Global Water Filtration Systems Market Size, Share, and COVID-19 Impact Analysis, By Technology (Membrane Filtration, Desalination Methods, Disinfection Methods, Filtration Methods, Purified Water Systems, RAS (Recirculating Aquaculture Systems), and Others), By Systems (Engineering Services, Equipment, and Project Management), By End-User (Aquaculture Farms, Recreational Aquariums, Industrial Process Water, Domestic & Industrial Wastewater, Swimming Pools, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Water Filtration Systems Market Insights Forecasts to 2035

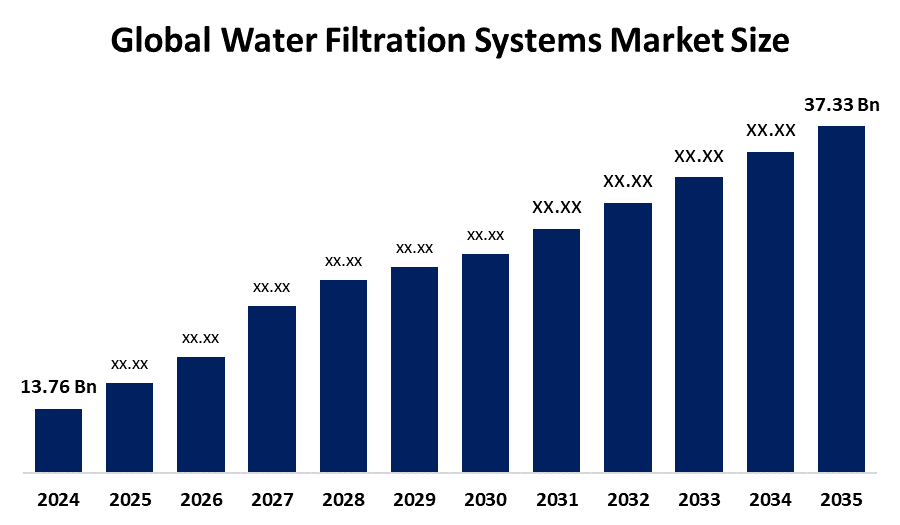

- The Global Water Filtration Systems Market Size Was Estimated at USD 13.76 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.5% from 2025 to 2035

- The Worldwide Water Filtration Systems Market Size is Expected to Reach USD 37.33 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global water filtration systems market size was worth around USD 13.76 billion in 2024 and is predicted to grow to around USD 37.33 billion by 2035 with a compound annual growth rate (CAGR) of 9.5% from 2025 to 2035. The water filtration systems market is growing due to rising water contamination and increasing health awareness among consumers. This is further driven by stringent government regulations, rapid technological advancements, and the pressures of urbanization and industrialization.

Market Overview

The Water Fltration Systems Market Size refers to technologies and devices that remove impurities, contaminants, and harmful substances from water, ensuring safe and clean drinking water for residential, commercial, and industrial use. These systems include various methods, such as activated carbon filters, reverse osmosis, ultraviolet (UV) purification, and ceramic filtration, catering to different water quality challenges. Water filtration systems are widely applied in households, hospitals, the food and beverage industries, pharmaceuticals, and municipal water treatment facilities, taking cognizance of growing concerns about waterborne diseases, chemical contamination, and overall public health. This market is primarily driven by an increase in awareness about water quality and safety, rapid urbanization, industrialization, and population growth, the factors that increase demand for reliable purification solutions. Additionally, stringent regulations by government authorities regarding water standards, together with rising disposable incomes, have supported the adoption of water filtration systems. Innovation plays a crucial role in this area, as companies are developing advanced filtration technologies offering higher efficiency, low maintenance, and eco-friendly solutions, including smart filtration systems and portable devices.

Market opportunities include growing applications in emerging economies, integration with smart home systems, and industrial sectors such as electronics and pharmaceuticals requiring ultra-pure water. In addition, increasing investments in green infrastructure for water and growing public-private initiatives are furthering growth prospects significantly. Major market participants in the industry include Pentair, Culligan, 3M, A. O. Smith, and Lenntech. The key players in the market are continuously making investments to develop better products and increase their presence in global markets. On June 16, 2025, Himachal Pradesh launched 'Mukhya Mantri Swachh Jal Shodhan Yojana' under Chief Minister Sukhvinder Singh Sukhu, with an investment of Rs 80 crore in the latest water purification technologies such as ozonisation, UV, RO, and nano-filtration. The initiative will cover all households to provide them with safe drinking water to reduce waterborne diseases while modernizing supply infrastructure, especially in rural and difficult terrains.

Report Coverage

This research report categorizes the water filtration systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the water filtration systems market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the water filtration systems market.

Water Filtration Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.76 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.5% |

| 2035 Value Projection: | USD 37.33 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By Systems |

| Companies covered:: | Veolia, SUEZ, Xylem Inc., Danaher Corporation (Pall Corporation), Ecolab Inc., Pentair plc, Evoqua Water Technologies, Culligan International, Toray Industries, Inc., Kurita Water Industries Ltd., DuPont, BWT AG, Koch Membrane Systems, 3M Company, Aquatech International, And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major factors driving the water filtration systems market globally include increased concern over water pollution, contamination, and scarcity, which force consumers and industries towards adopting effective filtration solutions. Increased urbanization, industrialization, and population drive demand for clean and safe drinking water. Strict government regulations and growing awareness towards health and hygiene are also fostering the installation of advanced water purification systems. Further, advancements in the technology of filtration methods, such as reverse osmosis, UV purification, and activated carbon filters, increase efficiency and attractiveness. On the other hand, growing applications across residential, commercial, and industrial sectors, combined with increased disposable income, are driving the market globally.

Restraining Factors

Limitations to the water filtration systems market include high initial installation and maintenance costs for some of the latest technologies, such as reverse osmosis. Other important factors include a general ageing of infrastructure in many regions, relatively low consumer awareness, the relatively low cost of less effective substitutes, and complex and sometimes risk-averse regulatory frameworks, which hinder the uptake of innovations.

Market Segmentation

The water filtration systems market share is classified into technology, systems, and end-user.

- The membrane filtration segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the technology, the water filtration systems market is divided into membrane filtration, desalination methods, disinfection methods, filtration methods, purified water systems, RAS (Recirculating Aquaculture Systems), and others. Among these, the membrane filtration segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominance of market growth by membrane filtration is due to its high efficiency in the removal of impurities, pathogens, and dissolved solids, thus ensuring superior water quality. Technologies such as RO, UF, and NF witnessed widespread adoption due to cost-effectiveness, low energy consumption, and versatility across industrial, municipal, and residential applications. Increasing demand for sustainable, chemical-free purification solutions further strengthens the dominance of membrane filtration in the global water filtration systems market.

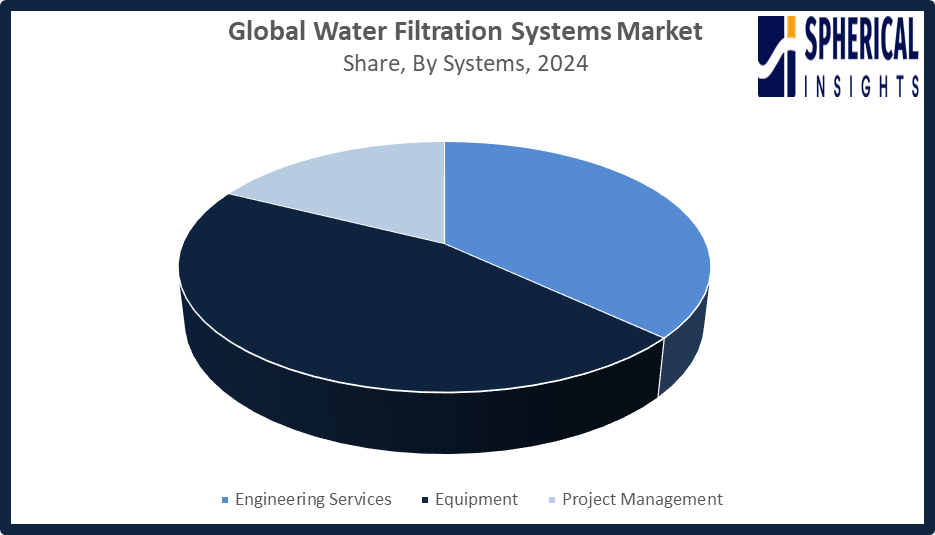

- The equipment segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the systems, the water filtration systems market is divided into engineering services, equipment, and project management. Among these, the equipment segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The equipment segment growth is owing to the rising demand for advanced and efficient water filtration systems in residential, industrial, and municipal sectors. Several reasons, including increasing concern for water contamination, automated, energy-efficient, smart filtration units, expansion of infrastructure projects, and strict regulatory standards related to clean water, have contributed to increasing the installation of high-performance filtration equipment globally.

Get more details on this report -

- The industrial process water segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the water filtration systems market is divided into aquaculture farms, recreational aquariums, industrial process water, domestic & industrial wastewater, swimming pools, and others. Among these, the industrial process water segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment is experiencing market growth due to the increasing demand for high-quality water from different industries, such as manufacturing, power generation, and chemicals. The growth has been further influenced by strict government regulations related to water quality, increasing industrialization, and demands for effective wastewater management. Further, advanced water filtration technologies, including reverse osmosis, membrane filtration, and UV treatment, have driven the growth by assuring cleaner water and operational efficiency.

Regional Segment Analysis of the Water Filtration Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the water filtration systems market over the predicted timeframe.

North America is anticipated to hold the largest share of the water filtration systems market over the predicted timeframe. North America is expected to capture a 40% share of the water filtration systems market during the forecast period, owing to developed infrastructure for water treatment, strong regulatory policies, and high public awareness of water quality. The United States accounts for the leading regional market due to rigid standards laid down by the EPA and higher penetration of advanced filtration technologies across residential, industrial, and municipal sectors. Canada accounts for a substantial share, with government initiatives for safe drinking water, particularly in remote areas. Innovations in technology, increasing industrial applications, and growing demand for sustainable and energy-efficient filtration solutions fuel regional development.

Asia Pacific is expected to grow at a rapid CAGR in the water filtration systems market during the forecast period. The Asia Pacific region is rapidly growing in the water filtration systems market, with an approximate 27% market share, driven by rapid urbanization, industrialization, and growing water pollution concerns. Growth in the region is dominated by countries such as China and India, driven by rising demand for safe drinking water, stringent government regulations, and initiatives such as India's Jal Jeevan Mission and China's Water Ten Plan. Growing industrial activities, increasing population, and rising awareness of waterborne diseases also fuel the adoption of advanced filtration technologies across residential, commercial, and industrial sectors in the region.

Europe’s water filtration systems market is growing steadily due to stringent environmental regulations, increasing investments in water treatment infrastructure, and rising demand for clean and safe water. Germany, France, and the UK contribute to this, driven by advanced industrial activities, robust healthcare and municipal water systems, and government initiatives related to sustainable water management. Further technological advancements in the field of membrane filtration, UV disinfection, and smart monitoring solutions foster market expansion in residential, commercial, and industrial settings within the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the water filtration systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Veolia

- SUEZ

- Xylem Inc.

- Danaher Corporation (Pall Corporation)

- Ecolab Inc.

- Pentair plc

- Evoqua Water Technologies

- Culligan International

- Toray Industries, Inc.

- Kurita Water Industries Ltd.

- DuPont

- BWT AG

- Koch Membrane Systems

- 3M Company

- Aquatech International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, DuPont Water Solutions was named Most Sustainable in the Water Sector by World Finance Magazine for advancing technologies that reduce the carbon footprint of water purification, conservation, and reuse. The Water Solutions Sustainability Navigator digital tool was also recognized for assessing water treatment sustainability indicators.

- In October 2025, Toray Industries launched the TLF 400ULD reverse osmosis membrane, developed with Toray Membrane and Toray Advanced Materials Research Laboratories in China. Designed for industrial wastewater reuse and sewage treatment, it will be marketed globally by Toray and Toray BlueStar Membrane, showcasing its ability to optimize water resource usage.

- In March 2025, DuPont Water Solutions launched WAVE PRO, an advanced online modeling tool for ultrafiltration (UF) applications, including drinking water, industrial utility water, wastewater, and seawater desalination. It guides design processes with high-accuracy calculations, helping water treatment professionals optimize system productivity and streamline operations effectively.

- In May 2025, Culligan International launched Culligan with ZeroWater Technology, featuring water pitchers and dispensers with 5-stage advanced filtration. Certified to remove five times more contaminants than leading filters, including lead, pharmaceuticals, and PFAS, the line provides cleaner, safer, and better-tasting water, combining Culligan’s expertise with ZeroWater’s innovation.

- In May 2021, Toray Industries launched the Torayvino Branch household water purifier exclusively in Japan. Building on the Torayvino brand since 1986, it features hollow fibre membrane filters and is Japan’s first system allowing users to switch between tap and purified water simply by lifting a faucet lever.

- In February 2020, SUEZ acquired the Reverse Osmosis (RO) membrane portfolio from LANXESS, integrating it into its Water Technologies & Solutions products. This strategic move strengthens SUEZ’s industrial water capabilities, expands RO technology deployment across growing sectors, and increases global membrane production to better address water treatment challenges.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the water filtration systems market based on the below-mentioned segments:

Global Water Filtration Systems Market, By Technology

- Membrane Filtration

- Desalination Methods

- Disinfection Methods

- Filtration Methods

- Purified Water Systems

- RAS (Recirculating Aquaculture Systems)

- Others

Global Water Filtration Systems Market, By Systems

- Engineering Services

- Equipment

- Project Management

Global Water Filtration Systems Market, By End-User

- Aquaculture Farms

- Recreational Aquariums

- Industrial Process Water

- Domestic & Industrial Wastewater

- Swimming Pools

- Others

Global Water Filtration Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the water filtration systems market over the forecast period?The global water filtration systems market is projected to expand at a CAGR of 9.5% during the forecast period.

-

2. What is the market size of the water filtration systems market?The global water filtration systems market size is expected to grow from USD 13.76 billion in 2024 to USD 37.33 billion by 2035, at a CAGR of 9.5% during the forecast period 2025-2035.

-

3. What is the water filtration systems market?The water filtration systems market is a global industry encompassing the design, production, and sale of devices that remove contaminants from water for various uses, including residential, commercial, and industrial applications.

-

4. Which region holds the largest share of the water filtration systems market?North America is anticipated to hold the largest share of the water filtration systems market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global water filtration systems market?Veolia, SUEZ, Xylem Inc., Danaher Corporation (Pall Corporation), Ecolab Inc., Pentair plc, Evoqua Water Technologies, Culligan International, Toray Industries, Inc., Kurita Water Industries Ltd., and Others.

-

6. What factors are driving the growth of the water filtration systems market?Growth in the water filtration systems market is driven by declining water quality, rising consumer awareness of health risks from contaminated water, and increasing population and urbanization.

-

7. What are the market trends in the water filtration systems market?Market trends in the water filtration systems industry include the rise of smart and IoT-enabled purifiers, the growing demand for point-of-use systems due to health concerns and urbanization, and technological advancements like nanotechnology and membrane-based filters.

-

8. What are the main challenges restricting the wider adoption of the water filtration systems market?The main challenges restricting the wider adoption of water filtration systems include high initial and maintenance costs, limited consumer awareness and education, and a complex, risk-averse regulatory environment.

Need help to buy this report?