Global Wind Turbine Bearing Market Size, Share, and COVID-19 Impact Analysis, By Bearing Type (Rolling Element Bearings, Hydrodynamic Bearings, and Magnetic Bearings), By Application (Main Rotor Bearings, Gearbox Bearings, and Generator Bearings), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Wind Turbine Bearing Market Insights Forecasts to 2035

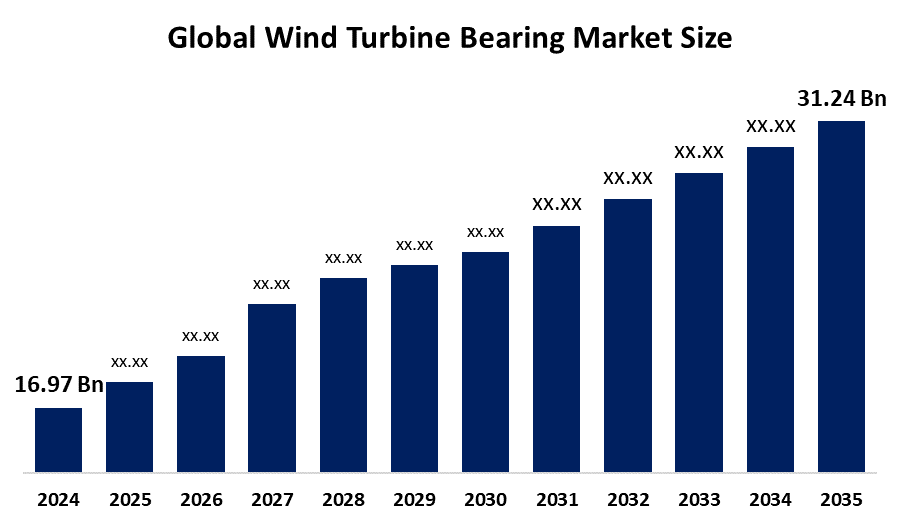

- The Global Wind Turbine Bearing Market Size Was Estimated at USD 16.97 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.70 % from 2025 to 2035

- The Worldwide Wind Turbine Bearing Market Size is Expected to Reach USD 31.24 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Wind Turbine Bearing Market Size was valued at USD 16.97 Billion in 2024 and is predicted to grow to around USD 31.24 Billion by 2035 with a compound annual growth rate (CAGR) of 5.70 % from 2025 to 2035. The market for wind turbine bearings offers opportunities for increasing the use of renewable energy, offshore wind projects, technological developments in high-efficiency bearings, predictive maintenance solutions, and growing demand for long-lasting, low-friction, and environmentally friendly components.

Market Overview

The global ecosystem for creating, producing, and distributing specialized rolling and plain bearings necessary for wind turbine drivetrains, rotor hubs, and yaw systems is represented in the wind turbine bearing market. The wind turbine bearing market helps the shift to sustainable energy by reducing frictional losses, withstanding high axial and radial loads, and improving operational efficiency in both onshore and offshore facilities. To support component innovations to lower prices and certify turbines up to 1 MW, the U.S. Department of Energy's NREL released its 2025 Competitiveness Improvement Project RFP in January. The project specifically targets reliability improvements in crucial components like bearings. The demand for renewable energy sources and collaterally the bearing type improvements are the main forces that are currently powering the wind turbine bearing market. The market of wind turbine bearings is mainly driven by government subsidies and legal frameworks that support the industry.

Report Coverage

This research report categorizes the wind turbine bearing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wind turbine bearing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wind turbine bearing market.

Global Wind Turbine Bearing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.97 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.70% |

| 2035 Value Projection: | USD 31.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Bearing Type, By Application |

| Companies covered:: | AB SKF, Dalian Metallurgical Bearing Co. Ltd., Fersa Bearings SA, Groupe Legris Industries, IMO Holding GmbH, JTEKT Corp., Liebherr International AG, LYC Bearing Corp., NRB Bearings Ltd., Schaeffler AG, Scheerer Bearing Corp., TFL BEARINGS Co. Ltd., The Timken Co and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is being driven by the aforementioned factors, including the establishment of both onshore and offshore wind farms, the growth of the renewable energy sector, and advancements in bearing materials and designs that improve performance, durability, and maintenance efficiency. The construction of onshore and offshore wind farms, the growing use of renewable energy, and technological developments in bearing materials and designs that improve performance, durability, and maintenance efficiency are the key drivers of this market's growth. It is anticipated that government policies that encourage the achievement of renewable energy goals would foster an atmosphere that is more conducive to the expansion of the wind turbine bearing sector.

Restraining Factors

High manufacturing and maintenance costs, technological complexity, a shortage of skilled labor, supply chain limitations, and susceptibility to operational failures in challenging environmental conditions are some of the major factors restricting the wind turbine bearing market's growth and widespread adoption.

Market Segmentation

The wind turbine bearing market share is classified into bearing type and application.

- The rolling element bearings segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the wind turbine bearing market is divided into rolling element bearings, hydrodynamic bearings, and magnetic bearings. Among these, the rolling element bearings segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. High sensitivity, precision, and quick detection are what propel the rolling element bearings (PCR) market. Rolling element bearings are widely used in a variety of wind turbine components, such as main rotors, gearboxes, and generators, because of their high load-carrying capacity, longevity, and effective friction reduction. These bearings are favored because they can function in hostile environments and at different speeds without compromising structural stability.

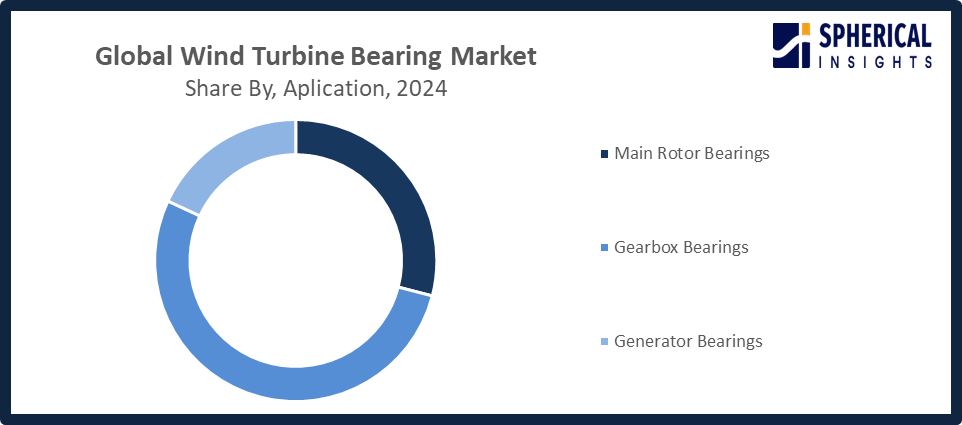

- The gearbox bearings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the wind turbine bearing market is divided into main rotor bearings, gearbox bearings, and generator bearings. Among these, the gearbox bearings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In order to transfer torque between the rotor and generator while lowering mechanical wear and friction, gearbox bearings are crucial. Gearbox bearings' dominance has been further cemented by rising expenditures in wind energy infrastructure and improvements in bearing materials and designs, positioning this market.

Get more details on this report -

Regional Segment Analysis of the Wind Turbine Bearing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the wind turbine bearing market over the predicted timeframe.

North America is anticipated to hold the largest share of the wind turbine bearing market over the predicted timeframe. The existence of significant wind turbine manufacturers and the growing use of wind energy are the reasons behind this. Significant investments are being made in both onshore and offshore wind farms in the US and Canada, which calls for sophisticated, high-performance bearings to guarantee dependable and effective turbine operations. The National Renewable Energy Laboratory (NREL) of the U.S. Department of Energy announced its 2025 Competitiveness Improvement Project Request for Proposals in January, offering up to USD 20 million in cost-shared funding for creative component designs, such as bearing optimizations to improve reliability and lower levelized costs for turbines up to 1 MW. Technological developments, such as the creation of robust, low-friction, and corrosion-resistant bearings, contribute to the expansion of the market.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the wind turbine bearing market during the forecast period. Wind energy installations in the area are expanding quickly due to favorable government policies and the rising demand for renewable energy. Increased investments in renewable energy infrastructure in nations like China, India, Japan, and South Korea are the main driver of this rise. Large-scale wind power project development has intensified due to rising energy demand and government measures to cut carbon emissions. The Beijing Declaration 2.0, which was released on October 20, 2025, during China Wind Power 2025, pledged to double wind capacity by 2030 and reach 3.6 TW combined wind-solar by 2035. It also included governmental incentives for bearing advancements and 120 GW of new installations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wind turbine bearing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB SKF

- Dalian Metallurgical Bearing Co. Ltd.

- Fersa Bearings SA

- Groupe Legris Industries

- IMO Holding GmbH

- JTEKT Corp.

- Liebherr International AG

- LYC Bearing Corp.

- NRB Bearings Ltd.

- Schaeffler AG

- Scheerer Bearing Corp.

- TFL BEARINGS Co. Ltd.

- The Timken Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, the government launched a mandate requiring major wind turbine components to be sourced from the Approved List of Models and Manufacturers, following MNRE’s earlier procedure for inclusion in the Revised List of Models and Manufacturers (RLMM).

- In April 2025, the Ministry of New and Renewable Energy (MNRE) launched a proposal promoting local manufacture of major wind turbine components, boosting domestic production and causing shares of Suzlon Energy and Inox Wind to surge, reducing dependency on imports.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wind turbine bearing market based on the below-mentioned segments:

Global Wind Turbine Bearing Market, By Bearing Type

- Rolling Element Bearings

- Hydrodynamic Bearings

- Magnetic Bearings

Global Wind Turbine Bearing Market, By Application

- Main Rotor Bearings

- Gearbox Bearings

- Generator Bearings

Global Wind Turbine Bearing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is trade credit insurance, and its primary use?Trade credit insurance is an effective way to handle the credit risk of a company. It ensures that your firm can continue to progress without the fear of losing income from unpaid invoices. Thus, it is a major factor contributing to a secure business environment. The rising number of corporate liquidations leads to the usage of trade credit insurance for credit management, lowering bad debt, and improving cash flow, which in turn is a driving factor for the market.

-

What are the key growth drivers of the market?Market growth is driven by the rising occurrence of businesses going bankrupt has led to a corresponding rise in the adoption of trade credit insurance by companies which serving as a protective measure against insolvency and also ensuring smooth cash flow. A 7% rise in the number of bankruptcies was witnessed in 2023, and a further 9% increase by the end of 2024 is predicted

-

What factors restrain the Asia Pacific credit insurance market?The market is restrained by the loss ratios and the lack of awareness among small to middling enterprises (SMEs) are still the main hindrances to the trade credit insurance sector. Economic downturns drive insurers to adopt tighter underwriting practices and charge higher premiums as a result of rising defaults and changing claim patterns, which are under profitability pressure.

-

How is the market segmented by enterprise size?The market is segmented into large enterprises, small and medium enterprises

-

Who are the key players in the Asia Pacific credit insurance market?Key companies include Chubb Ltd, Allianz SE, Zurich Insurance Group AG, EFCIS Limited, Bridge Insurance Brokers, Credit Man, Thomas Carroll Group Plc, Sace Simest, UK Export Finance, and ICBA Trade Finance.

Need help to buy this report?