Global Virtual Currencies Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, and Software), By Type (Bitcoin, Litecoin, and XPR), By End-user (Trading, Retail & E-commerce, Banking, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Virtual Currencies Market Insights Forecasts to 2032

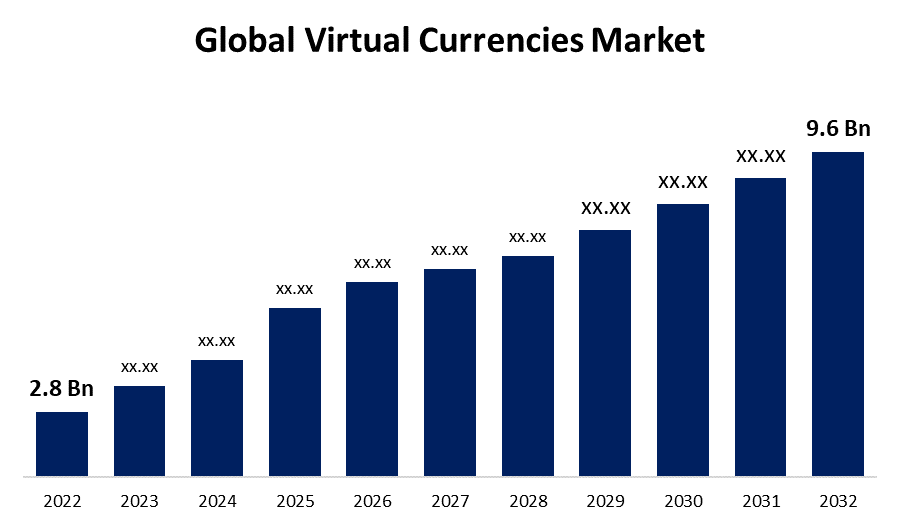

- The Global Virtual Currencies Market Size was Valued at USD 2.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 13.11% from 2022 to 2032

- The Worldwide Virtual Currencies Market Size is Expected to Reach USD 9.6 Billion by 2032

- North America is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Virtual Currencies Market Size is Anticipated to Exceed USD 9.6 Billion by 2032, Growing at a CAGR of 13.11% from 2022 to 2032.

Market Overview

A digital representation of value that is only accessible electronically is called a virtual currency. It is handled and saved using computer, mobile, or application-specific software. Virtual currency transactions take place over the internet or secure, specialized networks. A subset of digital currencies that are issued by private companies are called virtual currencies. These include tokens and cryptocurrencies. Faster transaction speeds, more accessibility, and ease of use are all possible with virtual currencies. The use of real currency has decreased as a result of the increasing acceptance of contactless payments and the introduction of digital wallets by numerous international companies. The global market for virtual currencies is a dynamic financial environment that is expanding quickly. A range of virtual currencies, including Bitcoin, Ethereum, Litecoin, and Ripple, are available in this market. On digital currency exchanges throughout the world, these currencies can be purchased, sold, and traded. Furthermore, the acceptance of virtual currencies like Bitcoin by large shops is growing, which is contributing to its rise in the international market.

Report Coverage

This research report categorizes the market for the global virtual currencies market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global virtual currencies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global virtual currencies market.

Global Virtual Currencies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 13.11% |

| 2032 Value Projection: | USD 9.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Type, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Xilinx, Inc., Canaan Inc., Binance, Bit fury Group Limited, Xapo Holdings Limited, Bit Go, Inc., Advanced Micro Devices, Inc., Intel Corporation, NVIDIA Corporation, Ripple, Bit Main Technologies Holding Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling the global virtual currencies market expansion is the growing public acceptance and trust in digital currencies. The rise of blockchain technology has contributed to the increasing ubiquity of virtual currencies like Ripple, Ethereum, and Bitcoin in recent years. The public's trust in virtual currencies has also grown as a result of the growing accessibility of platforms and wallets for virtual currencies. The global virtual currencies market is expanding due to the growing need for efficiency and convenience. Compared to traditional fiat currencies, digital currencies have lower transaction costs and quicker transaction times, which makes them a desirable choice for both consumers and companies.

Restraining Factors

Digital currencies are unrestricted, uncontrolled, and decentralized platforms for trading. Currency users have expressed numerous grievances about currency misuse, money loss, and illicit activity. The virtual currency is constantly fluctuating and occasionally exhibits an increase or decrease in the exchange rate, which has an impact on investors' funds. One of the greatest obstacles to the virtual currencies market expansion is the absence of widespread acceptance of digital currencies. Even though interest in digital currency is rising, most prospective users are still ignorant of the idea and its possible uses. Because of this unfamiliarity, there aren't as many users or transactions, which makes it challenging for companies to establish a presence in the market.

Market Segmentation

The Global Virtual Currencies Market share is classified into component, type, end-user.

- The hardware segment is expected to hold the largest share of the global virtual currencies market during the forecast period.

The virtual currencies market is categorized by component into hardware, and software. Among these, the hardware segment is expected to hold the largest share of the virtual currencies market during the forecast period. The anticipated rise in the hardware segment of the global virtual currencies market is attributed to the significant fluctuations in pricing and decreased power usage of Bitcoin users. To create mining devices, hardware such as graphical processing units must be efficient, quick, and stable.

- The bitcoin segment is expected to grow at the highest pace in the global virtual currencies market during the forecast period.

Based on the type, the global virtual currencies market is divided into Bitcoin, litecoin, and XPR. Among these, the bitcoin segment is expected to grow at the highest pace in the virtual currencies market during the forecast period. The digital currency known as Bitcoin was created as a decentralized means of conducting transactions. During the projection period, it is anticipated that the emergence of Bitcoin exchange-traded funds will entail worldwide Bitcoin trades.

- The trading segment is anticipated to hold the largest share of the global virtual currencies market during the forecast period.

Based on the end-user, the global virtual currencies market is divided into trading, retail & e-commerce, banking, and others. Among these, the trading segment is expected to hold the largest share of the global virtual currencies market during the forecast period. Users who trade virtual currency can receive deposit addresses, buy, sell, and check their asset balances. To facilitate easy virtual currency trading for their clients, several browser technology providers are focusing on partnering with blockchain technology companies.

Regional Segment Analysis of the Global Virtual Currencies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

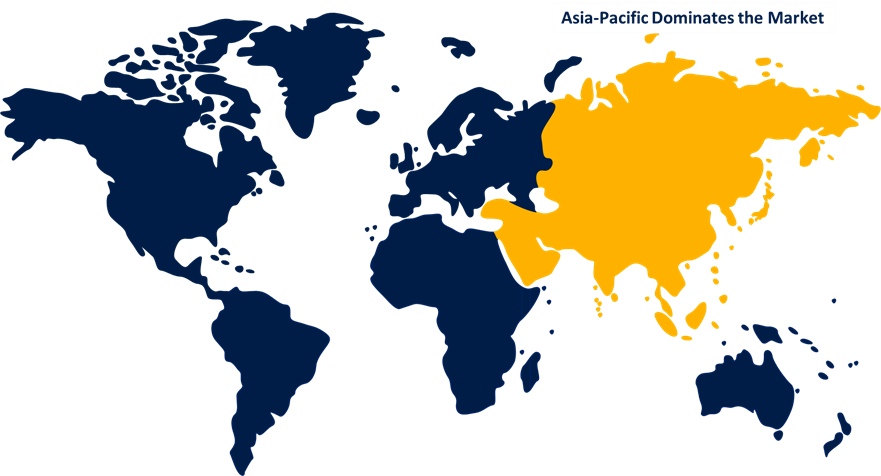

Asia-Pacific is anticipated to hold the largest share of the global Virtual Currencies market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global virtual currencies market over the predicted years. The acceptance of virtual currency in nations like South Korea, Japan, and India is responsible for the supremacy. Furthermore, it is anticipated that the existence of cryptocurrency mining firms like Canaan, Inc., Bit Main Technologies Limited, and Ebang International Holdings, Inc. will help the expansion of the market in the area. Moreover, prominent entities in the area are forming alliances to tackle the fiercely competitive sector.

North America is expected to grow at the fastest pace in the global virtual currency market during the forecast period. The growth of the regional market is being driven by the use of virtual money in NFTs and the growing acceptability of cryptocurrencies as a means of wealth storage. Additionally, the area is seeing significant investments in businesses creating blockchain technology and innovative ways to power Bitcoin mining devices with higher hash rates and greater power efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global virtual currencies along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xilinx, Inc.

- Canaan Inc.

- Binance

- Bit fury Group Limited

- Xapo Holdings Limited

- Bit Go, Inc.

- Advanced Micro Devices, Inc.

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Bit Main Technologies Holding Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Intel Corporation declared that it will provide a roadmap of energy-efficient accelerators to aid in the development of blockchain technology. The blockchain accelerator chip will ship later this year, according to the business. For this future solution, Argo Blockchain, Block & Grid Infrastructure is one of their initial clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Virtual Currencies Market based on the below-mentioned segments:

Global Virtual Currencies Market, By Component

- Hardware

- Software

Global Virtual Currencies Market, By Type

- Bitcoin

- Litecoin

- XPR

Global Virtual Currencies Market, By End-user

- Trading

- Retail & E-commerce

- Banking

- Others

Global Virtual Currencies Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within market?Xilinx, Inc., Canaan Inc., Binance, Bit fury Group Limited, Xapo Holdings Limited, Bit Go, Inc., Advanced Micro Devices, Inc., Intel Corporation, NVIDIA Corporation, Ripple, Bit Main Technologies Holding Company, and others.

-

2. How big is the global virtual currencies market?The Global Virtual Currencies Market is expected to grow from USD 2.8 Billion in 2022 to USD 9.6 Billion by 2032, at a CAGR of 13.11% during the forecast period 2022-2032.

-

3. Which region is holding largest share of market?Asia-Pacific is anticipated to hold the largest share of the global Virtual Currencies market over the predicted timeframe.

Need help to buy this report?