Global Wet Waste Management Market Size By Service (Collection & Transportation, Disposal & landfill, Processing, Sorting), By Source (Industrial, Municipal, Commercial), By Geographic Scope And Forecast, 2022 – 2032

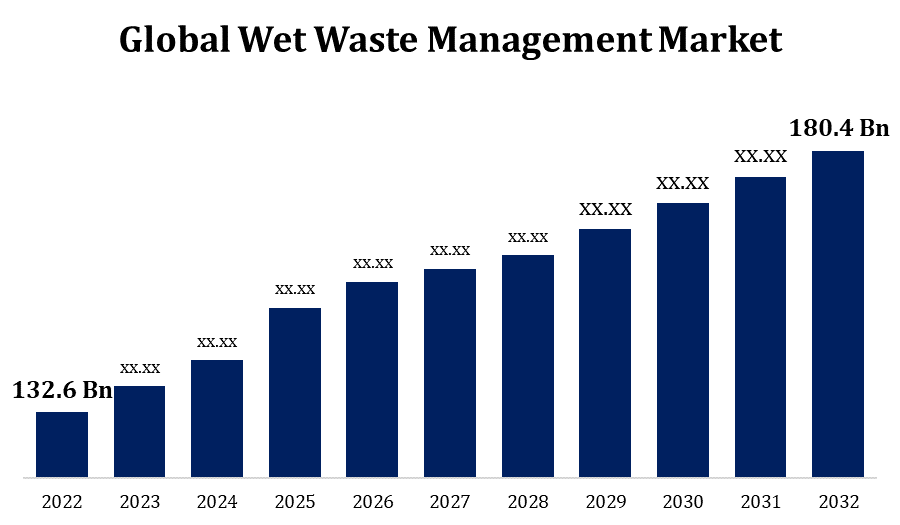

Industry: Chemicals & MaterialsGlobal Wet Waste Management Market Size to grow from USD 132.6 billion in 2022 to USD 180.4 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period.

The collecting, handling, treatment, and disposal of organic waste materials that are biodegradable in nature are referred to as "wet waste management," sometimes known as "organic waste management" or "biodegradable waste management." Kitchen scraps, leftover food, garden garbage, and other organic items that can naturally decay make up the majority of these wastes. The need for wet waste management services has been fuelled by rising concerns about environmental sustainability, the effect of organic waste on landfills, and greenhouse gas emissions. The effectiveness of wet waste management has increased as a result of improvements in garbage sorting and processing technology. These innovations include anaerobic digesters, automated sorting systems, and biogas production machinery. A variety of public and private sector entities, including waste management companies, recycling businesses, composting facilities, and technology providers, are present in the wet waste management industry. Innovation and better service options have resulted from the sector's competition. Urban population growth is causing an increase in organic waste production, including food scraps and kitchen garbage. The demand for wet waste collection and management solutions is being driven by this development.

Get more details on this report -

the Global Wet Waste Management Market Size to grow from USD 132.6 billion in 2022 to USD 180.4 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period

Impact of COVID 19 On Global Wet Waste Management Market

People spent more time at home due to lockdowns and restrictions, which increased the production of household wet waste such food scraps and kitchen garbage. The need for domestic waste collection services increased as a result. In contrast, operations at enterprises, eateries, lodgings, and institutions were curtailed or shut down during lockdowns, which reduced the production of commercial wet waste. This had an effect on waste management businesses that heavily relied on contracts for the collection of commercial garbage. The pandemic interrupted waste management equipment and material supply networks, making it difficult for businesses to get the resources they need to run their operations. Personal protective equipment (PPE), medical waste, and waste related to healthcare all increased as a result of the epidemic. This needed unique handling and disposal techniques.

Global Wet Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 132.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.3% |

| 2032 Value Projection: | USD 180.4 Billion |

| Historical Data for: | 2017-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Source and COVID 19 Impact |

| Companies covered:: | Waste Management Inc., Clean Harbors Inc., Progressive Waste Solution Ltd., Veolia Environment S.A., Suez Environment, Stericycle, Advanced Disposal, Covanta, Remondis SE & Co. Kg, Republic Services, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Dynamics

Wet Waste Management Market Dynamics

Increasing awareness of wet waste management

Better garbage collection and disposal services are in demand as more people become aware of the advantages of good wet waste management for the environment and their health. Businesses, restaurants, hotels, and other establishments may actively seek out trash management firms that provide environmentally friendly and sustainable solutions. The desire to adopt sustainable practises and a sense of responsibility are fostered through awareness. People and organisations can take proactive measures to cut down on food waste, compost, and separate organic waste from other waste streams. The need for the technologies and services that support these practises may rise as a result. Growing industry innovation may be sparked by problems with wet waste management. Businesses may invest in creating and providing cutting-edge technologies and solutions for composting, biogas production, and organic waste collection. As more effective and environmentally friendly solutions become available, this invention may boost the market.

Restraints & Challenges

Shortage of landfill locations affects the market

Garbage management organisations must carry wet garbage over greater distances to available dump sites when landfill space is scarce and far away. The entire cost of wet waste management services rises as a result of greater transportation costs, which may then be passed on to customers. The operational effectiveness of waste management operations might be decreased by longer transportation distances. The collection, transportation, and disposal of wet garbage may take more time and resources, which could reduce waste management firms' productivity. For garbage management and collection organisations, the lack of dumping sites might present practical difficulties. They could have to plan more regularly for garbage disposal visits, which could cause service interruptions or delays.

Regional Forecasts

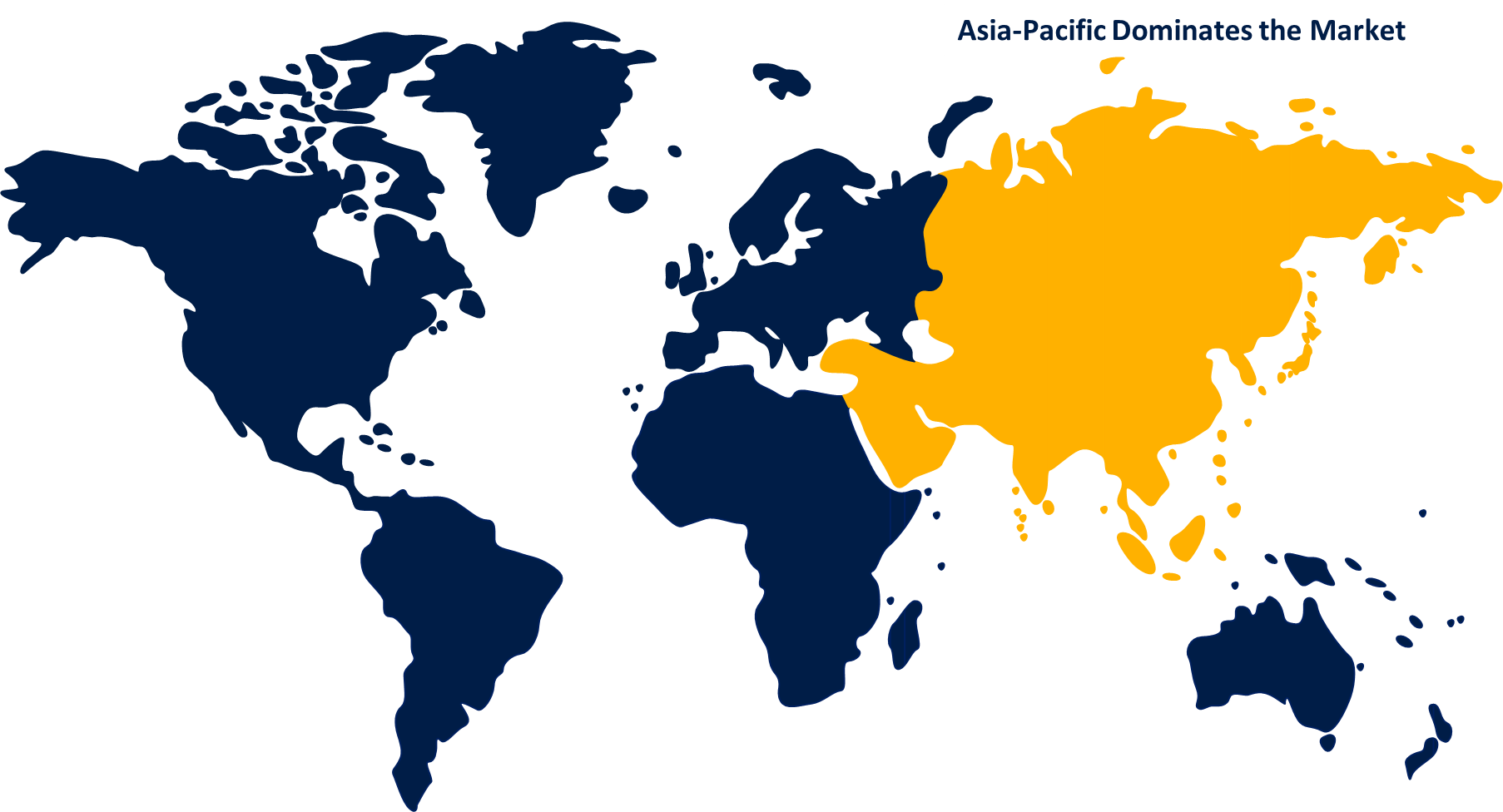

Asia Pacific Market Statistics

Get more details on this report -

Asia Pacific is anticipated to dominate the Wet Waste Management market from 2023 to 2032. Some of the countries with the highest population densities on earth are found in the APAC area. There is a rise in trash production as a result of population development and rapid urbanisation, including substantial amounts of moist waste from homes and businesses. Regulations for waste management, particularly the appropriate handling and disposal of wet waste, have been created or improved in many APAC nations. Reducing landfilling and promoting recycling and composting are the goals of these policies. Innovative wet waste management techniques have been adopted in the APAC region, including the creation of large-scale composting facilities and the manufacture of biogas from organic waste. Significant investment has been made in the waste management business in the APAC area, including money for infrastructure development, technology adoption, and capacity expansion.

North America Market Statistics

North America is witnessing the fastest market growth between 2023 to 2032. Regulations controlling waste management, especially the treatment and disposal of wet waste, are well-established in North America, particularly in the United States and Canada. The purpose of these restrictions is to increase recycling and composting while reducing landfilling. Biogas facilities that turn organic waste into sustainable energy sources like electricity or natural gas have been built in a few areas of North America. These initiatives support the creation of clean energy as well as trash management. Waste management enterprises offer their services to municipalities and businesses, which is a substantial contribution from the private sector to North American waste management. Problems with garbage management are frequently addressed through public-private partnerships.

Segmentation Analysis

Insights by Service

The processing segment accounted for the largest market share over the forecast period 2023 to 2032. Composting is a popular technique for handling organic waste. Composting facilities turn wet waste into nutrient-rich compost, which is then utilised in landscaping and agriculture as a soil conditioner and fertiliser. Composting facilities are expanding as a result of rising consumer demand for sustainable and organic farming methods. The resource recovery component of the processing segment emphasises the extraction of valuable components, energy, and nutrients from wet waste. This strategy adheres to the tenets of the circular economy, in which trash is seen as a resource to be used. Public and corporate investments in wet waste processing have been drawn by growing awareness of environmental issues and sustainability. As a result of these expenditures, the market will rise as new facilities and technologies are developed.

Insights by Source

The municipal waste segment accounted for the largest market share over the forecast period 2023 to 2032. Greater amounts of municipal garbage, especially wet waste, are produced as a result of rising population and urbanisation rates. There is an increasing need for efficient waste management services as cities grow and urban populations rise. The separation of organic waste from other waste streams is being encouraged by municipalities through waste diversion programmes. To manage this segregated organic material, facilities for composting and anaerobic digestion have been constructed. Participating in wet waste diversion programmes is convenient for residents because many municipalities provide curbside pickup services for organic trash. This strategy promotes increased participation and source-based trash sorting. Municipalities are making investments in the infrastructure needed to process garbage, including composting plants, anaerobic digestion facilities, and waste-to-energy initiatives. The ability to manage wet waste more effectively is improved by these efforts.

Recent Market Developments

- In January 2022, Veolia declared that the sale of the new Suez to the consortium of investors made up of Meridiam, GIP, CDC Group, and CNP Assurances had been successfully completed.

Competitive Landscape

Major players in the market

- Waste Management Inc.

- Clean Harbors Inc.

- Progressive Waste Solution Ltd.

- Veolia Environment S.A.

- Suez Environment

- Stericycle

- Advanced Disposal

- Covanta

- Remondis SE & Co. Kg

- Republic Services, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Wet Waste Management Market, Service Analysis

- Collection & Transportation

- Disposal & landfill

- Processing

- Sorting

Wet Waste Management Market, Source Analysis

- Industrial

- Municipal

- Commercial

Wet Waste Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Wet Waste Management Market?The global Wet Waste Management Market is expected to grow from USD 132.6 Billion in 2023 to USD 180.4 Billion by 2032, at a CAGR of 5.3% during the forecast period 2023-2032.

-

Who are the key market players of the Wet Waste Management Market?Some of the key market players of market are Waste Management Inc., Clean Harbors Inc., Progressive Waste Solution Ltd., Veolia Environment S.A., Suez Environment, Stericycle, Advanced Disposal, Covanta, Remondis SE & Co. Kg, Republic Services, Inc.

-

Which segment holds the largest market share?The municipal segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the Wet Waste Management Market?Asia Pacific is dominating the Wet Waste Management Market with the highest market share

Need help to buy this report?