Global Vitamin B-Complex Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vitamin B1, Vitamin B2, Vitamin B3, Vitamin B5, Vitamin B6, Vitamin B7, Vitamin B9, and Vitamin B12), By Application (Dietary Supplements, Food and Beverages, Pharmaceuticals, Animal Feed, and Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Vitamin B-Complex Ingredients Market Insights Forecasts to 2035

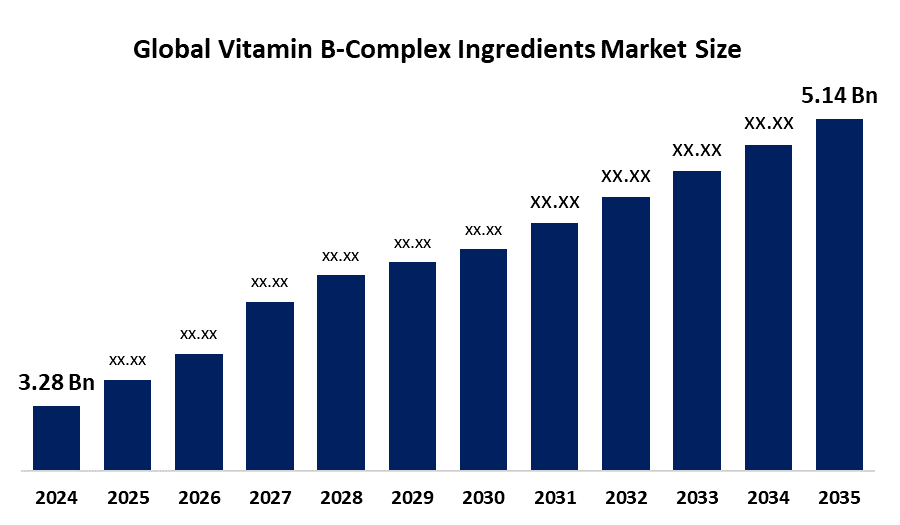

- The Global Vitamin B-Complex Ingredients Market Size Was Estimated at USD 3.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The Worldwide Vitamin B-Complex Ingredients Market Size is Expected to Reach USD 5.14 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global vitamin B-complex ingredients market size was worth around USD 3.28 billion in 2024 and is predicted to grow to around USD 5.14 billion by 2035 with a compound annual growth rate (CAGR) of 4.17% from 2025 to 2035. A rise in health consciousness, growing intake of supplements for energy and metabolism, expansion of ageing populations, and demand for fortified foods and beverages support preventive healthcare and overall wellness is growing in the vitamin B-complex ingredients market.

Market Overview

The global vitamin B-complex ingredients market refers to the manufacture and sale of essential water-soluble B vitamins, including B1 (thiamine), B2 (riboflavin), B3 (niacin), B5 (pantothenic acid), B6 (pyridoxine), B7 (biotin), B9 (folate), and B12 (cobalamin), crucial in energy metabolism, nervous system function, and overall cellular health. These are also widely utilized in nutritional supplements, food and beverage fortification, pharmaceuticals, and animal nutrition to enhance energy levels, cognitive function, and immunity. Market growth is partly driven by increasing consumer awareness of preventive healthcare, rising cases of micronutrient deficiencies, and increasing adoption of dietary supplements among health-conscious and ageing populations. Innovation within fermentation, encapsulation, and biofortification technologies has notably enhanced stability and improved the bioavailability of B-complex vitamins, thereby helping product quality and efficacy. Besides, the demand for plant-based and sustainably sourced vitamin ingredients is stimulated by the expansion of vegan and vegetarian lifestyles.

Opportunities are arising due to government initiatives for food fortification programs, especially for folic acid and vitamin B12, as seen from large-scale nutrition programs in Asia and Africa. Growing demand for fortified foods, functional beverages, and nutraceuticals offers lucrative prospects for manufacturers. Some important companies operating in the market include DSM Nutritional Products, BASF SE, Lonza Group, DuPont de Nemours Inc., ADM, and Zhejiang NHU Co. Ltd., and they continue to be engaged with innovations, sustainability, and strategic partnerships to consolidate their positions in the global market. On 9 October 2024, the Union Cabinet of India, led by Prime Minister Narendra Modi, approved further implementation of the fortified rice scheme under PMGKAY and other welfare schemes until December 2028. With complete financing to be borne by the Centre, the Scheme aimed at addressing anaemia and micronutrient deficiencies seeks to distribute iron, folic acid, and vitamin B12-enriched rice across the country.

Report Coverage

This research report categorizes the vitamin B-complex ingredients market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vitamin B-complex ingredients market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vitamin B-complex ingredients market.

Global Vitamin B-Complex Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.17% |

| 2035 Value Projection: | USD 5.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | BASF SE DSM Adisseo Lonza Group Ltd. Glanbia Plc. Amway Corporation Evonik Industries AG Archer Daniels Midland (ADM) Kyowa Hakko Bio Co., Ltd. GlaxoSmithKline PLC Pfizer Inc. Cargill, Incorporate Bayer AG Foodchem International Corporation AIE Pharmaceuticals and other, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global vitamin B-complex ingredients market is driven by increased health awareness, a rise in the incidence of lifestyle-related diseases, and growing demand for dietary supplements. Growing vegan and vegetarian populations have boosted demand for plant-based vitamin sources. In addition, the application of vitamin B-complex in functional food, beverages, and pharmaceutical formulations propels the market. Growing ageing populations and higher disposable incomes further increase supplement intake. Advanced technologies in fermentation and extraction techniques improve ingredient quality and bioavailability, while government initiatives for nutritional health and fortified food programs accelerate the adoption of different vitamins. The increasing wellness and preventive healthcare trends also drive market growth significantly.

Restraining Factors

The vitamin B-complex ingredients market faces restraints such as high production costs, fluctuating raw material prices, and stringent regulatory requirements for supplement formulations. Another key limiting factor in the growth of this market is low consumer awareness, especially in developing markets, and possible side effects due to overconsumption. Competition coming from synthetic alternatives and counterfeited products further affects market expansion and brand trust.

Market Segmentation

The vitamin B-complex ingredients market share is classified into product type, application, and distribution channel.

- The vitamin B1 segment dominated the market in 2024, approximately 25% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the vitamin B-complex ingredients market is divided into vitamin B1, vitamin B2, vitamin B3, vitamin B5, vitamin B6, vitamin B7, vitamin B9, and vitamin B12. Among these, the vitamin B1 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The vitamin B1 (thiamine) segment dominated the vitamin B-complex ingredients market due to increasing awareness of thiamine's role in energy metabolism and neurological health, rising prevalence of vitamin B1 deficiencies, and growing demand for fortified foods, dietary supplements, and functional beverages. Growing populations of health-conscious people and government nutrition programs further support the market expansion.

- The dietary supplements segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the vitamin B-complex ingredients market is divided into dietary supplements, food and beverages, pharmaceuticals, animal feed, and others. Among these, the dietary supplements segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth in the dietary supplements segment is due to increasing health awareness, rising vitamin deficiency incidents, and a greater adoption of preventive healthcare practices. Besides this, the expanding ageing population, growing fitness and wellness trends, and popularity of fortified supplements in convenient formats drive demand in this segment.

Get more details on this report -

- The supermarkets/hypermarkets segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the vitamin B-complex ingredients market is divided into online stores, supermarkets/hypermarkets, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment's growth is driven by wide product availability, competitive pricing, and strong in-store promotions. Additionally, the preference for one-stop shopping, increasing consumer trust in established retail chains, and the expansion of modern retail infrastructure across the emerging markets are causes for the continued dominance and revenue growth of the segment.

Regional Segment Analysis of the Vitamin B-Complex Ingredients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vitamin B-complex ingredients market over the predicted timeframe.

North America is anticipated to hold the largest share of the vitamin B-complex ingredients market over the predicted timeframe. North America accounts for a 35% share of the vitamin B-complex ingredient market, driven by growing health awareness, increasing demand for dietary supplements, and established healthcare infrastructure. This region is dominated by the United States, with high consumer expenditure on nutrition and wellness products, well-developed distribution channels, and regulatory requirements that ensure quality. In addition, the increasing prevalence of lifestyle-related health disorders, such as cardiovascular diseases and diabetes, promotes supplementation with vitamin B-complex. Further, Canada contributes to an increasingly expanding nutraceutical consumption. Overall, robust market maturity and strong purchasing power underpin North America's leading position.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the vitamin B-complex ingredients market during the forecast period. The Asia Pacific is rapidly growing in the vitamin B-complex ingredients market, with an approximate 24% market share, which is driven by rising health consciousness, improved disposable income, and growing urban populations. Large populations in countries such as China and India, coupled with an increasing middle class and demand for dietary supplements, have been driving this growth. Government initiatives on nutritional awareness, along with the expansion of e-commerce and retail channels, have made vitamin B-complex products more accessible and will foster significant market growth in the region.

The European region continues to hold a considerable market share in the vitamin B-complex ingredients market, facilitated by increasing health awareness, a growing ageing population, and strong demand for dietary supplements. Major contributors include Germany and the United Kingdom due to their highly developed healthcare infrastructures and supportive regulatory frameworks that ensure product quality. Additionally, there is an increased trend toward preventive health and wellness, which fosters supplementation. Increasing consumer preference for fortified foods and nutraceuticals further enables steady market growth in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vitamin B-complex ingredients market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- DSM

- Adisseo

- Lonza Group Ltd.

- Glanbia Plc.

- Amway Corporation

- Evonik Industries AG

- Archer Daniels Midland (ADM)

- Kyowa Hakko Bio Co., Ltd.

- GlaxoSmithKline PLC

- Pfizer Inc.

- Cargill, Incorporate

- Bayer AG

- Foodchem International Corporation

- AIE Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, BASF and Louis Dreyfus Company (LDC) announced the successful completion of BASF’s Food and Health Performance Ingredients business sale, formerly part of BASF’s Nutrition & Health division, to LDC, following approval from the relevant regulatory authorities.

- In February 2025, Neurobion Forte launched the Sabse Bada B campaign to raise awareness about vitamin B deficiency and related symptoms. The initiative includes a TV commercial and outreach efforts, emphasizing vitamin B’s crucial role in nerve health and its associated warning signs.

- In May 2024, Evonik showcased its nutraceutical innovations at Vitafoods Europe in Geneva, featuring AvailOm & Boswellia for joint health, IN VIVO BIOTICS study results, and the Healthberry portfolio’s U.S. expansion, offering advanced, evidence-based ingredients to enhance consumer appeal and differentiate functional foods and supplements.

- In February 2021, Bayer launched The Nutrient Gap Initiative to expand access to vitamins and minerals for underserved communities, aiming to combat malnutrition. The program targets reaching 50 million people annually by 2030 through direct action and partnerships with NGOs, focusing on intervention, education, and advocacy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vitamin B-complex ingredients market based on the below-mentioned segments:

Global Vitamin B-Complex Ingredients Market, By Product Type

- Vitamin B1

- Vitamin B2

- Vitamin B3

- Vitamin B5

- Vitamin B6

- Vitamin B7

- Vitamin B9

- Vitamin B12

Global Vitamin B-Complex Ingredients Market, By Application

- Dietary Supplements

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Others

Global Vitamin B-Complex Ingredients Market, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Vitamin B-Complex Ingredients Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vitamin B-complex ingredients market over the forecast period?The global vitamin B-complex ingredients market is projected to expand at a CAGR of 4.17% during the forecast period.

-

2. What is the market size of the vitamin B-complex ingredients market?The global vitamin B-complex ingredients market size is expected to grow from USD 3.28 billion in 2024 to USD 5.14 billion by 2035, at a CAGR of 4.17% during the forecast period 2025-2035.

-

3. What is the vitamin B-complex ingredients market?The vitamin B-complex ingredients market refers to the industry for the raw materials used to create B-complex supplements, which are used in pharmaceuticals, food and beverages, and animal feed.

-

4. Which region holds the largest share of the vitamin B-complex ingredients market?North America is anticipated to hold the largest share of the vitamin B-complex ingredients market over the predicted timeframe

-

5. Who are the top 10 companies operating in the global vitamin B-complex ingredients market?BASF SE, DSM, Adisseo, Lonza Group Ltd., Glanbia Plc., Amway Corporation, Evonik Industries AG, Archer Daniels Midland (ADM), Kyowa Hakko Bio Co., Ltd., GlaxoSmithKline PLC, and Others.

-

6. What factors are driving the growth of the Vitamin B-Complex Ingredients market?The growth of the vitamin B-complex ingredients market is driven by increased consumer awareness of health and wellness, the rising demand for nutritional supplements, and a growing desire for natural and organic products.

-

7. What are the market trends in the vitamin B-complex ingredients market?Market trends in the vitamin B-complex ingredients market include growing demand driven by health and wellness awareness, an ageing population, and increased use in food fortification and animal nutrition.

-

8. What are the main challenges restricting wider adoption of the vitamin B-complex ingredients market?The main challenges restricting the wider adoption of the vitamin B-complex ingredients market involve production costs, regulatory complexities, product stability, and supply chain disruptions.

Need help to buy this report?