Amorphous Iron (Fe Amorphous) Market Summary, Size & Emerging Trends

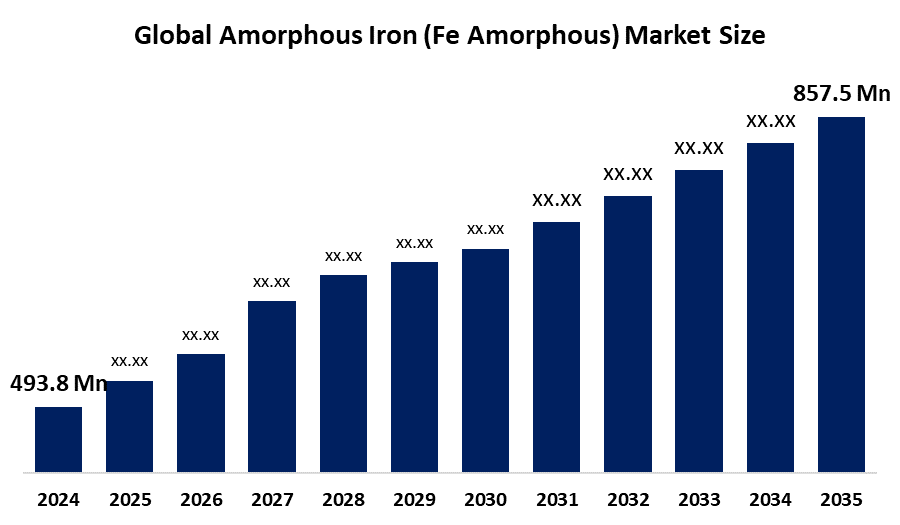

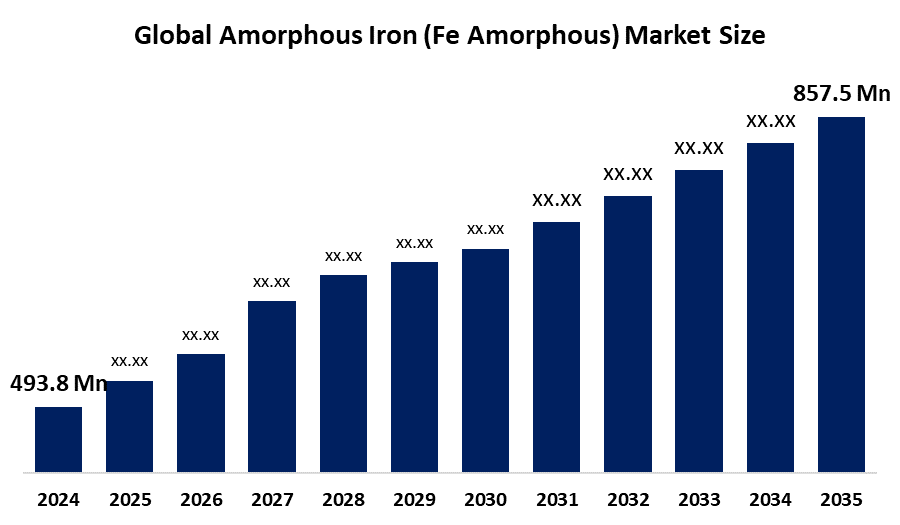

According to Decision Advisor, The Global Amorphous Iron (Fe Amorphous) Market Size is Expected To Grow from USD 493.8 Million in 2024 to USD 857.5 Million by 2035, at a CAGR of 5.15% during the forecast period 2025-2035. Increasing demand for energy-efficient electrical components and transformers is a key driving factor for the amorphous iron market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the amorphous iron market size during the forecast period.

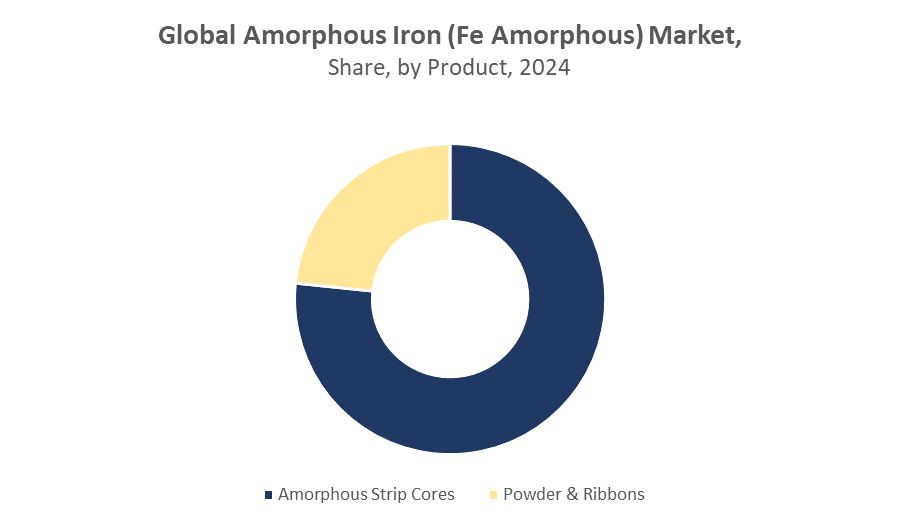

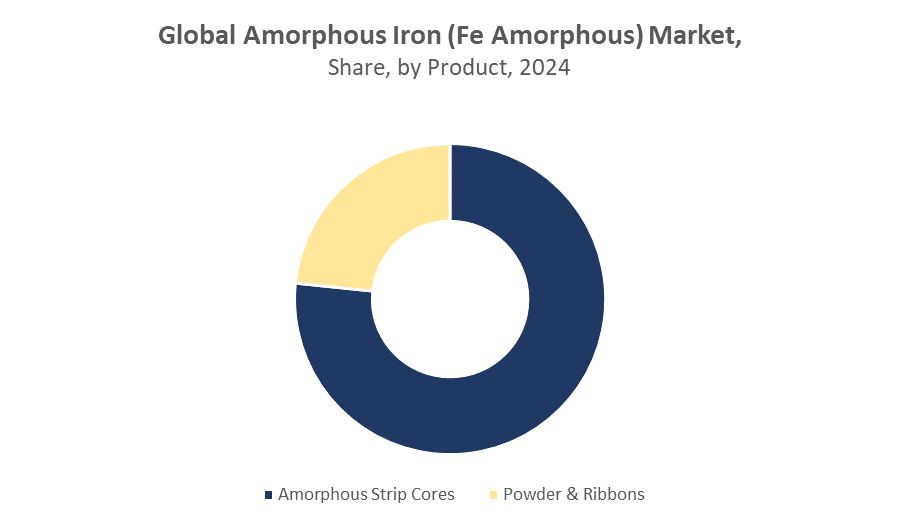

- In terms of product, the amorphous strip cores segment dominated in terms of revenue during the forecast period.

- In terms of application, the power transformers & inductors segment accounted for the largest revenue share in the global amorphous iron market size during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 493.8 Million

- 2035 Projected Market Size: USD 857.5 Million

- CAGR (2025-2035): 5.15%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Amorphous Iron (Fe Amorphous) Market

The Amorphous Iron Market Size focuses on the production of iron in a non-crystalline, amorphous form, primarily used in energy-efficient electrical components. Amorphous iron is widely employed in transformers, inductors, and specialty motors due to its low core loss, high permeability, and superior magnetic properties. The market is driven by increasing demand for energy-efficient solutions in power transmission and industrial applications. Governments are promoting energy-saving technologies, which further supports market growth. The ongoing transition to renewable energy and smart grids also fuels demand for high-performance amorphous iron components.

Amorphous Iron (Fe Amorphous) Market Trends

- Increasing adoption of energy-efficient transformers and low-loss electrical components.

- Advancements in manufacturing processes for powder and ribbon forms of amorphous iron.

- Strategic partnerships and mergers to expand product portfolios globally.

Amorphous Iron (Fe Amorphous) Market Dynamics

Driving Factors: Rising Demand from Power and Industrial Sectors

The increasing need for energy-efficient solutions in the power and industrial sectors is a primary driver for the growth of the amorphous iron market. Modern power transformers and industrial motors demand materials that reduce energy losses while maintaining high performance, and amorphous iron meets these requirements due to its superior magnetic properties and low core losses. As the global demand for electricity continues to rise, especially in developing and industrializing regions, the adoption of amorphous iron in transformer cores and inductors becomes more crucial to optimize energy efficiency and reduce operational costs. Government policies promoting energy conservation and renewable energy adoption further accelerate market growth. Many countries have implemented regulations that encourage the use of low-loss transformers and motors, incentivizing industries to replace traditional silicon steel cores with amorphous iron alternatives. These initiatives directly support wider adoption, providing a favorable environment for market expansion.

Restraint Factors: High Production Costs and Raw Material Dependency

Despite its benefits, amorphous iron production is highly energy-intensive and requires specialized equipment. The manufacturing process involves precise cooling rates and controlled processing conditions to achieve the desired non-crystalline structure, making it more expensive than conventional silicon steel cores. High capital investment in production facilities and the cost of raw materials contribute to overall high manufacturing expenses, which can limit adoption, particularly among smaller manufacturers or in cost-sensitive markets. The market also faces competition from alternative materials such as silicon steel, which is widely available, less expensive, and familiar to manufacturers.

Opportunities: Adoption of Smart Grids and Renewable Energy Infrastructure

The global shift toward energy-efficient infrastructure presents significant opportunities for amorphous iron manufacturers. Smart grid initiatives, which focus on optimized electricity distribution, low-loss transformers, and efficient industrial motors, create strong demand for materials that reduce energy dissipation. Amorphous iron, with its low core losses and high efficiency, is ideally suited to support this transformation, making it an attractive choice for utilities and industrial players implementing smart grid technologies. Emerging applications in specialty motors and electromagnetic interference (EMI) suppression also offer additional revenue potential. As industries increasingly adopt electric vehicles, robotics, and high-frequency electronics, the demand for high-performance amorphous iron components rises, providing new market avenues.

Challenges: Supply Chain Disruptions and Technological Complexity

The production of amorphous iron is technically complex and requires precise control over cooling rates, alloy composition, and processing conditions. Any deviations in these parameters can affect material properties, resulting in inconsistent performance. This complexity poses a challenge for manufacturers seeking to maintain high-quality standards while scaling up production. Additionally, the supply chain for raw materials, particularly high-purity iron alloys, is vulnerable to price fluctuations and geopolitical tensions. Disruptions in material availability can lead to production delays, increased costs, and market instability, especially in regions dependent on imports for raw inputs.

Global Amorphous Iron (Fe Amorphous) Market Ecosystem Analysis

The global Amorphous Iron (Fe Amorphous) Market Size ecosystem comprises raw material suppliers providing high-purity iron powders and alloys, manufacturers producing strip cores, powders, and ribbons, and end-users in power transformers, inductors, EMI suppression systems, and specialty motors. Regulatory frameworks promoting energy-efficient, low-loss technologies further influence the market. Growth depends on a balanced interplay of consistent raw material supply, advanced production technologies, and compliance with environmental and efficiency standards, enabling manufacturers to meet rising demand for high-performance, energy-saving magnetic components worldwide.

Global Amorphous Iron (Fe Amorphous) Market, By Product

The amorphous strip cores segment dominates The Global Amorphous Iron Market Size in terms of revenue, accounting for approximately 65% of the total market. This leadership is attributed to their superior magnetic properties, low core losses, and excellent energy efficiency. Widely used in power transformers, inductors, and power electronics, amorphous strip cores help reduce energy wastage and operational costs, making them the preferred choice for large-scale industrial and utility applications. Their high adoption in established markets ensures steady revenue generation.

The powder and ribbons segment contributes a significant share of around 40% of the global market. These products are crucial in specialty motors, EMI suppression, and high-frequency applications, where precision and adaptability are required. Their versatility allows use in advanced industrial equipment, renewable energy systems, and compact electronic devices. Continuous innovation in powder and ribbon processing improves performance and reduces losses, supporting strong demand growth, especially in emerging industrial and electronics sectors.

Global Amorphous Iron (Fe Amorphous) Market, By Application

The power transformers and inductors segment holds the largest revenue share in the global Amorphous Iron market size, accounting for approximately 60% of the total market. This dominance is driven by amorphous iron’s ability to significantly reduce energy losses and enhance efficiency in transformer cores and inductive components. The widespread use in utilities, industrial power distribution, and energy-efficient transformer applications ensures consistent demand, making this segment the primary revenue contributor in the market.

The EMI (Electromagnetic Interference) suppression segment contributes around 30% of the market revenue. Amorphous iron’s excellent magnetic shielding properties make it ideal for use in electronic devices, industrial machinery, and high-frequency systems where interference reduction is critical. Growing adoption in consumer electronics, renewable energy systems, and industrial automation drives demand for amorphous iron in EMI suppression applications, highlighting its importance as a specialized, high-value segment.

Asia Pacific is poised to dominate the global Amorphous Iron market, contributing approximately 45% of total revenue. The region’s growth is primarily led by China, Japan, and India, driven by rapid industrialization, expansion of power infrastructure, and robust government initiatives promoting energy-efficient technologies. China and Japan continue to invest heavily in upgrading electrical grids and industrial power systems, where amorphous iron is preferred for transformer cores and inductors due to its low core loss and high efficiency. India is emerging as a high-growth market, projected to expand at a CAGR of ~10%, fueled by widespread infrastructure development, adoption of energy-efficient transformers, and increasing focus on smart grids and renewable energy projects. Government incentives, policy support, and rising awareness of energy conservation are further catalyzing market adoption across the region.

North America is expected to register a significant CAGR during the forecast period. Market growth in the region is supported by substantial investments in renewable energy infrastructure, adoption of advanced manufacturing processes, and the growing emphasis on energy-efficient power distribution systems. The United States demonstrates steady and sustained growth, driven by stringent power efficiency regulations, rising demand for specialty electrical components, and modernization of industrial power systems. Amorphous iron’s ability to reduce energy losses in transformers and enhance performance in EMI suppression and specialty motors positions it as a critical material in North America’s evolving energy landscape. Expanding applications in smart grids, high-efficiency transformers, and industrial automation further reinforce market growth potential.

WORLDWIDE TOP KEY PLAYERS IN THE AMORPHOUS IRON (FE AMORPHOUS) MARKET INCLUDE

- Metglas, Inc.

- Vacuumschmelze GmbH & Co. KG

- Hitachi Metals, Ltd.

- Honeywell International Inc.

- Electron Energy Corp.

- Shanghai Baosteel Amorphous Products Co., Ltd.

- Adaptec Materials

- Allied Magnetics Group

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the amorphous iron (Fe Amorphous) market based on the below-mentioned segments:

Global Amorphous Iron (Fe Amorphous) Market, By Product

- Amorphous Strip Cores

- Powder & Ribbons

Global Amorphous Iron (Fe Amorphous) Market, By Application

- Power Transformers & Inductors

- EMI Suppression

- Specialty Motors

Global Amorphous Iron (Fe Amorphous) Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa