Global Wheat Starch Market Size, Share, and COVID-19 Impact Analysis, By Type (Native, Modified, and Clean Label), By End-use (Food Processing Industry, Pharmaceuticals, Textile & Paper, Cosmetics, Animal Feed, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Wheat Starch Market Size Insights Forecasts to 2035

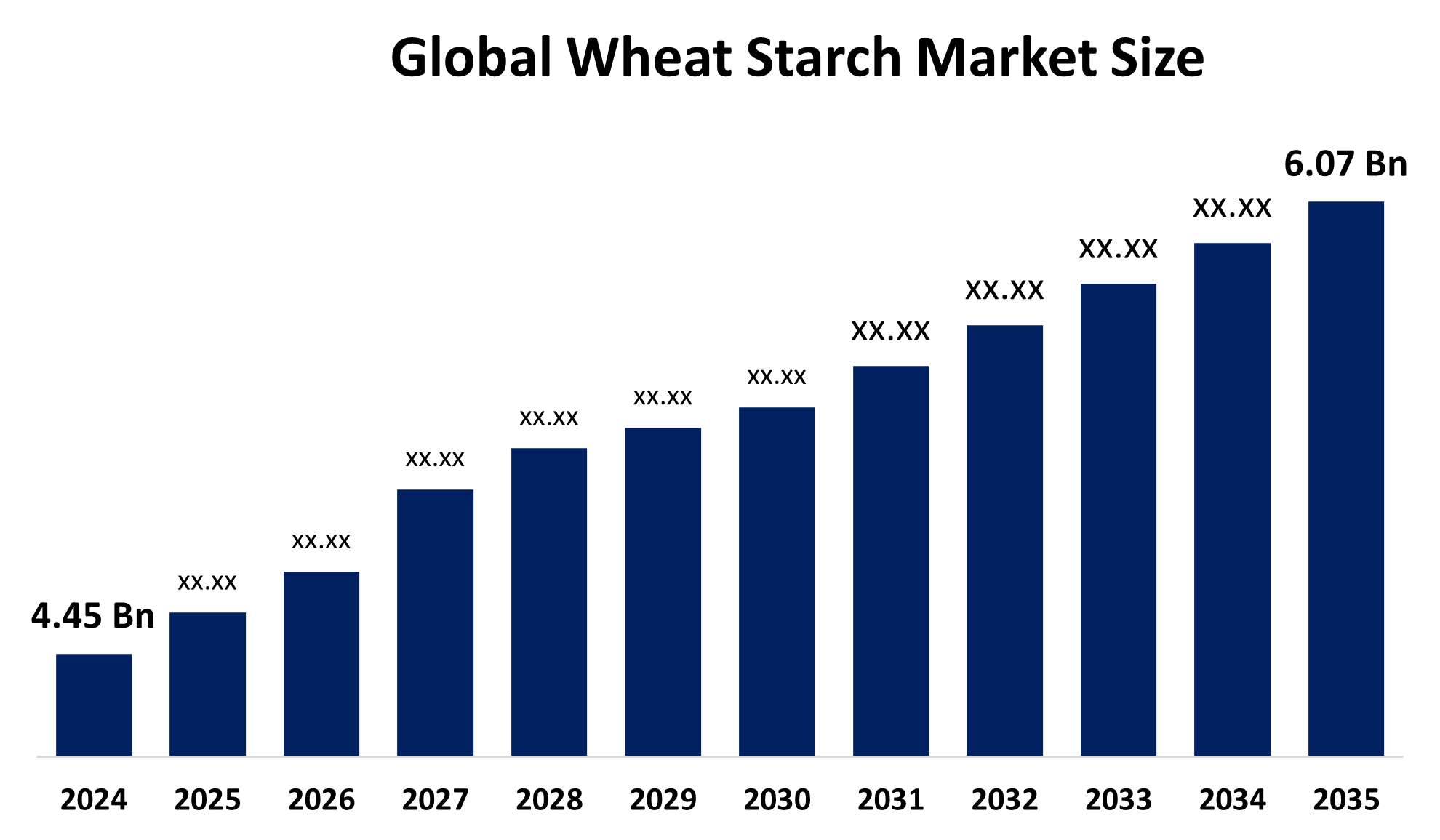

- The Global Wheat Starch Market Size Was Estimated at USD 4.45 Billion in 2024

- The Global Wheat Starch Market Size is Expected to Grow at a CAGR of around 2.86% from 2025 to 2035

- The Worldwide Wheat Starch Market Size is Expected to Reach USD 6.07 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Wheat Starch Market Size was worth around USD 4.45 Billion in 2024 and is Predicted to Grow to around USD 6.07 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 2.86% from 2025 to 2035. The global wheat starch market is expanding due to rising consumer interest in processed foods, clean-label products, and gluten-free items. The market is experiencing growth because of its rising application in personal care products, biodegradable packaging solutions and natural thickener and stabiliser functions.

Market Overview

The Global Wheat Starch Market Size refers to the commercial production and consumption of starch extracted from wheat, which people value because of its ability to create thick substances and bind materials, form gels and produce protective films. Wheat starch serves as a major component in food and beverage production for bakery items and confectionery products, and noodle dishes, soups and sauces, while finding applications in non-food sectors, including paper and textiles, pharmaceuticals, cosmetics and adhesives. Processed food demand and convenience food demand, industrial applications and people choosing natural plant-based ingredients drive market growth. The demand for products in the market receives support from the expansion of paper packaging and biodegradable materials, and pharmaceutical production.

On December 8 2025, President Donald J Trump declared that the USDA would deliver $12 billion in one-time bridge payments to American farmers who faced trade disruptions and escalating production expenses. The support will assist farmers until the One Big Beautiful Bill Act establishes new reference prices for vital commodities on October 1, 2026. The development of clean-label food products, bio-based chemicals and sustainable packaging solutions creates business opportunities in emerging economies. The global wheat starch market includes Cargill Incorporated and Archer Daniels Midland Company, Tereos Group, Roquette Freres, Agrana Beteiligungs AG, and Manildra Group as main competitors who use capacity expansion, product innovation and strategic partnerships to build their market presence.

Report Coverage

This research report categorizes the wheat starch market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wheat starch market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the wheat starch market.

Global Wheat Starch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.45 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.86% |

| 2035 Value Projection: | USD 6.07 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | Cargill, Incorporated, Tereos Group, Roquette Freres, Archer Daniels Midland Company (ADM), Manildra Group, Beneo GmbH, Tate & Lyle PLC, Ingredion Incorporated, Kroner-Starke GmbH, Avebe U.A., Pruthvi Foods, Crespel & Dieters GmbH, Fengchen Group, Agrana Beteiligungs AG and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Global Wheat Starch Market Size develops because the food industry needs clean-label plant-based non-GMO functional ingredients, which wheat starch provides as a vital ingredient that thickens and stabilizes and improves the texture of baked goods, packaged food and ready-to-eat products. The demand in emerging economies, particularly in the Asia-Pacific region, grows because of rapid urbanization, new eating patterns and higher demand for ready-to-eat meals. The increasing use of modified wheat starch in pharmaceuticals and cosmetics, and sustainable packaging through bioplastics, leads to market growth. The market expands because consumers prefer gluten-free products that maintain high quality.

Restraining Factors

The Global Wheat Starch Market Size experiences major limitations through three obstacles, which include high, unstable raw material prices, strong competition from inexpensive corn and tapioca products and growing consumer interest in gluten-free items. The market experiences growth limitations through supply chain interruptions and strict food safety laws, and the risk of allergenic reactions, which affect particular market segments.

Market Segmentation

The wheat starch market share is classified into type and application.

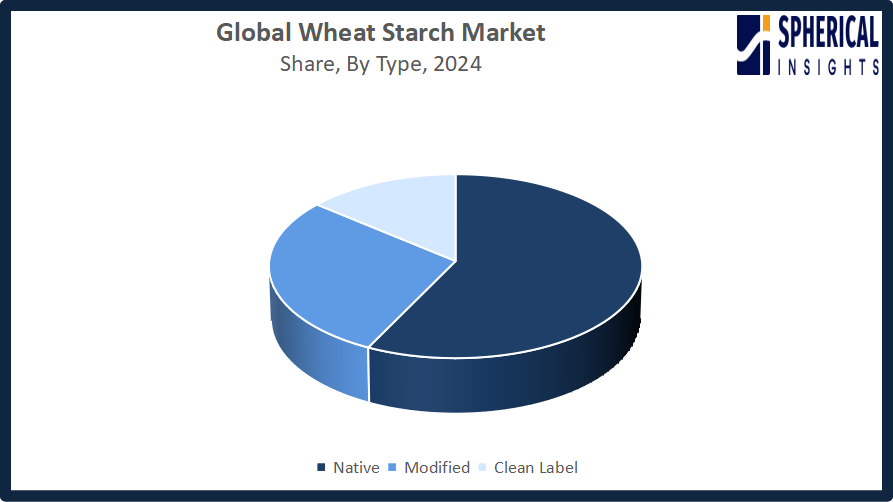

- The native segment dominated the market in 2024, approximately 57% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the Global Wheat Starch Market Size is divided into native, modified, and clean label. Among these, the native segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment expanded because wheat starch originates from nature and serves multiple functions, which include thickening, stabilizing, and texturizing food products. Native wheat starch serves as the optimal choice for clean-label organic and natural products because it delivers consistent results for baking and sauce preparation, and dairy production. The food processing industry experiences ongoing growth because consumers prefer minimally processed ingredients, which match current regulatory requirements.

Get more details on this report -

- The food processing industry segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the Global Wheat Starch Market Size is divided into food processing industry, pharmaceuticals, textile & paper, cosmetics, animal feed, and other. Among these, the food processing industry segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food processing industry segment achieved the highest market growth because consumers increased their demand for convenient processed foods while they consumed more bakery and confectionery and snack products, and preferred clean-label ingredients. Wheat starch gained wider use in various food products because its functional properties enabled it to serve as a thickener, stabiliser, and texture enhancer.

Regional Segment Analysis of the Wheat Starch Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the wheat starch market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Global Wheat Starch Market Size over the predicted timeframe. The wheat starch market will see its 40% market share from the Asia Pacific region because food processing, pharmaceutical and paper industries demand natural, clean-label products. The market experiences growth because urban development progresses and people in China, India and Japan acquire more money and show rising interest in processed foods. The adoption of starch-based applications increases through government programs, factory growth, and funding support. India’s 2025–26 fiscal policy increased agricultural budgets, introduced higher minimum support prices, digital farmer tools, and expanded procurement frameworks, which stabilized cereal production and strengthened the wheat value chain and supported downstream industries such as starch processing.

North America is expected to grow at a rapid CAGR in the Global Wheat Starch Market Size during the forecast period. The wheat starch market in North America will experience rapid growth, with an approximate 23% share, because food processing, bakery, and pharmaceutical companies need more of their products. The United States and Canada are key contributors because consumers prefer clean-label and natural ingredients while processed food consumption increases and starch processing technology advances. The region experiences market expansion through government policies that support trade and investments in sustainable bio-based solutions.

Europe's wheat starch market shows consistent development because food processing, paper and pharmaceutical sectors require high volumes of wheat starch. The three countries of Germany, France and the UK lead market entry because customers prefer clean-label and natural and organic products. The EU direct payment system and rural development funds and eco-schemes established through CAP 2023-27 provided financial support for cereal production stability in October 2025. The late-2025 reforms created easier environmental compliance requirements while providing higher financial support to small farms, which resulted in less regulatory work and increased agricultural productivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wheat starch market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Tereos Group

- Roquette Freres

- Archer Daniels Midland Company (ADM)

- Manildra Group

- Beneo GmbH

- Tate & Lyle PLC

- Ingredion Incorporated

- Kroner-Starke GmbH

- Avebe U.A.

- Pruthvi Foods

- Crespel & Dieters GmbH

- Fengchen Group

- Agrana Beteiligungs AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Manildra Group USA celebrates its 50th anniversary as a leading producer and distributor of vital wheat gluten, wheat starches, and wheat proteins. Marking five decades of innovation, growth, and partnerships, the company continues to play a pivotal role in the grain and food ingredient industry.

- In December 2024, Punjab Agricultural University (PAU) launched PBW Biscuit 1, a new wheat variety designed for nutritious ‘atta’ biscuits. Inspired by Punjab’s love for these biscuits, the variety aims to enhance the agriculture-based industry, supporting farmers and boosting production for value-added baked products in the region.

- In November 2023, Amber Wave announced the start of production at what is set to become North America’s largest wheat protein facility in Phillipsburg, Kansas. Backed by Summit Agricultural Group, the state-of-the-art plant features advanced milling, wheat protein extraction, renewable biofuels, a 27,500-cwt flour mill, and grain storage silos.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Wheat Starch Market Size based on the below-mentioned segments:

Global Wheat Starch Market, By Type

- Native

- Modified

- Clean Label

Global Wheat Starch Market, By End-use

- Food Processing Industry

- Pharmaceuticals

- Textile & Paper

- Cosmetics

- Animal Feed

- Other

Global Wheat Starch Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the wheat starch market over the forecast period?The global wheat starch market is projected to expand at a CAGR of 2.86% during the forecast period.

-

2.What is the global wheat starch market?The global wheat starch market involves the production and use of wheat-derived starch in food, industrial, pharmaceutical, and paper applications worldwide.

-

3.What is the market size of the wheat starch market?The global wheat starch market size is expected to grow from USD 4.45 billion in 2024 to USD 6.07 billion by 2035, at a CAGR of 2.86% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the wheat starch market?Asia Pacific is anticipated to hold the largest share of the wheat starch market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global wheat starch market?Cargill, Incorporated, Tereos Group, Roquette Freres, Archer Daniels Midland Company (ADM), Manildra Group, Beneo GmbH, Tate & Lyle PLC, Ingredion Incorporated, Kroner-Starke GmbH, Avebe U.A., and Others.

-

6.What factors are driving the growth of the wheat starch market?The drivers include soaring demand for processed/ready-to-eat foods, the clean-label trend, rising applications in pharmaceuticals and animal feed, increased adoption of biodegradable packaging, and versatility in enhancing food textures.

-

7.What are the market trends in the wheat starch market?Key trends include rising demand for gluten-free/clean-label products, increased use in sustainable biofuels, and technological advancements improving processing and functionality.

-

8.What are the main challenges restricting wider adoption of the wheat starch market?The challenges restricting the wheat starch market include high raw material price volatility, competition from cheaper alternatives (corn/tapioca), perceived gluten sensitivity, and stringent regulatory standards for clean-label products.

Need help to buy this report?