Global Alternative Legal Service Providers Market Insights Forecasts to 2035

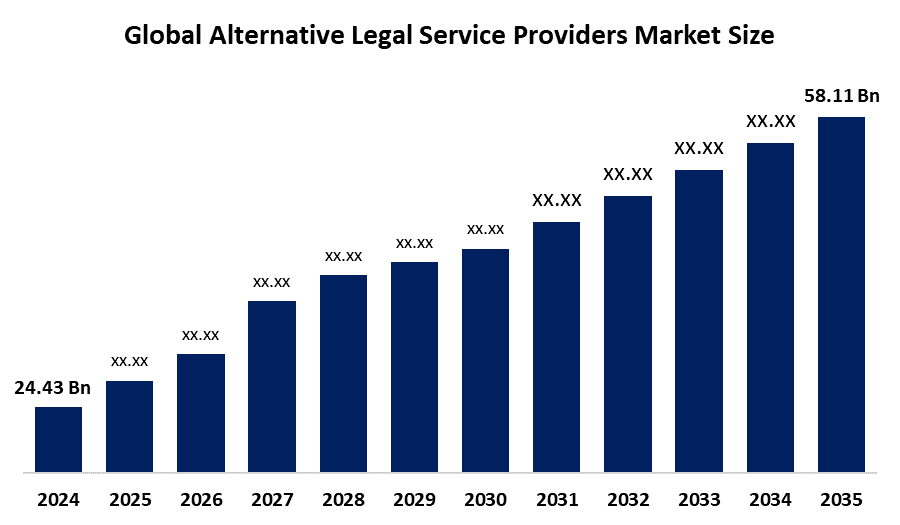

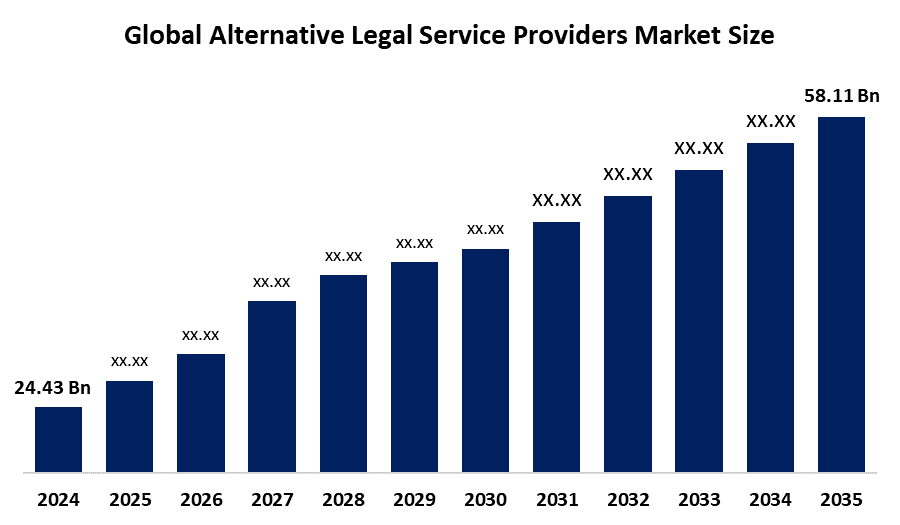

- The Global Alternative Legal Service Providers Market Size Was Estimated at USD 24.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.2% from 2025 to 2035

- The Worldwide Alternative Legal Service Providers Market Size is Expected to Reach USD 58.11 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Alternative Legal Service Providers Market

The global alternative legal service providers market includes firms delivering legal services beyond traditional law firms, such as legal process outsourcing, contract management, e-discovery, and compliance support. Leveraging advanced technology and specialized expertise, ALSPs offer efficient, flexible, and cost-effective legal solutions, fueling significant market growth amid rising demand for streamlined legal operations and digital transformation. Governments worldwide support this growth through initiatives like regulatory sandboxes, funding for legal tech startups, and policy reforms aimed at enhancing access to justice, for example, the UK’s Solicitors Regulation Authority sandbox and technology grants from the U.S. Legal Services Corporation. As businesses and legal departments increasingly adopt these alternative models, ALSPs play a vital role in litigation support, intellectual property management, and regulatory compliance, underscoring their expanding significance in the evolving global legal services landscape.

Attractive Opportunities in the Alternative Legal Service Providers Market

- Incorporating advanced technologies such as AI, machine learning, and blockchain allows ALSPs to deliver faster, more accurate, and scalable legal services. This technological edge appeals to a wider client base seeking efficient and innovative legal solutions.

- Growing demand for services like contract lifecycle management, e-discovery, regulatory compliance, legal analytics, intellectual property, data privacy, and cybersecurity opens new revenue streams for ALSPs. These emerging areas require specialized expertise that ALSPs can provide cost-effectively.

- As businesses increasingly operate internationally, ALSPs have the opportunity to offer flexible and efficient cross-border legal services. Favorable government initiatives promoting digital transformation and the availability of skilled professionals in emerging markets (e.g., Asia Pacific) further support this expansion.

Global Alternative Legal Service Providers Market Dynamics

DRIVER: Government programs encouraging legal tech adoption and digital innovation bolster market growth

Companies are increasingly looking for affordable legal solutions, driving them toward ALSPs that offer flexible and cost-efficient services. Technological innovations like AI, automation, and cloud platforms empower ALSPs to deliver faster, more accurate legal support. The rising complexity of regulatory environments worldwide creates a greater need for specialized compliance and risk management services. In-house legal teams are also prioritizing efficiency and outsourcing routine or specialized tasks to ALSPs. Moreover, government programs encouraging legal tech adoption and digital innovation bolster market growth. Finally, as businesses operate globally, ALSPs’ ability to manage international legal matters through adaptable service models is a significant growth catalyst in this evolving market.

RESTRAINT: Regulatory and compliance variations across different countries

One major challenge is the reluctance of some traditional law firms and clients to fully trust ALSPs due to concerns about data security and confidentiality. Regulatory and compliance variations across different countries can also complicate the delivery of uniform services on a global scale. Additionally, the lack of standardization in service quality and limited awareness about ALSP capabilities may hinder wider adoption. Resistance to change within established legal departments can slow the transition to alternative providers. Lastly, high initial investment costs in advanced technologies and skilled talent required to maintain competitive ALSP services can be a barrier for smaller providers, limiting overall market expansion despite growing demand.

OPPORTUNITY: Integration of cutting-edge technologies

Corporations and law firms increasingly seek affordable legal solutions, creating opportunities for ALSPs to broaden services like contract lifecycle management, e-discovery, regulatory compliance, and legal analytics. The integration of cutting-edge technologies such as AI, machine learning, and blockchain empowers ALSPs to deliver faster, more precise, and scalable services, appealing to a wider client base. Growing regulatory complexity worldwide fuels demand for specialized compliance and risk advisory services. Furthermore, expanding global business operations require ALSPs to offer efficient cross-border legal support. Government initiatives promoting digital transformation and innovation in legal services provide additional momentum. With in-house legal teams outsourcing more routine and complex work, ALSPs are well-positioned to become trusted partners in emerging areas like intellectual property, data privacy, and cybersecurity, driving sustained market growth and diversification.

CHALLENGES: Absence of universal quality standards contributes to varied client experiences

A significant challenge is the skepticism from traditional law firms and corporate clients regarding data security, confidentiality, and consistent service quality. Diverse legal frameworks across different countries complicate the ability of ALSPs to offer seamless, standardized services on a global scale. Additionally, the absence of universal quality standards contributes to varied client experiences, affecting overall trust in ALSPs. Internal resistance within established legal departments also hinders the shift toward outsourcing. Moreover, the substantial investment required for cutting-edge technology and attracting top legal talent can be prohibitive for smaller providers. Intense market competition further challenges both new and existing ALSPs to differentiate themselves and sustain growth amid evolving client expectations and technological demands.

Global Alternative Legal Service Providers Market Ecosystem Analysis

The global alternative legal service providers market ecosystem includes independent ALSPs, law firm affiliates, Big Four accounting firms, corporate legal departments, and technology providers. ALSPs deliver services through models like legal managed services, project-based, and subscription-based offerings. Technological integration, especially AI and automation, drives efficiency and cost savings. Regional differences impact adoption, with North America leading. Regulatory changes, such as Big Four firms practicing law, reshape competition. Overall, the ecosystem is diverse and technology-focused, fueling strong market growth and evolving legal service delivery.

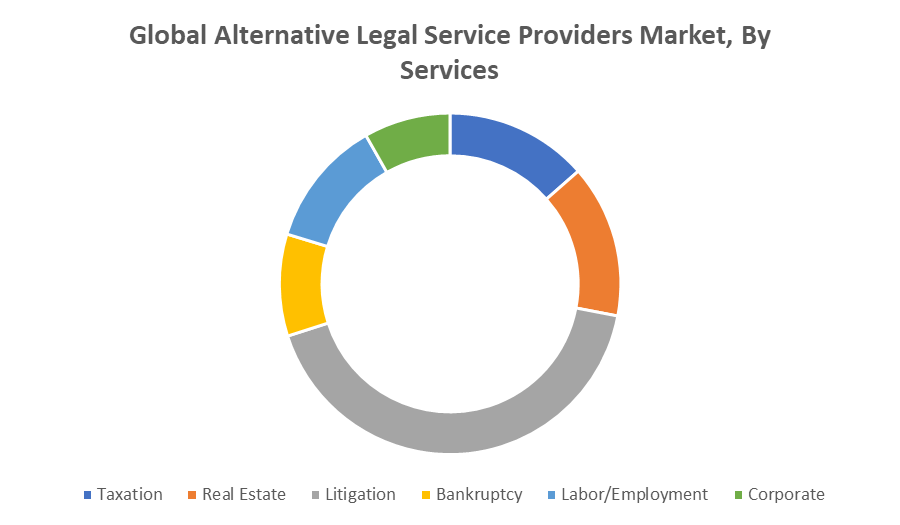

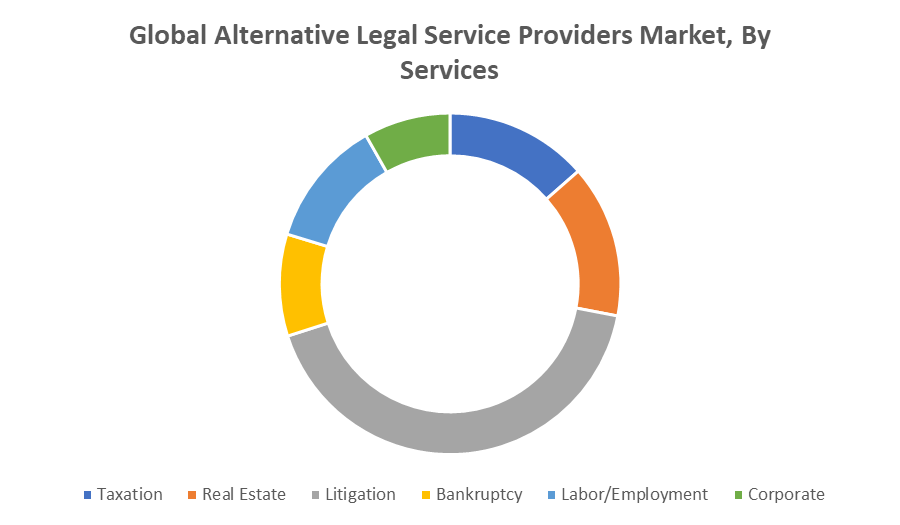

Based on the services, the litigation segment dominated the market with a revenue share over the forecast period

The litigation segment dominated the alternative legal service providers market, accounting for the largest revenue share over the forecast period. This dominance is attributed to the rising demand for cost-effective and specialized litigation support services, including document review, e-discovery, and legal research. As law firms and corporate legal departments face increasing pressure to reduce legal spending, outsourcing litigation-related tasks to ALSPs has become a strategic approach. The segment’s growth is further driven by the complexity and volume of litigation cases across sectors.

Based on the billing type, the hourly billing segment accounted for the largest market revenue share during the forecast period

The hourly billing segment accounted for the largest market revenue share during the forecast period. This dominance is due to its widespread acceptance and familiarity within the legal industry, offering transparency and flexibility in tracking time spent on specific tasks. Clients often prefer hourly billing for short-term or specialized legal projects where the scope may change. Additionally, many ALSPs continue to adopt this model for litigation support, contract review, and regulatory compliance services, reinforcing its strong market presence.

North America is anticipated to hold the largest market share of the alternative legal service providers market during the forecast period

North America is anticipated to hold the largest market share of the alternative legal service providers market during the forecast period. This dominance is driven by the region’s mature legal industry, early adoption of legal technologies, and strong presence of leading ALSPs. Corporate legal departments and law firms in the U.S. and Canada are increasingly outsourcing routine and specialized tasks to enhance efficiency and reduce costs. Additionally, supportive regulatory frameworks and growing demand for flexible, technology-driven legal solutions further bolster the region's leadership in the global ALSP market.

Asia Pacific is expected to grow at the fastest CAGR in the alternative legal service providers market during the forecast period

Asia Pacific is expected to grow at the fastest rate in the alternative legal service providers market during the forecast period. This rapid growth is driven by increasing legal outsourcing from Western markets, expanding corporate activity, and rising demand for cost-effective legal solutions in countries like India, China, and the Philippines. The region is also witnessing growing adoption of legal technologies and digital transformation across law firms and corporate legal departments. Additionally, favorable government policies and the availability of skilled legal professionals are supporting the expansion of ALSP services in Asia Pacific, positioning it as a key emerging market in the global legal services landscape.

Recent Development

- In April 2025, Axiom Global launched Axiom Self Service, a digital legal marketplace that allows businesses to easily find and hire legal professionals online without going through traditional processes. This self-service platform enables corporate legal teams to search, screen, interview, and onboard qualified legal talent, often within just 24 hours. Designed to make hiring faster and more efficient, Axiom Self Service helps companies save time and reduce costs while still accessing top-tier legal expertise. The platform is currently available in the U.S., with plans for global expansion.

Key Market Players

KEY PLAYERS IN THE ALTERNATIVE LEGAL SERVICE PROVIDERS MARKET INCLUDE

- Axiom Global Inc.

- Elevate Services Inc.

- Integreon Inc.

- UnitedLex Corporation

- QuisLex, Inc.

- Cognia Law

- Morae Global Corporation

- Pangea3 (acquired by EY)

- Consilio

- Deloitte Legal

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the alternative legal service providers market based on the below-mentioned segments:

Global Alternative Legal Service Providers Market, By Services

- Taxation

- Real Estate

- Litigation

- Bankruptcy

- Labor/Employment

- Corporate

Global Alternative Legal Service Providers Market, By Billing Type

- BFSI

- IT & Telecom

- Healthcare

- Energy & Utilities

- Retail & E-commerce

- Manufacturing

Global Alternative Legal Service Providers Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa