Global Wireless Infrastructure Market Size By Platform (Defense, Government, Commercial); By Type (Satellite, 2G & 3G, 4G, 5G); By Infrastructure (Small and Macro Cells, Radio Access Networks, Mobile Core, Distributed Area Network, SATCOM), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Wireless Infrastructure Market Insights Forecasts to 2033

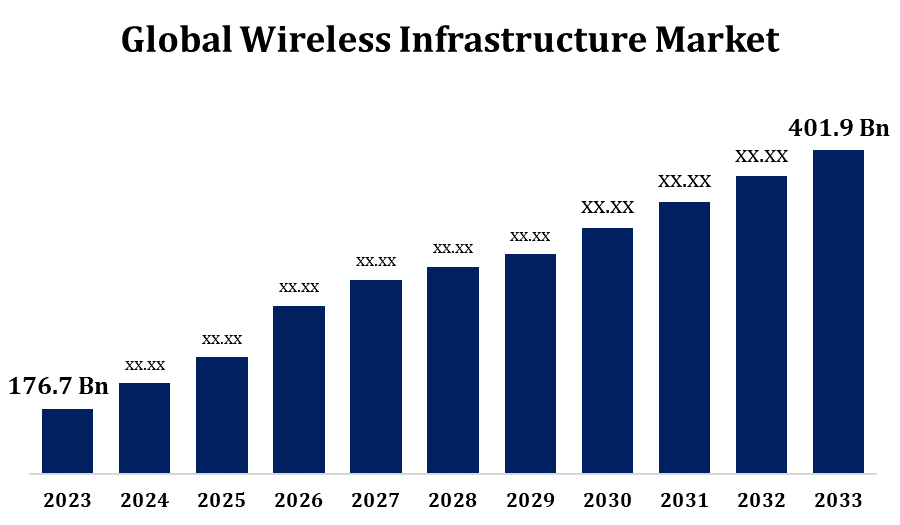

- The Global Wireless Infrastructure Market Size was valued at USD 176.7 Billion in 2023.

- The Market Size is growing at a CAGR of 8.56% from 2023 to 2033

- The Worldwide Wireless Infrastructure Market Size is expected to reach USD 401.9 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Wireless Infrastructure Market Size is expected to reach USD 401.9 Billion by 2033, at a CAGR of 8.56% during the forecast period 2023 to 2033.

In order to facilitate seamless connectivity and high-speed data transfer, a strong wireless infrastructure is becoming increasingly necessary due to the widespread use of smartphones, tablets, Internet of Things devices, and other connected devices. Large investments in wireless infrastructure are being made in order to accommodate 5G network rollout, which will enable faster data rates, lower latency, and greater capacity. Small cell deployment, large MIMO (Multiple Input Multiple Output) antennas, and other cutting-edge technologies are examples of this. The rise in demand for wireless infrastructure to meet the connectivity needs of Internet of Things (IoT) devices is being driven by their adoption in a variety of industries, including healthcare, manufacturing, automotive, and smart cities. Wireless networks are under pressure to expand and improve their infrastructure in order to accommodate the increasing data traffic due to the surge in mobile data usage, which is mostly being driven by apps that require a lot of bandwidth, such as social media, gaming, and video streaming.

Wireless Infrastructure Market Value Chain Analysis

The hardware and software components for wireless infrastructure, such as base stations, antennas, radios, switches, routers, and other networking equipment, are made by component makers. These components are provided to network equipment vendors and are necessary for constructing wireless networks. The infrastructure equipment used in wireless communication networks is designed, developed, and produced by network equipment vendors. They construct base stations, access points, controllers, and other network components by integrating parts from different vendors. Mobile operators, internet service providers (ISPs), and other telecommunications businesses are examples of telecommunication operators or service providers that own and run wireless networks. For the purpose of deploying wireless infrastructure, infrastructure providers lease or sell telecommunication operators physical assets including towers, poles, and rooftops. Technology vendors provide platforms, software, and services to improve wireless network efficiency, security, and performance. Complex wireless network solution design, implementation, and integration are the areas of expertise for system integrators. The people who use wireless communication services and applications—individuals, companies, and organizations—are known as end-users. For phone calls, internet access, texting, IoT connectivity, and other wirelessly enabled services, they depend on wireless infrastructure.

Wireless Infrastructure Market Opportunity Analysis

Significant potential for wireless infrastructure providers are presented by the deployment and expansion of 5G networks. The increasing adoption of 5G technology will drive up demand for infrastructure components like massive MIMO antennas, edge computing platforms, and small cells to support new use cases like virtual and augmented reality (VR) and higher data speeds and lower latency. Wireless infrastructure providers have potential as a result of the expansion of IoT devices in many different industries, including healthcare, manufacturing, transportation, and smart cities. Network densification is required to increase capacity and coverage in high-traffic and metropolitan locations due to the rising demand for mobile data and the number of connected devices. For wireless infrastructure providers, investigating new markets and verticals including smart manufacturing, telemedicine, smart agriculture, and rural connection might open up new business prospects. Solutions for optimisation and automation that boost network efficiency, dependability, and performance are becoming more and more in demand as wireless networks become more complicated.

Global Wireless Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 176.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.56% |

| 2033 Value Projection: | USD 401.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Platform, By Type, By Infrastructure, By Region |

| Companies covered:: | D-Link Corporation, Qualcomm Technologies Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Fujitsu Ltd., NEC CORPORATION, NXP Semiconductors, Cisco Systems, Inc., Mavenir, Samsung, and Other Key Vendors. |

| Growth Drivers: | Rise in the investments by market players to deploy high-speed networks |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Wireless Infrastructure Market Dynamics

Rise in the investments by market players to deploy high-speed networks

The increased use of bandwidth-intensive activities like online gaming, cloud computing, and video streaming has resulted in a growing need for high-speed internet and connectivity. Faster and more dependable wireless networks are expected by both consumers and companies to support their digital lives and operations. Due to fierce competition in the market, telecommunications operators and service providers must make investments to extend and upgrade their wireless infrastructure in order to obtain a competitive advantage. In a highly competitive market climate, providing high-speed networks with exceptional performance and coverage is critical to drawing and keeping consumers.Digital transformation projects are being implemented by businesses in a variety of industries, and in order to support cloud-based apps, data analytics, and Internet of Things deployments, reliable and fast connectivity is necessary.

Restraints & Challenges

Installing wireless infrastructure necessitates a large financial outlay, particularly for next-generation technologies like 5G. Especially in heavily populated urban areas or isolated rural areas, the cost of obtaining spectrum, buying equipment, and constructing networks can be high. Particularly for the licenced bands that mobile operators utilise, the supply of spectrum is extremely restricted and regulated. Particularly in urban locations where there is a significant demand for wireless services, spectrum scarcity can result in congestion, interference, and difficulties in delivering enough capacity and coverage. Managing and deploying wireless infrastructure requires handling technical challenges such interoperability problems, signal propagation, radio frequency interference, and network optimisation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Wireless Infrastructure Market from 2023 to 2033. Due to the region's widespread adoption of smartphones, robust 4G LTE coverage, and continuous 5G network deployment, investments in wireless infrastructure are steadily increasing. Major US and Canadian wireless carriers are actively deploying 5G networks in cities and specific areas, placing North America at the forefront of the 5G deployment wave. In order to enable high-speed, low-latency connectivity, these deployments are pushing investments in new infrastructure, including as massive MIMO antennas, fiber-optic backhaul, and tiny cells. North American wireless carriers are updating their networks to satisfy changing customer and business needs for fast data, dependable connectivity, and cutting-edge services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Leading the world in 5G network deployment are a number of Asia-Pacific nations. With major telecom carriers investing extensively in infrastructure development and spectrum acquisition, China has made notable progress in the introduction of 5G. 5G adoption is also being driven by other nations in the area, such as South Korea and Japan, through vigorous network expansion and commercialization initiatives. The fast uptake of smartphones and mobile internet services has resulted in a big and diverse mobile subscriber base in Asia Pacific. The increased demand for data services, multimedia content, and mobile apps is being met by investments in wireless infrastructure driven by this growing subscriber base.

Segmentation Analysis

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Companies are implementing digital transformation programmes in order to boost customer satisfaction, increase productivity, and open up new business opportunities. Because wireless infrastructure offers high-speed connectivity, mobility, and access to cloud-based apps and services, it is essential to the support of digital transformation. The retail and hospitality sectors are allocating resources towards wireless infrastructure in order to augment client interaction, optimise operational efficacy, and provide tailored experiences. Wireless connectivity is essential for the smooth operation of digital signage systems, Wi-Fi networks, location-based services, and mobile payment options. In order to facilitate telemedicine, remote patient monitoring, electronic health records (EHR), and medical Internet of things devices, the healthcare sector is implementing wireless infrastructure.

Insights by Type

The 4G segment accounted for the largest market share over the forecast period 2023 to 2033. In many parts of the world, 4G networks still serve as the foundation for mobile communication infrastructure, even if 5G implementation is picking up speed. 4G networks remain the main way to provide high-speed mobile internet services in places where 5G deployment is still ongoing or where 5G coverage is restricted. Widespread coverage is provided by 4G networks in urban, suburban, and rural locations, providing dependable connectivity and fast data services to a large number of users. To provide consumers with seamless coverage and capacity, wireless operators are investing in growing and improving their 4G networks.The 4G segment's steady expansion is facilitated by the accessibility and affordability of 4G-compatible gadgets, such as tablets, smartphones, and Internet of Things devices.

Insights by Infrastructure

The distributed area networks segment accounted for the largest market share over the forecast period 2023 to 2033. More wireless coverage and capacity in both indoor and outdoor settings are needed as a result of the widespread use of mobile devices and rising data usage. In order to meet this need, distributed area networks expand wireless coverage, enhance signal quality, and boost network capacity in places with dense populations or difficult radio frequency circumstances. In densely populated metropolitan settings like stadiums, airports, shopping centres, and office buildings, conventional macrocell networks might not be able to offer sufficient coverage and capacity. By dispersing wireless signals from centralised base stations to several antennas positioned strategically around the area, distributed area networks provide an effective solution that improves user service quality and makes better use of available spectrum.

Recent Market Developments

- In January 2023, the giant of e-commerce Amazon announced the launch of its two cargo planes and freight service, Amazon Air, in India.

Competitive Landscape

Major players in the market

- D-Link Corporation

- Qualcomm Technologies Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Fujitsu Ltd.

- NEC CORPORATION

- NXP Semiconductors

- Cisco Systems, Inc.

- Mavenir

- Samsung

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Wireless Infrastructure Market, Platform Analysis

- Defense

- Government

- Commercial

Wireless Infrastructure Market, Type Analysis

- Satellite

- 2G & 3G

- 4G

- 5G

Wireless Infrastructure Market, Infrastructure Analysis

- Small and Macro Cells

- Radio Access Networks

- Mobile Core

- Distributed Area Network

- SATCOM

Wireless Infrastructure Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Wireless Infrastructure Market?The global Wireless Infrastructure Market is expected to grow from USD 176.7 billion in 2023 to USD 401.9 billion by 2033, at a CAGR of 8.56% during the forecast period 2023-2033.

-

2. Who are the key market players of the Wireless Infrastructure Market?Some of the key market players of the market are D-Link Corporation, Qualcomm Technologies Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Fujitsu Ltd., NEC CORPORATION, NXP Semiconductors, Cisco Systems, Inc., Mavenir, Samsung.

-

3. Which segment holds the largest market share?The distributed area networks segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Wireless Infrastructure Market?North America is dominating the Wireless Infrastructure Market with the highest market share.

Need help to buy this report?