Global Wheat and Rice Flour Substitute-Resistant Starch Market Size, Share, and COVID-19 Impact Analysis, By Source (Fruits & Nuts, Grains, Vegetables, Cereal Food, Beans & Legumes, and Others), By Application (Bakery Products, Confectionery, Beverages, Breakfast Cereals, Pasta & Noodles, Dairy Products, Nutrition Bars, Meat & Processed Food, Meat Substitutes, Soup, Dressings, & Condiments, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Wheat & Rice Flour Substitute-Resistant Starch Market Insights Forecasts To 2035

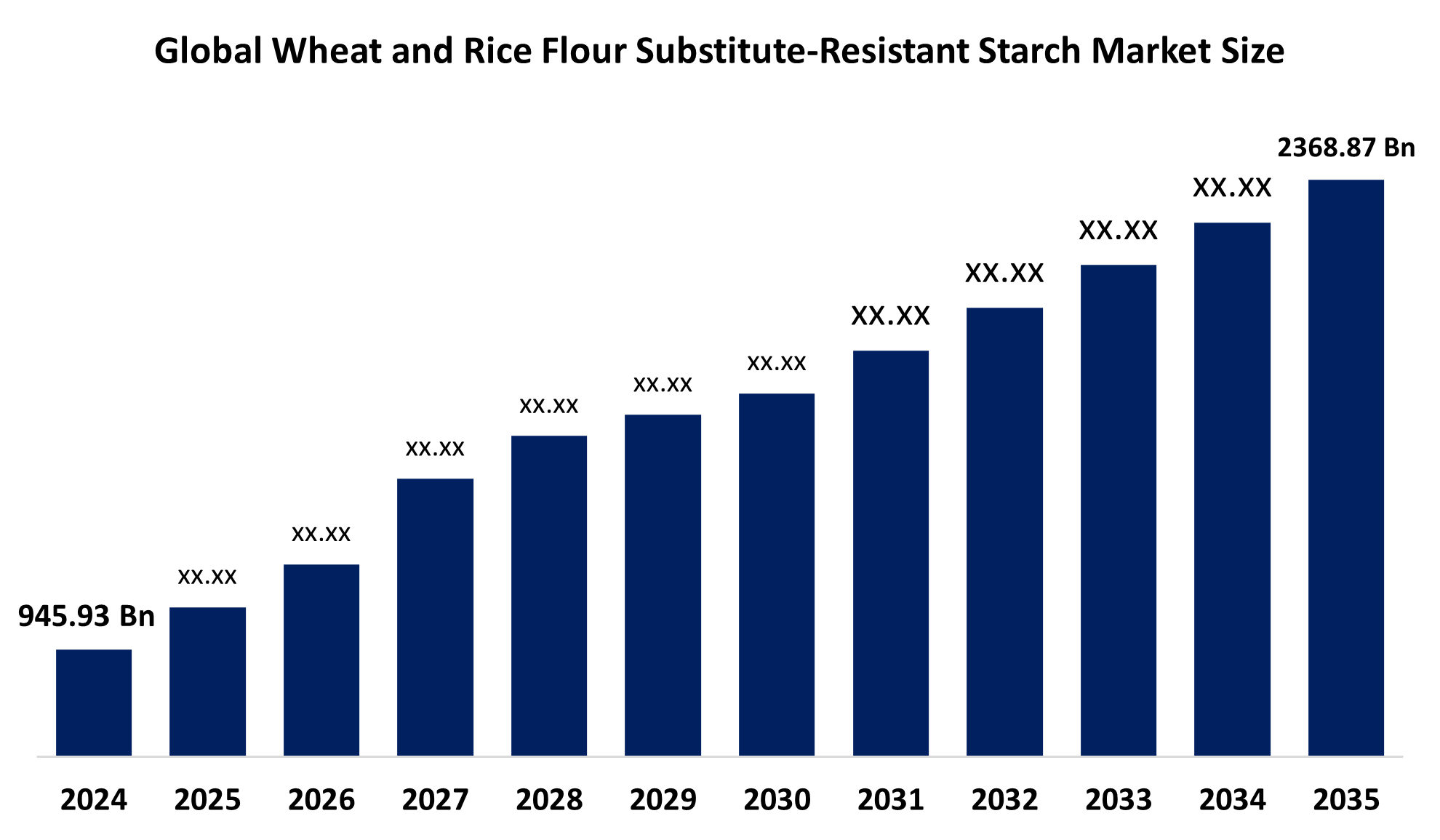

- The Global Wheat & Rice Flour Substitute-Resistant Starch Market Size Was Estimated at USD 945.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.7% from 2025 to 2035

- The Worldwide Wheat & Rice Flour Substitute-Resistant Starch Market Size is Expected to Reach USD 2368.87 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Wheat & Rice Flour Substitute-Resistant Starch Market Size was worth around USD 945.93 Billion in 2024 and is Predicted To Grow to around USD 2368.87 Billion by 2035 with a compound annual growth rate (CAGR) of 8.7% from 2025 to 2035. The resistant starch market for wheat and rice flour substitutes is increasing due to consumers are increasingly seeking healthier, high-fiber alternatives to conventional flours. Increased awareness of health and worries about obesity, metabolic disease, and chronic disease drive it. Companies are developing functional, gluten-free ingredients in response, leveraging clean-label consumer attitudes and the established health effects of resistant starch.

Global Wheat & Rice Flour Substitute-Resistant Starch Market Forecast and Revenue Outlook

- 2024 Market Size: USD 945.93 Billion

- 2035 Projected Market Size: USD 2368.87 Billion

- CAGR (2025-2035): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The resistant starch market for wheat and rice flour alternatives refers to the manufacture and use of resistant starches, which function as dietary fiber. The resistant starches are made into a healthier substitute compared to normal wheat and rice flours to be used in various foods such as baked goods, snacks, pasta, cereals, and gluten-free foods. Resistant starch is launched with multiple health benefits, such as improved gut health, enhanced blood sugar control, and enhanced satiety, all of which have resulted in its appeal to health-aware consumers. Market growth is driven by increasing interest in metabolic health, diabetes, obesity, and low-glycemic, high-fiber food choices.

The opportunities in the market are vast in the gluten-free, diabetes food, and functional food industries, especially in the developing world with growing health complications and dietary consumption patterns. Leading players in the market are Cargill, Ingredion, Tate & Lyle, and Roquette, which invest heavily in R&D for manufacturing clean-label and functional resistant starch. Government initiatives promoting the consumption of dietary fiber, nutritional labeling of food, and healthy eating contribute to increasing the market growth. To counteract the disruption of the global supply chain, South Korea's MAFRA will substitute 10% of wheat flour demand with rice flour by 2027, with a view to improving food security and reducing reliance on wheat imports.

Key Market Insights

- North America is expected to account for the largest share in the wheat & rice flour substitute-resistant starch market during the forecast period.

- In terms of source, the grains segment is projected to lead the wheat & rice flour substitute-resistant starch market throughout the forecast period

- In terms of application, the bakery products segment captured the largest portion of the market

Wheat & Rice Flour Substitute-Resistant Starch Market Trends

- Increasing popularity of gluten-free and low-GI foods boosts resistant starch market growth.

- Rising health awareness is driving demand for fiber-rich wheat and rice flour substitutes.

- Clean-label and natural ingredient trends encourage innovation in resistant starch products.

- Manufacturers are developing functional starches to enhance gut health and metabolic benefits.

- Expansion in processed and convenience foods fuels resistant starch adoption.

Report Coverage

This research report categorizes the wheat & rice flour substitute-resistant starch market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the wheat & rice flour substitute-resistant starch market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wheat & rice flour substitute-resistant starch market.

Global Wheat and Rice Flour Substitute-Resistant Starch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 945.93 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.7% |

| 2035 Value Projection: | USD 2368.87 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Application, By Region |

| Companies covered:: | Ingredion Inc., Cargill, Incorporated, Tate & Lyle PLC, Emsland Group, Puris, Roquette Freres, MSP Starch Products, ADM (Archer Daniels Midland), The Scoular Company, Lodaat Pharmaceuticals, MGP Ingredients, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factors

The demand for wheat & rice flour substitute, resistant starch comes from growing consumer demand for health-oriented food, functional ingredients, and convenient foods. Consumer demand for health-oriented food is driven by rising awareness of conditions such as obesity, diabetes, and digestive well-being. Demand for functional ingredients invites manufacturers to utilize resistant starch due to its advantages, including enhanced gut well-being and blood sugar regulation. In addition, consumers look for convenient foods that fit busy lifestyles, so ready meals or pre-cooked foods with health benefits are becoming popular in international markets.

Restraining Factor

The wheat and rice flour substitute resistant starch market is mainly restricted by expensive production, complex processing needs, and undesirable effects on food texture. The high cost restricts mass usage since resistant starch creation and acquisition costs more than conventional flours. Sophisticated processing necessitates advanced technology, raising manufacturing complexities. Negative aspects of food texture can influence consumer acceptance since certain formulations can change taste or mouthfeel.

Market Segmentation

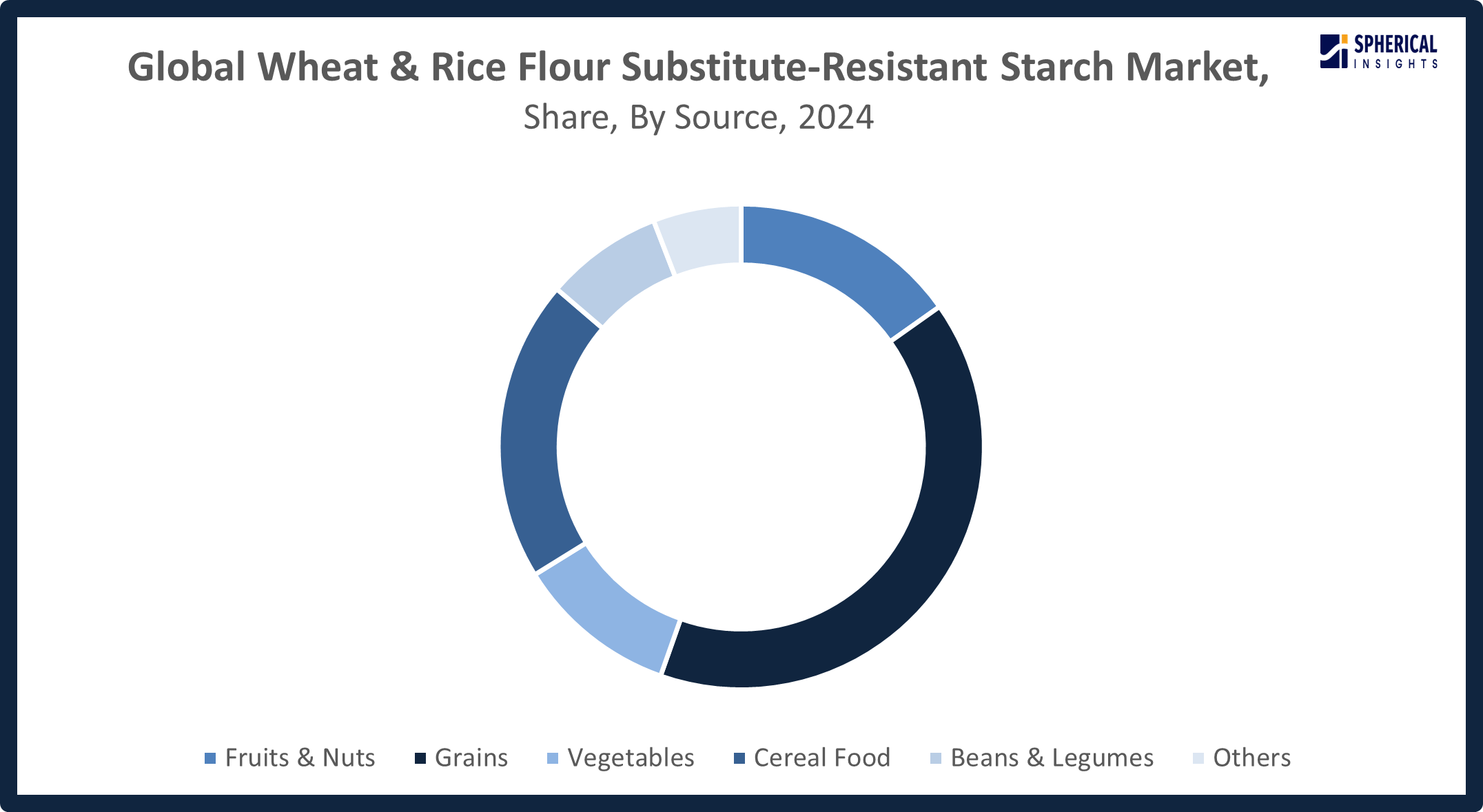

The global wheat & rice flour substitute-resistant starch market is divided into source and application.

Global Wheat & Rice Flour Substitute-Resistant Starch Market, By Source:

- The grains segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on source, the global wheat & rice flour substitute-resistant starch market is segmented into fruits & nuts, grains, vegetables, cereal food, beans & legumes, and others. Among these, the grains segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The grains segment dominated market share due to the extensive availability, price competitiveness, and high resistant starch composition of grains such as wheat, corn, and rice. They are also highly versatile in food uses and have strong consumer acceptability towards grain-based foods, which contributes to segment growth.

Get more details on this report -

The cereal food segment in the wheat & rice flour substitute-resistant starch market is expected to grow at the fastest CAGR over the forecast period. The cereal food segment will expand the most, owing to the increasing demand for convenient, high-fiber breakfast foods and resistant starch, enhancing the nutrition, texture, and shelf life of cereal foods.

Global Wheat & Rice Flour Substitute-Resistant Starch Market, By Application:

- The bakery products segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global wheat & rice flour substitute-resistant starch market is segmented into bakery products, confectionery, beverages, breakfast cereals, pasta & noodles, dairy products, nutrition bars, meat & processed food, meat substitutes, soup, dressings, & condiments, and others. Among these, the bakery products segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The bakery products segment had the majority share attributed to greater consumer demand for healthier, fiber-enriched baked foods. Resistant starch enhances nutrition, texture, and shelf life of applications such as bread, cookies, and muffins, which would fit with clean-label trends and increased health awareness.

The meat substitutes segment in the wheat & rice flour substitute-resistant starch market is expected to grow at the fastest CAGR over the forecast period. Meat substitutes are the market segment that is expanding rapidly, with increased demand for plant-based diets, and resistant starch for improving texture, water retention, and nutritional content in vegan and vegetarian foods.

Regional Segment Analysis of the Global Wheat & Rice Flour Substitute-Resistant Starch Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Wheat & Rice Flour Substitute-Resistant Starch Market Trends

North America is expected to hold the largest share of the global wheat & rice flour substitute-resistant starch market over the forecast period.

Get more details on this report -

North America dominates the global wheat and rice flour substitute-resistant starch market, attributed to the rising consumer health awareness, growth in demand for gluten-free and clean-label options, and broader applications in the food and beverage sectors. Strong research and development investments, coupled with supportive government policies encouraging healthy food options, are fuelling market growth within this region. Strong supply chains and sophisticated manufacturing facilities further enhance market leadership.

U.S. Wheat & Rice Flour Substitute-Resistant Starch Market Trends

The US wheat and rice flour substitute-resistant starch market is expanding owing to growing demand for gluten-free and clean-label foods, health consciousness, new starch sources, and increasing applications in functional foods.

Asia Pacific Wheat & Rice Flour Substitute-Resistant Starch Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the wheat & rice flour substitute-resistant starch market during the forecast period. Asia Pacific is rapidly growing due to the market for wheat and rice flour substitute-resistant starch, due to rising health concerns, and growing demand for gluten-free and functional foods. Consumer expenditures on healthier products are being driven by rapid urbanization and rising disposable incomes. Moreover, increasing food processing industries and advancements in starch modification are driving product availability. The huge population base of the region and shifting consumption habits towards low-calorie, high-fiber food also fuel the market growth. The government's push for agricultural innovations and clean-label products also plays a huge role in the market's growth.

India Wheat & Rice Flour Substitute-Resistant Starch Market Trends

India's market for wheat and rice flour substitute-resistant starch is expanding fast with increasing health awareness, demand for gluten-free and low-glycemic foods, government encouragement for millet-based foods, and developments in starch derivatives fueling greater use by the food industry.

China Wheat & Rice Flour Substitute-Resistant Starch Market Trends

China's market for wheat and rice flour substitute-resistant starch increases due to rising demand for processed foods, consumer health awareness, and the quest for low-glycemic, high-fiber content. Increasing emphasis on substitute grains, as well as continuous innovation by industry participants and widening production capacity in the country, further propels this growth.

Japan Wheat & Rice Flour Substitute-Resistant Starch Market Trends

Japan's resistant starch market is being fueled by high demand for healthy, functional food ingredients within its convenience and processed food industry, particularly in cereal foods. Increasing consumer interest in dietary supplements and gut health-supporting products also drives the growth of this market, driving demand for novel, clean-label solutions from various starch sources.

Europe Wheat & Rice Flour Substitute-Resistant Starch Market Trends

Europe's wheat & rice flour substitute-resistant starch market expands due to increased consumer demand for healthier, gluten-free, and clean-label food, driven by health awareness and growing lifestyle disease awareness. Companies react by innovating their products and expanding production capacity for ingredients such as corn and pea starch to serve the processed foods industry and shifting dietary trends towards functional, nutrient-dense alternatives.

Germany Wheat & Rice Flour Substitute-Resistant Starch Market Trends

Germany's wheat & rice flour alternative market expands with the growing health awareness, demand for functional foods, and demand for high-fiber intake, especially in bakery and processed food segments, propelling demand for resistant starch as a functional ingredient with multiple applications in Germany and the overall European market.

France Wheat & Rice Flour Substitute-Resistant Starch Market Trends

France's resistant starch market expands owing to the rising health awareness, a move towards clean-label, plant-based products, and healthier processed food. Expansion is also evident in certain applications, such as functional bread and cereal products and sports nutrition, driven by innovation and supportive regulatory environments for gut health benefits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wheat & rice flour substitute-resistant starch market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Wheat & Rice Flour Substitute-Resistant Starch Market Include

- Ingredion Inc.

- Cargill, Incorporated

- Tate & Lyle PLC

- Emsland Group

- Puris

- Roquette Freres

- MSP Starch Products

- ADM (Archer Daniels Midland)

- The Scoular Company

- Lodaat Pharmaceuticals

- MGP Ingredients

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In November 2024, Tate & Lyle introduced a new range of sweetener and stabilizer solutions for the Middle Eastern market, including non-GMO EUOLIGO FOS and TASTEVA M, enhancing taste, texture, nutrition, and delivering improved mouthfeel with a clean flavor for better sensory experiences.

- In September 2024, Ingredion Incorporated announced the APAC launch of FIBERTEX CF 500 and CF 100, multi-benefit citrus fibers offering enhanced texturizing properties and clean label solutions for consumer-preferred food and beverage products.

- In August 2024, Emsland Group launched Emvision 2030, a plan focused on advanced modified starch production through innovation, significant investment, innovative engineering, and sustainability, addressing evolving food and specialty industry customer needs globally.

- In February 2024, Ingredion Incorporated launched NOVATION Indulge 2940 starch, the first non-GMO functional native corn starch offering unique gelling and co-texturizing for dairy and alternative dairy products, expanding their clean-label texturizer ingredient line.

- In June 2022, Ingredion Incorporated launched its first waxy rice-based texturizing solutions made from sustainably farmed rice, meeting consumer demand for sustainable products while delivering flavor, color, texture, and brand differentiation for manufacturers.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wheat & rice flour substitute-resistant starch market based on the following segments:

Global Wheat & Rice Flour Substitute-Resistant Starch Market, By Source

- Fruits & Nuts

- Grains

- Vegetables

- Cereal Food

- Beans & Legumes

- Others

Global Wheat & Rice Flour Substitute-Resistant Starch Market, By Application

- Bakery Products

- Confectionery

- Beverages

- Breakfast Cereals

- Pasta & Noodles

- Dairy Products

- Nutrition Bars

- Meat & Processed Food

- Meat Substitutes

- Soup, Dressings, & Condiments

- Others

Global Wheat & Rice Flour Substitute-Resistant Starch Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the wheat & rice flour substitute-resistant starch market over the forecast period?The global wheat & rice flour substitute-resistant starch market is projected to expand at a CAGR of 8.7% during the forecast period

-

2. What is the market size of the wheat & rice flour substitute-resistant starch market?The global wheat & rice flour substitute-resistant starch market size is expected to grow from USD 945.93 billion in 2024 to USD 2368.87 billion by 2035, at a CAGR 8.7% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the wheat & rice flour substitute-resistant starch market?North America is anticipated to hold the largest share of the wheat & rice flour substitute-resistant starch market over the predicted timeframe.

-

4. What factors are driving the growth of the wheat & rice flour substitute-resistant starch market?The wheat & rice flour substitute-resistant starch market is growing due to increasing consumer demand for healthier, high-fiber, and convenient processed foods, combined with the clean-label trend for natural ingredients such as potato and corn-based starches.

-

5. What are the main challenges restricting wider adoption of the wheat & rice flour substitute-resistant starch market?High production costs, limited consumer awareness, texture differences, regulatory hurdles, and supply chain complexities restrict the wider adoption of resistant starch substitutes.

-

6. What are market trends in the wheat & rice flour substitute-resistant starch market?Market trends include strong demand from the booming packaged/processed food sector, growth in clean-label and non-GMO ingredients, and rapid expansion in the Asia Pacific.

-

7. Who are the top 10 companies operating in the global wheat & rice flour substitute-resistant starch market?The major players operating in the wheat & rice flour substitute-resistant starch market are Ingredion Inc., Cargill, Incorporated, Tate & Lyle PLC, Emsland Group, Puris, Roquette Freres, MSP Starch Products, ADM (Archer Daniels Midland), The Scoular Company, Lodaat Pharmaceuticals, MGP Ingredients, and Others.

Need help to buy this report?