Vietnam Furniture Market Size, Share, By Type (Wooden Furniture, Metal Furniture, Plastic Furniture, And Upholstered Furniture), By Material (Hardwood, Softwood, Metal, Plastic, And Fabric), By Application (Residential, Commercial, Hospitality, And Institutional), And Vietnam Furniture Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsVietnam Furniture Market Insights Forecasts To 2035

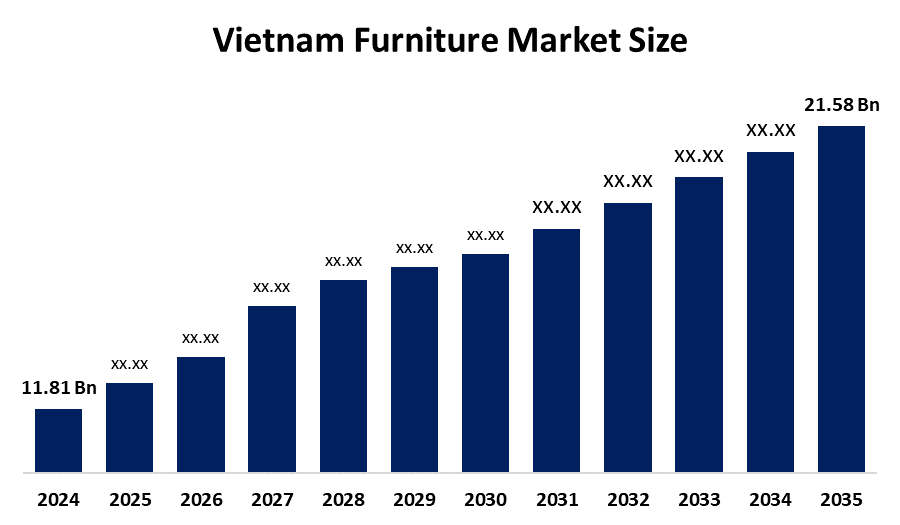

- Vietnam Furniture Market Size 2024: USD 11.81 Bn

- Vietnam Furniture Market Size 2035: USD 21.58 Bn

- Vietnam Furniture Market Size CAGR 2024: 5.63%

- Vietnam Furniture Market Size Segments: Type, Material, And Application

Get more details on this report -

Vietnam Furniture Market Size Defines The Economic Sector Involved With The Development, Sale And Exportation Of All Types Of Furniture Product Manufactured In And Sold In Vietnam. Furniture is a movable object that provides a platform for human activity or creates an organizational space for possessions. The Vietnam furniture market provides furniture products manufactured using a combination of various raw materials, such as metal, aluminium, steel or plastic and allows for technology integration to respond to growing consumer needs due to globalization, urban development; increased disposable income; and growth of e-commerce.

The Furniture In Vietnam Are Backed By Government Support, Including The Foreign Direct Investment (FDI), Streamline Customs Procedures, And Develop Industrial Zones Focused On Furniture And Wood Processing, Making The Sector More Competitive Internationally And Attractive To Global Buyers. These policies, along with adoption of sustainability standards such as Forest Stewardship Council (FSC) certification, aim to strengthen both export performance and environmental compliance. Vietnam is now ranked among the top furniture producers globally, with wood and wood products exports exceeding USD 10 billion annually, underscoring the industry’s export-oriented growth and its contribution to the national economy.

As Technology Advances, Vietnamese Furniture Providers Are Now Using Automation Technology Such As CNC Machining, Robotic Assembly, And Digital Design Tools To Provide Manufacturers With Greater Efficiency, Accuracy, And Quality Through Increased Use Of Automation Technologies. Manufacturers are also embracing new technologies such as smart technology and digital marketing platforms that include the use of AI for customized designs and production as well as e-commerce tools such as AR/VR to provide shoppers with a better shopping experience. These innovative technologies help manufacturers to reduce their production costs, increase the product differentiation of their products, and satisfy the increased consumer demand for technology-rich and multi-functional furniture.

Vietnam Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 11.81 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.63% |

| 2023 Value Projection: | 21.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type By Application |

| Companies covered:: | Cuong Wood Joint Stock Company, AA Corporation, Phu Tai JSC, Xuan Hoa Furniture, Kaiser 1 Furniture Industry Co., Ltd., IKEA, JYSK, Nitori Co., Ltd., Woodnet, Vinafor, Scaviwood, Foster Vietnam, Glory Oceanic, Wanek Furniture, BoConcept, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Vietnam Furniture Market:

The Vietnam Furniture Market Size Is Driven By The Aging Population, rapid urbanization is contributing to the demand for new housing, increasing disposable income and an expanding middle class, government provides substantial support; direct foreign investment contributes to the upgrade of production facilities and technology, and emergence of e-commerce encouraging domestic spending.

The Vietnam Furniture Market Size Is Restrained By The Initial Cost Of Production High, intense competition among a large number of manufacturers, vulnerabilities in the supply chain, fluctuations in raw material prices, and financial barriers that prevent smaller companies from adopting advanced technology.

The Future Of Vietnam Furniture Market Size Is Bright And Promising, With Versatile Opportunities Emerging From The Increase In Demand For Premium And Sustainable Products As Consumers Become Increasingly Interested In Eco-Friendly And Design-Oriented Products. The growth of Vietnam's manufacturing base offers significant export potential, coupled with ongoing trade agreements, and continued development of smart and multifunctional furniture that supports urban living. The increase in online retail and digitalisation opens up additional avenues for brands to expand their footprint, innovate their offerings and respond to new opportunities in both the domestic and international marketplace.

Market Segmentation

The Vietnam Furniture Market share is classified into type, material, and application.

By Type:

The Vietnam Furniture Market Size Is Divided By Type Into Wooden Furniture, Metal Furniture, Plastic Furniture, And Upholstered Furniture. Among these, the wooden furniture segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Abundant domestic forestry resources, strong raw material base, traditional appeal and durability, established craftsmanship, and mature supply chains and advanced production technologies all contribute to the wooden furniture segment's largest share and higher spending on furniture when compared to other type.

By Material:

The Vietnam Furniture Market Size Is Divided By Material Into Hardwood, Softwood, Metal, Plastic, And Fabric. Among these, the hardwood segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hardwood segment dominates because of abundant forestry resources, established craftsmanship, increase demand for eco-friendly and sustainable furniture, aesthetic appeal with durable action, and strong export market in Vietnam.

By Application:

The Vietnam Furniture Market Size Is Divided By Application Into Residential, Commercial, Hospitality, And Institutional. Among these, the residential segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Rapid urbanization, increase in disposable income, focus on comfort and aesthetics, e-commerce expansion, and demand for space saving solutions all contribute to the residential segment's largest share and higher spending on furniture when compared to other application.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organisations/Companies Involved Within The Vietnam Furniture Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Vietnam Furniture Market:

- An Cuong Wood Joint Stock Company

- AA Corporation

- Phu Tai JSC

- Xuan Hoa Furniture

- Kaiser 1 Furniture Industry Co., Ltd.

- IKEA

- JYSK

- Nitori Co., Ltd.

- Woodnet

- Vinafor

- Scaviwood

- Foster Vietnam

- Glory Oceanic

- Wanek Furniture

- BoConcept

- Others

Recent Developments in Vietnam Furniture Market:

In May 2025, Hoa Phat Group launched a new 70,000 m cube high-end bamboo and rubber flooring plant, which meets international EPA, CARB, and FDA standards, highlighting a focus on sustainable and certified products.

In March 2025, Kuka Home expanded its manufacturing operations in Vietnam with a new 470,000-square-foot factory in Binh Duong province and became fully operational. This expansion aimed at meeting high demand from North America customers, particularly for motion upholstery.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Vietnam, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Vietnam furniture market based on the below-mentioned segments:

Vietnam Furniture Market, By Type

- Wooden Furniture

- Metal Furniture

- Plastic Furniture

- Upholstered Furniture

Vietnam Furniture Market, By Material

- Hardwood

- Softwood

- Metal

- Plastic

- Fabric

Vietnam Furniture Market, By Application

- Residential

- Commercial

- Hospitality

- Institutional

Frequently Asked Questions (FAQ)

-

What is the Vietnam furniture market size?Vietnam furniture market is expected to grow from USD 11.81 billion in 2024 to USD 21.58 billion by 2035, growing at a CAGR of 5.63% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rapid urbanization, which increases new housing demand, rising disposable incomes, expanding middle class seeking quality furniture, strong government support, robust foreign direct investment that upgrades production capacity and technology, growth of e-commerce, which broadens consumer access to products nationwide and support strong domestic consumption.

-

What factors restrain the Vietnam furniture market?Constraints include the high initial cost of production, intense competition among a large number of manufacturers, supply chain vulnerabilities and fluctuations in raw material costs, and the financial barriers for smaller firms to adopt advanced technologies.

-

How is the market segmented by material?The market is segmented into hardwood, softwood, metal, plastic, fabric.

-

Who are the key players in the Vietnam furniture market?Key companies include An Cuong Wood Joint Stock Company, AA Corporation, Phu Tai JSC, Xuan Hoa Furniture, Kaiser 1 Furniture Industry Co., Ltd., IKEA, JYSK, Nitori Co., Ltd., Woodnet , Vinafor, Scaviwood, Foster Vietnam, Glory Oceanic, Wanek Furniture, BoConcept, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?