Global Zinc Ingots Market Size, Share, and COVID-19 Impact Analysis, By Grade (Zn> 98.7%, Zn> 99.5%, Zn> 99.99%, and Others), By End-Use (Electroplate, Galvanized Steel, Alloy, Zinc Oxide, Battery, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Zinc Ingots Market Insights Forecasts to 2035

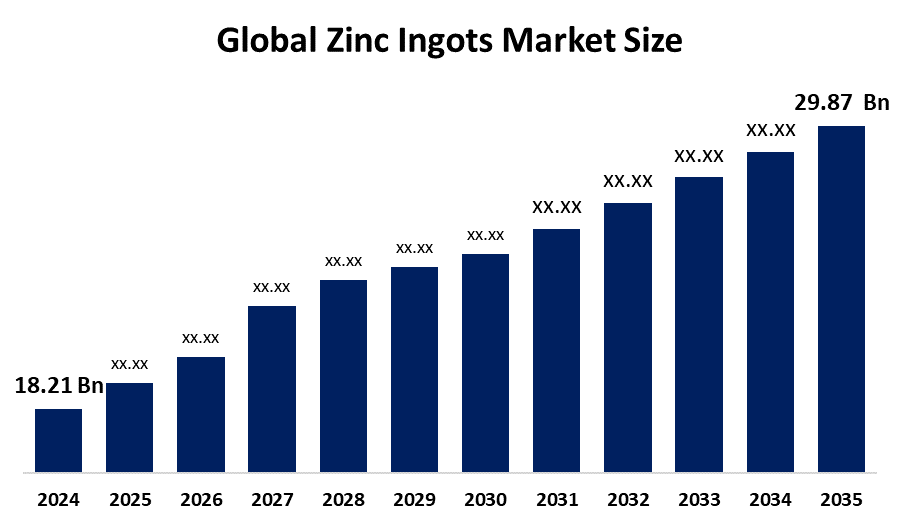

- The Global Zinc Ingots Market Size Was Estimated at USD 18.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.6% from 2025 to 2035

- The Worldwide Zinc Ingots Market Size is Expected to Reach USD 29.87 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Zinc Ingots Market Size Was Worth Around USD 18.21 Billion In 2024 And Is Predicted To Grow To Around USD 29.87 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.6% From 2025 To 2035. Market demand for galvanized steel used in infrastructure projects, construction activities, and automotive production, particularly for electric vehicles, drives the global zinc ingots market expansion. The industry expands because companies focus on producing anti-corrosion materials that meet sustainability standards and use solar panel structures as renewable energy sources.

Market Overview

The global zinc ingots market refers to the production and international distribution of refined zinc, which manufacturers produce in solid ingot form because it serves as the main raw material for various industrial uses. Zinc ingots serve multiple purposes in various industries because they protect steel from corrosion through galvanisation, and they function in die casting, brass production, alloy creation, chemical processing and battery manufacturing. The market experiences growth because the construction and automotive sectors need galvanised steel and zinc-based materials that provide strength and lightweight properties. The demand for products used in infrastructure development and urbanisation, and corrosion-resistant materials, continues to rise because of these three factors.

In April 2025, zinc producer Nexa Resources is set to receive 200 million Brazilian reais ($38.47 million) from Brazil’s development bank BNDES to implement decarbonization practices. The Luxembourg-based company, operating in Brazil and Peru, said strong demand from Europe and Asia is driving interest in reducing carbon emissions across the zinc value chain. The market presents new opportunities that arise from the increasing development of renewable energy projects and electric vehicle technology, and the improvements made in zinc recycling and sustainable production methods. The industrial growth happening in developing economies creates essential business opportunities in those markets. The global zinc ingots market has key participants who include Nyrstar, Hindustan Zinc Ltd., Glencore, Teck Resources, Korea Zinc, Boliden Group, and China Minmetals, which compete through their production capacity, product quality and their ability to deliver products consistently to customers.

Report Coverage

This research report categorizes the zinc ingots market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the zinc ingots market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the zinc ingots market.

Global Zinc Ingots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 29.87 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Grade, By End-Use and By Region |

| Companies covered:: | Nyrstar NV, Hindustan Zinc Ltd., Korea Zinc Co., Ltd., Glencore plc, Teck Resources Limited, Trafigura Pte Ltd., Boliden AB, Sumitomo Corporation, Advameg Inc., Siyaram Impex Pvt. Ltd., China Minmetals Corporation, Zinc Nacional S.A. de C.V., Phoenix Industries Ltd., Industrial Metal Supply Company, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The global zinc ingots market exists because the infrastructure industry, construction industry and automotive industry demand galvanization, which provides corrosion protection. The consumption of zinc ingots increases because people in developing countries, especially in China and India). The electric vehicle (EV) industry drives more demand for zinc-based alloys and die-cast components, which are used in EV production. The market advances through two factors, which include increased solar and wind project spending that depends on galvanized steel and the rising demand for sustainable materials and the development of stronger zinc alloys.

Restraining Factors

The global zinc ingots market faces three important constraints, which include high raw material and energy price fluctuations and environmental regulations that increase production expenses and supply chain problems caused by restricted concentrate availability. Health dangers from zinc oxide fumes and the availability of substitute products and trade restrictions all contribute to limitations on market expansion.

Market Segmentation

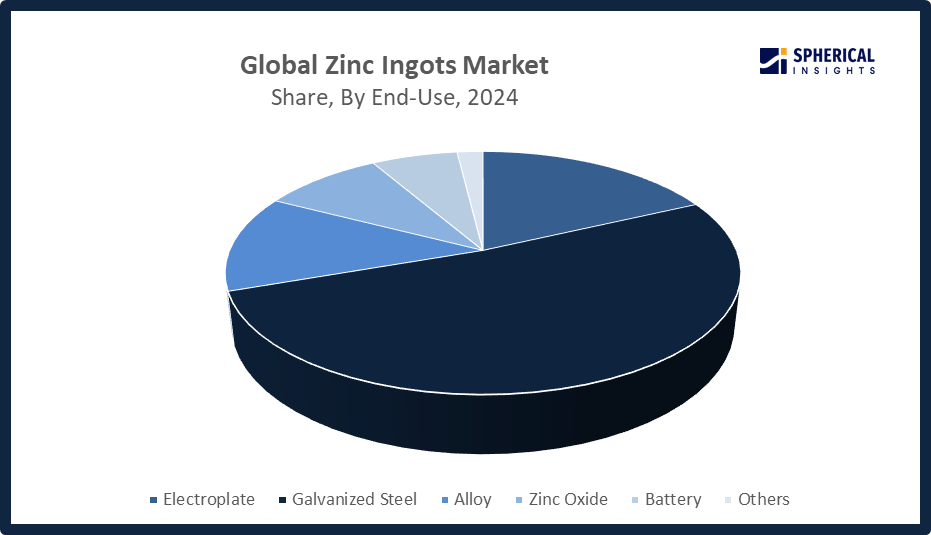

The zinc ingots market share is classified into grade and end-use.

- The Zn> 99.99% segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the zinc ingots market is divided into Zn> 98.7%, Zn> 99.5%, Zn> 99.99%, and others. Among these, the Zn> 99.99% segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The Zn>99.99% segment dominated market growth because of its ultra-high purity, which meets requirements for specialized applications in electronics and battery production and high-performance alloy manufacturing. The global zinc ingots market experiences its fastest growth through this segment, which delivers high-quality zinc products that the industrial and technological sectors depend on.

- The galvanized steel segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the zinc ingots market is divided into electroplate, galvanized steel, alloy, zinc oxide, battery, and others. Among these, the galvanized steel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction and automotive industries created demand for galvanized steel, which resulted in the highest market growth for that steel segment. Zinc ingots serve as the primary material for protecting against corrosion, which helps steel to achieve greater durability and extended operational lifespan. The global market for galvanized steel applications has experienced substantial growth because of increasing infrastructure development and urbanization, and the demand for materials that can withstand extreme weather conditions.

Get more details on this report -

Regional Segment Analysis of the Zinc Ingots Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the zinc ingots market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the zinc ingots market over the predicted timeframe. The Asia Pacific region will 60% share of the zinc ingots market due to its fast industrial growth and urban development, and the high demand from its construction and automotive industries. China leads the region as the world’s top producer and consumer of zinc because of its infrastructure development and manufacturing requirements, while India grows through its increasing demand for galvanized steel and battery products. The renewable energy and electrical equipment investments in Japan and South Korea drive industrial expansion. South Korea’s Supreme Court issued an order in February 2025 that required Young Poong to halt operations at its Seokpo smelter for 58 days because of its unauthorized discharge of wastewater. The smelter achieved a production volume of approximately 290000 metric tons of zinc ingots during 2024, which operated at an annual capacity of 400000 metric tons.

North America is expected to grow at a rapid CAGR in the zinc ingots market during the forecast period. The zinc ingots market in North America will experience a 25% share of fast growth because governments support domestic production and processing activities. The United States leads the market because it receives subsidies from the Inflation Reduction Act and invests in infrastructure and renewable energy projects. The construction and automotive industries require more galvanized steel, which drives growth in Canada and Mexico as they try to decrease their need for imported materials. In December 2025, Tennessee Governor Bill Lee and Korea Zinc made a $6.6 billion investment announcement for Clarksville and Gordonsville, which will create 740 jobs in Montgomery and Smith counties through their first U.S. facilities.

The demand for galvanized steel, batteries and sustainable manufacturing methods is driving growth in Europe's zinc ingots market. Germany leads the market through its strong automotive and industrial sectors, while France and Italy support infrastructure development. The implementation of strict environmental regulations together with recycling programs creates additional opportunities for business growth. The European Union established new Battery and Critical Raw Materials Regulations in June 2025, which will lead to increased zinc recycling and reuse in the new energy sector while supporting a green, low-carbon transformation throughout the zinc industry value chain.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the zinc ingots market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nyrstar NV

- Hindustan Zinc Ltd.

- Korea Zinc Co., Ltd.

- Glencore plc

- Teck Resources Limited

- Trafigura Pte Ltd.

- Boliden AB

- Sumitomo Corporation

- Advameg Inc.

- Siyaram Impex Pvt. Ltd.

- China Minmetals Corporation

- Zinc Nacional S.A. de C.V.

- Phoenix Industries Ltd.

- Industrial Metal Supply Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the zinc ingots market based on the below-mentioned segments:

Global Zinc Ingots Market, By Grade

- Zn> 98.7%

- Zn> 99.5%

- Zn> 99.99%

- Others

Global Zinc Ingots Market, By End-Use

- Electroplate

- Galvanized Steel

- Alloy

- Zinc Oxide

- Battery

- Others

Global Zinc Ingots Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the zinc ingots market over the forecast period?The global zinc ingots market is projected to expand at a CAGR of 4.6% during the forecast period.

-

2. What is the global zinc ingots market?The global zinc ingots market involves the production, trade, and use of refined zinc in solid ingot form for industrial applications.

-

3. What is the market size of the zinc ingots market?The global zinc ingots market size is expected to grow from USD 18.21 billion in 2024 to USD 29.87 billion by 2035, at a CAGR of 4.6% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the zinc ingots market?Asia Pacific is anticipated to hold the largest share of the zinc ingots market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global zinc ingots market?Nyrstar NV, Hindustan Zinc Ltd., Korea Zinc Co., Ltd., Glencore plc, Teck Resources Limited, Trafigura Pte Ltd., Boliden AB, Sumitomo Corporation, Advameg Inc., Siyaram Impex Pvt. Ltd., and Others.

-

6. What factors are driving the growth of the zinc ingots market?The drivers of the zinc ingots market include rising demand for galvanized steel in infrastructure/construction, increased automotive production, growing EV battery manufacturing, and the need for anticorrosive materials.

-

7. What are the market trends in the zinc ingots market?Zinc ingot trends include rising demand for galvanized steel, EV batteries, and solar; supply surpluses are increasing; focus on green, high-purity, and recycling.

-

8. What are the main challenges restricting wider adoption of the zinc ingots market?Key challenges limiting wider zinc ingot adoption include high price volatility, strict environmental regulations on smelting, logistical bottlenecks, and competition from substitute materials, alongside demand pressures from slow construction markets.

Need help to buy this report?