Global Workflow Orchestration Market Size, Share, and COVID-19 Impact Analysis, By Deployment Model (On-Premises, Cloud-Based, and Hybrid), By Organization Size (Small Enterprises, Medium Enterprises, and Large Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Workflow Orchestration Market Insights Forecasts to 2035

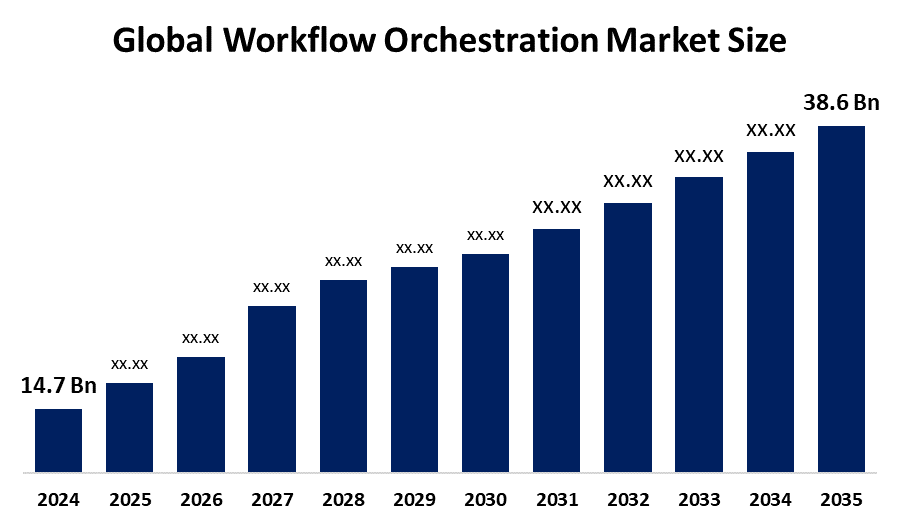

- The Global Workflow Orchestration Market Size Was Estimated at USD 14.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.17% from 2025 to 2035

- The Worldwide Workflow Orchestration Market Size is Expected to Reach USD 38.6 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Workflow Orchestration Market Size was worth around USD 14.7 Billion in 2024 and is predicted to grow to around USD 38.6 Billion by 2035 with a compound annual growth rate (CAGR) of 9.17% from 2025 and 2035. The market for workflow orchestration has a number of opportunities to grow due to automation, which is being used by organizations more and more to improve productivity, decrease manual errors, and streamline operations. The desire for increased production and cost reduction is what is driving this change. Furthermore, the broad use of cloud computing provides flexibility and scalability, increasing the accessibility of orchestration solutions.

Market Overview

Workflow orchestration is the automated management and coordination of several tasks or processes inside a predetermined workflow. Automation is becoming more and more necessary in a number of industries, according to the global workflow orchestration market. Automated processes are becoming more and more popular among organizations as a way to increase productivity and cut expenses. Orchestration technologies, for example, are being used by companies in the healthcare and financial sectors to improve service delivery by streamlining procedures. The market is anticipated to reach 16.1 USD billion by 2024, exhibiting a strong development trend. This pattern indicates that as businesses look to streamline their processes, they will probably depend more on workflow orchestration solutions, which will propel the market's growth. Incorporating machine learning and artificial intelligence into process orchestration is revolutionizing the global workflow orchestration market. Organizations can use these technologies to automate decision making, forecast results, and analyze enormous volumes of data.

The UK government is looking at how artificial intelligence can be used to automate complex, repetitive bureaucratic processes, since 84% of these transactions are highly automatable. The goal of this project is to save a significant amount of administrative time while improving service delivery. In March 2025, IBM Corporation partners with Astronomer to enhance Apache Airflow's enterprise capabilities, improving data orchestration, automation, and governance. The collaboration ensures reduced data downtime, better reliability, and scalability, benefiting AI, MLOps, and analytics workloads while simplifying deployment for regulated industries.

Report Coverage

This research report categorizes the workflow orchestration market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the workflow orchestration market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the workflow orchestration market.

Workflow Orchestration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.17% |

| 2035 Value Projection: | USD 38.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Deployment Model, By Organization Size and By Region |

| Companies covered:: | Microsoft, IBM, Cisco Systems, Oracle, VMware, BMC Software, Ayehu Software Technologies, Google, ServiceNow, SAP, Appian, Pegasystems, Newgen Software Technologies, Broadcom, OpenText, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The workflow orchestration market is driven by an increasing demand for business process automation across multiple industries, such as manufacturing, healthcare, and financial services. Businesses are routinely under pressure to improve service delivery, reduce costs, and boost operational efficiency as a result of the emergence of cloud computing and movement to remote working environments, workflow orchestration solutions have proliferated and give organizations the ability to automate and manage processes across different locations and time zones. In addition, businesses are investing in integrated orchestration solutions that provide seamless communication across applications and processes due to the increase in data driven decision making and the need to integrate disparate systems.

Restraining Factors

The workflow orchestration market is restricted by factors like small and medium sized businesses may be deterred from adopting orchestration solutions due to the costs associated with upfront investment. Although the benefits of orchestration, including lessened operational costs and increased productivity, are clear, the costs associated with software purchases, infrastructure, and training can be overwhelming.

Market Segmentation

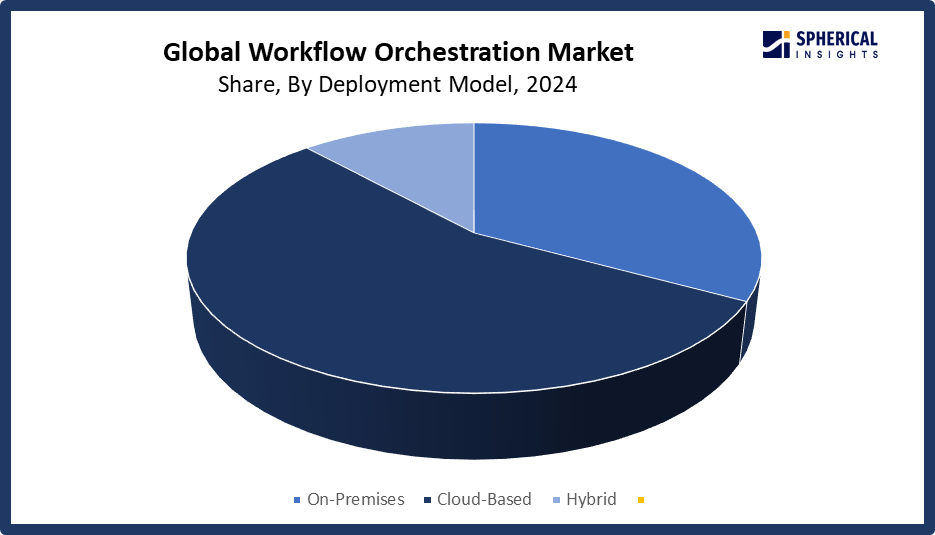

The workflow orchestration market share is classified into deployment model and organization size.

- The cloud-based segment dominated the market in 2024, accounting for approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the deployment model, the workflow orchestration market is divided into on-premises, cloud-based, and hybrid. Among these, the cloud-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by the cloud based approach, which is valued at USD 6.0 billion and reflects the high demand for adaptable and scalable solutions the effect of businesses that are seeking to improve operational efficiency and reduce infrastructure costs.

Get more details on this report -

- The large enterprises segment accounted for the largest share in 2024, accounting for approximately 64% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the organization size, the workflow orchestration market is divided into small enterprises, medium enterprises, and large enterprises. Among these, the large enterprises segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the more complex workflows and the necessity for dependable orchestration solutions to manage extensive operations while achieving productivity and compliance. As organizations become more comfortable with cloud based solutions, they provide an increasingly right-solution for a wider range of organizations spanning from small businesses to enterprise level.

Regional Segment Analysis of the Workflow Orchestration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 40% of the workflow orchestration market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 40% of the workflow orchestration market over the predicted timeframe. In the North America market, the is rising due to the early adoption of digital transformation initiatives and the presence of large technology companies. Important companies in the region investing in orchestration platforms with R&D are IBM, Microsoft, and Oracle. The market is also expanding from policy influence in the form of the Infrastructure Investment and Jobs Act and the Digital Services Act.

The US leads the workflow orchestration market due to its well-established IT infrastructure, numerous IT companies, significant investments in digital transformation across sectors, including telecom, BFSI, and healthcare, and early adoption of automation solutions.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 20% in the workflow orchestration market during the forecast period. The Asia Pacific area has a thriving market for workflow orchestration due to investment in infrastructure and an accelerated pace of adopting digital transformation. Important companies in the region investing in next generation orchestration solutions are Infosys, Alibaba, and Huawei. Additionally, the emphasis locally on logistics build outs and innovation clusters has supported the uptake of workflow orchestration solutions.

China leads the APAC workflow orchestration market because of its extensive digital transformation projects in the public, manufacturing, and financial sectors, significant investments in cloud, artificial intelligence, and automation, and pro business government initiatives like Made in China 2025.

Europe is a significant market for workflow orchestration, with 19% market share driven by the growing use of cloud based technologies and the emphasis on digital transformation. Leading businesses in the area that are investing in cutting edge orchestration solutions include SAP, Siemens, and Capgemini. The market is expanding policy effects like the NHS modernization programmes and the EU Green Deal. Workflow orchestration solutions are being further supported by the region's emphasis on serialization, cold chain, and patient safety regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the workflow orchestration market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microsoft

- IBM

- Cisco Systems

- Oracle

- VMware

- BMC Software

- Ayehu Software Technologies

- ServiceNow

- SAP

- Appian

- Pegasystems

- Newgen Software Technologies

- Broadcom

- OpenText

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Pegasystems launched Pega Agent Experience, an AI-driven orchestration solution that automates enterprise workflows across front and back offices. It integrates AI agents, supports third-party automation, ensures governance, and enhances efficiency, reinforcing Pegasystems' leadership in workflow orchestration and enterprise automation.

- In January 2025, ServiceNow launches AI Agent Orchestrator and AI Agent Studio to streamline enterprise workflows. These innovations unify AI agents, automate complex tasks, and enhance productivity by integrating with existing systems, redefining workflow orchestration, and driving AI-powered business transformation at scale.

- In December 2024, ServiceNow, Inc. and AWS expand collaboration, integrating Amazon Bedrock for AI-powered workflows on the Now Platform. New automation solutions for security and procurement are available in AWS Marketplace, accelerating GenAI adoption, enhancing digital experiences, and optimizing enterprise workflow orchestration across industries.

- In November 2024, Qntrl, a business process management platform, released an updated version of its platform, adding new features aimed at enterprises with an emphasis on the Indian market. Among its features were Bridge, a tool that could automate workflows between cloud and legacy systems, and Circuit, which was a visual engine for orchestrating IT workflows that made coding and managing business processes easier.

- In September 2024, Oracle Corporation introduced Intelligent Data Lake as part of its Data Intelligence Platform, enhancing AI-driven analytics, data integration, and workflow automation. Built on Oracle Cloud Infrastructure, it enables enterprises to unify data, streamline operations, and gain real-time insights.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the workflow orchestration market based on the below-mentioned segments:

Global Workflow Orchestration Market, By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

Global Workflow Orchestration Market, By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Global Workflow Orchestration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the workflow orchestration market over the forecast period?The global workflow orchestration market is projected to expand at a CAGR of 9.17% during the forecast period.

-

2. What is the market size of the workflow orchestration market?The global workflow orchestration market size is expected to grow from USD 14.7 Billion in 2024 to USD 38.6 Billion by 2035, at a CAGR of 9.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the workflow orchestration market?North America is anticipated to hold the largest share of the workflow orchestration market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global workflow orchestration market?NuVasive Inc., Medtronic Plc, Stryker Corporation, Dentsply Sirona Inc., Smith & Nephew Plc, Geistlich Pharma AG, Orthofix Holdings Inc., Kuros Biosciences AG, NovaBone Products LLC, Baxter International Inc., RTI Surgical Holdings Inc., Wright Medical Group N.V., Botiss Biomaterials GmbH, Zimmer Biomet Holdings Inc., and others.

-

5. What factors are driving the growth of the workflow orchestration market?The workflow orchestration market growth is driven by a growing need for operational efficiency and process automation as companies look to cut expenses, speed up decision making, and minimize manual errors. As cloud based technologies become more widely used, scalability, remote access, and flexible deployment choices become possible.

-

6. What are market trends in the workflow orchestration market?The workflow orchestration market trends include rising demand for synthetic grafts, advancements in biocompatible materials, increasing minimally invasive procedures, and strategic partnerships for innovative product development and distribution.

-

7. What are the main challenges restricting wider adoption of the workflow orchestration market?The workflow orchestration market trends include that smaller businesses are discouraged by the hefty initial expenditures of infrastructure, licensing, and training. Deployment and optimization are also slowed by a significant skills gap, since few employees possess knowledge of cloud/hybrid systems, AI, or orchestration frameworks.

Need help to buy this report?