Global Wollastonite Market Size, Share, and COVID-19 Impact Analysis, By Grade (Needle, Fine, Coarse, and Microfine), By Application (Ceramics, Paints and Coatings, Plastics, Rubber, Foundry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Wollastonite Market Insights Forecasts to 2035

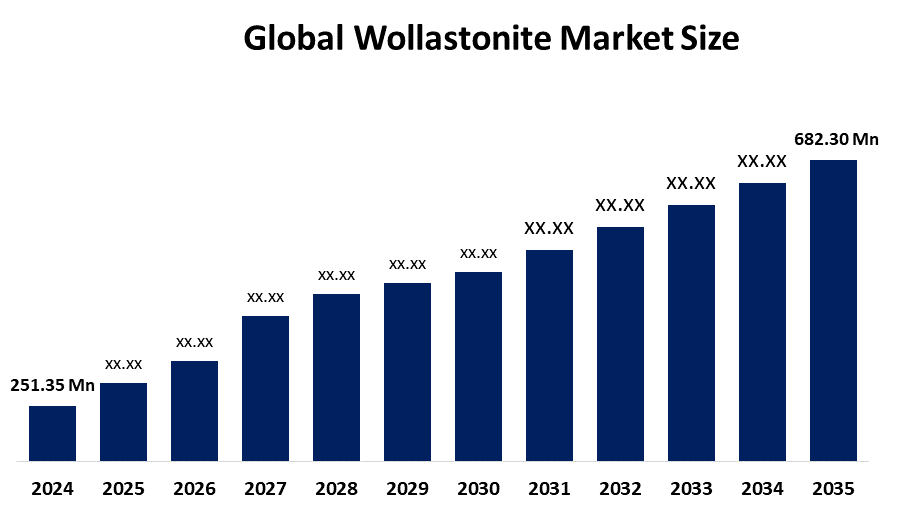

- The Global Wollastonite Market Size Was Estimated at USD 251.35 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.5 % from 2025 to 2035

- The Worldwide Wollastonite Market Size is Expected to Reach USD 682.30 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Wollastonite Market Size was valued at around USD 251.35 Million in 2024 and is predicted to Grow to around USD 682.30 Million by 2035 with a compound annual growth rate (CAGR) of 9.5 % from 2025 to 2035. Wollastonite is gaining popularity in the building, ceramics, plastics, and automotive industries due to its eco-friendly properties, thermal stability, and potential for expanding uses in rising nations.

Market Overview

The wollastonite market focuses on the extraction, processing, and trade of wollastonite (CaSiO3), a rare mineral sourced from the earth's crust, which is the result of thermal metamorphism of siliceous limestone. It is a versatile filler and a reinforcing agent for construction materials, metallurgical applications, paints and coatings, ceramics, plastics, and friction products. Its natural acicular morphology, low thermal conductivity, and chemical inertness allow it to be used as a substitute for asbestos in some applications. Wollastonite mineral is one of the earth's luxuries due to its industrial uses, owing to its needle-like crystal structure, high brightness, low moisture absorption, thermal stability, and chemical inertness. For instance, in October 2025, Microsoft and UNDO Carbon made a historic carbon removal deal that involved the use of wollastonite for improved rock weathering (ERW) to store 28,900 tonnes of CO2 by 2036, thus showcasing the material's promise in mitigating the climate issue. Another factor for the rising demand in the market, the technology advancements in mining and processing are the main ones, besides the gradually increasing demand in the construction sector.

Report Coverage

This research report categorizes the wollastonite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wollastonite market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wollastonite market.

Global Wollastonite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 251.35 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.5% |

| 2035 Value Projection: | USD 682.30 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | ACBM JSC, ACCO Minerals / MCA International (India), Anshan Jinhengxin Commercial and Trading Co., Ltd., Canadian Wollastonite, Changxing Earth New Type of Material Co., Ltd., Imerys S.A., Jilin Shanwei Wollastonite Mining Co., Ltd., Keiwa Fine Material Co., Ltd., Nordkalk Corporation, NYCO Minerals, Inc., Omya AG, R.T. Vanderbilt Holding Company, Inc., Wolkem India Ltd., Xinyu South Wollastonite Co., Ltd., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The mineral is a desirable choice for automobile components since it can improve mechanical qualities while lowering weight. The wollastonite market is being largely driven by the increasing infrastructure and construction industries, particularly in the case of the emerging economies, which growing demand for cement, wallboards, and other building materials. In addition, the increasing need for lightweight and high-performance composites in the industrial and automotive sectors is supporting wollastonite acceptance, as it has the properties of improved mechanical strength, durability, and heat resistance.

Restraining Factors

High mining and processing costs, the scarcity of high-quality deposits, competition from substitute materials, strict environmental regulations, and volatile raw material prices all restrict the widespread adoption and long-term growth of the wollastonite market.

Market Segmentation

The wollastonite market share is classified into grade and application.

- The needle segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the wollastonite market is divided into needle, fine, coarse, and microfine. Among these, the needle segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Its broad applicability, reliable performance, and high dependability across end-use sectors are the reasons behind the needle grade segment. Continuous technical improvements, strict quality standards, and affordability when compared to other classes all contribute to the high demand. Needle-grade items are becoming more and more popular as sectors place a greater emphasis on accuracy and efficiency.

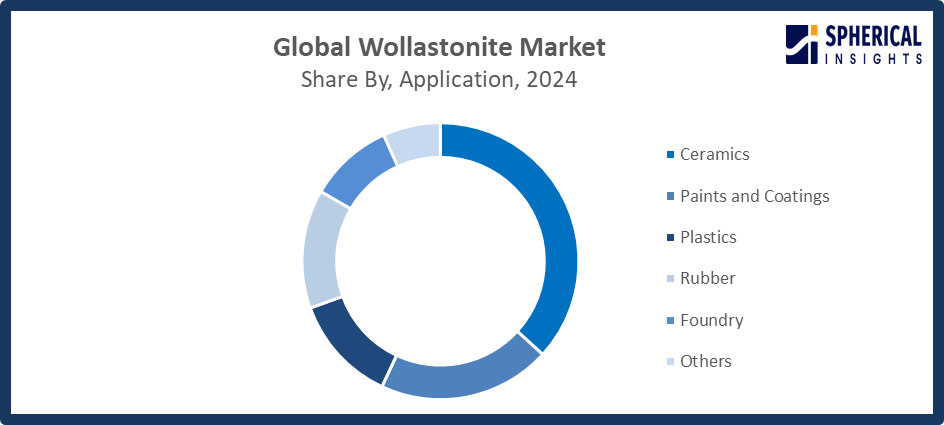

- The ceramics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the wollastonite market is divided into ceramics, paints and coatings, plastics, rubber, foundry, and others. Among these, the ceramics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Ceramics is motivated by its vital function in the production of pottery, sanitary ware, and tiles. Wollastonite's high aspect ratio, low thermal expansion, and capacity to improve surface quality and mechanical strength make it a popular choice in ceramic formulations.

Get more details on this report -

Regional Segment Analysis of the Wollastonite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the wollastonite market over the predicted timeframe.

North America is anticipated to hold the largest share of the wollastonite market over the predicted timeframe. Region's development comes from the rising demand of the construction, ceramics, and plastics industries, and also from favorable mining regulations that encourage the use of sustainable methods. Among these two countries, the U.S. is the largest producer, while Canada is the second largest, taking advantage of rich mineral reserves and state-of-the-art processing techniques. The Department of Energy announced in August 2025 the Critical Minerals and Materials Accelerator program with the goal to provide a supply of industrial minerals, including wollastonite, and to create a resilient supply chain through the thus improved extraction and processing.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the wollastonite market during the forecast period. Rapid urbanization, industrialization, and infrastructure development in nations like China, India, and Japan are what propel the Asia Pacific. Government initiatives that support industry and infrastructure development are important drivers of this expansion. The region's biggest market is China, where production is dominated by firms like Shaanxi Huaneng and Shaanxi Yulin. The establishment of India's "Make in India, Minerals Mission" in 2025 encouraged investments in value-added processing by allocating INR 5,000 crore to modernize mines in Gujarat and Rajasthan, improving export competitiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wollastonite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACBM JSC

- ACCO Minerals / MCA International (India)

- Anshan Jinhengxin Commercial and Trading Co., Ltd.

- Canadian Wollastonite

- Changxing Earth New Type of Material Co., Ltd.

- Imerys S.A.

- Jilin Shanwei Wollastonite Mining Co., Ltd.

- Keiwa Fine Material Co., Ltd.

- Nordkalk Corporation

- NYCO Minerals, Inc.

- Omya AG

- R.T. Vanderbilt Holding Company, Inc.

- Wolkem India Ltd.

- Xinyu South Wollastonite Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Canadian Wollastonite launched a landmark three-year agreement to supply UNDO Carbon with 450,000 tonnes of wollastonite, supporting the world’s second-largest geo-engineered CO2 removal project and positioning Kingston as a global climate innovation leader hub.

- In October 2023, UNDO launched a strategic partnership with Canadian Wollastonite to scale enhanced rock weathering operations, aiming to generate permanent carbon credits, advance ERW science, improve soils, create jobs, and remove one million tonnes of CO2

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wollastonite market based on the below-mentioned segments:

Global Wollastonite Market, By Grade

- Needle

- Fine

- Coarse

- Microfine

Global Wollastonite Market, By Application

- Ceramics

- Paints and Coatings

- Plastics

- Rubber

- Foundry

- Others

Global Wollastonite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the wollastonite market over the forecast period?The global wollastonite market is projected to expand at a CAGR of 9.5% during the forecast period.

-

2.What is the market size of the wollastonite market?The global wollastonite market size is expected to grow from USD 251.35 million in 2024 to USD 682.30 million by 2035, at a CAGR of 9.5 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the wollastonite market?North America is anticipated to hold the largest share of the Wollastonite market over the predicted timeframe.

-

4.Who are the top companies operating in the global wollastonite market?ACBM JSC, ACCO Minerals / MCA International (India), Anshan Jinhengxin Commercial and Trading Co., Ltd., Canadian Wollastonite, Changxing Earth New Type of Material Co., Ltd., Imerys S.A., Jilin Shanwei Wollastonite Mining Co., Ltd., Keiwa Fine Material Co., Ltd., Nordkalk Corporation, NYCO Minerals, Inc., Omya AG, R.T. Vanderbilt Holding Company, Inc., Wolkem India Ltd., Xinyu South Wollastonite Co., Ltd., and Others.

-

5.What factors are driving the growth of the wollastonite market?The Wollastonite market growth is driven by rising demand in construction, automotive, plastics, and ceramics, coupled with its thermal stability, reinforcing properties, eco-friendliness, and increasing adoption in emerging economies.

-

6.What are the market trends in the wollastonite market?High-performance composites' growth, their greater use in sustainable and environmentally friendly applications, processing technology improvements, product diversity, and rising infrastructural and industrial development investments worldwide are some of the major developments.

-

7.What are the main challenges restricting the wider adoption of the wollastonite market?Wollastonite market adoption is restrained by high production costs, limited availability of quality deposits, regulatory restrictions, competition from alternative materials, and volatility in raw material prices, affecting overall market growth.

Need help to buy this report?