Global Wood Plastic Composites Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyethylene, Polypropylene, Polyvinylchloride, and Others), By Application (Automotive Components, Building and Construction, Automotive Components, Industrial and Consumer Goods, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Wood Plastic Composite Market Size Insights Forecasts to 2035

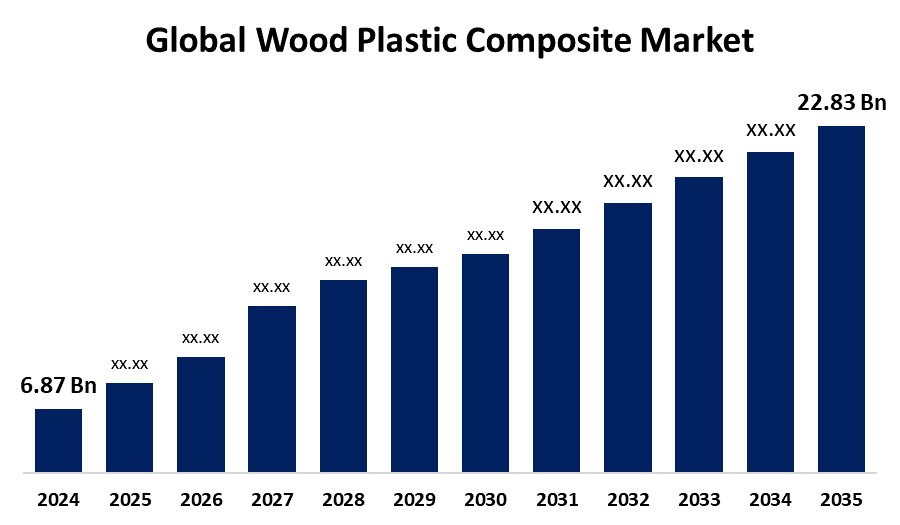

- The Global Wood Plastic Composite Market Size Was Estimated at USD 6.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.54% from 2025 to 2035

- The Worldwide Wood Plastic Composite Market Size is Expected to Reach USD 22.83 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Wood Plastic Composite Market Size was worth around USD 6.87 Billion in 2024 and is Projected to Grow from USD 7.66 Billion in 2025 to around USD 22.83 Billion by 2035 at a compound annual growth rate (CAGR) of 11.54% during the forecast period (2025–2035). The expansion of the global wood plastic composite market is propelled by demand for sustainable materials that lessen reliance on natural wood and regulations, and growing environmental consciousness. The usage of WPCs for decking, fencing, siding, and other applications is being driven by an increase in infrastructure and construction activities worldwide. WPCs are preferred due to their long-term cost savings, low maintenance requirements, and resilience to rot, dampness, and insects.

Global Wood Plastic Composite Market Forecast and Revenue Outlook

- 2024 Market Size: USD 6.87 Billion

- 2035 Projected Market Size: USD 22.83 Billion

- CAGR (2025-2035): 11.54%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The wood plastic composite is a composite material composed of thermoplastic polymer matrix and wood-based fibers or particles, i.e, wood flour, sawdust, or other lignocellulosic byproducts. Wood-plastic composites are being used with increasing frequency to produce glass windows and roofing. Their longevity has made wood-plastic composites a favored material in developing countries when compared to traditional wood for roofing applications. Large-scale projects in the production of smart, sustainable cities are being supported by many of the world's largest IT brands, including Microsoft, Cisco, and IBM. The anticipated total investment in these cities, over the next two years, after accounting for other projects doing similar work, is USD 135.00 trillion. Additionally, various global megaprojects, including Masdar City and Hudson Yards, are providing opportunities for interior builders that can drive demand for wood-plastic composites into the near future, for further potential growth. Companies in the industry are acquiring one another as a means of gaining market share in the wood-plastic composite market. In May 2022, UFP Industries, Inc. announced it would purchase Cedar Poly LLC for the price of USD 17 million. UFP Industries, Inc. would vertically integrate its sourcing of raw materials, specifically recycled polymers, while enabling a shift towards greater use of post-industrial waste inputs with no compromise to the quality of products produced.

Governments are boosting demand for wood-plastic composites by enacting more incentives and regulatory frameworks to encourage sustainable and circular materials. The Circular Economy Action Plan, the Ecodesign for Sustainable Products Regulation, and the plastics strategy are some of the EU initiatives that promote better product lifecycle design, more recycled material, and less usage of virgin plastics.

Key Market Insights

- North America is expected to account for the largest share in the Wood Plastic Composite Market during the forecast period.

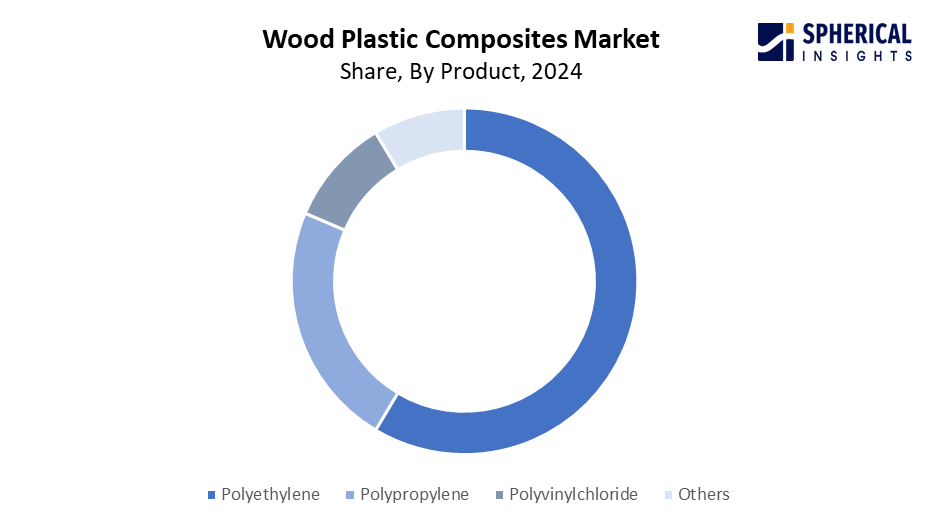

- In terms of product, the polyethylene segment is projected to lead the Wood Plastic Composite Market throughout the forecast period

- In terms of application, the building and construction segment captured the largest portion of the market

Wood Plastic Composite Market Trends

- Sustainability, Recycled & Bio Based Materials

- Product Innovation & Performance Enhancements

- Expanded Applications Beyond Decking & Fencing

- Customization & Design Flexibility

- Regulatory Push & Green Construction Demand

Report Coverage

This research report categorizes the wood plastic composite market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wood plastic composite market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wood plastic composite market.

Global Wood Plastic Composite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.87 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.54% |

| 2035 Value Projection: | USD 22.83 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | CertainTeed, LLC., Beologic, Fiberon, FKuR, Guangzhou Kindwood Co. Ltd., JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, RENOLIT SE, TAMKO Building Products LLC, The AZEK Company Inc. (TimberTech), Trex Company, Inc., UFP Industries, Inc., Hardy Smith Designs Private Limited., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The wood plastic composite market is driven by the rising global expectations for sustainable and smart cities. WPCs meet the current circular economy and green construction requirements necessary for many large-scale restoration projects, given their low maintenance and recyclability. Based on 2023 city procurement documents, the Trex Transcend WPC decking is suggested as a park improvement in Vancouver, Canada, due to its 25-year residential guarantee and 95% post-consumer recycled plastic content. Alternatively, the National Parks Board's 2024 tender suggests using WPC benches and walkways will soon be installed in urban green areas of Singapore. It identifies the installation of composite benches with PVDF coatings that contain 80% recycled plastic and ground wood fiber, in addition to traditional wood-based and concrete options.

Restraining Factor

One of the main factors restraining the wood plastic composite market is the high upfront cost of WPCs, particularly in cost-sensitive markets and the low-income construction sector. At the point of sale, WPCs are typically priced 15–25% higher than traditional materials, such as softwood or virgin plastic.

Market Segmentation

The global wood plastic composite market is divided into product and application.

Global Wood Plastic Composites Market, By Product:

- The polyethylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product, the global wood plastic composite market is segmented into polyethylene, polypropylene, polyvinylchloride, and others. Among these, the polyethylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by furniture for homes, offices, restaurants, holidays, and hospitals. Additionally, it is projected that the increased demand for polyethylene in the automotive sector, due to affordability, high rigidity, and biodegradability, will help fuel market growth in the coming years. The wood plastic composite products that are made of polyethylene have a low price, high rigidity, abundant raw materials, and biodegradability, which could provide cash for the growth of the market.

Get more details on this report -

The polypropylene segment in the wood plastic composite market is expected to grow at the fastest CAGR over the forecast period. The growing market share can be attributed to the significant applications in specialty application areas such as high-temperature controlled wooden units and waterproof coatings for wooden furniture.

Global Wood Plastic Composites Market, By Application:

- The building and construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global wood plastic composite market is segmented into automotive components, building and construction, automotive components, industrial and consumer goods, and others. Among these, the building and construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the growth in construction for infrastructure projects in developing economies, e.g., China, India, Thailand, and Brazil, along with the worldwide demand for attractive flooring and furniture alternatives, which has caused an increase in demand for wood plastic composite in construction. The market will see additional growth driven by demand for alternative plastic wood products for construction applications, primarily decking.

The automotive components segment in the wood plastic composite market is expected to grow at the fastest CAGR over the forecast period. WPCs are a desirable substitute due to their exceptional strength-to-weight ratios, especially as manufacturers are being pressured to reduce vehicle weight to boost EV range and fuel economy. Moreover, WPCs meet stricter emissions and environmental standards since they are recyclable and offer effective acoustic insulation, or noise damping.

Regional Segment Analysis of the Global Wood Plastic Composite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Wood Plastic Composites Market Trends

Get more details on this report -

North America is expected to hold the largest share of the global wood plastic composites market over the forecast period.

The North American region's supremacy includes the construction and automotive sectors in North America. In addition, the area is experiencing growth in the construction sector due to declining unemployment rates and the passage of landmark legislation related to infrastructure, as well as reductions in pricing from the influx of shale gas into the market, which raises the region's demand for products.

U.S. Wood Plastic Composites Market Trends

In North America, the U.S. market for wood-plastic composites accounted for the most demand and production activity. Due to the expanding scope of applications for the product in the manufacture of window frames, porches, and docks, demand is projected to grow throughout the forecast period. Demand is raised both by stronger demand from building and construction activity and ongoing stronger propensity towards the use of consumer goods and product specialty sectors.

Asia Pacific Wood Plastic Composites Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the wood plastic composite market during the forecast period. In the Asia Pacific market, the rise is due to increasing populations in countries like Bangladesh, Pakistan, China, and India, along with changing consumption patterns have increased consumer goods and construction industries in the area, which is expected to drive market growth during the forecast period.

India Wood Plastic Composites Market Trends

The rising capital market of India, as well as the presence of both small and large-sized companies, increasing foreign exchange reserves, are expected to significantly increase the wood plastics market in India. Along with this, the government's Make in India initiative is expected to boost the consumer products application market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wood plastic composite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Wood Plastic Composites Market Include

- CertainTeed, LLC.

- Beologic

- Fiberon

- FKuR

- Guangzhou Kindwood Co. Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- PolyPlank AB

- RENOLIT SE

- TAMKO Building Products LLC

- The AZEK Company Inc. (TimberTech)

- Trex Company, Inc.

- UFP Industries, Inc.

- Hardy Smith Designs Private Limited.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In April 2025, Century introduced its premium quality product called louvers made from wood plastic composite. It marked a significant step toward enhancing the market for functional and aesthetic interior and exterior solutions in India.

- In April 2025, Biesse India announced the launch of its new Material Hubs in six cities worldwide, namely, Toronto, Sydney, Porto, Lyon, and Osaka. This strategy marked a milestone in the company’s journey to transform its value proposition in an ever-changing world.

- In April 2024, Oakio Plastic Wood Building Materials Co., Ltd., Inc. introduced Proshield WPC Cladding. This advanced cladding solution offers durability, sustainability, and aesthetic versatility for exterior building materials. Proshield WPC Cladding is engineered with a unique blend of wood fibers and high-density polyethylene encased in a robust polymer shield.

- In January 2023, UFP Industries, Inc. announced that feature new and innovative products from two leading brands, Deckorators and UFP-Edge. These distinctive products allow both DIYers and builders to bring the personal creativity of interior design to outdoor living, thereby helping the company to gain a competitive edge.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wood plastic composite market based on the following segments:

Global Wood Plastic Composites Market, By Product

- Polyethylene

- Polypropylene

- Polyvinylchloride

- Others

Global Wood Plastic Composites Market, By Application

- Automotive Components

- Building and Construction

- Automotive Components

- Industrial and Consumer Goods

- Others

Global Wood Plastic Composites Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the wood plastic composite market over the forecast period?The global wood plastic composite market is projected to expand at a CAGR of 11.54% during the forecast period.

-

2. What is the market size of the wood plastic composite market?The global wood plastic composite market size is expected to grow from USD 6.87 billion in 2024 to USD 22.83 billion by 2035, at a CAGR 11.54% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the wood plastic composite market?North America is anticipated to hold the largest share of the wood plastic composite market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global wood plastic composite market?CertainTeed, LLC., Beologic, Fiberon, FkuR, Guangzhou Kindwood Co. Ltd., JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, RENOLIT SE, TAMKO Building Products LLC, The AZEK Company Inc. (TimberTech), Trex Company, Inc., UFP Industries, Inc., Hardy Smith Designs Private Limited., and Others.

-

5. What factors are driving the growth of the wood plastic composite market?The wood plastic composite market's growth is driven by industry adoption of WPCs as a more environmentally friendly substitute for pure wood, and plastics are being driven by growing environmental concerns and the demand for sustainable materials.

-

6. What are the market trends in the Wood Plastic Composites market?Sustainability, Recycled & Bio‑Based Materials, Product Innovation & Performance Enhancements, Expanded Applications Beyond Decking & Fencing, Customization & Design Flexibility, and Regulatory Push & Green Construction Demand.

-

7. What are the main challenges restricting wider adoption of the Wood Plastic Composite market?The wood plastic composite market faces challenges, including high initial production and material costs, particularly because of high-quality raw materials and specialized gear. Inconsistent quality results from variations in the raw materials i.e, wood fibers, recycled plastics.

Need help to buy this report?