Global Virtual Cards Market Size, Share, and COVID-19 Impact Analysis, By Card Type (Debit Card, Credit Card), By Product Type (B2B Virtual Cards, B2B Virtual Cards, B2C Remote Payment Virtual Cards, C2B POS Virtual Cards), By Application (Consumer Use, Business Use), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Information & TechnologyGlobal Virtual Cards Market Insights Forecasts to 2030

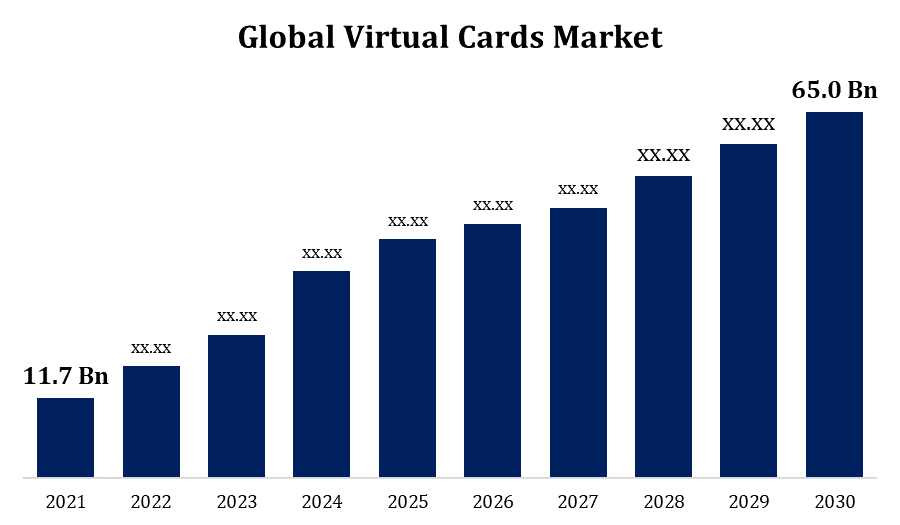

- The global Virtual Cards market was valued at USD 11.7 billion in 2021.

- The market is growing at a CAGR of 21% from 2021 to 2030

- The global Virtual Cards market is expected to reach USD 65.0 billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global Virtual Cards market is expected to reach USD 65.0 billion by 2030, at a CAGR of 21% during the forecast period 2021 to 2030. The increasing demand for Virtual Cards systems designed specifically for food to identify products with incorrect labels and low-quality products drives the market’s growth over the forecast period. However, the Virtual Cards system is highly expensive, restraining the market’s growth. In addition, a low penetration rate of Virtual Cards systems challenges the market’s growth over the forecast period.

Market Overview

The virtual Cards Market is projected to grow from USD 11.7 billion in 2021 to USD 65.0 billion by 2030 at a CAGR of 21% during the forecast period. A virtual card enables secure online transactions since it lowers the possibility of disclosing the actual credit/debit card information to the merchant. There are very chances of cloning or fraud because virtual cards are only visible to the user. Additionally, each virtual card is only intended for one use. It is made specifically for a single online transaction and is only valid for 48 hours. Depending on the bank, the credit limit and validity term may change. Virtual cards are less expensive than physical cards since there is no cost involved in making the cards and procuring the raw materials. Moreover, several banks charge very few from customers holding virtual cards. Additionally, since everything is managed online, the virtual bank may lower operating expenses, which allows them to lower the fees for the virtual cards they issue to their clients. In addition, virtual cards give users additional security advantages compared to actual cards. Moreover, users can customize their spending caps on a virtual card, increasing their savings. These are some driving factors for the growth of the virtual card market. However, the increasing demand for digital payment options among users, such as Gpay, UPI payments, net banking, Phonepe, etc., hinders the market’s growth. The increasing use of mobile phones and innovative technological advancements, such as the incorporation of 5G technology, is expected to provide growth opportunities for the market during the forecast period.

Global Virtual Cards Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 11.7 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 21% |

| 2030 Value Projection: | USD 65.0 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Card Type, By Product Type, By Application, by Region |

| Companies covered:: | American Express Company, Capital One, BTRS Holdings, Inc., JPMorgan Chase & Co., Wise Payments Limited, JPMorgan Chase & Co., Marqeta, Inc., MasterCard, Skrill USA, Inc., Stripe, Inc., WEX Inc., Adyen, Bento Technologies Inc., Billtrust (BTRS Holdings Inc.), Citigroup Inc., ePayService, DBS Bank Ltd, HSBC, Revolut Ltd, Stripe, Inc., State Bank of India, Mastercard, Marqeta, Inc., Standard Chartered Bank, WEX Inc., Wise Payments Limited |

Get more details on this report -

Report Coverage

This research report categorizes the market for Virtual Cards based on various segments and regions and forecasts revenue growth and analysis trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Virtual Cards market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Virtual Cards market.

Segmentation Analysis

- In 2021, the credit card segment dominated the market with the largest market share of 63% and market revenue of 7.3 billion.

Based on the card type, the virtual card market is categorized into debit cards and credit cards. In 2021, the credit card segment dominated the market with the largest market share of 63% and market revenue of 7.3 billion. The credit card segment will account for the greatest revenue in the market owing to the growing concerns among businesses and individuals to prevent corporate fraud. In order to reduce these risks, companies have switched to centralized, controlled, and seamless payment methods like Virtual Credit Cards (VCCs). In addition, several banks have partnered with fintech firms to offer virtual credit cards to customers. For instance, the Bank of Baroda announced in November 2021 that it would partner with OneCard, a fintech firm, to offer a virtual credit card that will arrive in three minutes. On the VISA Signature platform, this credit card was supposed to be made available by BOB Financial Services Limited (BFSL) and managed by OneCard.

- In 2021, the BB2B Virtual Cards systems segment accounted for the largest share of the market, with 36.4% and market revenue of 4.2 billion.

Based on product type, the Virtual Cards Market is categorized into B2C Remote Payment Virtual Cards, B2B Virtual Cards, and C2B POS Virtual Cards. In 2021, the BB2B Virtual Cards systems segment accounted for the largest share of the market, with 36.4% and market revenue of 4.2 billion. BB2B Virtual Cards segment has accounted for the largest revenue in the market due to the increased import and export of goods and services worldwide. The increasing import and export of goods and services have increased the B2B transactions among businesses, propelling the segment’s growth. These days, businesses are using virtual cards for B2B payment processes as it helps enhance cash flow, boost security, and simplify accounts payable (AP) automation instead of relying on older payment techniques like cheques and bank transactions. Additionally, enabling virtual card acceptance through automated accounts receivable can increase productivity and help firms seize growth prospects.

- In 2021, the business use segment accounted for the largest share of the market, with 59.6% and market revenue of 6.9 billion.

Based on Application, the Virtual Cards Market is categorized into consumer use and business use. In 2021, the business use segment accounted for the largest share of the market, with 59.6% and market revenue of 6.9 billion. The business use segment has accounted for the largest revenue in the market as virtual cards reduce the risk of fraud and theft. Virtual cards are used by businesses to make online payments to suppliers and merchants. Because they cannot be lost or stolen, unlike conventional credit and debit cards, these cards offer improved security. Furthermore, the likelihood of fraud is decreased by the fact that these cards can only be used once or for a specific amount of transactions. The issuing authority can quickly block the virtual card in the event of any probable fraud. Businesses can also use virtual cards to book business travel and pay employee expenses.

Regional Segment Analysis of the Virtual Cards Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

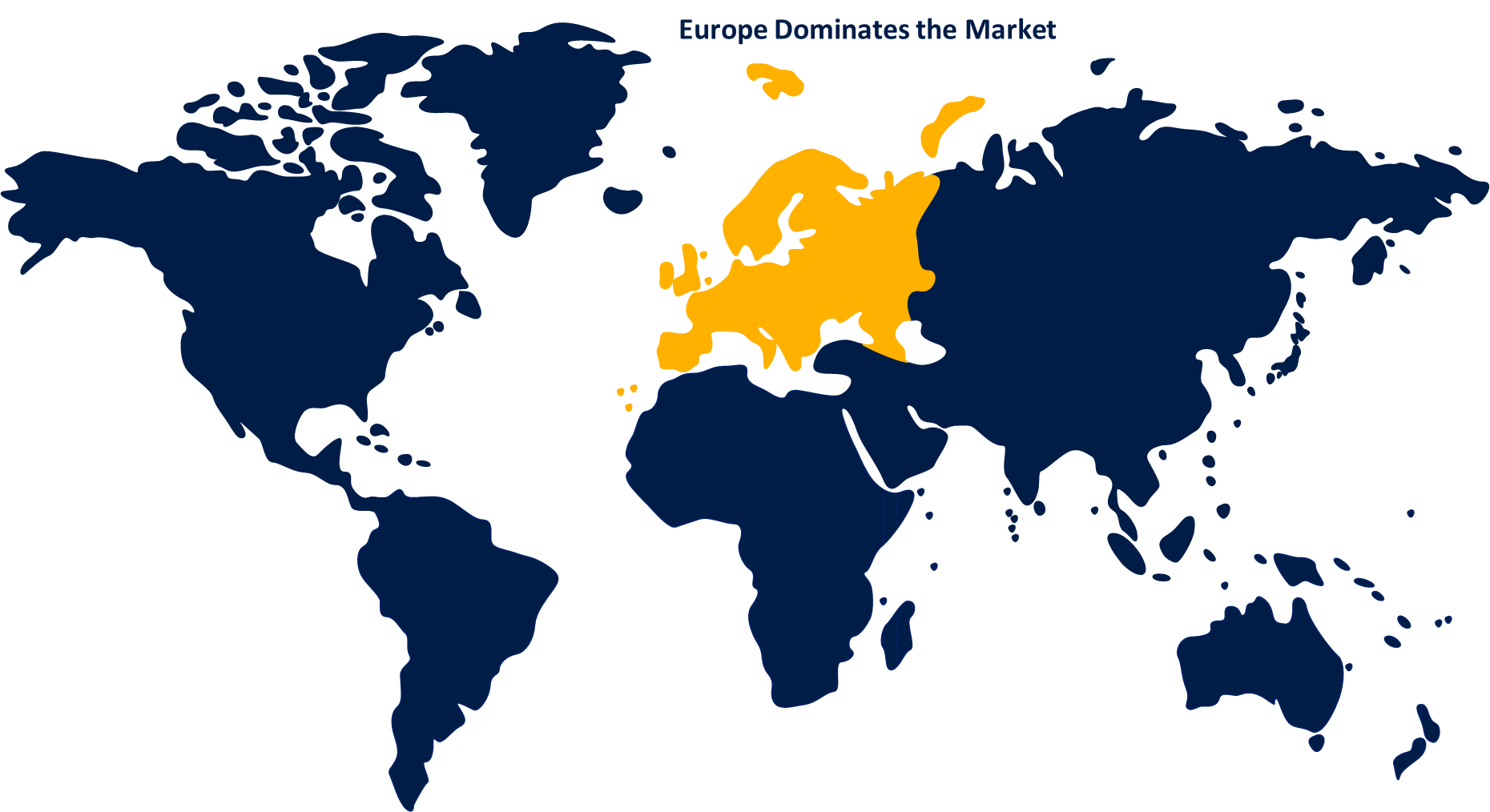

Europe emerged as the largest market for the global Virtual Cards market, with a market share of around 35.4% and 4.14 billion of the market revenue in 2021.

- Europe emerged as the largest market for the global Virtual Cards market, with a market share of around 35.4% and 4.14 billion of the market revenue in 2021. The U.K., Germany, and other European nations, with a rising inclination for cashless transactions, are projected to fuel the growth of the virtual cards market in the region. Additionally, several market participants are introducing cutting-edge items to the European market to entice consumers to use virtual cards. For instance, Stripe introduced Stripe Issuing in European countries in April 20, 2021. Businesses may now have more control over how their money is spent thanks to Stripe Issuing, which makes it possible to create, manage, and distribute both virtual and physical payment cards.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing use of smartphones and internet penetration. The growing adoption of smartphones in countries like India, China, and Japan is expected to help grow the virtual market in the Asia Pacific region. Additionally, the rising use of smartphones in these nations has increased consumers' propensity for making digital payments, boosting the need for virtual card payment solutions. For instance, according to a report released by Asian Bankers Worldwide in October 2021, Japan has a penetration rate of 70.6% for digital wallets, which is predicted to rise to 98.6% by 2025.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Virtual Cards market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- American Express Company

- Capital One

- BTRS Holdings, Inc.

- JPMorgan Chase & Co.

- Wise Payments Limited

- JPMorgan Chase & Co.

- Marqeta, Inc.

- MasterCard

- Skrill USA, Inc.

- Stripe, Inc.

- WEX Inc.

- Adyen

- Bento Technologies Inc.

- Billtrust (BTRS Holdings Inc.)

- Citigroup Inc.

- ePayService

- DBS Bank Ltd

- HSBC

- Revolut Ltd

- Stripe, Inc.

- State Bank of India

- Mastercard

- Marqeta, Inc.

- Standard Chartered Bank

- WEX Inc.

- Wise Payments Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In September 2021, Extend Enterprises, Inc., a fintech company specializing in virtual cards, partnered with American Express Company to promote the use of virtual cards in the United States. Holders of American Express Business Cards in the United States can utilize the Extend Enterprises, Inc. app to initiate virtual cards, also known as tokens.

- In May 2022, Google announced its collaboration with American Express, MasterCard, and Visa to make virtual cards accessible for consumers on the Chrome and Android platforms. This collaboration aims to develop virtual cards that will facilitate digital currency transactions.

Market Segment

This study forecasts global, regional, and country revenue from 2021 to 2030. Spherical Insights has segmented the global virtual cards market based on the below-mentioned segments:

Virtual Cards Market, By Card

- Debit Card

- Credit Card

Virtual Cards Market, By Product Type

- B2B Virtual Cards

- B2C Remote Payment Virtual Cards

- B2C POS Virtual Cards

Virtual Cards Market, By Application

- Consumer Use

- Business Use

Virtual Cards Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global Virtual Cards market?As per Spherical Insights, the size of the Virtual Cards market was valued at USD 11.7 Billion in 2021 to USD 65.0 Billion by 2030.

-

What is the market growth rate of the global Virtual Cards market?The global Virtual Cards market is growing at a CAGR of 21% during the forecast period 2021-2030.

-

Which region dominates the global Virtual Cards market?The Europe emerged as the largest market for Virtual Cards.

-

What is the significant driving factor for the Virtual Cards market?The Increasing Number of Online Transactions will influence the market's growth.

-

Which factor is limiting the growth of the Virtual Cards market?Increasing incidences of theft could hamper the market growth.

-

What is an opportunity for the Virtual Cards market?Innovative technological advancements will provide considerable opportunities to the market.

-

Who are the key players in the global Virtual Cards market?Key players of the Virtual Cards market are American Express Company, Capital One, BTRS Holdings, Inc., JPMorgan Chase & Co., Wise Payments Limited, JPMorgan Chase & Co., Marqeta, Inc., MasterCard, Skrill USA, Inc., Stripe, Inc., WEX Inc., Adyen, Bento Technologies Inc., Billtrust (BTRS Holdings Inc.), Citigroup Inc., ePayService, DBS Bank Ltd, HSBC, Revolut Ltd, Stripe, Inc., State Bank of India, Mastercard, Marqeta, Inc., Standard Chartered Bank, WEX Inc., Wise Payments Limited.

Need help to buy this report?