Global Vitamin B2 Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct and Indirect), By End User (Animal feed, Pharmaceuticals & Supplements, Food & Beverage Fortification, Colorant, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Vitamin B2 Market Insights Forecasts to 2035

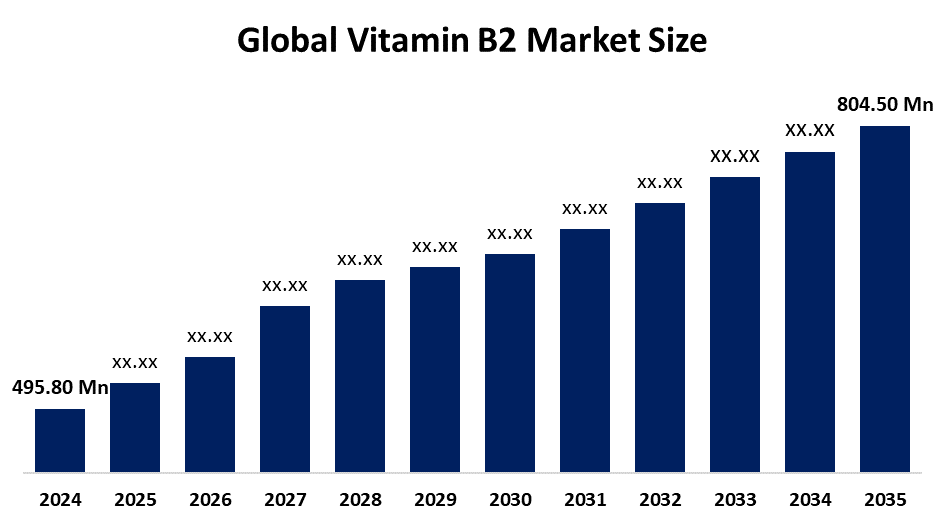

- The Global Vitamin B2 Market Size Was Valued at USD 495.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.5 % from 2025 to 2035

- The Worldwide Vitamin B2 Market Size is Expected to Reach USD 804.50 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Vitamin B2 Market Size Was Worth Around USD 495.80 Million In 2024 And Is Predicted To Grow To Around USD 804.50 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.5% From 2025 To 2035.

Market Overview

The vitamin B2 market refers to the global commercial ecosystem encompassing the production distribution and consumption of riboflavin vitamin B2 which is an essential water-soluble vitamin that humans need for their metabolic processes and energy production and general well-being. This market includes natural and synthetic riboflavin which commercial establishments use in dietary supplements fortified foods beverages and pharmaceuticals and animal nutrition products. The Food Safety and Standards Authority of India (FSSAI) requires all staple foods which include wheat flour and rice to contain riboflavin along with other nutrients according to regulations that were revised in 2018 and which became part of POSHAN Abhiyaan and PM POSHAN initiatives. The Vitamin B2 market growth results from two main factors, which include increased consumer health and nutrition knowledge and higher demand for dietary supplements and fortified food products. The global food and beverage industry development particularly in fortified beverages and cereals and dairy products has created significant vitamin B2 market growth.

Report Coverage

This research report categorizes the vitamin B2 market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vitamin B2 market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the vitamin B2 market.

Global Vitamin B2 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 495.80 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.5% |

| 2035 Value Projection: | USD 804.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sales Channel, By End User and By Region |

| Companies covered:: | Anhui Tiger Biotech Co., Ltd, BASF SE, dsm-firmenich, Lonza Group AG, N.B Group AG, and Sanofi S.A |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market has experienced substantial growth because of the worldwide expansion of the food and beverage industry, which focuses on fortified beverages and cereals and dairy products. The development of affordable production methods and advancements in riboflavin synthesis technology have made products more accessible to consumers which has resulted in increased market share. Multiple countries use their dietary supplement and food fortification regulations as tools to support industry growth. The rising chronic disease and malnutrition rates have led to increased consumer demand for vitamin supplements according to research studies.

Restraining Factors

The market for vitamin B2 is restricted by a number of factors, including high production costs, strict regulations, low consumer awareness in some areas, unstable raw material supply, and competition from synthetic and alternative vitamins. These factors all work together to prevent the market from growing quickly.

Market Segmentation

The vitamin B2 market share is classified into sales channel and end user.

- The indirect segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the vitamin B2 market is divided into direct and indirect. Among these, the indirect segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Well-established distribution networks, such as wholesalers, distributors, and third-party retailers, are the main drivers of indirect, as they enable greater product availability across a variety of locations and end-user groups. Manufacturers can effectively access small and medium-sized consumers, retail locations, and industrial purchasers through indirect channels, which eliminate the need for a large direct sales infrastructure.

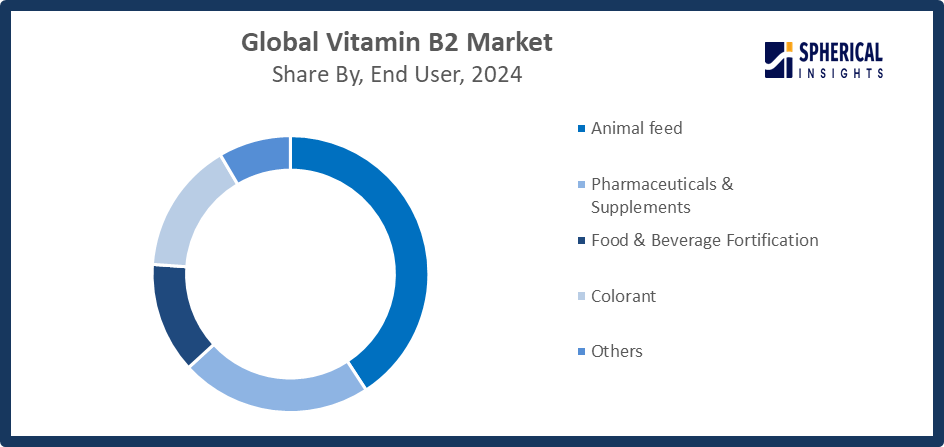

- The animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the vitamin B2 market is divided into animal feed, pharmaceuticals & supplements, food & beverage fortification, colorant, and others. Among these, the animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Riboflavin consumption in animal nutrition has increased dramatically due to the need to enhance animal feed conversion ratios and the growing demand for animal products high in protein. The market demand is also fueled by industry standards and regulatory requirements for animal feed.

Get more details on this report -

Regional Segment Analysis of the Vitamin B2 Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vitamin B2 market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vitamin B2 market over the predicted timeframe. The availability and effectiveness of products are improved in North America due to the existence of important market participants, technological developments in vitamin production, and significant expenditure in R&D. Widespread availability to fortified foodstuffs is made possible by robust distribution networks and rising disposable incomes, cementing North Americas Under 21 CFR 137.165 for enriched flour, the U.S. Food and Drug Administration (FDA) enforces enrichment requirements that require the addition of riboflavin in addition to thiamin, niacin, and iron in standardized cereal goods. More than 70% of baked products and packaged cereals are fortified, and around 75% of multivitamin formulations contain riboflavin (1.7–20 mg or serving).

Asia Pacific is expected to grow at a rapid CAGR in the vitamin B2 market during the forecast period. Rising disposable incomes, growing urban populations embracing modern dietary practices, and growing health and nutrition consciousness are the main factors driving the Asia Pacific. The demand for nutritional supplements, functional foods, and fortified beverages that contain riboflavin to address micronutrient deficiencies is rising in the regions expanding economies, especially in China and India. The Food Safety and Standards Authority (FSSAI) of India requires that staples be fortified. The fortified rice program, which was expanded nationwide in 2022, was approved by the Union Cabinet and extended until December 2028 with R 17,082 crore in central financing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vitamin B2 market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Researchers have launched a novel battery powered by vitamin B2 (riboflavin) and glucose, using riboflavin to shuttle electrons between electrodes, generating sustainable energy from sugar, inspired by the human body’s natural glucose breakdown process.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vitamin B2 market based on the below-mentioned segments:

Global Vitamin B2 Market, By Sales Channel

- Direct

- Indirect

Global Vitamin B2 Market, By End User

- Animal feed

- Pharmaceuticals & Supplements

- Food & Beverage Fortification

- Colorant

- Others

Global Vitamin B2 Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vitamin B2 market over the forecast period?The global Vitamin B2 market is projected to expand at a CAGR of 4.5% during the forecast period.

-

2. What is the market size of the vitamin B2 market?The global vitamin B2 market size is expected to grow from USD 495.80 million in 2024 to USD 804.50 million by 2035, at a CAGR of 4.5 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the vitamin B2 market?North America is anticipated to hold the largest share of the Vitamin B2 market over the predicted timeframe.

-

4. Who are the top companies operating in the global vitamin B2 market?Anhui Tiger Biotech Co., Ltd., BASF SE, dsm-firmenich, DSM Nutritional Products (dsm‑firmenich), GlaxoSmithKline plc, Haijianuo Pharmaceutical Co., Ltd., Hebei Shengxue Dacheng Pharmaceutical Co., Ltd., Hubei Guangji Pharmaceutical Co., Ltd, Jiangsu Jinghai Bioengineering Co., Ltd., Lonza Group AG, N.B Group Co. Ltd, Ningxia Qiyuan Pharmaceutical Co., Ltd., Sanofi S.A., Shandong Hongda Biological Technology Co., Ltd., and Others.

-

5. What factors are driving the growth of the vitamin B2 market?Rising health awareness, increasing demand for dietary supplements, fortified foods, and functional beverages, technological advancements in riboflavin production, preventive healthcare trends, regulatory support, and growing chronic disease prevention drive Vitamin B2 market growth.

-

6. What are the market trends in the vitamin B2 market?Trends include fortified and functional food products, plant-based supplements, sustainable riboflavin production, growing nutraceutical and animal feed applications, rising e-commerce sales, and innovation in bioavailability-enhanced formulations shaping the Vitamin B2 market.

-

7. What are the main challenges restricting the wider adoption of the vitamin B2 market?High production costs, complex synthesis processes, strict regulations, limited raw material availability, competition from alternative vitamins, and low consumer awareness in certain regions restrict wider adoption of Vitamin B2 products.

Need help to buy this report?