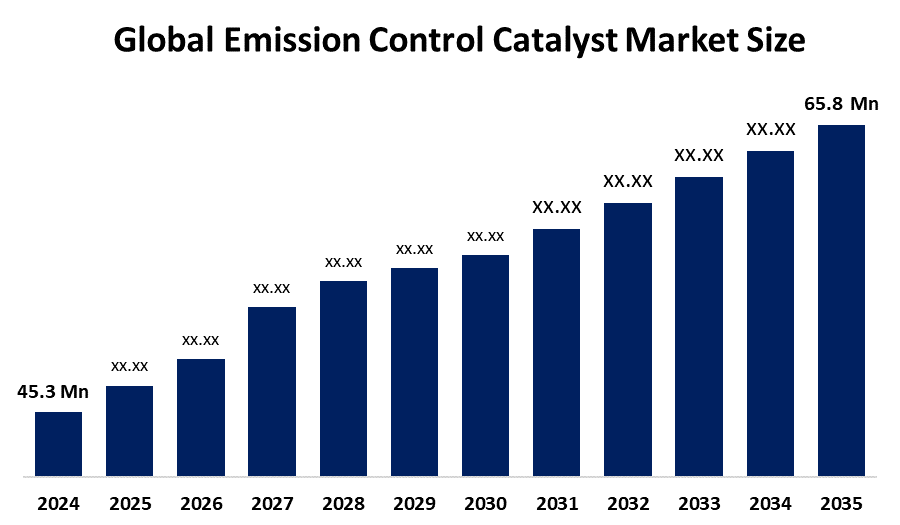

Global Emission Control Catalyst Market Insights Forecasts to 2035

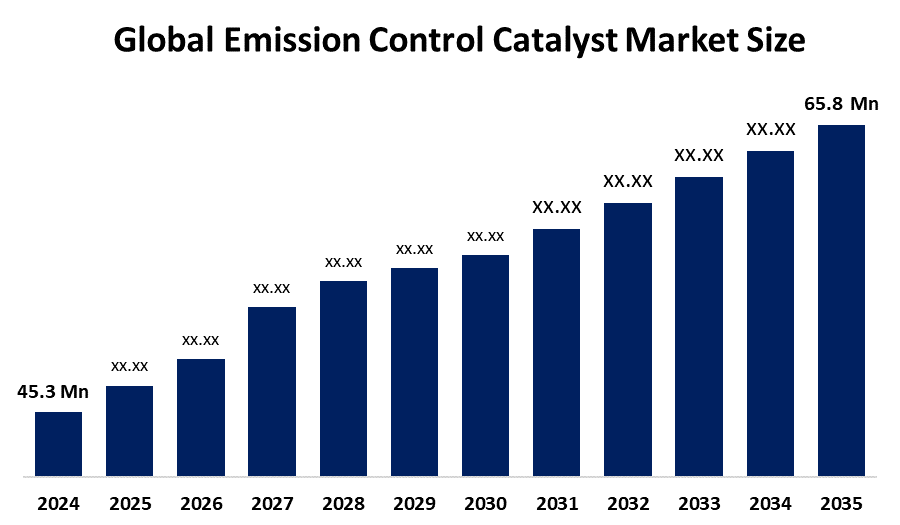

- The Global Emission Control Catalyst Market Size Was Estimated at USD 45.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.45% from 2025 to 2035

- The Worldwide Emission Control Catalyst Market Size is Expected to Reach USD 65.8 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Emission Control Catalyst Market

The global emission control catalyst market involves the production and supply of catalysts designed to reduce harmful emissions from vehicles and industrial sources. These catalysts are integral parts of exhaust systems, converting toxic gases such as carbon monoxide (CO), nitrogen oxides (NOx), and hydrocarbons (HC) into less harmful substances like carbon dioxide (CO2), nitrogen (N2), and water vapor. The primary types of emission control catalysts include three-way catalysts (TWC), selective catalytic reduction (SCR) catalysts, and oxidation catalysts. These catalysts typically use precious metals such as platinum, palladium, and rhodium to enhance their efficiency and durability. Emission control catalysts play a critical role in meeting environmental standards by minimizing air pollution and improving air quality. They are widely used in various vehicles, including gasoline and diesel engines, as well as in industrial applications. Continuous advancements in catalyst technology aim to improve effectiveness while reducing costs, making emission control catalysts an essential element in sustainable environmental management worldwide.

Attractive Opportunities in the Emission Control Catalyst Market

- With the rise of hydrogen, biofuel, and other alternative fuel vehicles, there is a growing need for specialized emission control catalysts tailored to these new fuel types. This opens up a promising market for innovation and product development beyond traditional gasoline and diesel engines.

- Beyond automotive use, emission control catalysts are increasingly in demand for industrial sectors such as power plants and chemical manufacturing. These industries face stricter emission regulations, creating new growth avenues for catalyst applications outside of vehicles.

- Innovations in nanomaterials and catalyst design offer the potential to produce more efficient, durable, and cost-effective catalysts with lower precious metal content. Simultaneously, improving recycling and recovery processes for precious metals from spent catalysts can reduce raw material costs and support sustainable production.

Global Emission Control Catalyst Market Dynamics

DRIVER: Rise in automobile production, especially in emerging economies, fuels demand for effective emission control solutions

Growth factors driving the global emission control catalyst market include increasing environmental awareness and stricter government regulations aimed at reducing vehicle and industrial emissions. As countries implement tighter emission standards, manufacturers are compelled to adopt advanced catalysts to comply with these norms. The rise in automobile production, especially in emerging economies, fuels demand for effective emission control solutions. Additionally, the growing preference for cleaner and fuel-efficient vehicles encourages the integration of high-performance catalysts. Technological advancements in catalyst materials, such as the use of precious metals like platinum, palladium, and rhodium, improve catalyst efficiency and durability, further boosting market growth. The expansion of diesel engine vehicles, which require specific catalysts like selective catalytic reduction (SCR), also contributes significantly. Moreover, increasing investments in research and development to create eco-friendly and cost-effective catalysts propel innovation in the market. Together, these factors contribute to the steady growth and evolving landscape of the emission control catalyst industry globally.

RESTRAINT: Complexity of catalyst manufacturing and stringent quality requirements add to operational challenges

One major challenge is the high cost of raw materials, particularly precious metals like platinum, palladium, and rhodium, which are essential components of catalysts. Their price volatility can increase production costs and limit widespread adoption. Additionally, the complexity of catalyst manufacturing and stringent quality requirements add to operational challenges. The shift toward electric vehicles (EVs), which do not require traditional emission control catalysts, poses a significant threat to the market’s long-term demand. Furthermore, recycling and recovery of precious metals from used catalysts remain limited, leading to higher dependency on mined resources. Regulatory uncertainties in some regions may also delay investments and technology adoption. Lastly, the availability of alternative technologies, such as advanced fuel injection systems and engine modifications that reduce emissions without catalysts, could impact market growth. These factors collectively restrain the rapid expansion of the emission control catalyst industry.

OPPORTUNITY: Development of catalysts for new and alternative fuel vehicles

Opportunities in the global emission control catalyst market arise from emerging trends and technological advancements beyond typical growth drivers. One key opportunity lies in the development of catalysts for new and alternative fuel vehicles, such as those running on hydrogen or biofuels, which require specialized emission control solutions. The increasing focus on industrial emission control beyond the automotive sector, including power plants and chemical manufacturing, opens new markets for catalyst applications. Advances in nanotechnology and material science offer opportunities to create more efficient and cost-effective catalysts with enhanced lifespan and lower precious metal content. Growing investments in catalyst recycling and recovery technologies present another avenue to reduce raw material costs and promote sustainability. Furthermore, expanding urbanization and increasing air pollution concerns in developing countries create demand for retrofit solutions in older vehicles, allowing market players to tap into a vast, underserved segment. These opportunities collectively support innovation and expansion in the emission control catalyst market.

CHALLENGES: Integrating new emission control technologies with existing vehicle systems can be complex and costly for manufacturers

Developing catalysts that can efficiently handle a wide range of fuels and engine types while maintaining durability under extreme conditions remains a significant technical hurdle. Ensuring consistent performance over the catalyst’s lifespan requires continuous innovation and rigorous testing. Supply chain disruptions for precious metals and other raw materials pose challenges in maintaining steady production and meeting demand. Additionally, integrating new emission control technologies with existing vehicle systems can be complex and costly for manufacturers. Regulatory landscapes are constantly evolving, requiring companies to stay agile and compliant with varying standards across different countries. Another challenge is raising awareness and encouraging adoption of emission control technologies in regions where enforcement of environmental regulations is weak. These challenges require coordinated efforts in research, manufacturing, and policy to sustain growth and effectiveness in the emission control catalyst market.

Global Emission Control Catalyst Market Ecosystem Analysis

The global emission control catalyst market ecosystem includes raw material suppliers providing precious metals like platinum and palladium, catalyst manufacturers producing various types such as TWC and SCR catalysts, and automotive OEMs integrating these into vehicles. Industrial users and aftermarket suppliers also play key roles. Regulatory bodies set emission standards that drive demand, while recycling firms recover valuable metals from spent catalysts. Together, these stakeholders create a collaborative network focused on innovation, sustainability, and reducing harmful emissions worldwide.

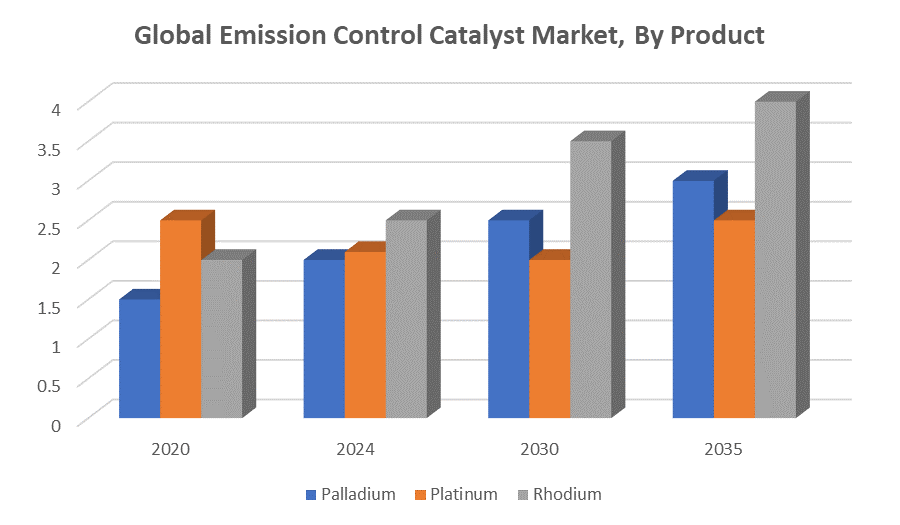

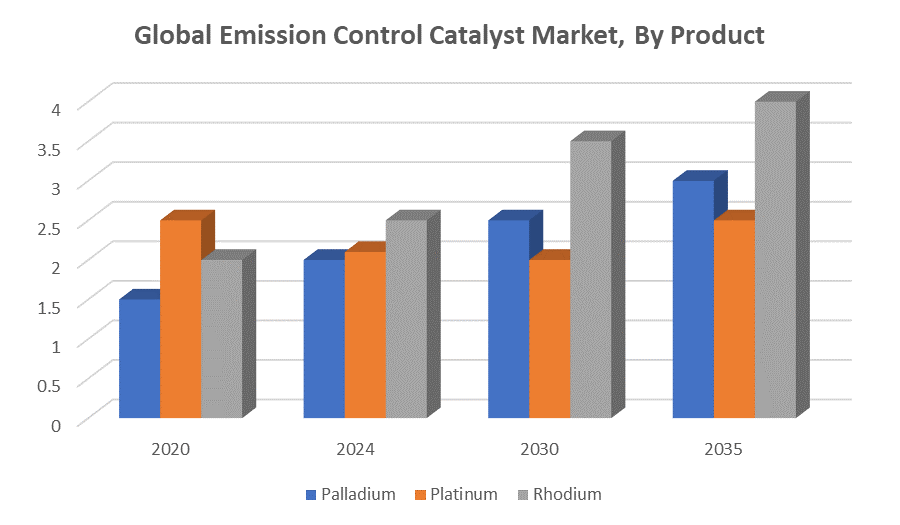

Based on the product, the rhodium is expected to register significant growth over the forecast period

Global Emission Control Catalyst Market, By Product

Rhodium is expected to register significant growth over the forecast period. This is due to its critical role as a key catalyst component in reducing nitrogen oxide (NOx) emissions, especially in three-way catalysts used in gasoline engines. Rhodium’s exceptional ability to convert harmful NOx gases into nitrogen and oxygen makes it indispensable for meeting stringent emission standards globally. Additionally, increasing regulatory pressure on vehicle emissions and rising demand for cleaner technologies are driving higher consumption of rhodium in emission control catalysts, supporting its robust market growth.

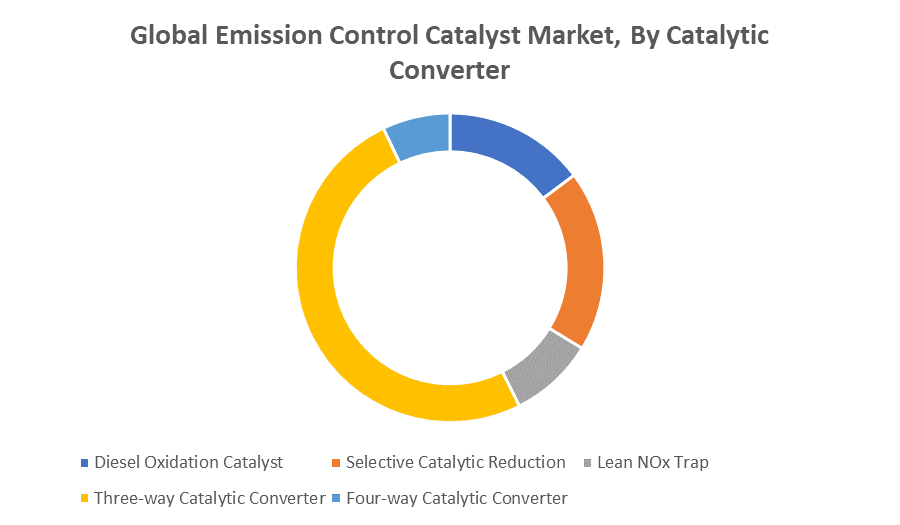

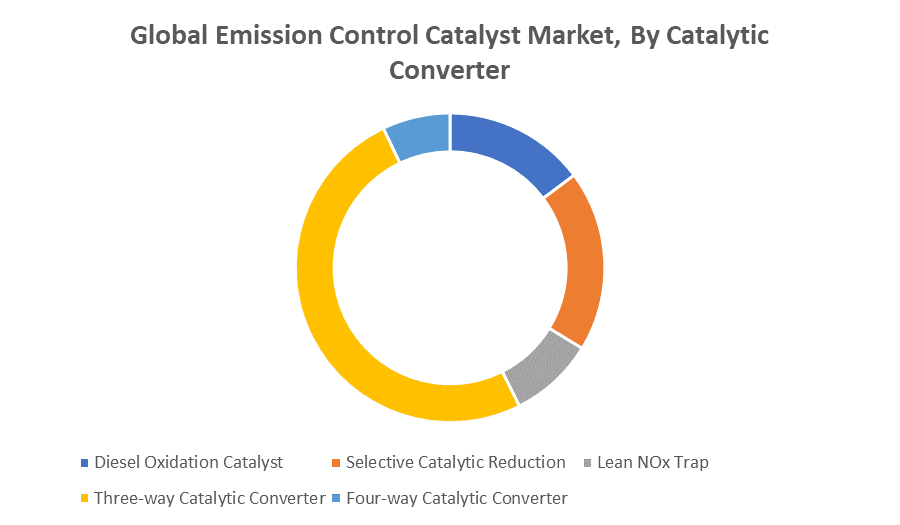

Based on the catalytic converter, the three-way catalytic converter (TWC) led the market with the largest share during the forecast period

TWCs are mainly used in gasoline vehicles because they reduce three harmful gases carbon monoxide, nitrogen oxides, and hydrocarbons at the same time. They help cars meet strict pollution rules while keeping the engine running well. Since many cars around the world use gasoline engines and emission rules are getting tougher, TWCs are the most popular and widely used type of catalytic converter in the market.

Asia Pacific is anticipated to hold the largest market share of the emission control catalyst market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the emission control catalyst market during the forecast period. This is due to the region’s rapid industrialization, growing automotive production, and increasing vehicle sales. Countries like China, India, and Japan are implementing stricter emission regulations to combat air pollution, which drives demand for advanced emission control catalysts. Additionally, rising awareness about environmental sustainability and government initiatives supporting cleaner technologies further contribute to the region’s market dominance in the emission control catalyst industry.

North America is expected to grow at the fastest CAGR in the emission control catalyst market during the forecast period

North America is expected to grow at the fastest CAGR in the emission control catalyst market during the forecast period. This rapid growth is driven by stringent emission regulations, increasing adoption of advanced vehicle technologies, and growing investments in research and development. Additionally, the region’s focus on reducing industrial emissions and rising demand for cleaner and more efficient vehicles contribute to the accelerating market expansion. Strong government support for environmental initiatives further boosts the adoption of emission control catalysts in North America.

Recent Development

- In December 2024, Clariant launched its EnviCat N2O-S catalyst at Sichuan Lutianhua’s nitric acid facility, aiming to reduce greenhouse gas emissions by approximately 275 kilotons of CO2 equivalent per year.

Key Market Players

KEY PLAYERS IN THE EMISSION CONTROL CATALYST MARKET INCLUDE

- Johnson Matthey plc

- BASF SE

- Umicore

- Clariant AG

- Honeywell International Inc.

- Cataler Corporation

- Tenneco Inc.

- NGK Insulators, Ltd.

- BASF Catalysts LLC

- Haldor Topsoe A/S

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the emission control catalyst market based on the below-mentioned segments:

Global Emission Control Catalyst Market, By Product

- Palladium

- Platinum

- Rhodium

Global Emission Control Catalyst Market, By Catalytic Converter

- Diesel Oxidation Catalyst

- Selective Catalytic Reduction

- Lean NOx Trap

- Three-way Catalytic Converter

- Four-way Catalytic Converter

Global Emission Control Catalyst Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa