Global Virtual Networking Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Deployment (On-Premise and Cloud), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Virtual Networking Market Insights Forecasts to 2035

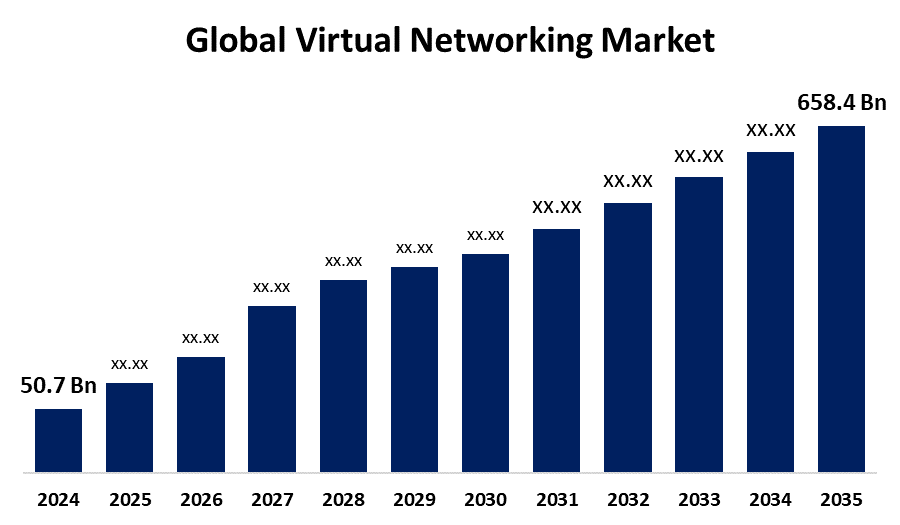

- The Global Virtual Networking Market Size Was Estimated at USD 50.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 26.25% from 2025 to 2035

- The Worldwide Virtual Networking Market Size is Expected to Reach USD 658.4 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Global Virtual Networking Market Size was Worth around USD 50.7 Billion in 2024 and is Predicted to Grow to around USD 658.4 Billion by 2035 with a compound annual Growth rate (CAGR) of 26.25% from 2025 and 2035. Rising cloud adoption, virtual machine technologies, software-defined networking, enhanced communication, industrial automation, and companies transitioning to cloud services to improve network and hardware virtualisation efficiency and decrease downtime are the primary factors driving market expansion.

Market Overview

The Virtual Networking Market Size includes technologies that use software to connect devices and virtual machines across networks, allowing for seamless communication. It provides scalable, secure, and cost-effective solutions that are extensively embraced across industries. The market for virtual networking is expanding significantly as a result of the growing use of software-defined networking, cloud computing, industrial automation, and the requirement for effective virtual machine administration. Cloud-based services are being used by businesses in an effort to improve network speed and decrease downtime. With virtual router products like "OCX-Router(v1)," businesses like BBIX and BBSakura Networks are advancing and facilitating smooth traffic exchange in cloud environments. By centralising configuration and facilitating automation, virtual networking streamlines network administration while decreasing human error and increasing productivity. Additionally, it facilitates scalable and adaptable network architecture, which is particularly useful in cloud environments where businesses can customise networks for particular uses. The proliferation of IoT devices is accelerating the need for scalable virtual networking systems to handle numerous connections and large amounts of data. However, the overall benefits, such as more scalable solutions, cost reduction, and productivity efficiencies, are pushing the usage of virtual networking technology in all sectors. Government organisations are using contracts and consolidation of networks to solidify the growth of virtual networks. To that point, Rivada Networks and the U.S. Navy partnered in December 2024 to provide applicable virtual network operator capabilities.

Report Coverage

This research report categorizes the virtual networking market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the virtual networking market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the virtual networking market.

Global Virtual Networking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 50.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 26.25% |

| 2035 Value Projection: | USD 658.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 251 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Deployment |

| Companies covered:: | Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Development LP, VMware, Inc., Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Citrix Systems, Inc., Juniper Networks, Inc., Oracle, Verizon Communications Inc., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for virtual networking is mostly driven by the expanding use of cloud computing as well as the ease of network administration and communication. Cloud systems provide flexibility and scalability by enabling the on-demand development of virtual networks via IaaS and PaaS. Furthermore, managed services, software-defined networking (SDN), and centralised management simplify network operations while boosting security and performance. The need for virtual networking solutions is rising across industries as a result of these capabilities, which greatly increase corporate productivity.

Restraining Factors

The virtual networking industry consists of major barriers such as complicated software integrations, bandwidth and latency challenges, and the challenge of managing data between various virtual environments. Barriers also include high initial costs incurred with software licenses, infrastructure, and training IT staff. Adoption can also be limited due to maintenance costs, upgrades, and support costs, especially for small to mid-sized businesses on a limited budget.

Market Segmentation

The virtual networking market share is classified into component and deployment.

- The software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the component, the virtual networking market is divided into hardware, software, and services. Among these, the software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The increasing use of Software-defined Networking (SDN), which enables enterprises to virtualise and control networks without reliance on hardware, is driving the growth of the virtual networking industry. This increases efficiency, scalability, and flexibility. Furthermore, hypervisor software makes it possible to run numerous virtual machines on a single physical server, encouraging affordable, adaptable solutions that lessen dependency on proprietary hardware and improve network performance in general.

- The cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment, the virtual networking market is divided into on-premise and cloud. Among these, the cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. As cloud utilization increases, organizations are increasingly taking advantage of the benefits of virtual networking, including being more flexible and scalable, as well as being more cost-effective. A significant trend in cloud adoption is the use of cloud-based VPNs for secure connectivity between on-premises and cloud services. Also, by allocating traffic, cloud-based load balancers enhance applications' performance. Therefore, the cloud market is expected to gain substantial momentum in the future.

Regional Segment Analysis of the Virtual Networking Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the virtual networking market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the virtual networking market over the predicted timeframe. With the growing need for cloud computing, software-defined networking (SDN), and Network Function Virtualisation (NFV) solutions, North America is expanding significantly. Businesses moving their IT infrastructure to the cloud to increase scalability, save money, and improve agility are driving up demand for virtual networking solutions in North America. SDN is becoming more and more popular in North America due to its ability to automate and consolidate network administration while reducing costs and improving agility. The factors that will cause the region's economy will continue to grow over the projected time frame.

Asia Pacific is expected to grow at a rapid CAGR in the virtual networking market during the forecast period. The growing use of hybrid cloud models, which provide flexibility, scalability, and cost-effectiveness, is propelling regional expansion. Advanced cloud technologies that improve security during public cloud migrations include virtual routers, firewalls, Secure Service Edge (SSE), and Zero Trust Network Access (ZTNA). Virtual networking is encouraged by Japan's emphasis on sustainability in order to lower emissions, energy use, and hardware usage. In the meantime, India is seeing large data centre investments as a result of the growth of digital services and its position in IT infrastructure. Virtual networking facilitates quicker service launch, network segmentation, and effective resource utilisation in these data centres.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the virtual networking market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- VMware, Inc.

- Cisco Systems, Inc.

- Microsoft Corporation

- IBM Corporation

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Oracle

- Verizon Communications Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Veracity Industrial Networks introduced the Veracity OT Network Security Appliance. This device combines an operational technology (OT) software-defined networking (SDN) controller and virtual switch on a single platform in a unique way. By providing centralised control over linked devices and strengthening cybersecurity features like network resiliency and micro-segmentation, this creative approach seeks to simplify industrial network management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the virtual networking market based on the below-mentioned segments:

Global Virtual Networking Market, By Component

- Hardware

- Software

- Services

Global Virtual Networking Market, By Deployment

- On-Premise

- Cloud

Global Virtual Networking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Virtual Networking market over the forecast period?The global Virtual Networking market is projected to expand at a CAGR of 26.25% during the forecast period.

-

2. What is the market size of the Virtual Networking market?The global Virtual Networking market size is expected to grow from USD 50.7 billion in 2024 to USD 658.4 billion by 2035, at a CAGR of 26.25% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Virtual Networking market?North America is anticipated to hold the largest share of the Virtual Networking market over the predicted timeframe.

Need help to buy this report?