Articulated Hauler Market Summary, Size & Emerging Trends

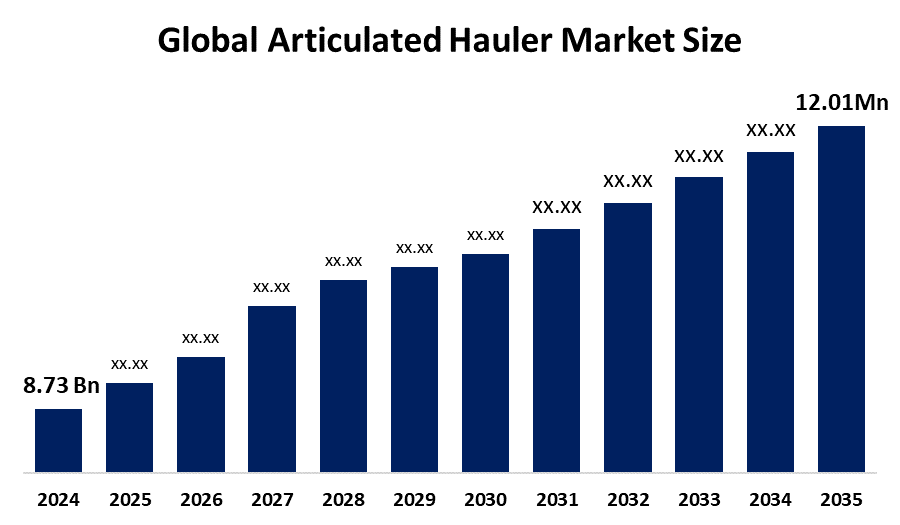

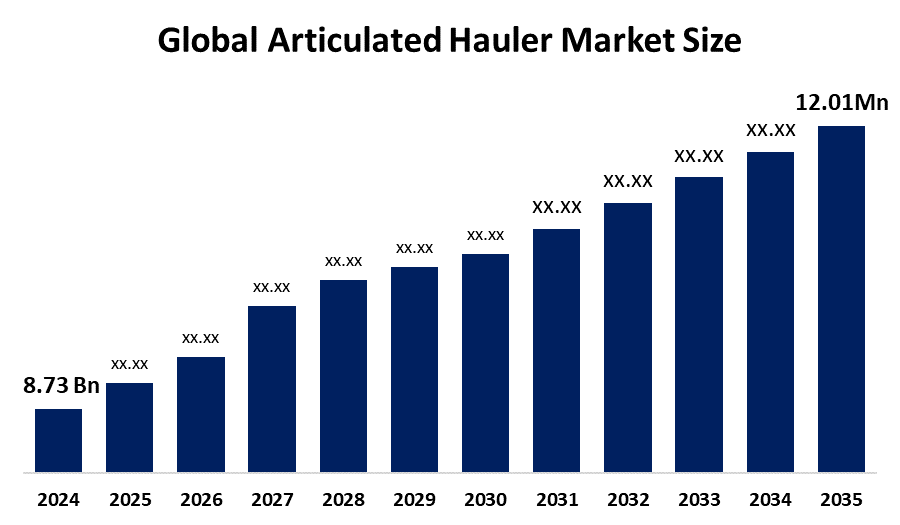

According to Decision Advisor, The Global Articulated Hauler Market Size is Expected To Grow from USD 8.73 Billion in 2024 to USD 12.01 Billion by 2035, at a CAGR of 2.94% during the forecast period 2025-2035. Growing demand for high-capacity hauling equipment in mining, construction, and infrastructure development is a key driving factor for the articulated hauler market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the articulated hauler market size during the forecast period.

- In terms of product, the 20–40 ton segment dominated in terms of revenue during the forecast period.

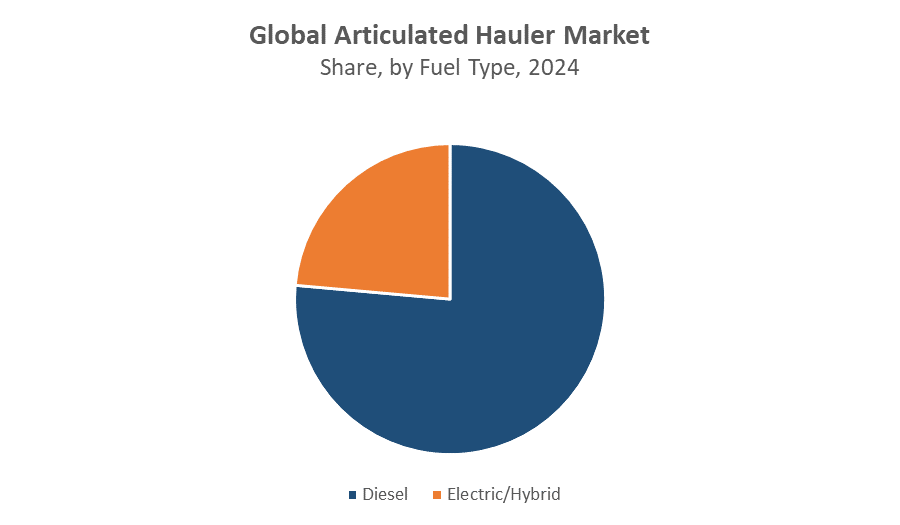

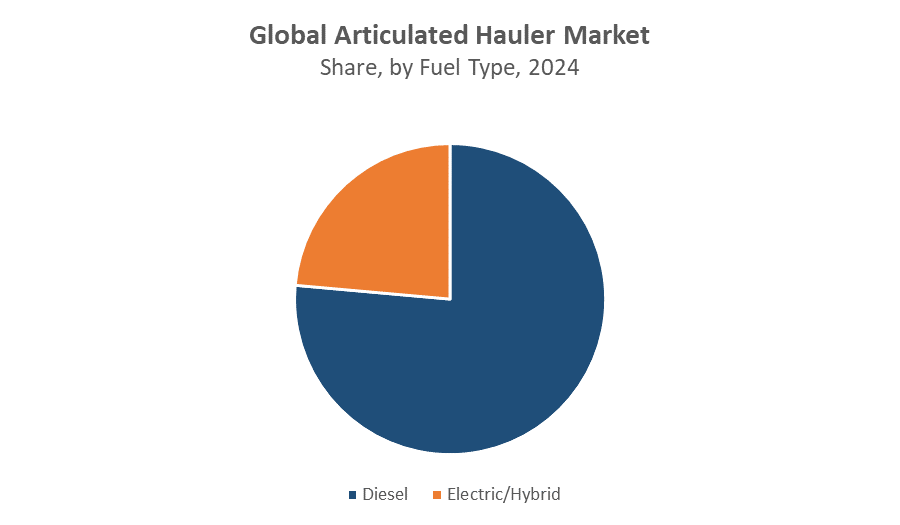

- In terms of fuel type, the diesel segment accounted for the largest revenue share in the global articulated hauler market size during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.73 Billion

- 2035 Projected Market Size: USD 12.01 Billion

- CAGR (2025-2035): 2.94%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Articulated Hauler Market

The Articulated Hauler Market Size focuses on producing high-capacity off-road vehicles built to transport heavy materials across rough and uneven terrains. These vehicles are essential in mining, construction, and infrastructure projects because of their high load capacity, excellent maneuverability, and fuel efficiency. Rising global infrastructure development, large-scale construction projects, and expanding urbanization drive market demand. Governments support the market through policies that fund modern construction machinery, enforce safety standards, and promote environmentally friendly emission norms. Additionally, increasing mining activities and industrial growth create steady requirements for durable, efficient hauling solutions. Technological improvements in vehicle design and fuel systems further enhance operational efficiency. Overall, the articulated hauler market benefits from a combination of industrial expansion, governmental support, and technological advancement, positioning it as a critical segment in modern heavy-duty vehicle manufacturing.

Articulated Hauler Market Trends

- There is a growing shift toward electric and hybrid haulers to reduce emissions and operational costs.

- Advances in vehicle design and telematics are improving efficiency, safety, and durability.

- Mergers and partnerships among manufacturers are expanding global reach and product offerings.

Articulated Hauler Market Dynamics

Driving Factors: Rising demand from construction, mining, and infrastructure projects

The Articulated Hauler Market Size is primarily driven by the increasing demand for efficient and high-capacity hauling solutions in construction, mining, and infrastructure sectors. Large-scale mining projects, urban infrastructure expansion, and road construction activities, especially in developing economies, fuel this demand. Advancements in vehicle efficiency, safety systems, and telematics enhance productivity and reduce operational costs, making articulated haulers more attractive for industrial applications. Additionally, government initiatives supporting the adoption of environmentally friendly and fuel-efficient machinery provide further impetus for market growth.

Restraint Factors: High upfront costs and competition from alternative hauling solutions

Despite the growth potential, the market faces restraints. High initial investment costs, particularly for electric and hybrid haulers, can deter small and medium-sized operators. Fluctuating diesel prices and ongoing maintenance expenses also impact operational affordability. Moreover, articulated haulers compete with other heavy-duty vehicles such as wheel loaders, rigid dump trucks, and conventional transport solutions, which can limit market penetration in certain regions. Compliance with strict emission regulations adds further financial and operational pressure on manufacturers and end-users.

Opportunity: Electrification and autonomous haulers

The transition toward electric and hybrid articulated haulers presents a major growth opportunity. These models help reduce emissions, improve energy efficiency, and lower long-term operational costs, aligning with global sustainability goals. Additionally, autonomous and semi-autonomous hauling solutions are gaining traction, particularly in mining and large-scale construction projects. Automation improves safety, reduces human error, and enhances productivity, providing a competitive edge for early adopters and technologically advanced manufacturers.

Challenges: Supply chain disruptions and regulatory compliance

The Articulated Hauler Market Size is also affected by challenges such as volatile raw material prices, logistical bottlenecks, and disruptions in the global supply chain. Compliance with stringent safety and emission regulations further complicates operations and production planning. Moreover, the shortage of skilled labor capable of operating advanced machinery, particularly in emerging markets, can slow adoption rates. Manufacturers must navigate these challenges while balancing cost, efficiency, and technological innovation to maintain growth momentum.

Global Articulated Hauler Market Ecosystem Analysis

The Global Articulated Hauler Market Size ecosystem comprises raw material suppliers, manufacturers, and end-users across mining, construction, and infrastructure sectors. Key manufacturers include Volvo Construction Equipment and Caterpillar, focusing on producing high-capacity, energy-efficient haulers. Suppliers, especially in Asia, play a critical role in material availability and cost management. Regulatory bodies enforce stringent safety and environmental standards, promoting sustainable operations and responsible production. The interplay between suppliers, manufacturers, regulators, and end-users shapes market dynamics, driving innovation, efficiency, and growth in the global articulated hauler industry.

Global Articulated Hauler Market, By Product

The 20–40 ton articulated hauler segment dominates the market in terms of revenue, holding approximately 55% of the global market share. This segment is favored for its balanced load capacity and operational efficiency, making it ideal for construction projects, urban infrastructure, and mid-sized mining operations. Its versatility allows for easier maneuverability on uneven terrains while maintaining high productivity, making it a preferred choice for contractors and mining operators who require reliable performance without the challenges of handling extremely large payloads.

The >40 ton articulated hauler segment accounts for around 30% of the market share, representing the high-capacity end of the spectrum. These haulers are essential for large-scale mining operations, heavy construction projects, and industrial applications that demand maximum payload capacity. While offering superior load handling, these vehicles require more investment and specialized operational expertise. The growing demand in large infrastructure projects and expansive mining sites drives adoption of this segment, especially in regions with significant industrial development.

Global Articulated Hauler Market, By Fuel Type

The diesel-fueled articulated hauler segment dominates the market, holding approximately 70% of the global market share during the forecast period. Diesel haulers are preferred for their reliability, long-duration operational capability, and widespread fuel availability. Established maintenance infrastructure and proven performance in harsh mining and construction environments make diesel models the standard choice for most end-users. Their high power output and efficiency for heavy-duty operations further reinforce their dominance across global markets, particularly in regions with extensive industrial and infrastructure projects.

The electric and hybrid articulated hauler segment accounts for around 25% of the market share and represents a rapidly growing segment. Adoption is driven by increasing government incentives, global sustainability trends, and rising demand for vehicles that reduce operational costs and greenhouse gas emissions. Electric and hybrid haulers are gaining traction in regions prioritizing eco-friendly construction practices, low-emission zones, and urban infrastructure projects. Technological advancements in battery life, charging infrastructure, and energy efficiency further support the expansion of this segment in the coming years.

Asia Pacific is expected to hold the largest share of the articulated hauler market during the forecast period, accounting for approximately 45% of global revenue. Rapid industrialization, large-scale mining activities, and expansive infrastructure projects in countries such as China, India, and Australia drive demand. The region’s growing construction and urban development projects require efficient and high-capacity hauling solutions. Additionally, government initiatives supporting modernization of construction machinery and mining equipment further fuel market growth. Strong manufacturing capabilities and a well-established supplier network in the region also contribute to Asia Pacific’s dominant market position.

North America is anticipated to register the fastest CAGR of around 7%, fueled by the modernization of mining operations and construction projects. The adoption of electric and hybrid articulated haulers is increasing, supported by government incentives for eco-friendly and energy-efficient machinery. Advanced technological infrastructure, skilled labor availability, and strong industrial investment accelerate market expansion. The United States and Canada, in particular, are witnessing growing demand from large-scale mining and infrastructure sectors, reinforcing North America’s position as a rapidly growing market for articulated haulers.

Europe is expected to experience steady growth, holding approximately 20% of the global market share, driven by stringent construction and mining regulations promoting low-emission and energy-efficient vehicles. Countries such as Germany, France, and the UK are investing in sustainable infrastructure projects, increasing the adoption of modern articulated haulers. Focus on environmental compliance, emission reduction, and occupational safety standards encourages manufacturers to offer advanced, eco-friendly hauling solutions. European operators increasingly prefer vehicles with advanced telematics and fuel-efficient engines, supporting long-term market stability in the region.

WORLDWIDE TOP KEY PLAYERS IN THE ARTICULATED HAULER MARKET INCLUDE

- Volvo Construction Equipment

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery

- Liebherr Group

- Doosan Infracore

- Bell Equipment

- Terex Corporation

- XCMG Group

- SANY Group

- Others

Product Launches in Articulated Hauler Market

- In March 2024, Volvo Construction Equipment introduced a new electric articulated hauler model in Europe, reflecting the industry’s shift toward sustainable and energy-efficient solutions. This launch targets mining and construction operations seeking to reduce greenhouse gas emissions while maintaining high productivity and operational efficiency. The electric hauler incorporates advanced battery technology, improved load-handling capabilities, and integrated telematics for real-time monitoring and maintenance optimization.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the articulated hauler market based on the below-mentioned segments:

Global Articulated Hauler Market, By Product

Global Articulated Hauler Market, By Fuel Type

Global Articulated Hauler Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Who are the leading companies operating in the Global Articulated Hauler Market?

A: Key players include Volvo Construction Equipment, Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Liebherr Group, Doosan Infracore, Bell Equipment, Terex Corporation, XCMG Group, and SANY Group.

Q: What are the main drivers of growth in the Articulated Hauler Market?

A: Rising demand from mining, construction, and infrastructure projects, government incentives for eco-friendly vehicles, and advances in vehicle technology are key growth drivers.

Q: What challenges are limiting growth in the Articulated Hauler Market?

A: High upfront costs, competition from alternative hauling solutions, regulatory compliance, and supply chain disruptions are major challenges.

Q: Which technological trends are shaping the Articulated Hauler Market?

A: Key trends include electrification, hybrid vehicles, telematics, and autonomous/semi-autonomous hauler development.

Q: What is the long-term outlook for the Articulated Hauler Market?

A: The market is expected to experience steady growth through 2035, driven by global infrastructure projects, sustainability trends, and technological innovations in hauling equipment.