Top 15 Global Companies in Carbon Black Market 2025: Strategic Overview & Future Trends (2024–2035)

RELEASE DATE: Oct 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

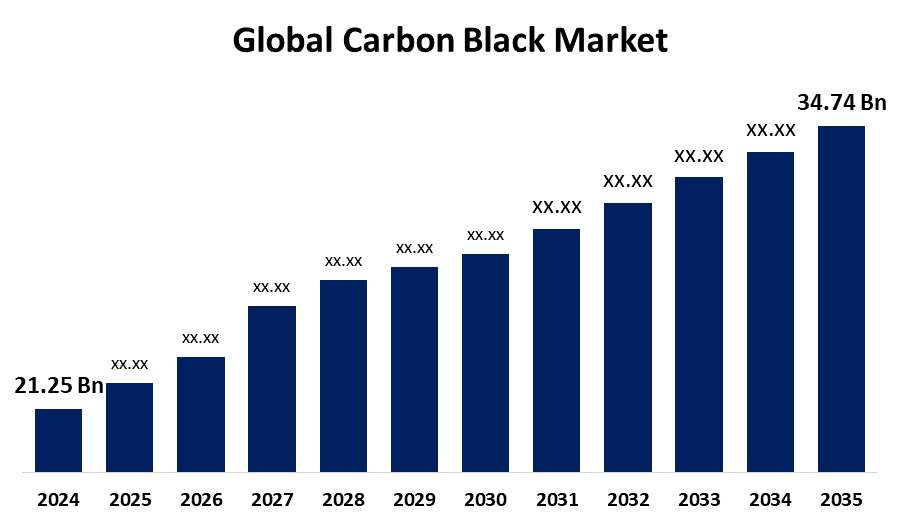

According to a research report published by Spherical Insights & Consulting, The Global Carbon Black Market Size is projected to Grow from USD 21.25 Billion in 2024 to USD 34.74 Billion by 2035, at a CAGR of 4.57% during the forecast period 2025–2035. The market is experiencing significant growth due to some factors, including the growing use of products in the tyre and plastics industries, the rise in construction activities worldwide, the introduction of intelligent manufacturing techniques, and stringent government-imposed environmental regulations.

Introduction

Carbon Black, a form of paracrystalline carbon that contains 95% pure carbon, improves the material's mechanical and physical qualities and boosts the final product's effectiveness. Tires, plastics, mechanical rubber products, printing inks, and toners are the main industries that use carbon black. Its primary use is in wire and cable insulation because of its capacity to absorb UV light and transform it into heat. Additionally, a range of rubber products and colours is made with it. It works well as an inexpensive rubber-strengthening compound in tyres. It is widely used in printing inks, resin colouring, paints, and toners because of its black pigment, which makes it a special colouring agent. The global market for carbon black has grown as a result of the automotive industry's heavy reliance on tyres. It is essential to the production of rubber because of its reinforcing qualities, which improve performance and longevity. Further supporting market expansion is the growing use of carbon black in industrial applications, such as inks, coatings, and plastics. The carbon black market share is also impacted by modifications in production technologies and the steadily rising demand for premium goods, such as recovered carbon black.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Carbon Black Market.

Carbon Black Market Size & Statistics

- The Market Size for Carbon Black Was Estimated to be worth USD 21.25 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 4.57% between 2025 and 2035.

- The Global Carbon Black Market Size is anticipated to reach USD 34.74 Billion by 2035.

- Asia Pacific is anticipated to generate the highest demand during the forecast period in The Carbon Black Market.

- North America is expected to grow the fastest during the forecast period in The Carbon Black Market.

Regional growth and demand

North America is projected to grow at the fastest CAGR during the forecast period in the carbon black market. North America's growing construction and automotive industries are anticipated to contribute to the region's notable growth in the carbon black market over the forecast period. The requirement for carbon black in tyre manufacturing, coatings, and plastics applications has increased due to the region's strong emphasis on high-performance and sustainable materials. This growth is also supported by an increase in infrastructure development projects and the automotive industry's increasing demand for lightweight materials. The carbon black market in North America is also being supported by favourable government regulations and higher R&D expenditures.

Asia Pacific is estimated to generate the highest demand during the forecast period in the carbon black market. Asia Pacific's robust industrial base, especially in the production of plastics, rubber, and automobiles, allowed it to dominate the market in 2024. The demand for carbon black was also increased by the region's packaging and electronics industries' explosive growth. The market's expansion has also been aided by the existence of top carbon black producers and an inexpensive production environment. In addition, the region's emphasis on infrastructure development and growing urbanisation has increased demand for carbon black in building materials and construction. Together, these elements strengthen the Asia Pacific's dominant position in the market.

Top 10 trends in the Carbon Black Market

- Automotive Sector Drives Demand

- Rise of Speciality Grades

- Sustainability & Green Carbon Black

- Furnace Black Dominance

- Expansion in Plastics & Inks

- Strategic Partnerships & M&A

- Digitalization & Process Optimization

- Infrastructure & Construction Boost

- Robust Market Growth

- Novel Market Leadership

1. Automotive Sector Drives Demand

The production of tyres continues to be the most common use, contributing more than 60% of the world's carbon black consumption.

2. Rise of Speciality Grades

The fastest-growing industries in speciality carbon blacks used in EV batteries, conductive polymers, and high-performance coatings boost the market growth.

3. Sustainability & Green Carbon Black

Businesses are making investments in environmentally friendly production techniques, such as using bio-based feedstocks and recovering carbon black (rCB) from tyres that have reached the end of their useful lives.

4. Furnace Black Dominance

Furnace black is still in the lead with about 62% of the market, owing to its affordability and adaptability.

5. Expansion in Plastics & Inks

Non-tire applications such as coatings, inks, and plastics are steadily expanding, particularly in electronics and packaging.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the carbon black market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Carbon Black Market

- Orion Engineered Carbons GmbH

- Omsk Carbon Group

- Tokai Carbon Co., Ltd.

- ASAHI CARBON CO., LTD.

- Atlas Organics Private Limited.

- Continental Carbon Company.

- OCI Ltd.

- Mitsubishi Chemical Group Corporation.

- Bridgestone Corporation

- Cabot Corporation.

- Longxing Chemical Stock Co., Ltd

- BASF

- Nippon Steel & Sumikin Chemical Co., Ltd.

- Jiangxi Black Cat Carbon Black Inc.

- Birla Carbon

1. Orion Engineered Carbons GmbH

Headquarters: Senningerberg, Luxembourg

A major supplier of carbon black and speciality carbon products worldwide is Orion Engineered Carbons GmbH, a division of Orion S.A. (NYSE: OEC). The company has been in business for more than 160 years, and it has 14 production facilities and innovation centres spread across three continents. For a wide range of applications, such as tyres, coatings, inks, batteries, plastics, and other high-performance industrial uses. Orion manufactures carbon black in powder and pellet form according to customer specifications.

2. Omsk Carbon Group

Headquarters: Omsk, Russia

The top producer of carbon black in Russia and the CIS, Omsk Carbon Group, is among the top ten producers worldwide. With a combined production capacity of over 500,000 metric tons annually and the potential to reach 620,000 metric tons as further investments expand the Mogilev facility, the company operates three production sites: Omsk and Volgograd in Russia and Mogilev in Belarus. The company support door-to-door logistics and personalised customer solutions. Omsk Carbon Group maintains ISO 9001:2015 certifications and oversees a network of sales and distribution centres in Europe, Turkey, North America, and Asia.

3. Tokai Carbon Co., Ltd.

Headquarters: Tokyo, Japan

Tokai Carbon's latest investments are concentrated on cutting-edge environmental machinery, which lowers sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions at its U.S. facility while increasing production efficiency and producing electricity from waste heat. The business has a track record of developing innovative process technology, quality enhancement techniques, and environmentally friendly production methods. Tokai Carbon's capacity and market positioning in Southeast Asia were further enhanced in 2024 when it purchased Bridgestone's Thai carbon black company. Tokai Carbon is distinguished by its robust support for the global industrial and mobility sectors, as well as its product quality and operational stability.

4. ASAHI CARBON CO., LTD.

Headquarters: Niigata, Japan

Asahi Carbon's dedication to quality control, safety, occupational health, and sustainability is demonstrated by its ISO9001, ISO14001, ISO45001, and ISCC PLUS certifications. The company reported yearly sales of more than 22.5 billion yen in 2024. In addition to supporting Japan's tyre and rubber industries by investing in technology and patented products. Asahi Carbon is a dependable supplier in the cutthroat global carbon black market, known for its high-quality products, innovative processes, and environmental compliance.

5. Atlas Organics Private Limited

Headquarters: Ahmedabad, Gujarat, India

A prominent producer and distributor of carbon black and associated goods like carbon compounds and organic wax, Atlas Organics Private Limited was founded in 1987. The company's plant can process about 1,800 metric tons of carbon black per month. Its products are mostly used as reinforcing agents in rubber compounding for the tyre industry. Their products are also widely used as pigments in paints, coatings, inks, plastic masterbatches, and toner for laser printers and photocopiers. The Government of India has granted Atlas Organics "Refinery Status," demonstrating its adherence to rules and industry standards.

Are you ready to discover more about the Carbon Black market?

The report provides an in-depth analysis of the leading companies operating in the global carbon black market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Orion Engineered Carbons GmbH

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Omsk Carbon Group

- Tokai Carbon Co., Ltd.

- ASAHI CARBON CO., LTD.

- Atlas Organics Private Limited.

- Continental Carbon Company.

- OCI Ltd.

- Mitsubishi Chemical Group Corporation.

- Bridgestone Corporation

- Cabot Corporation.

- Longxing Chemical Stock Co., Ltd

- BASF

- Nippon Steel & Sumikin Chemical Co., Ltd.

- Jiangxi Black Cat Carbon Black Inc.

- Birla Carbon

- Others.

Conclusion

The Global Carbon Black Market Size is expected to expand from USD 21.25 Billion in 2024 to USD 34.74 Billion by 2035, showing a CAGR of 4.57%. The growth is fueled by the robust demand from the automotive industry, increasing construction projects, and the emergence of innovative uses in the plastics and inks sectors. Upcoming trends show a clear shift toward specialisation and sustainability. The increase in speciality grades for high-performance uses such as EV batteries and conductive polymers, along with the industry's move towards Sustainability & Green Carbon Black (utilising bio-based feedstocks and recovered carbon black will transform the market environment. Although Asia Pacific continues to be the largest market, North America is anticipated to grow the quickest, supported by infrastructure initiatives and the need for high-performance, sustainable materials.

Browse Related Reports

Global AI Laptop Market Size To Exceed USD 28,399.5 Million by 2035 | CAGR of 17.77% : Industry Report

Global Crigler Najjar Syndrome Market Size To Exceed USD 2.36 Billion by 2035 | CAGR of 7.73% : Market Study Report

Global Generative AI In Agriculture Market Size To Exceed USD 3601.4 Million by 2035 | CAGR of 28.63% : Market Study Report

Global Multi-access Edge Computing Market Size To Exceed USD 369.36 Billion by 2035 | CAGR of 47.42% : Market Study Report

Global Spina Bifida Market Size To Exceed USD 3.43 Billion by 2035 | CAGR of 5.32% : Market Study Report

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?