Global Working Dog Market Size, Share, and COVID-19 Impact Analysis, By Type (Guide Dogs (Seeing Eye Dogs), Military Working Dogs (MWD), Police Dogs (K9) and Hunting Dogs), By Breeds (German Shepherd, Belgian Malinois, Dutch Shepherd, Labrador Retriever, Golden Retriever, Bloodhound and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Working Dog Market Insights Forecasts to 2033

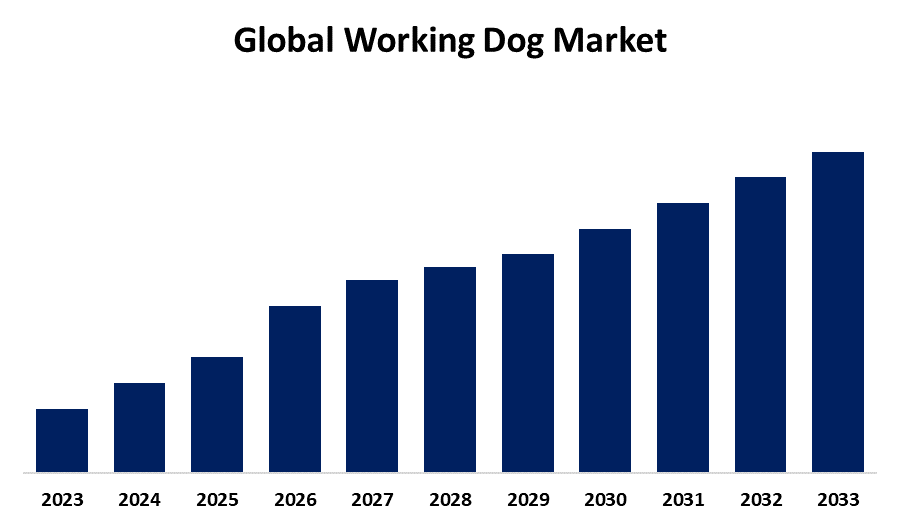

- The Market Size is Expected to Grow at a CAGR of around 6.3% from 2023 to 2033

- The Global Working Dog Market Size is Expected to hold a significant share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Working Dog Market Size is anticipated to hold a significant share by 2033, with a compound annual growth rate (CAGR) of 6.3% between 2023 and 2033. The working dog market is fueled by growing demand for therapy and service dogs, heightened security demands, improved technology in canine training, greater adoption rates for pets, increased perception of animal-assisted therapy, and increasing law enforcement and agriculture roles.

Market Overview

The working dog industry is a term used to describe the global market based on dogs that have been trained to perform certain duties other than companionship, e.g., security, detection, rescue, and assistance. Increasing demand for security in military as well as law enforcement applications has fueled demand for working dogs. These canines play a critical role in the detection of explosives, drugs, suspect tracking, and search-and-rescue missions in risky environments, thus being vital in securing borders, cities, and infrastructure. Better training methods and technological improvements, including detection equipment and GPS, have increased the efficiency of working dogs in conducting specialized functions. These upgrades make them more useful, resulting in wider use across industries such as law enforcement, the military, and search and rescue. Investment by governments in law enforcement and security has helped boost the working dog industry. K-9 unit and MWD funding helps ensure that working dogs continue to play a critical role in defense, law enforcement, and public safety operations.

Report Coverage

This research report categorizes the working dog market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the working dog market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the working dog market.

Working Dog Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.3% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Type and COVID-19 Impact Analysis |

| Companies covered:: | K9 Working Dogs International, International Working Dog Registry (IWDR), Vohne Liche Kennels, Saxon K9, The K9 Academy, Pro-K9, Working Dog Centre, Top Dog K9 Academy, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

As international security issues escalate, the need for dogs in law enforcement, the military, and private security increases. Working dogs are necessary for operations such as bomb detection, narcotics detection, search and rescue, and guarding. The capacity of working dogs to deliver increased security in dangerous environments stimulates market growth. Most nations are increasing their military and police establishments, and working dogs are key to operations. Military Working Dogs (MWDs) and K-9 units are employed for a range of tasks, including patrolling, tracking, and detection, fueling demand for specialized working dogs worldwide. Furthermore, as the pet care and animal services sector expands, increasing numbers of organizations and individuals are taking on working dogs for specialized purposes, including therapy, detection, and protection. The growing emphasis on pet welfare and health also favors the expansion of the working dog market.

Restraining Factor

Training working dogs properly needs specialized skills, and there is a lack of skilled trainers in certain areas. Furthermore, the process is lengthy, taking several months or even years to train dogs for particular purposes such as military, police, or search and rescue missions. In addition, the initial cost of buying, training, and keeping working dogs can be excessively expensive for most organizations, particularly in developing areas. This encompasses the cost of training programs, medical care, and specialized equipment, so working dogs are a significant financial investment.

Market Segmentation

The working dog market share is classified into type and breed.

- The military working dogs (MWD) segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the working dog market is divided into guide dogs (seeing eye dogs), military working dogs (MWD), police dogs (K9), and hunting dogs. Among these, the military working dogs (MWD) segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to MWDs play a crucial role in national defense missions like the detection of explosives, patrol, and search operations. Their use within high-risk areas increases soldier survival and mission achievement, making them invaluable assets to military forces worldwide. These canine animals receive arduous, specialized training that allows them to execute intricate responsibilities like tracking, attack, and bomb detection. This high state of functionality allows them to uniquely qualify in contrast to dogs that belong to different segments.

- The german shepherd segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the breeds, the working dog market is divided into german shepherd, belgian malinois, dutch shepherd, labrador retriever, golden retriever, bloodhound, and others. Among these, the german shepherd segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is attributed to german shepherds are highly devoted and obedient, forming strong bonds with their handlers. Their willingness to obey and please enhances control and trust, particularly in operations involving a high degree of stakes such as law enforcement or military deployment. Their quick ability to adjust to diverse working conditions renders them invaluable and commonly selected across diverse industries that need the assistance of dogs.

Regional Segment Analysis of the Working Dog Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the working dog market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the working dog market over the predicted timeframe. The U.S. government invests heavily in law enforcement and military K-9 programs. These funds assist in training, deployment, and medical care of working canines, which further solidifies North America's position of leadership in defense-focused sectors of the market. Some of the world's most renowned canine training academies and breeding centers are located in North America. These organizations provide a constant supply of highly trained working canines, raising performance levels and market share in many working dog applications.

Asia Pacific is expected to grow at a rapid CAGR in the working dog market during the forecast period. India, China, and the Southeast Asian region are countries confronted with growing domestic and external threats to security. Governments are increasing police and army K-9 units for the detection of bombs, border defense, and monitoring, which is increasing demand at a fast pace for highly qualified working dogs within the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the working dog market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- K9 Working Dogs International

- International Working Dog Registry (IWDR)

- Vohne Liche Kennels

- Saxon K9

- The K9 Academy

- Pro-K9

- Working Dog Centre

- Top Dog K9 Academy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, the U.S. Army opened a $21 million Veterinary Treatment Facility (VTF) at Joint Base Pearl Harbor-Hickam, Hawaii. The 12,000-square-foot facility centralizes veterinary services that were previously dispersed across various locations, increasing efficiency and access for both military working dogs and pets of Department of Defense members.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the working dog market based on the below-mentioned segments:

Global Working Dog Market, By Type

- Guide Dogs (Seeing Eye Dogs)

- Military Working Dogs (MWD)

- Police Dogs (K9)

- Hunting Dogs

Global Working Dog Market, By Form

- German Shepherd

- Belgian Malinois

- Dutch Shepherd

- Labrador Retriever

- Golden Retriever

- Bloodhound

- Others

Global Working Dog Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the working dog market over the forecast period?The global working dog market is projected to expand at a CAGR of 6.3% during the forecast period.

-

2. What is the market size of the working dog market?The global working dog market is anticipated to hold a significant share by 2033, growing at a CAGR of 6.3% from 2023 to 2033.

-

3. Which region holds the largest share of the working dog market?North America is anticipated to hold the largest share of the working dog market over the predicted timeframe. v

Need help to buy this report?