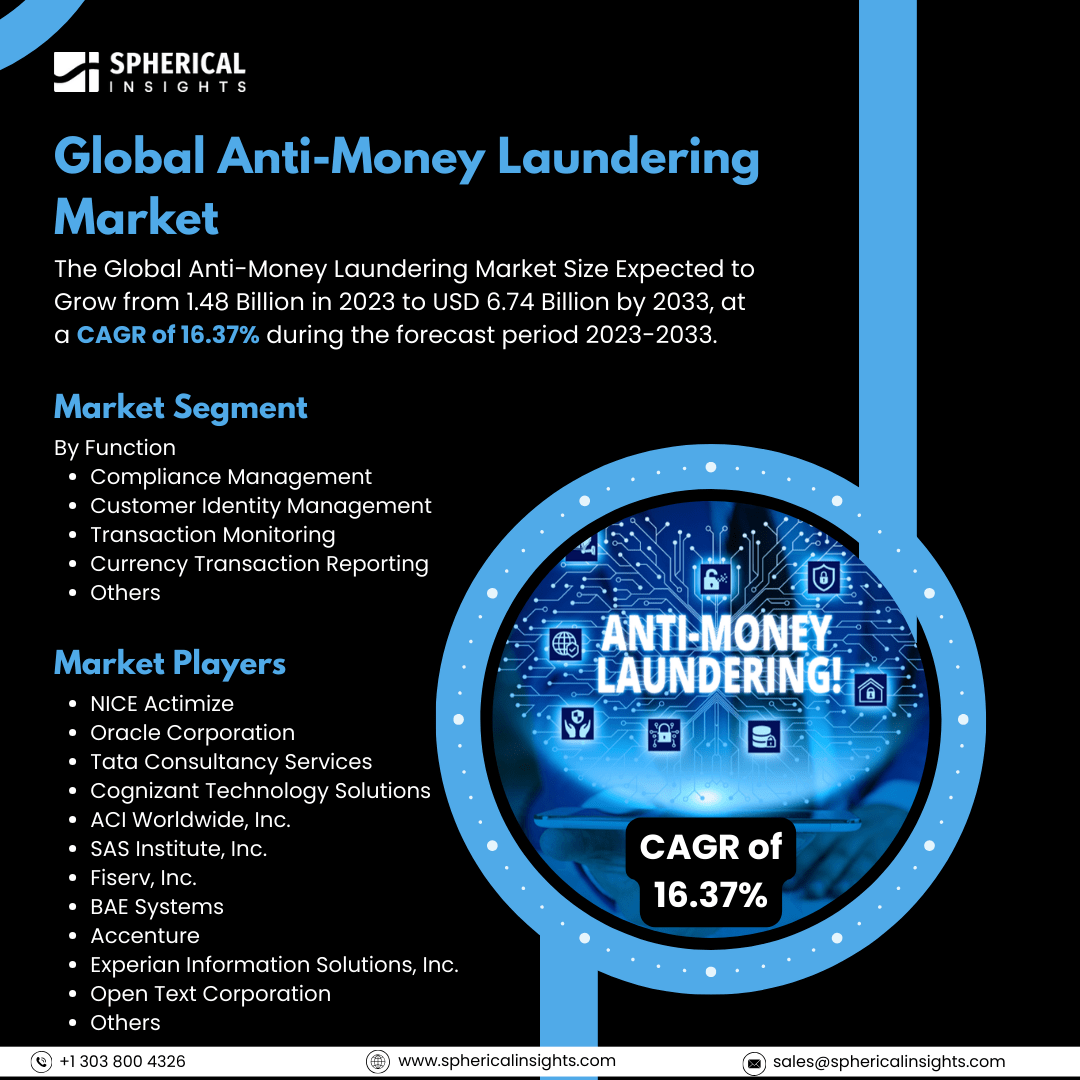

Global Anti-Money Laundering Market Size to Exceed USD 6.74 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Anti-Money Laundering Market Size Expected to Grow from 1.48 Billion in 2023 to USD 6.74 Billion by 2033, at a CAGR of 16.37% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Anti-Money Laundering Market Size, Share, and COVID-19 Impact Analysis, By Function (Compliance Management, Customer Identity Management, Transaction Monitoring, Currency Transaction Reporting, and Others), By Deployment (Cloud and On-Premise), By End Use (Banks & Financial Institution, Insurance Providers, Government, Gaming & Gambling, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Anti-Money Laundering (AML) market is the sector specializing in technologies, solutions, and services that enable financial institutions, enterprises, and regulatory authorities to identify, avoid, and combat money laundering processes. AML solutions encompass transaction monitoring, customer identification verification, compliance management, and risk assessment systems to abide by international financial rules and regulations and avoid financial offenses. Moreover, the anti-money laundering (AML) market is fueled by increased financial crimes, tougher international regulations, and greater usage of digital payments. Greater use of machine learning and artificial intelligence to detect fraud, increasing compliance obligations for financial institutions, and higher demand for real-time monitoring of transactions also drive market growth globally. However, the anti-money laundering (AML) industry is subject to impediments like prohibitively high cost of implementation, complicated compliance with regulations across borders, concerns about data privacy, and the issue of dealing with false positives in transaction monitoring systems.

The transaction monitoring segment accounted for the largest share of the global anti-money laundering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the global anti-money laundering market is divided into compliance management, customer identity management, transaction monitoring, currency transaction reporting, and others. Among these, the transaction monitoring segment accounted for the largest share of the global anti-money laundering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its pivotal function in monitoring suspicious behavior, halting fraud, and maintaining regulatory compliance. Banks are keen on AI and machine learning-based real-time monitoring solutions to process high volumes of transactions and check for money laundering accordingly.

The cloud segment accounted for a substantial share of the global anti-money laundering market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the deployment, the global anti-money laundering market is divided into cloud and on-premise. Among these, the cloud segment accounted for a substantial share of the global anti-money laundering market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of its scalability, affordability, and real-time processing of data. Cloud-based AML solutions are increasingly used by financial institutions due to increased security, regulatory compliance, and AI-based analytics, which make them the popular choice over conventional on-premises systems.

The banks & financial institution segment accounted for the largest share of the global anti-money laundering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the global anti-money laundering market is divided into banks & financial institutions, insurance providers, government, gaming & gambling, and others. Among these, the banks & financial institution segment accounted for the largest share of the global anti-money laundering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of stringent regulatory demands, a high volume of transactions, and a greater risk of financial crimes. These institutions invest a lot in AML solutions for transaction monitoring, fraud detection, and compliance management to avoid money laundering and ensure regulatory compliance.

North America is projected to hold the largest share of the global anti-money laundering market over the projected period.

North America is projected to hold the largest share of the global anti-money laundering market over the projected period. This is due to rigorous regulatory systems, elevated rates of financial crimes, and hefty investments from financial institutions and banks in compliance software. Having access to principal AML solution vendors and sophisticated AI-powered monitoring platforms is an added driving force of market supremacy within the region.

Asia Pacific is expected to grow at the fastest CAGR of the global anti-money laundering market during the projected period. This is owing to surging digital transactions, escalating financial fraud, and tighter regulatory oversight. Nations such as China, India, and Singapore are making significant investments in AML technology, prompted by increasing fintech usage, widening banking industries, and the requirement for improved financial security.

Company Profiling

Major vendors in the global anti-money Laundering market are NICE Actimize, Oracle Corporation, Tata Consultancy Services Limited, Cognizant Technology Solutions Corporation, ACI Worldwide, Inc., SAS Institute, Inc., Fiserv, Inc., BAE Systems, Accenture, Experian Information Solutions, Inc., Open Text Corporation., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Google Cloud introduced an AI-driven Anti Money Laundering (AML) solution to assist financial institutions in identifying money laundering effectively. The AML AI system employed machine learning to improve risk detection, lower operational expenditure, and enhance compliance by minimizing false positives. One of the early users, HSBC, stated that they identified 2-4 times more suspicious activity and cut alert volumes by more than 60%. The product was applied in many global jurisdictions, with advantages including higher accuracy and lower investigation time.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global anti-money laundering market based on the below-mentioned segments:

Global Anti-Money Laundering Market, By Function

- Compliance Management

- Customer Identity Management

- Transaction Monitoring

- Currency Transaction Reporting

- Others

Global Anti-Money Laundering Market, By Deployment

Global Anti-Money Laundering Market, By End Use

- Banks & Financial Institution

- Insurance Providers

- Government

- Gaming & Gambling

- Others

Global Anti-Money Laundering Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa