Vietnam Ammonia Market Size, Share, By Type (Green Ammonia, Blue Ammonia, And Conventional Ammonia), By End User (Agriculture, Industrial, Transportation, Power Generation, And Others), And Vietnam Ammonia Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsVietnam Ammonia Market Insights Forecasts to 2035

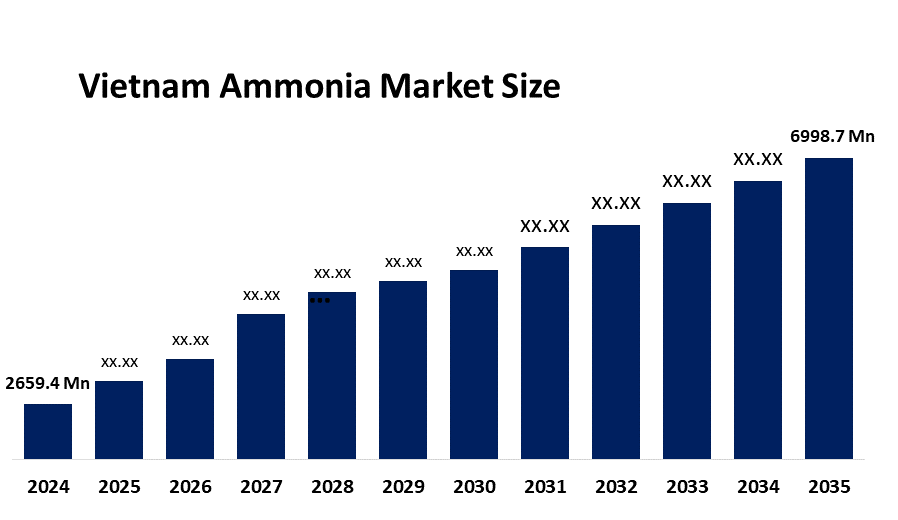

- Vietnam Ammonia Market Size 2024: USD 2659.4 Mn

- Vietnam Ammonia Market Size 2035: USD 6998.7 Mn

- Vietnam Ammonia Market CAGR 2024: 9.2%

- Vietnam Ammonia Market Segments: Type and End User.

Get more details on this report -

Vietnam ammonia Market consists of the production, transport, and usage of ammonia (NH3) in agriculture, chemical products, and energy. All forms of ammonia made in Vietnam and delivered into the Vietnam market include domestic manufacturing, shipping, and end consumption. Ammonia is a colourless gas that is made up of both hydrogen and nitrogen. It plays an important role as a basic component of the production of nitrogen fertilisers, additional folks in the chemical synthesis process, refrigeration, and evolving energy technologies that will lead to the development of hydrogen carrying devices, as well as low-carbon fuels in Vietnam.

The ammonia in Vietnam are backed by government support, including the Vietnamese Prime Ministerial decision, to develop value-added chemical products and a circular economy in the coal and mineral industries, supporting construction of new ammonia plants. Vietnam imported 111,358,000 kg of anhydrous ammonia at a cost of about USD 73.6 million, where the major suppliers are Indonesia and China. This indicates both the high level of demand in Vietnam and the need to rely on international suppliers.

As technology advances, Vietnamese ammonia providers are now using improved production technology and applying innovative methods to enhance efficiency and sustainability. Strong preference for blue ammonia and green ammonia production by manufacturers since they are produced using renewables with captured CO2, and therefore offer a way for many Vietnamese producers to meet both environmental objectives and future energy applications. Advanced technology used by Vietnamese manufacturers to produce energy more efficiently and create less of an environmental impact, enabling them to actively participate in developing clean energy value chains.

Market Dynamics of the Vietnam Ammonia Market:

The Vietnam ammonia market is driven by the robust demand for nitrogen-based fertilizers in agricultural sector, continued industrial growth in chemicals and related manufacturing, strategic emphasis on strengthening domestic production to reduce import dependence, versatility of ammonia across multiple industries, advanced technology and strong government supports further fuels broad market demand.

The Vietnam ammonia market is restrained by the high operational costs, environmental and safety concerns associated with ammonia production, handling, and transportation issues, intensive production processes, and stringent regulations and safety standards.

The future of Vietnam ammonia market is bright and promising, with versatile opportunities emerging from the use of low carbon energy systems and green ammonia increasingly used as a potential clean fuel or hydrogen carrier. Additionally, government-supported renewable energy targets and a growing number of investments into related technologies have creates new opportunities. The development of new methods to produce ammonia and the domestic focus on increasing the availability of ammonia allows domestic producers to meet their own needs while also taking advantage of export markets in the region, in particular Southeast Asia, where the demand for fertilizer and clean energy continues to increase.

Vietnam Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2659.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.2% |

| 2035 Value Projection: | USD 6998.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By End User |

| Companies covered:: | PetroVietnam Fertilizer and Chemical Corporation, PetroVietnam Ca Mau Fertilizer Joint Stock Company, Duc Giang Chemical Group Joint Stock Company, Hoa Phat Group, Binh Son Refining and Petrochemical Company, Southern Fertilizer Joint Stock Company, Lam Thao Fertilizers and Chemicals Joint Stock Company, Yara International ASA, EuroChem, Qatar Fertiliser Company, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Vietnam Ammonia Market share is classified into type and end user.

By Type:

The Vietnam ammonia market is divided by type into green ammonia, blue ammonia, and conventional ammonia. Among these, the conventional ammonia segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effectiveness, well established infrastructure, high consistent demand from the agricultural sector, suitable for large-scale production, and increased profit margin all contribute to the conventional ammonia segment's largest share and higher spending on ammonia when compared to other type.

By End User:

The Vietnam ammonia market is divided by end user into agriculture, industrial, transportation, power generation, and others. Among these, the agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The agriculture segment dominates because it serves as the essential raw material for nitrogen-based fertilizers, need for intensive rice cultivation, high value crop production, and maintain high agricultural productivity in Vietnam.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Vietnam ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Vietnam Ammonia Market:

- PetroVietnam Fertilizer and Chemical Corporation

- PetroVietnam Ca Mau Fertilizer Joint Stock Company

- Duc Giang Chemical Group Joint Stock Company

- Hoa Phat Group

- Binh Son Refining and Petrochemical Company

- Southern Fertilizer Joint Stock Company

- Lam Thao Fertilizers and Chemicals Joint Stock Company

- Yara International ASA

- EuroChem

- Qatar Fertiliser Company

- Others

Recent Developments in Vietnam Ammonia Market:

In January 2026, MICCO, a subsidiary of TKV, is in the planning stages of a new ammonia plant designed to “close the loop” from coal to chemical products to reduce reliance on imported ammonia.

In January 2026, Petrovietnam was officially renamed to Vietnam National Industry-Energy Group, with a renewed focus on leading the transition to green ammonia, as highlighted in updated 2026 strategy discussions.

In April 2025, the government of Vietnam formalized incentives for ammonia projects, signing Decree No. 58/2025/ND-CP, which provided land use fee exemptions for upto 3 years for green ammonia and renewable energy projects.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Vietnam, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Vietnam ammonia market based on the below-mentioned segments:

Vietnam Ammonia Market, By Type

- Green Ammonia

- Blue Ammonia

- Conventional Ammonia

Vietnam Ammonia Market, By End User

- Agriculture

- Industrial

- Transportation

- Power Generation

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the Vietnam ammonia market size?A:Vietnam ammonia market is expected to grow from USD 2659.4 million in 2024 to USD 6998.7 million by 2035, growing at a CAGR of 9.2% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the robust demand for nitrogen-based fertilizers in agricultural sector, continued industrial growth in chemicals and related manufacturing, strategic emphasis on strengthening domestic production to reduce import dependence, versatility of ammonia across multiple industries, advanced technology and strong government supports further fuels broad market demand.

-

Q:What factors restrain the Vietnam ammonia market?A:Constraints include the high operational costs, environmental and safety concerns associated with ammonia production, handling, and transportation issues, intensive production processes, and stringent regulations and safety standards.

-

Q:How is the market segmented by type?A:The market is segmented into green ammonia, blue ammonia, and conventional ammonia.

-

Q:Who are the key players in the Vietnam ammonia market?A:Key companies include PetroVietnam Fertilizer and Chemical Corporation, PetroVietnam Ca Mau Fertilizer Joint Stock Company, Duc Giang Chemical Group Joint Stock Company, Hoa Phat Group, Binh Son Refining and Petrochemical Company, Southern Fertilizer Joint Stock Company, Lam Thao Fertilizers and Chemicals Joint Stock Company, Yara International ASA, EuroChem, Qatar Fertiliser Company, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?