Global Vinasse Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Application (Fertilizer/Soil Amendment, Animal Feed, and Bioenergy), By Source (Sugarcane/Ethanol and Grain/Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsVinasse Market Summary, Size & Emerging Trends

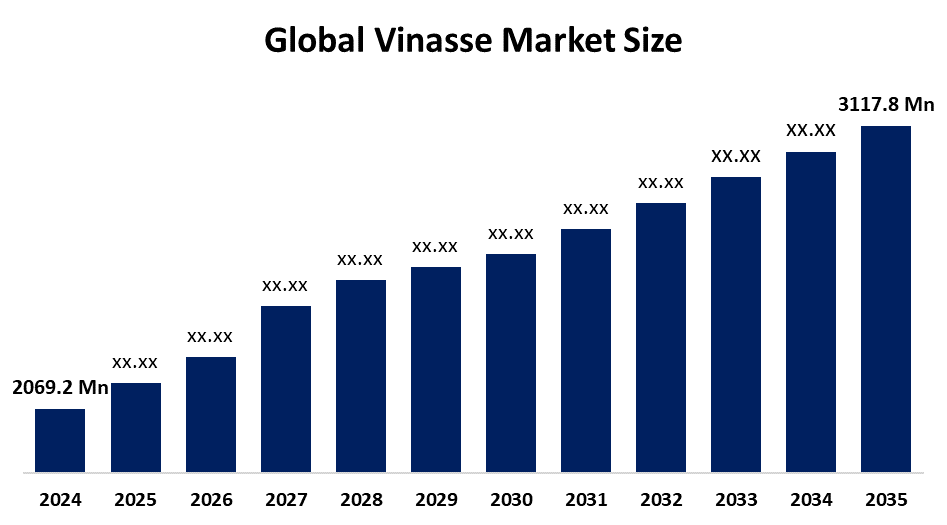

According to Decision Advisor, The Global Vinasse Market Size is expected to grow from USD 2069.2 Million in 2024 to USD 3117.8 Million by 2035, at a CAGR of 3.8% during the forecast period 2025-2035. The rising use of vinasse as an organic fertilizer and its growing applications in bioenergy production are key drivers for this market’s growth.

Get more details on this report -

Key Market Insights

- Asia Pacific is projected to dominate the global vinasse market in terms of revenue share during the forecast period.

- In terms of application, the fertilizer/soil amendment segment accounted for the largest share due to the high demand in sustainable agriculture.

- By source, sugarcane/ethanol-based vinasse led the market, driven by high production in countries like Brazil and India.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2069.2 Million

- 2035 Projected Market Size: USD 3117.8 Million

- CAGR (2025-2035): 3.8%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

Vinasse Market

The vinasse market centers around the utilization of a byproduct generated from ethanol distillation, primarily derived from sugarcane or grain. Traditionally considered waste, vinasse has emerged as a valuable resource in agriculture and renewable energy production. Rich in potassium and organic matter, it is increasingly used as a fertilizer and soil amendment, especially in sustainable farming. The market benefits from expanding ethanol production globally and the push for circular economy practices. Countries with robust ethanol industries, such as Brazil, India, and the U.S., are leading adopters. Moreover, vinasse is gaining traction in bioenergy, where it serves as a feedstock for biogas and other renewable fuels. As industries and governments pursue low-waste and eco-friendly production models, vinasse is evolving from a disposal problem into a profitable and sustainable input.

Vinasse Market Trends

- Rising demand for organic fertilizers and sustainable agriculture practices is boosting vinasse usage.

- Growing bioenergy investments are encouraging the use of vinasse in biogas and bioethanol production.

- Policy shifts supporting circular economy and waste valorization are enabling greater vinasse utilization globally.

Vinasse Market Dynamics

Driving Factors: Growing production of ethanol

The vinasse market is primarily driven by the growing production of ethanol, especially in countries like Brazil and India, which generates large volumes of vinasse. Its high nutrient content makes it a cost-effective and eco-friendly alternative to chemical fertilizers. Rising demand for organic farming and sustainable agriculture further supports market growth. Additionally, the shift toward renewable energy sources, where vinasse is used in biogas production, is increasing its industrial applications, positioning vinasse as a key contributor to circular economy initiatives.

Restraining Factors: Seasonal availability tied to ethanol production cycles limits year-round supply

One of the main restraints in the vinasse market is its high water content, which makes storage, transportation, and handling costly and logistically complex. Seasonal availability tied to ethanol production cycles limits year-round supply, affecting consistent usage. Excessive land application can also lead to environmental concerns such as soil salinity and groundwater pollution. Moreover, lack of awareness and infrastructure in some regions hinders adoption, particularly where ethanol production is limited or circular economy practices are not widely implemented.

Opportunity: Technological innovations such as vinasse concentration

Significant opportunities exist in leveraging vinasse for bioenergy production, particularly in biogas and biofertilizer industries. Technological innovations such as vinasse concentration and drying systems make transportation and storage more viable, expanding potential markets. Government support for organic farming and low-carbon technologies provides regulatory backing. Emerging economies with expanding ethanol industries offer untapped growth potential. Additionally, exporting processed vinasse as fertilizer can create new revenue streams, especially in regions seeking organic solutions for soil enrichment and sustainable agricultural practices.

Challenges: Compliance with environmental regulations is critical

The vinasse market faces several challenges, including logistics issues due to the bulky and perishable nature of raw vinasse. Compliance with environmental regulations is critical, as improper application can lead to contamination. The market also struggles with limited infrastructure for vinasse processing and distribution in less developed regions. Furthermore, technological limitations in small-scale ethanol plants restrict efficient vinasse utilization. Finally, economic viability can be affected by fluctuations in ethanol production, which directly influences vinasse availability and cost-efficiency in downstream applications.

Global Vinasse Market Ecosystem Analysis

The vinasse market ecosystem includes ethanol producers, agricultural cooperatives, fertilizer companies, and renewable energy providers. Key players source vinasse as a byproduct and integrate it into agricultural or energy production chains. Government agencies play a critical role by enforcing environmental guidelines and promoting organic farming. Research institutions also contribute by developing efficient technologies to treat and utilize vinasse across industries. The value chain is heavily influenced by ethanol production trends, regulatory frameworks, and sustainability goals.

Global Vinasse Market, By Application

The fertilizer/soil amendment segment dominated the global vinasse market, accounting for approximately 58% of total market revenue. This dominance is attributed to vinasse’s high content of potassium, organic matter, and micronutrients, which make it a valuable organic fertilizer. It’s especially used in sugarcane and vegetable farming, where it enhances soil fertility, supports microbial activity, and reduces reliance on chemical inputs. Widespread adoption in countries with large agricultural sectors, such as Brazil and India, reinforces its leading market position.

The bioenergy segment is expected to be the fastest-growing, with a projected CAGR of 7.8% of the market share in 2024. Vinasse is increasingly being utilized in anaerobic digestion systems to produce biogas, contributing to renewable energy generation and carbon footprint reduction. This segment is gaining traction in regions investing in circular economy models and decentralized energy systems, particularly in Latin America and parts of Europe.

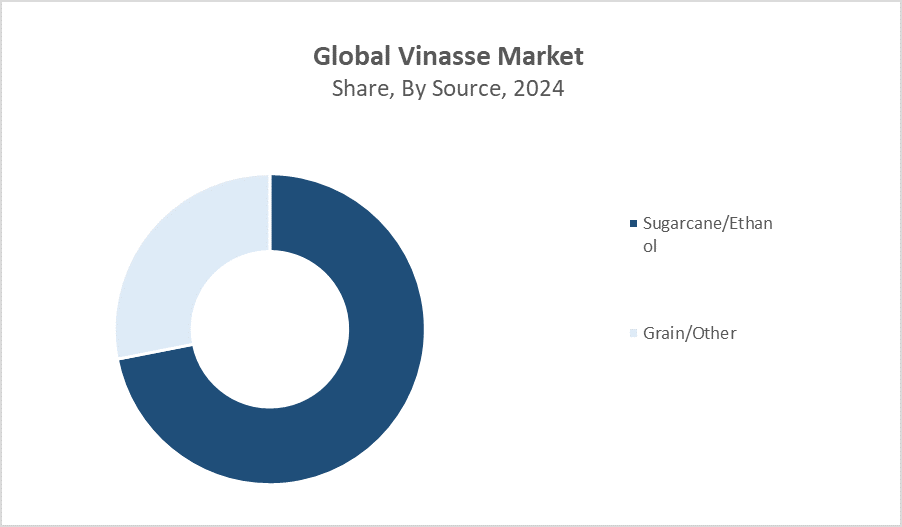

Global Vinasse Market, By Source

The sugarcane/ethanol segment held the largest share in the global vinasse market in 2024, accounting for approximately 67% of total market revenue. This dominance is primarily driven by high ethanol output in countries like Brazil, India, and Thailand, where sugarcane is the primary feedstock. The resulting vinasse is widely used in agricultural applications (fertilizer and fertigation) and increasingly in bioenergy systems. Strong sugarcane distillery infrastructure and supportive government policies in Latin America and Asia Pacific further reinforce this segment’s lead.

Get more details on this report -

The grain/other source segment accounted for around 33% of the market share in 2024 and is experiencing steady growth, particularly in North America and Europe. This segment primarily includes vinasse from corn, wheat, and barley-based ethanol production. It is gaining popularity for use in livestock feed, due to its nutrient content, and as a soil conditioner. Growth is supported by the expansion of grain ethanol plants and the rising focus on sustainable agricultural practices in these regions.

Asia Pacific is projected to account for the largest share of the global vinasse market, contributing approximately 38% of total market revenue by 2035.

Get more details on this report -

This dominance is fueled by high ethanol production from sugarcane in countries like India, China, and Thailand. The region also has a strong agricultural base, creating robust demand for vinasse as an organic fertilizer. Government support for sustainable agriculture and fertigation practices enhances adoption, particularly in India, where vinasse use in sugarcane fields is rapidly expanding.

Latin America is forecasted to be the fastest-growing regional market, with a CAGR of around 7.9% from 2025 to 2035.

Brazil leads in vinasse utilization, especially for fertigation in sugarcane farming, supported by a well-established ethanol production ecosystem and stringent environmental policies. Additionally, growing investments in bioenergy infrastructure across the region are driving vinasse use in biogas and renewable energy projects, positioning Latin America as a major growth hotspot in the coming years.

North America held an estimated 18% market share in 2024

is emerging as a key market for grain-based vinasse, particularly in the United States, where corn-based ethanol production is high. The region is experiencing a surge in biogas and renewable energy projects that increasingly incorporate vinasse as a substrate for anaerobic digestion. As interest in sustainable waste-to-energy solutions grows, the role of vinasse in the circular economy is expected to expand significantly across the U.S. and Canada.

WORLDWIDE TOP KEY PLAYERS IN THE VINASSE MARKET INCLUDE

- Raízen Energia S.A.

- Tereos Group

- Louis Dreyfus Company

- Balrampur Chini Mills Ltd.

- Shree Renuka Sugars Ltd.

- EID Parry (India) Limited

- Alcogroup

- Grain Processing Corporation

- BP Bunge Bioenergia

- Godavari Biorefineries Ltd.

- Others

Product Launches in Vinasse Market

- In May 2023, Balrampur Chini Mills, one of India’s leading sugar producers, announced the establishment of a concentrated vinasse processing unit in Uttar Pradesh. This facility is designed to process raw vinasse into a concentrated form, making it easier to store, transport, and apply as a fertilizer. The initiative addresses key challenges in vinasse logistics and supports sustainable agriculture by enhancing the usability of this nutrient-rich byproduct across the region.

- In August 2023, the Louis Dreyfus Company partnered with a European biogas firm to integrate vinasse as a feedstock in a new renewable energy facility in France. This move highlights the growing use of vinasse in biogas production, aligning with the EU’s goals for green energy and waste valorization. The project not only diversifies vinasse applications but also reinforces circular economy practices by converting agricultural byproducts into clean energy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the vinasse market based on the below-mentioned segments:

Global Vinasse Market, By Application

- Fertilizer/Soil Amendment

- Animal Feed

- Bioenergy

Global Vinasse Market, By Source

- Sugarcane/Ethanol

- Grain/Other

Global Vinasse Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What are the major application segments in the Global Vinasse Market?A: The primary applications are Fertilizer/Soil Amendment, Animal Feed, and Bioenergy.

-

Q: Which application segment holds the largest market share?A: The Fertilizer/Soil Amendment segment held the largest share, accounting for approximately 58% of total revenue in 2024.

-

Q: Which application segment is expected to grow the fastest?A: The Bioenergy segment is expected to grow at the fastest rate, with a projected CAGR of 7.8%.

-

Q: What are the major source segments in the Vinasse Market?A: Vinasse is segmented by source into Sugarcane/Ethanol and Grain/Other.

-

Q: Which source segment dominated the market in 2024?A: The Sugarcane/Ethanol segment held approximately 67% of the market share in 2024.

-

Q: Who are the top companies operating in the Global Vinasse Market?A: Key players include Raízen Energia S.A., Tereos Group, Louis Dreyfus Company, Balrampur Chini Mills Ltd., Shree Renuka Sugars Ltd., EID Parry (India) Limited, Alcogroup, Grain Processing Corporation, BP Bunge Bioenergia, and Godavari Biorefineries Ltd.

-

Q: What startups or innovations are disrupting the Vinasse Market?A: Companies are innovating in vinasse concentration and bioenergy applications. For example, Balrampur Chini Mills introduced a concentrated vinasse processing unit, while Louis Dreyfus Company partnered on a biogas facility in France.

-

Q: What challenges does the Vinasse Market face?A: Major challenges include seasonal availability tied to ethanol cycles, high water content leading to storage and transport issues, and compliance with environmental regulations.

-

Q: What are the key opportunities in the Vinasse Market?A: Opportunities include technological innovations in vinasse processing, bioenergy integration, and exports of processed vinasse as fertilizer in emerging markets.

-

Q: How are government policies impacting the Vinasse Market?A: Policies promoting sustainable agriculture, circular economy, and renewable energy significantly support vinasse adoption, especially in Asia and Latin America.

-

Q: What trends are shaping the future of the Vinasse Market?A: Emerging trends include the use of vinasse in anaerobic digestion for biogas, vinasse concentration technologies, and its role in organic farming.

Need help to buy this report?