall systems, for use in vehicles. In the Asia Pacific region, safety concerns of consumers are influencing the market growth of eCall. As consumers are looking for advanced safety features, such as the eCall system, it demonstrates that automakers are listening to customer demands.

- China's automotive eCall market is growing as a result of the country's automotive sector setting the standard for autonomous driving systems and electric cars (EVs). As the automotive sector adopts these technological advancements and acknowledges their importance, eCall is becoming recognized as a crucial component of vehicle technology integration, guaranteeing that current automobiles offer the infrastructure required for emergency communication systems and general vehicle safety.

- Strong growth in the Indian automotive eCall market is driven by an expanding automotive industry, increased production of vehicles and changing preferences for vehicle safety features. To satisfy consumer demands and improve vehicle safety, automakers are concentrating on creating eCall systems. Additionally, the usage of linked car apps and next-generation vehicle telematics to facilitate real-time connection with emergency services is growing.

North America Automotive eCall Market Trends

The North American automotive eCall market is steadily growing due to increasing demand for safer cars, enhancements in connected car technology, and growing recognition of the poor rate of eCall’s efficacy in saving lives. Automakers are embracing eCall technologies to enhance connectivity, safety, and customer satisfaction, even if it is not imposed by legislative priority. eCall systems provide help with expediting insurance claims, enhance emergency responders’ ability to respond, and provide real-time accident details. Supportive state-level laws as well as continued improvements in telematics, IoT, and autonomous vehicles will enhance growth and adoption potential in the market. Insurance companies are providing discounts for consumers for using vehicles with advanced safety technology, such as eCall systems. eCall reduces accident response time and therefore reduces claim severity.

U.S. Automotive eCall Market Trends

The U.S. automotive eCall market is experiencing significant growth, driven by a combination of rising customer awareness, regulatory requirements, and the infusion of new safety technologies into connected vehicles. Strong telecom infrastructure alongside AI and IoT advancements has increased the performance of eCall systems. Manufacturer and telematics company partnerships, and increased build rates of luxury and fully electrified automobiles with eCall options, are fuelling adoption. Cloud solutions enable instant connectivity and accident detection. Public programs to increase road safety and promote eCall use, such as the USD 172 million SS4A grants, complement the increasing connected and autonomous mobility paradigm.

Key Automotive eCall Companies:

The following are the leading companies in the automotive eCall market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- DENSO CORPORATION

- Visteon Corporation

- Telit Cinterion

- Infineon Technologies AG

- Valeo

- Robert Bosch GmbH

- Thales

- STMicroelectronics

- u-blox

Recent Developments

- In February 2025, Rohde & Schwarz and u-blox, a leading global supplier of GNSS modules, have verified u-blox's latest automotive GNSS module for the new Chinese GB/T test requirement for automotive on-board GNSS positioning systems with an automated R&S SMBV100 B-based GNSS simulator solution. This new solution will be demonstrated at the Mobile World Congress 2025 in Barcelona. In the automotive industry, GNSS (Global Navigation Satellite System) is increasingly important in supporting new infotainment and autonomous driving solutions.

- In March 2025, Telit Cinterion, an end-to-end IoT solutions provider, announced the SL871K2 GNSS module and LE310 LTE Cat. 1 bis module series. This modular offering enables a unique, best-in-class solution for wearables, telematics, asset trackers, and similar use cases that require a highly competitive combination of low-cost, cellular connectivity, multi-constellation GNSS location, and in ultra-compact packaging.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive ecall market based on the below-mentioned segments:

Global Automotive eCall Market, By Trigger Type

- Manually Initiated eCall (MIeC)

- Automatically Initiated eCall (AIeC)

Global Automotive eCall Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive eCall Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa