Global Water and Wastewater Treatment Equipment Market Size, Share, and COVID-19 Impact Analysis, By Process (Primary, Secondary, and Tertiary Treatment), By Application (Municipal and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Machinery & EquipmentGlobal Water and Wastewater Treatment Equipment Market Insights Forecasts to 2033

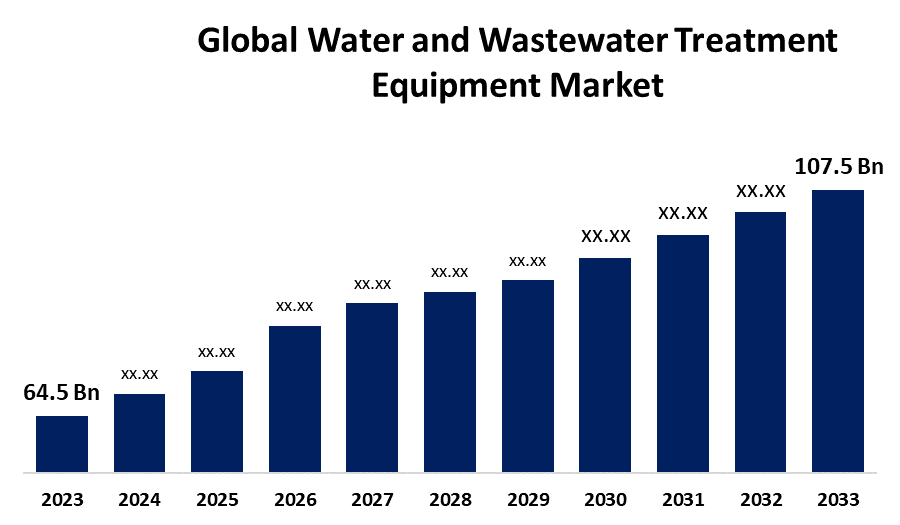

- The Global Water and Wastewater Treatment Equipment Market Size was Valued at USD 64.5 Billion in 2023

- The Market Size is Growing at a CAGR of 5.24% from 2023 to 2033

- The Worldwide Water and Wastewater Treatment Equipment Market Size is Expected to Reach USD 107.5 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Water and Wastewater Treatment Equipment Market Size is Anticipated to Exceed USD 107.5 Billion by 2033, Growing at a CAGR of 5.24% from 2023 to 2033.

Market Overview

Wastewater treatment is a process of purifying wastewater generated from various sources such as homes, industries, and commercial establishments. Their primary aim is to remove contaminants from the water and make it safe for reuse or discharge back into the environment. Water treatment equipment or tools are used to improve the water quality making it acceptable for its intended use. These equipments have several applications including drinking water treatment, wastewater treatment, irrigation water, industrial cooling water, process cooling water, industrial water treatment and others. Different types of equipment are available to address different levels of contamination in the water. Ultrafiltration systems, Vacuum evaporation and distillation, reverse osmosis systems, and tramp oil are used in the industrial sector. Technologies such as natural, aquatic, and terrestrial systems are designed to provide low-cost sanitation and environmental protection with additional benefits from the reuse of water. In addition to upgrading the quality of the purification process, IoT technology has also driven more efficient management of the resources used in plants, such as energy and reagents, by optimizing consumption and reducing waste, thus leading to lower operating costs. The integration of OT (operational technology) and IT (information technology) in supervision systems has enabled real-time process monitoring and control, raising operational productivity. The increased variety and standard of sensors measure water quality and the efficiency of the processes involved in its treatment at large volumes. The vast amounts of information generated by wastewater treatment plants can be leveraged through the use of advanced analytics and big data analysis techniques. Some of the technologies that are making inroads in the urban wastewater treatment sector include advanced oxidation, ultrafiltration and reverse osmosis, photocatalytic oxidation, ultrasonic reactors, naturally or genetically enhanced microorganisms, electrocoagulation, and electrooxidation.

Report Coverage

This research report categorizes the market for the global water and wastewater treatment equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global water and wastewater treatment equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global water and wastewater treatment equipment market.

Global Water and Wastewater Treatment Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 64.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 107.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Process, By Application, By Region |

| Companies covered:: | Xylem, Inc., Aquatech International LLC, Veolia Group, Ecolab Inc, Ovivo, Parkson Corporation, DuPont, Pentair plc., Evonik Industries AG, Evoqua Water Technologies LLC, Koch Membrane Systems, Inc, Toshiba Water Solutions Private Limited, Samco Technologies, Inc., Calgon Carbon Corporation, WPL Limited, Lenntech B.V., and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Population growth, rapid urbanization, technological advancements, and infrastructure expansion have all increased global demand for fresh and processed water. Thus, the rising need for fresh and processed water in urbanized regions and industries leads to driving the global water and wastewater treatment equipment market. The adoption of sustainable water management practices due to a lack of freshwater sources or water scarcity is raising the market growth. Further, reduced water resources and increased water pollution are also contributing to market demand for Water and Wastewater treatment equipment. The implementation of stringent standards for water quality and discharge raises the demand for the upgradation of water treatment infrastructure. Water treatment equipment, such as seawater desalination systems and condensate demineralizers, is installed in thermal power stations where a large volume of steam is required. Thus, the growing demand for energy fuels leads to a rise in the global demand for water and wastewater treatment equipment and is anticipated to remain high over the forecast period.

Restraining Factors

There is a need to implement advanced and costly water treatment technologies to fulfill the stringent regulations in the wastewater industry. Thus financial burden for small-scale companies or regions with limited financial resources, hindering the ability to invest in modern wastewater treatment. Excessive stringency or complexity in wastewater industry regulations impedes the market and increases operational costs, creating challenges for stakeholders in the water and wastewater treatment market.

Market Segmentation

The global water and wastewater treatment equipment market share is classified into process and application.

- The tertiary treatment segment is expected to grow at the fastest CAGR during the forecast period.

Based on the process, the global water and wastewater treatment equipment market is categorized into primary, secondary, and tertiary treatment. Among these, the tertiary treatment segment is expected to grow at the fastest CAGR during the forecast period. Tertiary treatment involves advanced treatment methods such as filtration, disinfection, and nutrient removal. Further, technological advancement in membrane filtration and UV disinfection has increased the use of tertiary treatment equipment. The adoption of tertiary treatment due to rising awareness about the environmental effects of untreated wastewater urges the market demand in the tertiary segment.

- The municipal segment dominates the market with the largest revenue share through the forecast period.

Based on the application, the global water and wastewater treatment equipment market is categorized into municipal and industrial. Among these, the municipal segment dominates the market with the largest revenue share through the forecast period. The municipal segment manages wastewater from households, businesses, and public facilities and delivers safe drinking water. Rapid urbanization and increasing population intensify the need for a municipal segment for water treatment and rising demand for water services. Further, growing community awareness about clean water and water management practices surges the municipal segment in the global water and wastewater treatment equipment market.

Regional Segment Analysis of the Global Water and Wastewater Treatment Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global water and wastewater treatment equipment market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global water and wastewater treatment equipment market over the forecast period. The increasing awareness among consumers and industries about the importance of water conservation and environmental protection. The presence of a large number of established and emerging players such as Huber SE, SUEZ SA, Veolia Water Solutions and Technologies, Kurita Water Industries Ltd., Thermax Limited, and SWA Water Australia are contributing to market growth. Further, rapid economic development, urbanization, and industrialization are responsible for market growth due to water scarcity and pollution issues. Further, manufacturing, energy production, agriculture, and municipal services need advanced treatment technologies and equipment for enhancing water quality and sustainable water management practices.

Europe is expected to grow at the fastest CAGR growth of the global water and wastewater treatment equipment market during the forecast period. The region's strict regulations, including the drinking water directive, Urban Wastewater Treatment Directive (UWWTD), and Water Framework Directive (WFD), lead to a rise the investments in water and wastewater treatment equipment. The high concentration of dairy producers in England will encourage an increase in water and wastewater treatment expenditure. Further, improvements in the UK's automotive industry following the Eurozone Crisis is enhancing the market demand for water and wastewater treatment equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global water and wastewater treatment equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xylem, Inc.

- Aquatech International LLC

- Veolia Group

- Ecolab Inc

- Ovivo

- Parkson Corporation

- DuPont

- Pentair plc.

- Evonik Industries AG

- Evoqua Water Technologies LLC

- Koch Membrane Systems, Inc

- Toshiba Water Solutions Private Limited

- Samco Technologies, Inc.

- Calgon Carbon Corporation

- WPL Limited

- Lenntech B.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Veolia and Vendée Eau inaugurated France's first unit for reusing treated wastewater to produce drinking water as part of the Jourdain program. This solution will provide an additional resource of 1.5 million m3 of drinking water over the period from May to October, during periods of increased water shortage in the Vendée.

- In July 2023, DuPont announced the commercial launch of the new DuPont FilmTec LiNE-XD nanofiltration membrane elements for lithium brine purification. The FilmTec LiNE-XD and LiNE-XD HP represent DuPont's first product offerings dedicated to lithium brine purification, offering high lithium passage from typical chloride-rich Li-brine streams and excellent selectivity over divalent metals such as magnesium.

- In May 2023, Xylem announced the acquisition completion of Evoqua Water Technologies Corp. (Evoqua), a leader in mission-critical water treatment solutions and services. The combination creates the world’s most advanced platform of capabilities to address customers’ and communities’ critical water challenges.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global water and wastewater treatment equipment market based on the below-mentioned segments:

Global Water and Wastewater Treatment Equipment Market, By Process

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

Global Water and Wastewater Treatment Equipment Market, By Application

- Municipal

- Industrial

Global Water and Wastewater Treatment Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global water and wastewater treatment equipment market over the forecast period?The global water and wastewater treatment equipment market is projected to expand at a CAGR of 5.24% during the forecast period.

-

2. What is the projected market size & growth rate of the global water and wastewater treatment equipment market?The global water and wastewater treatment equipment market was valued at USD 64.5 Billion in 2023 and is projected to reach USD 107.5 Billion by 2033, growing at a CAGR of 5.24% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global water and wastewater treatment equipment market?The Asia-Pacific region is expected to hold the highest share of the global water and wastewater treatment equipment market.

Need help to buy this report?