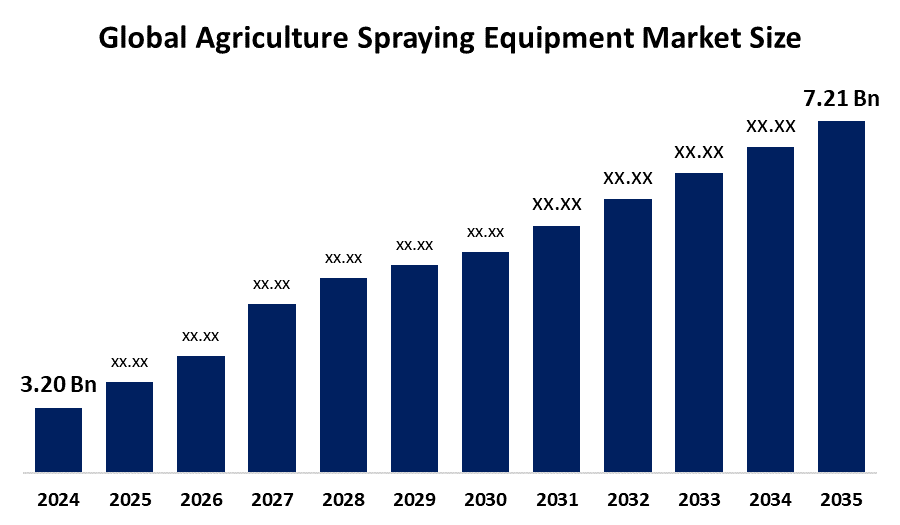

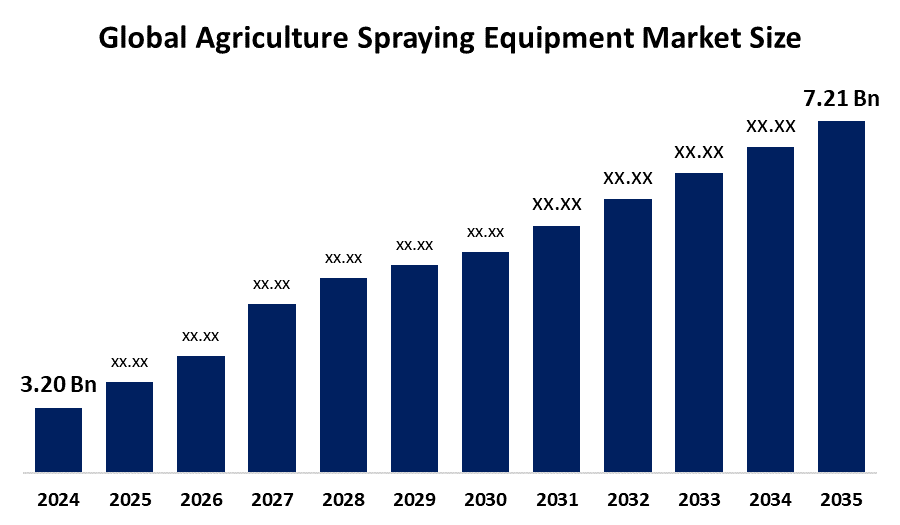

Global Agriculture Spraying Equipment Market Insights Forecasts to 2035

- The Global Agriculture Spraying Equipment Market Size Was Estimated at USD 3.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.66% from 2025 to 2035

- The Worldwide Agriculture Spraying Equipment Market Size is Expected to Reach USD 7.21 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Agriculture Spraying Equipment Market

The Global Agriculture Spraying Equipment Market Size encompasses the manufacturing and supply of machinery designed to apply pesticides, herbicides, fertilizers, and other chemicals to crops efficiently. These spraying devices play a crucial role in modern farming by ensuring uniform distribution of agricultural inputs, which helps protect crops from pests and diseases while promoting healthy growth. The equipment ranges from simple handheld sprayers to sophisticated tractor-mounted and aerial spraying systems, including emerging technologies like drone sprayers. Agriculture spraying equipment enhances productivity by reducing manual labor and improving the accuracy of chemical application. The market serves a wide variety of farming operations, from small-scale farms to large commercial agricultural enterprises. With ongoing innovation, these systems are becoming more precise, automated, and user-friendly, supporting sustainable agricultural practices. Overall, the market is integral to the agricultural industry’s efforts to maintain crop health and maximize yields in an efficient and effective manner.

Attractive Opportunities in the Agriculture Spraying Equipment Market

- The integration of IoT sensors and AI algorithms allows farmers to monitor crop health in real-time and automate spraying schedules. This leads to more precise chemical application, reducing waste and environmental harm. Smart spraying also enhances efficiency, lowers input costs, and supports sustainable practices. As demand for precision agriculture grows, this represents a high-impact market opportunity.

- Developing regions in Asia, Africa, and Latin America are increasingly adopting agricultural mechanization. Medium-sized farms, in particular, are investing in spraying equipment to boost productivity and reduce labor dependency. This segment balances affordability with efficiency, making it ideal for targeted solutions. Expanding in these areas offers strong growth potential for manufacturers.

Global Agriculture Spraying Equipment Market Dynamics

DRIVER: Technological advancements

The growth of the global agriculture spraying equipment market is primarily driven by the increasing need for enhanced crop protection and improved agricultural productivity. As the global population rises, there is greater demand for food, pushing farmers to adopt advanced spraying technologies that ensure efficient and precise application of pesticides, herbicides, and fertilizers. Technological advancements, such as GPS-guided and drone-based spraying systems, enable targeted treatment, reducing chemical waste and environmental impact. Additionally, mechanization in agriculture reduces dependency on manual labor, addressing labor shortages and cutting operational costs. Growing awareness about sustainable farming practices encourages the use of modern spraying equipment to minimize chemical overuse and soil degradation. Government initiatives promoting modern agricultural tools and subsidies also support market expansion. These factors collectively contribute to the steady growth of the agriculture spraying equipment market, as farmers increasingly invest in innovative solutions to optimize crop yield and maintain plant health effectively.

RESTRAINT: Environmental concerns related to the overuse of chemical pesticides and herbicides

High initial costs and maintenance expenses of advanced spraying machinery can be a significant barrier, especially for small-scale and resource-limited farmers. Additionally, the lack of awareness and technical expertise in using sophisticated equipment limits adoption in many developing regions. Environmental concerns related to the overuse of chemical pesticides and herbicides also impact market growth, as stricter regulations are being implemented globally to control chemical residues and protect ecosystems. Moreover, the complexity of equipment operation and the need for regular calibration and maintenance can deter farmers from investing in these technologies. In some areas, inconsistent electricity supply and poor infrastructure reduce the effectiveness and accessibility of mechanized spraying solutions. Finally, the availability of cheaper manual alternatives continues to slow the shift toward mechanized spraying, restraining the market’s overall expansion despite its technological advantages.

OPPORTUNITY: Integration of smart farming technologies

One key opportunity lies in the integration of smart farming technologies, such as Internet of Things (IoT) sensors and artificial intelligence (AI), which can optimize spraying schedules and chemical usage based on real-time crop health data. Expansion into untapped rural and developing regions presents another promising avenue, as many farmers there are beginning to adopt mechanized solutions. Additionally, the growing trend toward organic and precision agriculture creates opportunities for developing specialized spraying equipment that applies bio-pesticides and organic fertilizers more efficiently. Innovations in drone and robotic spraying technologies offer the chance to reduce human exposure to chemicals while improving accuracy and speed. Collaborations between equipment manufacturers and agricultural technology firms can also foster product innovation and customization for diverse crop types and terrains. These emerging opportunities allow the market to evolve and diversify, catering to new farming needs and sustainability goals.

CHALLENGES: Climate variability and unpredictable weather patterns can affect spraying schedules

Integration of new technologies like drones and AI also raises concerns about data privacy and cybersecurity. Additionally, climate variability and unpredictable weather patterns can affect spraying schedules, reducing equipment utilization efficiency. Supply chain disruptions, such as shortages of critical components or raw materials, can delay production and increase costs. Lastly, regulatory complexities around chemical use and machinery standards vary widely between countries, making global market penetration and compliance more difficult for manufacturers. These challenges require strategic management to sustain growth and innovation in the sector.

Global Agriculture Spraying Equipment Market Ecosystem Analysis

The global agriculture spraying equipment market ecosystem includes manufacturers who produce various spraying systems, supported by technology providers offering innovations like GPS and AI. Distributors connect these products to farmers and agribusinesses, the primary end-users applying chemicals for crop protection. Service providers ensure equipment maintenance and training, while regulatory bodies set policies and standards. Research institutions contribute through technology development and farmer education. Together, these stakeholders drive the market by fostering innovation, efficient distribution, and effective use of spraying equipment worldwide.

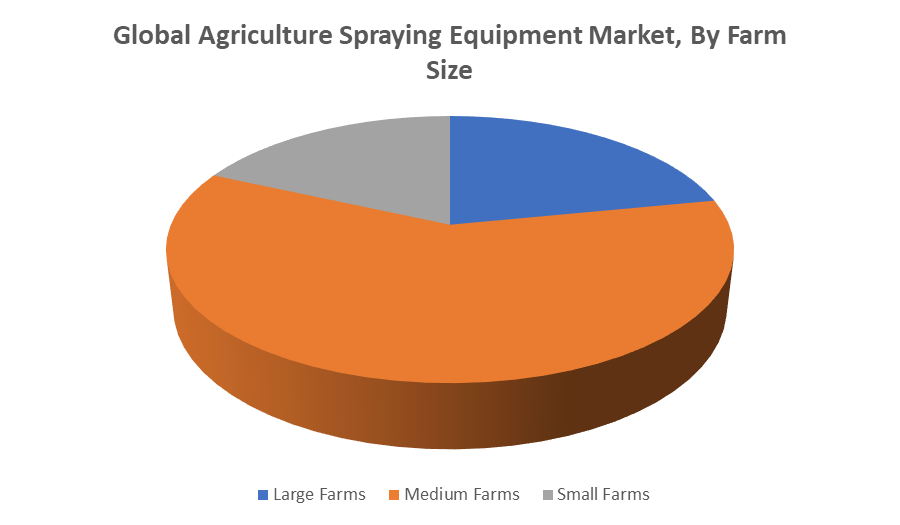

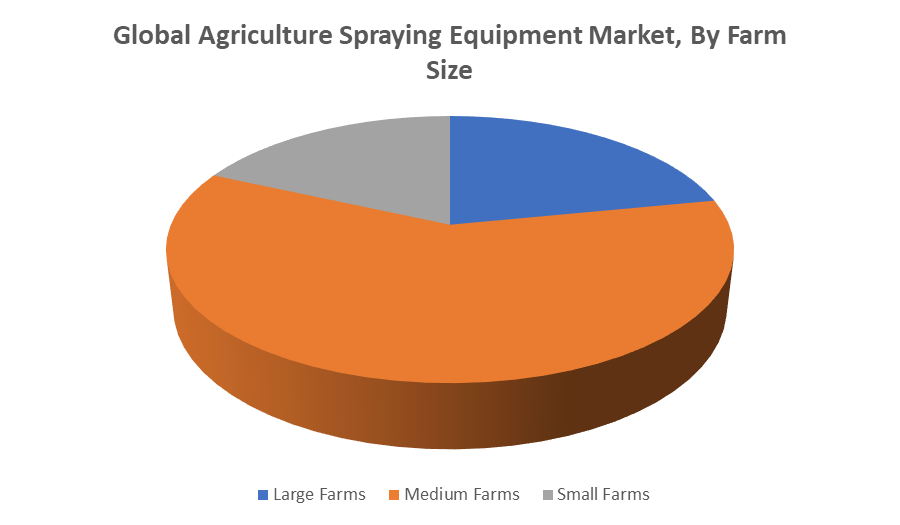

Based on the farm size, the medium farms segment held the major revenue share over the forecast period

The medium farms segment held the major revenue share over the forecast period. This is because medium-sized farms typically have sufficient resources to invest in advanced spraying equipment, balancing affordability and efficiency. They benefit from mechanization to increase productivity and reduce labor costs without the scale complexities of large farms. Medium farms often seek technology that optimizes input use while maintaining manageable operational costs, driving strong demand for spraying equipment tailored to their specific needs.

Based on the type, the self-propelled segment held the leading revenue share during the forecast period

Self-propelled sprayers offer greater efficiency, higher spraying speed, and better maneuverability compared to other types, making them ideal for large and medium-sized farms. Their advanced technology allows precise application of chemicals, reducing waste and improving crop protection. These advantages, combined with growing demand for automation and time-saving equipment in agriculture, have driven the strong market preference and revenue dominance of self-propelled spraying equipment.

Asia Pacific is anticipated to hold the largest market share of the agriculture spraying equipment market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the agriculture spraying equipment market during the forecast period. This is due to the region's vast agricultural land, growing population, and increasing demand for food production. Rapid modernization of farming practices, government support for agricultural mechanization, and rising adoption of advanced spraying technologies in countries like China, India, and Southeast Asian nations contribute significantly to market growth. Additionally, the region’s diverse crop patterns and the need for efficient pest and nutrient management further drive the demand for spraying equipment.

North America is expected to grow at the fastest CAGR in the agriculture spraying equipment market during the forecast period

North America is expected to grow at the fastest CAGR in the agriculture spraying equipment market during the forecast period. This rapid growth is driven by the increasing adoption of precision agriculture technologies and government support for modern farming practices. The region’s focus on sustainable and efficient crop protection solutions further boosts demand. Additionally, advancements such as GPS-guided sprayers and drone-based applications improve the accuracy and efficiency of spraying operations, contributing significantly to the market expansion in North America.

Recent Development

- In May 2024, Stara launched its SMART SPRAY system within its Imperador 4000 Eco Spray model in Latin America, integrating Bosch cameras and Xarvio Digital Farming Solutions to enable selective herbicide application, and support night spraying via LED lighting.

Key Market Players

KEY PLAYERS IN THE AGRICULTURE SPRAYING EQUIPMENT MARKET INCLUDE

- John Deere

- AGCO Corporation

- CNH Industrial (New Holland & Case IH)

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Yamaha Motor Co., Ltd.

- Amazonen-Werke

- Buhler Industries Inc. (Versatile)

- Stara S.A.

- GUSS Automation

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the agriculture spraying equipment market based on the below-mentioned segments:

Global Agriculture Spraying Equipment Market, By Farm Size

- Large Farms

- Medium Farms

- Small Farms

Global Agriculture Spraying Equipment Market, By Type

- Self-propelled

- Tractor-mounted

Global Agriculture Spraying Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa