Global Wealth Management Platform Market Size, Share, and COVID-19 Impact Analysis, By Advisory Model (Human Advisory, Robo Advisory, and Hybrid), By Business Function (Portfolio Accounting & Trading Management, Performance Management, Risk & Compliance Management, Reporting, Financial Advice Management, and Others), By End-user (Trading & Exchange Firms, Investment Management Firms, Brokerage Firms, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Information & TechnologyGlobal Wealth Management Platform Market Insights Forecasts to 2033.

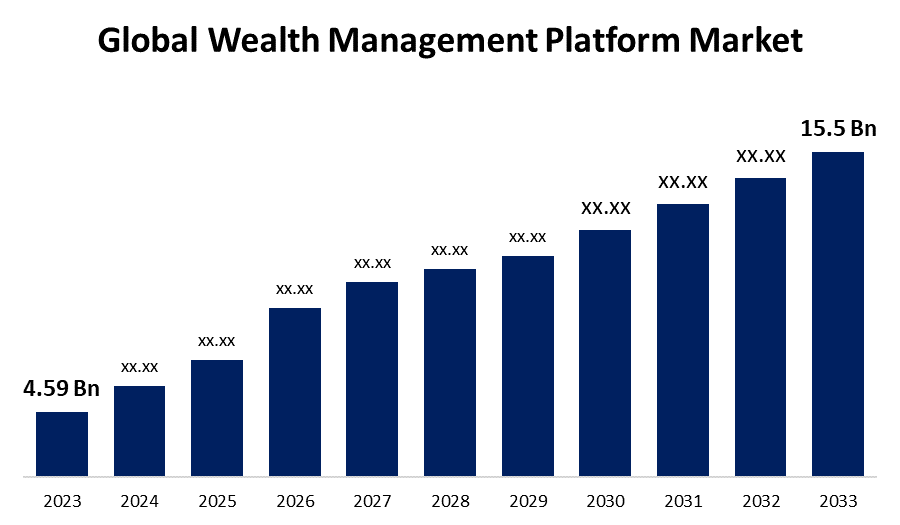

- The Global Wealth Management Platform Market Size was Valued at USD 4.59 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.9% from 2023 to 2033.

- The Worldwide Wealth Management Platform Market Size is Expected to Reach USD 15.5 Billion by 2033.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Wealth Management Platform Market Size is Anticipated to Exceed USD 15.5 Billion by 2033, Growing at a CAGR of 12.9% from 2023 to 2033.

Market Overview

The wealth management platform is a software that is mainly designed for monitoring and planning financial stats and offers legal advice & tax regulations, property planning, personal expenses, banking service, and investments planning. The wealth management platform is a front-to-mid advising platform, which genuinely offers 360° consumers wealth overview. The global wealth management platform market is expanding due to the growing adoption of digitalization among various sectors and industries as well as increasing focus on system automation by banking institutions establishing workflows to make lives easier for consumers. The wealth management platform provides numerous benefits, including service standardization, increased business process efficiency via system automation, enriched and streamlined business, Omni channel approach, regulatory requirement compliance, and excellent user experience. The growth of the global wealth management platform market is propelled by the mandatory regulations and compliances for wealth management activities by the local and federal governments of economies. Furthermore, most businesses are recasting their efforts towards digital platforms to modernize their operations. The wealth management platform is among the greatest options available to enterprises to properly manage finances and track transaction accounts. Over the projected period, technological evolutions in the industry of artificial intelligence and blockchain are predicted to drive the growth of the global wealth management platform.

Report Coverage

This research report categorizes the market for the global wealth management platform market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global wealth management platform market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global wealth management platform market.

Global Wealth Management Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.59 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.9% |

| 2033 Value Projection: | USD 15.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Advisory Model, By Business Function, By End-user, By Region |

| Companies covered:: | Profile Systems and Software S.A., Prometeia S.p.A, SS&C Technologies Inc., Avaloq (NEC Corporation), Backbase, Tata Consultancy Services Limited, Temenos Headquarters SA., Broadridge Financial Solutions Inc., Comarch SA, Crealogix AG, Fidelity National Information Services Inc., Fiserv Inc., Infosys Limited, SEI Investments Company, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The increase of technological innovations in blockchain and AI will propel the growth of the wealth management platform market. The artificial intelligence system monitors financial stats and provides appropriate suggestions to the user. Blockchain and AI monitor consumers' trends and expenses and provide roughly calculated data based on the monitored information. The wealth management platform offers stable and effective user assistance and suggestions to manage budgets which are calculated by the monitored database. Furthermore, well-increased security and protection of consumer data is a key factor for organizations to build relationships with consumers, which is anticipated to be a major factor in driving the global wealth management platform market.

Restraining Factors

The wealth management platform market will be hampered due to a lack of awareness among the target consumers about the importance and benefits of the wealth management platform. In addition, the lack of professional technical expertise to manage the wealth management platform is a major concern in the growth of the global wealth management platform market. Furthermore, developing customer trust can obstruct market expansion because it takes time for prospective consumers to develop and expose essential details.

Market Segmentation

The Global Wealth Management Platform Market share is classified into advisory model, business function, and end-user

- The human advisory segment is expected to hold the largest share of the global wealth management platform market during the forecast period.

Based on the advisory model, the global wealth management platform market is divided into human advisory, robo advisory, and hybrid. Among these, the human advisory segment is expected to hold the largest share of the global wealth management platform market during the forecast period. This is because financial planning and monitoring are complicated processes that require refined understanding and emotional intelligence qualities that artificial intelligence is unable to deliver. This is the main driver for the growth of the human advisory segment in the global wealth management platform market.

- The portfolio accounting & trading management segment is expected to grow at the fastest pace in the global Wealth Management Platform market during the forecast period.

Based on the business function, the global wealth management platform market is divided into portfolio accounting & trading management, performance management, risk & compliance management, reporting, financial advice management, and others. Among these, the portfolio accounting & trading management segment is expected to grow at the fastest pace in the global wealth management platform market during the forecast period. This is because the portfolio accounting & trading management segment offers to track the performance of individual securities in a stock portfolio and estimate which investment might increase or decrease.

- The banks segment is expected to grow at the greatest pace in the global wealth management platform market during the forecast period.

Based on the end-user, the global wealth management platform market is divided into trading & exchange firms, investment management firms, brokerage firms, banks, and others. Among these, the banks segment is expected to grow at the greatest pace in the global wealth management platform market during the forecast period. This is due to the wide range of the population using mobile banking apps and banking websites from various devices, banks create a large unwanted database that can be used for monitoring and planning financial stats as per consumers' needs. This is the primary factor in the growth of the banks segment in the global wealth management platform market.

Regional Segment Analysis of the Global Wealth Management Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global wealth management platform market over the predicted timeframe.

North America is anticipated to hold the largest share of the global wealth management platform market over the predicted timeframe. This is because the developed financial sector of North America provides fertile ground for wealth management platforms to grow. In addition, in the North American region notable number of high-net-worth individuals might contribute to the growth of the global wealth management platform market. Furthermore, large data and artificial intelligence (AI), which are essential components of contemporary wealth management platforms, are two other technologies whose adoption is most prevalent in North America. In addition, the regional government's implementation of a stringent and well-defined regulatory framework, which promotes confidence in wealth management services, is fueling the market's expansion. Furthermore, North American investors want more from their wealth management platforms since they are more knowledgeable and financially literate. In addition, a robust and resilient economy is supporting market expansion by giving investors and wealth management service providers the required financial stability and trust.

Europe is expected to grow at the fastest pace in the global wealth management platform market during the forecast period. This is because digital technology has disrupted several industries in Europe, leading to the rise of new business models and the collapse of incumbents. Technology-driven business models in wealth management are drawing in new customers and assets. Furthermore, the region is home to several providers of essential wealth management platforms, whose recent investments open up new opportunities in the area. Many small and medium-sized fintech businesses quickly grow their services and clientele by collaborating with aggregators.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global wealth management platform along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Profile Systems and Software S.A.

- Prometeia S.p.A

- SS&C Technologies Inc.

- Avaloq (NEC Corporation)

- Backbase

- Tata Consultancy Services Limited

- Temenos Headquarters SA.

- Broadridge Financial Solutions Inc.

- Comarch SA

- Crealogix AG

- Fidelity National Information Services Inc.

- Fiserv Inc.

- Infosys Limited

- SEI Investments Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, BlackRock and Avaloq (NEC Corporation) collaborated to offer wealth managers integrated technological solutions.

- In January 2023, to increase customer satisfaction and maximize advisory team productivity, Broadridge Financial Solutions Inc. teamed with IG Wealth Management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Wealth Management Platform Market based on the below-mentioned segments:

Global Wealth Management Platform Market, By Advisory Model

- Human Advisory

- Robo Advisory

- Hybrid

Global Wealth Management Platform Market, By Business Function

- Portfolio Accounting & Trading Management

- Performance Management

- Risk & Compliance Management

- Reporting

- Financial Advice Management

- Others

Global Wealth Management Platform Market, By End-user

- Trading & Exchange Firms

- Investment Management Firms

- Brokerage Firms

- Banks

- Others

Global Wealth Management Platform Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Profile Systems and Software S.A., Prometeia S.p.A, SS&C Technologies Inc., Avaloq (NEC Corporation), Backbase, Tata Consultancy Services Limited, Temenos Headquarters SA., Broadridge Financial Solutions Inc., Comarch SA, Crealogix AG, Fidelity National Information Services Inc., Fiserv Inc., Infosys Limited, SEI Investments Company, and others.

-

2. What is the size of the global wealth management platform market?The Global Wealth Management Platform Market is expected to grow from USD 4.59 Billion in 2023 to USD 15.5 Billion by 2033, at a CAGR of 12.9% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global wealth management platform market over the predicted timeframe.

Need help to buy this report?