Vietnam Ethanol Derivative Market Size, Share, By Derivative (Ethyl Acetate, Ethylamines, Ethylene, Ethyl Ether, Ethyl Chloride, And Others), By Purity (Denatured And Undenatured), And Vietnam Ethanol Derivative Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsVietnam Ethanol Derivative Market Insights Forecasts to 2035

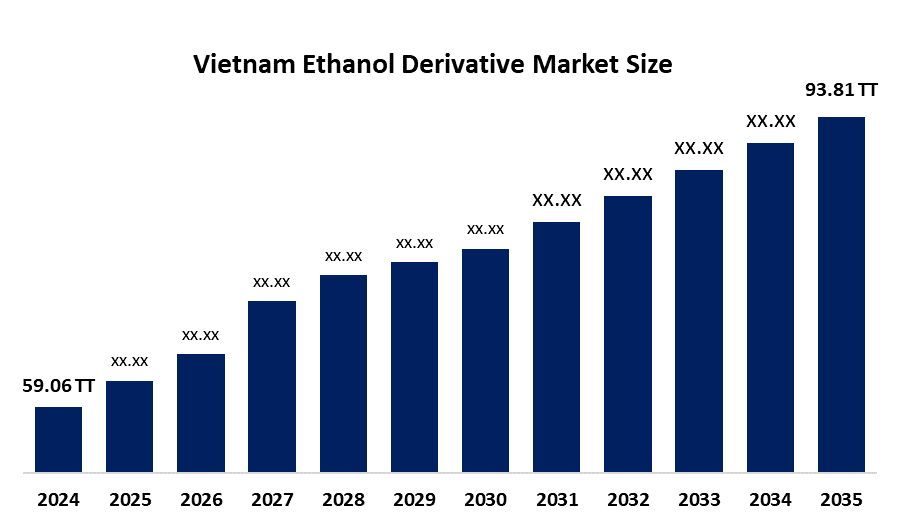

- Vietnam Ethanol Derivative Market 2024: 59.06 Thousand Tonnes

- Vietnam Ethanol Derivative Market Size 2035: 93.81 Thousand Tonnes

- Vietnam Ethanol Derivative Market CAGR 2024: 4.3%

- Vietnam Ethanol Derivative Market Segments: Derivative and Purity

Get more details on this report -

The Vietnam ethanol derivative market includes an economic system that involves the production, processing, distribution, and consumption of ethanol and its derivatives in Vietnam. Ethanol derivatives can be defined as products that are made partly or totally from ethanol. Examples of ethanol derivatives are E10 blended fuel, industrial solvents, disinfectants, personal care products, and other chemicals that use ethanol as a main ingredient. In the Vietnam ethanol derivatives market, demand for ethanol is driven primarily by the transportation and the manufacturing sector.

The ethanol derivative in Vietnam is backed by government support, including the Vietnam’s nationwide switch to mandatory E10 fuel (10% ethanol blended with gasoline) starting 1 January 2026. Under this policy, all petrol types sold domestically including A92 and A95 grades must be pre-blended with 10% ethanol before reaching consumers, effectively institutionalizing bioethanol as a mainstream fuel component and massively increasing ethanol demand for fuel blending.

As technology advances, Vietnamese ethanol derivative providers are now using improved fermentation techniques, increased variety of feedstocks, and development of second-generation bioethanol technologies using non-food biomass. These methods will help to lower ethanol production costs, increase yield, and reduce the impact of competition on food supplies by using waste products. Improved processing and blending technologies are also being developed for ethanol-based products to provide additional uses for these products beyond fuels, while also improving the quality and facilitating an increased degree of integration quality among downstream industries in Vietnam.

Market Dynamics of the Vietnam Ethanol Derivative Market:

The Vietnam ethanol derivative market is driven by the strong government mandates for renewable fuel blending, increasing awareness of climate change and energy security, inherent renewable nature of ethanol derived from agricultural raw materials, abundant feedstock such as cassava, sugarcane, and rice, natural advantage in producing bioethanol, benefit of reducing dependence on imported fossil fuels increasing stabilize energy supply chains, growing industrial demand for ethanol in various chemicals and products, and increasing potential export opportunities to neighboring markets for biofuels.

The Vietnam ethanol derivative market is restrained by the insufficient domestic ethanol production capacity, complex reliance on imports, exposed to global price volatility, infrastructure limitations, concerns over feedstock availability and competition with food sectors, also constrain growth.

The future of Vietnam ethanol derivative market is bright and promising, with versatile opportunities emerging from the increased investments to develop new type of bioethanol from raw materials. Ethanol producers, traders and transporters have a lot of new opportunities with implementation of E10 fuel on a mandatory basis while also giving themselves time to build up an inventory of this fuel as well. Ethanol derivative have been expanded into larger product categories like solvents, disinfectants, personal care products and various types of industrial chemicals providing new opportunities for ethanol derivatives producer to expand their operations in country as well as globally.

Vietnam Ethanol Derivative Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 59.06 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.3% |

| 2035 Value Projection: | 93.81 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Tung Lam Company Limited, Duy Minh Joint Stock Company, Merck Vietnam Company, Bumjin Electronics Vina Co., Ltd., Van Minh Co., Ltd., Thinh Cuong Co. Ltd., Le Gia Co., Ltd., Sapa Trading & Services Company Limited, Anh Duy Trading Co., Ltd., Nguyen Khoi Trading Company Limited, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Vietnam Ethanol Derivative Market share is classified into derivative and purity.

By Derivative:

The Vietnam ethanol derivative market is divided by derivative into ethyl acetate, ethylamines, ethylene, ethyl ether, ethyl chloride, and others. Among these, the ethyl acetate segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rapidly expanding manufacturing base, growth in flexible packaging industry, widely used for drug extraction, and favoured as eco-friendly solvent due to lower toxicity all contribute to the ethyl acetate segment's largest share and higher spending on ethanol derivative when compared to other derivative.

By Purity:

The Vietnam ethanol derivative market is divided by purity into denatured and undenatured. Among these, the denatured segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The denatured segment dominates because of its extensive use in the fuel and fuel additives sector, widely used for ethanol-blended gasoline, cost effective for industrial purposes, provide regulatory and tax advantages, and increasing demand for cleaner fuels from automotive sector in Vietnam.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Vietnam ethanol derivative market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Vietnam Ethanol Derivative Market:

- Tung Lam Company Limited

- Duy Minh Joint Stock Company

- Merck Vietnam Company

- Bumjin Electronics Vina Co., Ltd.

- Van Minh Co., Ltd.

- Thinh Cuong Co. Ltd.

- Le Gia Co., Ltd.

- Sapa Trading & Services Company Limited

- Anh Duy Trading Co., Ltd.

- Nguyen Khoi Trading Company Limited

- Others

Recent Developments in Vietnam Ethanol Derivative Market:

In August 2025, Vietnam National Petroleum Group, Petrolimex planned to start pilot blending and supply of E10 gasoline in major cities, including Ho Chi Minh City, effectively, ahead of the 2026 mandate.

In March 2025, US ethanol industry representatives signed a MoU with Vietnamese officials, including Petrolimex to develop a robust ethanol and its derivatives supply chain infrastructure for the upcoming mandate.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Vietnam, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Vietnam ethanol derivative market based on the below-mentioned segments:

Vietnam Ethanol Derivative Market, By Derivative

- Ethyl Acetate

- Ethylamines

- Ethylene

- Ethyl Ether

- Ethyl Chloride

- Others

Vietnam Ethanol Derivative Market, By Purity

- Denatured

- Undenatured

Frequently Asked Questions (FAQ)

-

Q: What is the Vietnam ethanol derivative market size?A: Vietnam ethanol derivative market is expected to grow from 59.06 thousand tonnes in 2024 to 93.81 thousand tonnes by 2035, growing at a CAGR of 4.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong government mandates for renewable fuel blending, increasing awareness of climate change and energy security, inherent renewable nature of ethanol derived from agricultural raw materials, abundant feedstock such as cassava, sugarcane, and rice, natural advantage in producing bioethanol, benefit of reducing dependence on imported fossil fuels increasing stabilize energy supply chains, growing industrial demand for ethanol in various chemicals and products, and increasing potential export opportunities to neighbouring markets for biofuels.

-

Q: What factors restrain the Vietnam ethanol derivative market?A: Constraints include the insufficient domestic ethanol production capacity, complex reliance on imports, exposed to global price volatility, infrastructure limitations, concerns over feedstock availability and competition with food sectors, also constrain growth.

-

Q: How is the market segmented by derivative?A: The market is segmented into ethyl acetate, ethylamines, ethylene, ethyl ether, ethyl chloride, and others.

-

Q: Who are the key players in the Vietnam ethanol derivative market?A: Key companies include Tung Lam Company Limited, Duy Minh Joint Stock Company, Merck Vietnam Company, Bumjin Electronics Vina Co., Ltd., Van Minh Co., Ltd., Thinh Cuong Co. Ltd., Le Gia Co., Ltd., Sapa Trading & Services Company Limited, Anh Duy Trading Co., Ltd., Nguyen Khoi Trading Company Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?