Global Vinyl Ester Resin Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bisphenol A-based Vinyl Ester Resins, Novolac-based Vinyl Ester Resins, Brominated Vinyl Ester Resins, and Others), By Application (Pipes and Tanks, Marine Composites, Wind Turbine Blades, FRP Bridges and Structure, Corrosion-Resistant Coatings, Aerospace Composites, and Others), By End-Use (Construction, Marine, Chemical Processing, Automotive, Wind Energy, Aerospace, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Vinyl Ester Resin Market Insights Forecasts to 2035

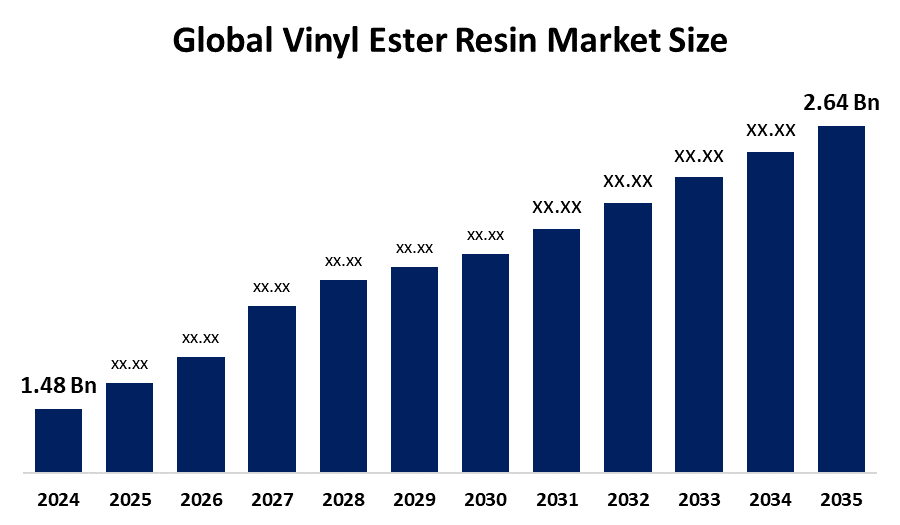

- The Global Vinyl Ester Resin Market Size Was Estimated at USD 1.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035

- The Worldwide Vinyl Ester Resin Market Size is Expected to Reach USD 2.64 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Vinyl Ester Resin Market Size Was Worth Around USD 1.48 Billion In 2024 And Is Predicted To Grow To Around USD 2.64 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.4% From 2025 To 2035. The market for vinyl ester resins worldwide is witnessing an increase due to the rising demand for corrosion-resistant and lightweight materials in applications such as pipes and tanks, marine, and wind energy sectors in the Asia Pacific region.

Market Overview

The international vinyl ester resins market includes thermoset resins that are obtained by esterifying epoxy resins with unsaturated carboxylic acids, offering the mechanical properties of epoxies, as well as ease of handling, such as that of polyesters. Vinyl ester resins are commonly utilized in corrosion-resistant pipes, storage tanks, boats, wind turbine blades, autos, construction materials, etc., because of their outstanding chemical resistance, mechanical strength, and durability. Market demand is fueled by a growing use of vinyl ester resins in chemical processing, oil, gas, water, renewable power, and other industries, where a long-life span and ease of maintenance are musts.

In the US market, the November 2024 EPA’s National Strategy to Prevent Plastic Pollution provides detailed guidance on the plastic lifecycle and the production of petrochemicals. As the strategy emphasizes the TSCA risk evaluations for plastics such as vinyl chloride and promotes the adoption of materials with lower impacts, the approach is expected to foster the development of sustainable vinyl ester materials and also apply pressure on the traditional manufacturers to comply with the regulations. Opportunities are generated from enhancing infrastructure, increasing adoption of wind power, and a growing demand for light-weight materials to displace metals, thereby increasing demand from non-traditional sectors as well. Dominant market participants include Ashland, Polynt-Reichhold, AOC Resins, Scott Bader, DSM, and Swancor, which concentrate on product development and augmentation of capacities worldwide.

Report Coverage

This research report categorizes the vinyl ester resin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vinyl ester resin market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vinyl ester resin market.

Global Vinyl Ester Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.4% |

| 2035 Value Projection: | USD 2.64 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By End-Use and By Region |

| Companies covered:: | Ashland Global Holdings Inc., Hexion Inc., Scott Bader, Polynt Reichhold Group, AOC Resins, INEOS Composites, Swancor Holding, DSM Composite Resins, Showa Denko K.K., Allnex, Sino Polymer Co., Ltd., Huntsman Corporation, DIC Corporation, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The vinyl ester resin market trends are driven by increased demand from high-performance, corrosion-resistant applications. The fast-growing sectors in the chemicals and oil and gas industries boost demand for vinyl ester resins, which are sought after to create corrosion-resistant pipes, tanks, and coatings. Use of vinyl ester resins promotes weight reduction properties in wind energy, boats, and the automotive sectors. Infrastructure development and wastewater treatment projects further boost demand. Besides, the growing impetus on extending product life cycles and reducing maintenance costs encourages the replacement of conventional materials with vinyl ester-based composites across different parts of the world.

Restraining Factors

The main drawbacks for the global vinyl ester resin market are high raw material and production costs compared to polyester resins. Besides, volatility in petrochemical prices takes its toll on profitability. A number of health, safety, and environmental concerns relating to styrene emissions, strict regulations, and limited recyclability further reduce market growth.

Market Segmentation

The vinyl ester resin market share is classified into product type, application, and end-use.

- The bisphenol A-based vinyl ester resins segment dominated the market in 2024, approximately 66% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the vinyl ester resin market is divided into bisphenol A-based vinyl ester resins, novolac-based vinyl ester resins, brominated vinyl ester resins, and others. Among these, the bisphenol A-based vinyl ester resins segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The bisphenol A–based vinyl ester resins segment dominated the growth in the market owing to the high mechanical strength, excellent chemical and corrosion resistance, and superior thermal stability. These advantages make it ideal for construction, marine, and industrial applications because these properties ensure durability, longer service life, and reduced maintenance costs.

- The pipes and tanks segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the vinyl ester resin market is divided into pipes and tanks, marine composites, wind turbine blades, FRP bridges and structure, corrosion-resistant coatings, aerospace composites, and others. Among these, the pipes and tanks segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pipes and tanks segment held the largest share in market growth due to rising demands for corrosion-resistant, durable, and lightweight materials in chemical processing, water treatment, oil and gas, and industrial storage applications. Some of the properties vinyl ester resins exhibit are excellent chemical resistance with a long service life, minimizing maintenance costs.

- The chemical processing segment accounted for the highest market revenue in 2024, approximately 57.8% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the vinyl ester resin market is divided into construction, marine, chemical processing, automotive, wind energy, aerospace, electronics, and others. Among these, the chemical processing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Chemical processing accounted for the market growth due to increasing demand for materials with superior chemical, heat, and corrosion resistance properties. Vinyl ester resin is being used in the production of reactors, pipes, tanks, and storage systems in all forms due to its durability, safety, and minimal maintenance cost that sustains efficient operations under aggressive chemicals.

Regional Segment Analysis of the Vinyl Ester Resin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vinyl ester resin market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vinyl ester resin market over the predicted timeframe. The vinyl ester resin market in North America is expected to have the 40% share in terms of growth due to its growing demand from chemical processing, construction, shipbuilding, and infrastructure industries, in addition to its enhanced manufacturing development capabilities and high adoption levels of corrosion-resistant materials. The United States is driving this market because of substantial investments in its industrial infrastructure, oil & gas industry, and water treatment plants. These factors are contributing to increased demand from Canada, which is driven by its use in pipes, tanks, and environmental applications.

Asia Pacific is expected to grow at a rapid CAGR in the vinyl ester resin market during the forecast period. The Asia Pacific vinyl ester resin market is projected to have a 30% market share, due to the increasing pace of industrialization and urbanization, and development activities that are gaining momentum, especially in China, the Indian subcontinent, and Japan. Increasing demand from the construction, automotive, marine, and chemical industries is fueling the demand for vinyl ester resin as a material that provides high protection against corrosion and can be made into a composite material based on the application requirements.

The European vinyl ester resin market is expanding steadily owing to the strict environmental and safety regulations in this region, and also due to its increased use in wind turbines as a raw material for making wind turbine blades. Germany, France and the U.K. are contributing significantly to this growth because of their increased industrial operations and modern infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vinyl ester resin market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ashland Global Holdings Inc.

- Hexion Inc.

- Scott Bader

- Polynt Reichhold Group

- AOC Resins

- INEOS Composites

- Swancor Holding

- DSM Composite Resins

- Showa Denko K.K.

- Allnex

- Sino Polymer Co., Ltd.

- Huntsman Corporation

- DIC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, DIC Corporation announced plans to build a new epoxy resin production facility at its Chiba Plant in Ichihara, Japan. The expansion supports its chemitronics focus, providing advanced materials for semiconductor packaging and cutting-edge electronics, addressing growing future demand.

- In May 2025, Scott Bader announced its return to TCT 3Sixty to support manufacturers in industrial additive manufacturing, offering design flexibility, shorter lead times, and cost efficiency. Leveraging its existing additive manufacturing resin portfolio, the company aims to enhance marine, land transport, rail, and renewable energy industrial applications.

- In April 2025, Huntsman announced it would exhibit at LIGNA 2025 in May, unveiling two new bio-based MDI resins for composite wood products. The binders, containing up to 25% bio-based content, reduce carbon footprint by 30% while maintaining high quality and performance in panels.

- In February 2025, AOC opened a new pilot plant in Filago, Italy, to boost scalability and product innovation. The facility aims to shorten time-to-market for new resins and create opportunities for AOC and customers to grow a sustainable business in composite materials.

- In August 2024, Hexion Inc. partnered with Clariant to develop advanced intumescent coatings, combining Hexion’s VeoVa vinyl ester binders with Clariant’s additives, aiming to enhance fire protection systems in critical industrial and infrastructure applications globally.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vinyl ester resin market based on the below-mentioned segments:

Global Vinyl Ester Resin Market, By Product Type

- Bisphenol A-based Vinyl Ester Resins

- Novolac-based Vinyl Ester Resins

- Brominated Vinyl Ester Resins

- Others

Global Vinyl Ester Resin Market, By Application

- Pipes and Tanks

- Marine Composites

- Wind Turbine Blades

- FRP Bridges and Structure

- Corrosion-Resistant Coatings

- Aerospace Composites

- Others

Global Vinyl Ester Resin Market, By End-Use

- Construction

- Marine

- Chemical Processing

- Automotive

- Wind Energy

- Aerospace

- Electronics

- Others

Global Vinyl Ester Resin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vinyl ester resin market over the forecast period?The global vinyl ester resin market is projected to expand at a CAGR of 5.4% during the forecast period.

-

2. What is the vinyl ester resin market?The vinyl ester resin market refers to the global trade and demand for high-performance resins used in corrosion-resistant composites and industrial applications.

-

3. What is the market size of the vinyl ester resin market?The global vinyl ester resin market size is expected to grow from USD 1.48 billion in 2024 to USD 2.64 billion by 2035, at a CAGR of 5.4% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the vinyl ester resin market?North America is anticipated to hold the largest share of the vinyl ester resin market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global vinyl ester resin market?Ashland Global Holdings Inc., Hexion Inc., Scott Bader, Polynt-Reichhold Group, AOC Resins, INEOS Composites, Swancor Holding, DSM Composite Resins, Showa Denko K.K., Allnex, Sino Polymer Co., Ltd., and Others.

-

6. What factors are driving the growth of the vinyl ester resin market?The vinyl ester resin market is driven by industrialization, infrastructure development, chemical and marine applications, corrosion resistance demand, renewable energy projects, and government initiatives supporting durable, high-performance composite materials.

-

7. What are the market trends in the vinyl ester resin market?Growing adoption in corrosion‑resistant composites, sustainability focus, low‑VOC formulations, increased infrastructure demand, automotive/renewables use, regional Asia Pacific expansion, and continuous innovation.

-

8. What are the main challenges restricting wider adoption of the vinyl ester resin market?The main challenges restricting the wider adoption of the vinyl ester resin market are high costs, raw material price volatility, limited shelf life, complex processing, and competition from alternative materials.

Need help to buy this report?