Global Xylan Market Size, Share, and COVID-19 Impact Analysis, By Product (Hardwood Xylan, Cork Xylan, Glucose Aldehyde Acyl Xylan, and Arabinoxylan), By Application (Food and Beverages, Pharmaceuticals, Bakery & Confectionery, Sauces & Dressings, and Ice Creams & Desserts), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Xylan Market Insights Forecasts to 2035

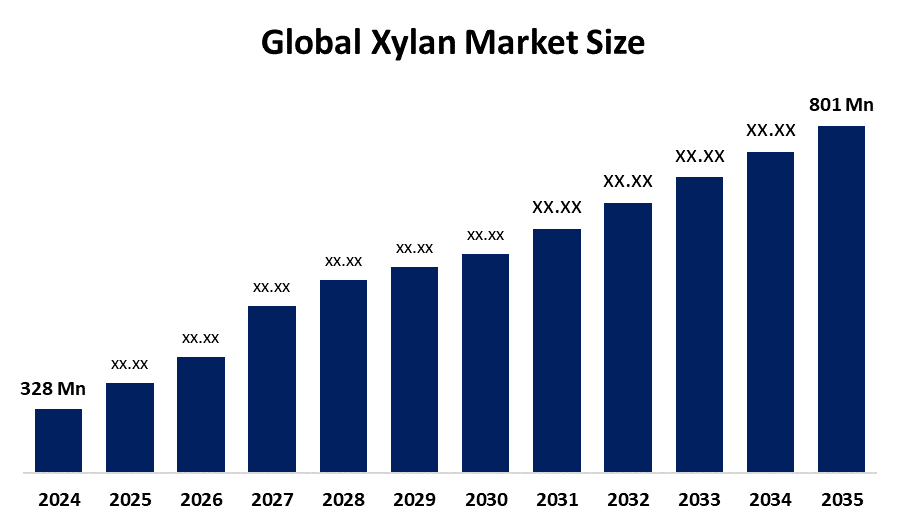

- The Global Xylan Market Size Was Estimated at USD 328 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.46% from 2025 to 2035

- The Worldwide Xylan Market Size is Expected to Reach USD 801 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Xylan market size was worth around USD 328 million in 2024 and is predicted to grow to around USD 801 million by 2035 with a compound annual growth rate (CAGR) of 8.46% from 2025 and 2035. The market for Xylan has a number of opportunities to grow due to a growing market for nutraceuticals and functional foods as individuals look for natural, plant based ingredients that support digestive health and provide prebiotic advantages.

Market Overview

Xylan, a complex polymer that is a component of hemicellulose, is mostly composed of five carbon sugars called β-1,4-linked xylose units. The market for xylan as a prebiotic dietary fiber is expected to rise by more than 35% in 2024 due to rising consumer interest in gut health and immunity. Xylan is being used by the food and beverage industries to improve the nutritional value of supplements, fortified snacks, and health drinks. Adoption in both developed and emerging economies is fueled by its appeal as a functional food ingredient due to its capacity to enhance product texture and promote digestive health. A hydrothermal pretreatment, for instance, produced 21.24% xylo oligosaccharides in the hydrolysate, and further enzymatic hydrolysis increased the proportion of X2-X3 fractions from 38.87% percent to 68.21%, which enhanced probiotic development, according to a study involving bamboo shoots. The pharmaceutical industry is responsible for about 30% of the increase in the xylan market due to its growing use as a stabilizer in formulations and in drug delivery systems. Targeted delivery systems, wound healing materials, and controlled release medications can all benefit from xylan's biocompatibility and film forming qualities. Opportunities for the creation of high value medical grade xylan are being created by the growing investment in biopolymers for medical applications and the study of xylan based nanocarriers. For example, created quercetin conjugated xylan polymer by the carbodiimide reaction, producing nanoparticles as small as 200 nanometers for better transport and P glycoprotein suppression.

The Department of Energy has committed financing in the United States, such as a USD12 million call to expand integrated biorefineries that can use biomass feedstocks to create both biofuels and biochemicals. Such financing supports procedures that may entail hemicellulose extraction. In order to enhance the sustainability and performance of bioenergy crops, DOE has also allocated resources, such as USD 75 million spread over five years.

Report Coverage

This research report categorizes the xylan market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the xylan market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the xylan market.

Global Xylan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 328 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.46% |

| 2035 Value Projection: | USD 801 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Jinan Haohua Industry, Chemos GmbH, Southwestern Plating Company, Soyoung, Biochemical Group, Thomson Biotech, ZhongYun, Xylan Corporation, Richman Chemical, Chemos GmbH, CM Fine Chemicals, Hangzhou J&H, Habio, Afine chemicals limited, And Others players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The xylan market is driven by the market for xylan offers a lot of prospects as sustainability becomes more and more important. The bio based origin of xylan fits in nicely with the sustainability objectives of enterprises looking to lower their carbon footprints. By 2030, the European Union wants to reduce greenhouse gas emissions by 30%, and it has set aggressive goals to increase the usage of bio based products. As producers look for environmentally acceptable alternatives, this regulatory framework may result in a rise in the demand for xylan. Furthermore, the investigation of novel uses, as bioplastics and biofuels, creates new sources of income. The practice of incorporating xylan into these cutting edge applications is becoming more popular in the fields of research and development, underscoring the possibility of market growth.

Restraining Factors

The xylan market is restricted by factors like the lack of raw materials is one important problem that could impact production capacity. Variations in crop yields can disrupt the supply chain, and crop leftovers are a common source of xylan.

Market Segmentation

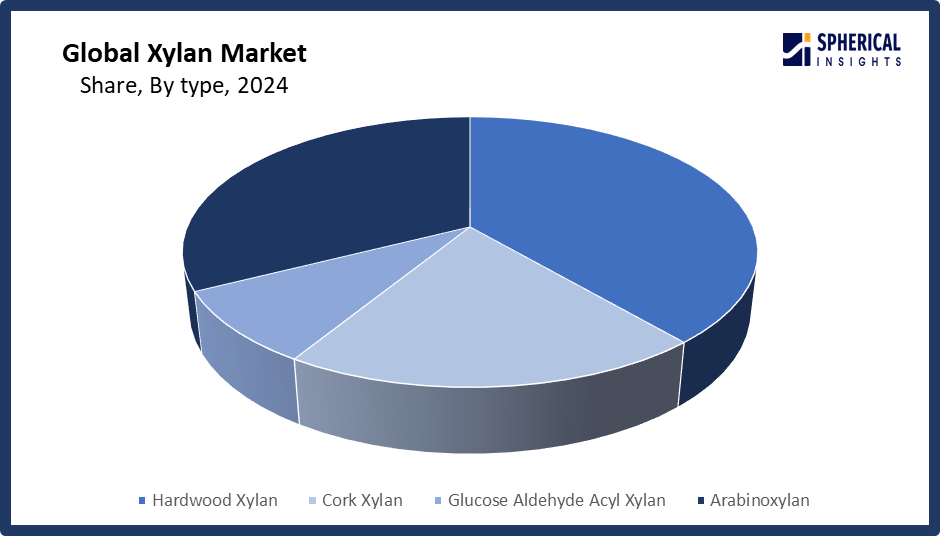

The xylan market share is classified into product and application.

- The hardwood xylan segment dominated the market in 2024, accounting for approximately 39% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the xylan market is divided into hardwood xylan, cork xylan, glucose aldehyde acyl xylan, and arabinoxylan. Among these, the hardwood xylan segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by xylan, which is a hemicellulose found in hardwood, and because of its polymolecularity and polydiversity, it has a variety of applications. The amount of starch in a hardwood varies with the wood species, and depending on the conditions of cultivation and harvest. Therefore, the global xylan market is expected to grow during the forecast period.

Get more details on this report -

- The food and beverages segment accounted for the largest share in 2024, accounting for approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the xylan market is divided into food and beverages, pharmaceuticals, bakery & confectionery, sauces & dressings ice creams and desserts. Among these, the food and beverages segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the xylan is used as an emulsifier and protein foam stabilizer in the food industry. The baking industry also uses xylan to improve grain flour quality. In emerging countries, changing consumer preferences and desires for nutritional product quality and quality and content have created new and lucrative applications of xylan, both in food and pharmaceutical processing. Ongoing research and development to improve industry knowledge of xylan biosynthesis has also helped with this market growth.

Regional Segment Analysis of the Xylan Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 33% of the xylan market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 33% of the xylan market over the predicted timeframe. In the North America market, the is rising due to the rise in xylan use in pharmaceuticals, dietary supplements, and functional foods. With the US being the leading market for xylan usage in baked goods and beverages, demand remains consistent as consumer demand for clean label products and intestinal health rises. Pharmacists utilize xylan in drug delivery systems and controlled release applications. Furthermore, innovative extraction methods, favorable regulations, and increasing research spending to support medical grade and nutraceutical applications assist in xylan demand.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 30% in the xylan market during the forecast period. The Asia Pacific area has a thriving market for xylan due to the growth of dietary supplements, fortifying drinks, and functional foods has also made China, India, and Japan. Health consciousness and an expanding middle class support the demand for packaged foods. Increasingly, xylan is being produced using clean technology from hardwood waste and grain husks, establishing local supplies at lower costs. Regional manufacturers will be developing xylan for drug formulations and wound healing products in response to an increasing number of pharmaceutical applications. This growth is supplemented by government programs that encourage biopolymer commercialization and food safety.

Europe held a 28% market share in 2024 due to a well developed food and beverage industry and stringent regulations that promoted natural and clean label products. Germany, France, and the UK are major customers, and xylan is being utilized more and more in bakeries, dairy alternatives, and confections there. The production of xylan from agricultural waste is encouraged by the region's focus on sustainable sourcing and circular economy initiatives. Xylan's use in medications and cosmetics is expanding due to its biocompatibility. As more environmentally friendly and bio based additives are sought after, industry growth is stimulated by R&D projects and investments in green processing methods, which enhance product quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the xylan market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jinan Haohua Industry

- Chemos GmbH

- Southwestern Plating Company

- Soyoung

- Biochemical Group

- Thomson Biotech

- ZhongYun

- Xylan Corporation

- Richman Chemical

- Chemos GmbH

- CM Fine Chemicals

- Hangzhou J&H

- Habio

- Afine chemicals limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, NOVUS introduced CIBENZA XCEL in India during a three day event in Kovalam, Kerala. This enzyme additive is designed to optimize nutrient utilization in poultry diets. The launch follows NOVUS’s acquisition of BioResource International Inc., expanding its enzyme portfolio with science based technologies tailored for the cost-sensitive poultry sector.

- In March 2024, Novus International, Inc. announced it had completed the acquisition of U.S. based enzyme company, BioResource International, Inc.Opens a new window. Under the terms of the agreement, NOVUS becomes the owner of all BRI’s products and intellectual property and takes control of the company’s facilities.

- In June 2023, Richman Chemical promoted Christopher Kulp to Chief Operating Officer, strengthening its leadership team and aligning operations for future growth.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the xylan market based on the below-mentioned segments:

Global Xylan Market, By Product

- Hardwood Xylan

- Cork Xylan

- Glucose Aldehyde Acyl Xylan

- Arabinoxylan

Global Xylan Market, By Application

- Food and Beverages

- Pharmaceuticals

- Bakery & Confectionery

- Sauces & Dressings

- Ice Creams & Desserts

Global Xylan Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the xylan market over the forecast period?The global xylan market is projected to expand at a CAGR of 8.46% during the forecast period.

-

What is the market size of the xylan market?The global xylan market size is expected to grow from USD 328 million in 2024 to USD 801 million by 2035, at a CAGR of 8.46% during the forecast period 2025-2035.

-

Which region holds the largest share of the xylan market?North America is anticipated to hold the largest share of the xylan market over the predicted timeframe.

-

Who are the top 15 companies operating in the global xylan market?Jinan Haohua Industry, Chemos GmbH, Southwestern Plating Company, Soyoung, Biochemical Group, Thomson Biotech, ZhongYun, Xylan Corporation, Richman Chemical, Chemos GmbH, CM Fine Chemicals, Hangzhou J&H, Habio, Afine chemicals limited, and Others.

-

What factors are driving the growth of the xylan market?The xylan market growth is driven by functional foods and nutraceuticals which are becoming more and more popular as customers look for natural, plant-based ingredients that support digestive health and provide prebiotic advantages. This trend is supported by xylan, a natural fiber that is used in a variety of food and drink products.

-

What are the market trends in the xylan market?The xylan market trends include rising demand for functional Foods, advancements in biotechnology, sustainability trends, biofuel industry growth, and regulatory support.

-

What are the main challenges restricting wider adoption of the xylan market?The xylan market trends include the high production costs arising from complex extraction processes and specialized equipment make xylan-based products less competitive when compared to synthetic alternatives.

Need help to buy this report?